Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we age, health insurance becomes a critical aspect of our lives. Medicare is a government-run health insurance program for people aged 65 and older, and it can be a lifesaver for many seniors. However, Medicare doesn’t cover all medical expenses, which is why many people opt for additional insurance coverage. One of the most popular options is Personal Injury Protection (PIP) insurance. But if you have Medicare, do you still need PIP insurance? Let’s explore this question in more detail.

PIP insurance is designed to cover medical expenses and lost wages in the event of an accident, regardless of who is at fault. It’s a type of insurance that is required in some states, but it’s optional in others. Medicare, on the other hand, is a federal health insurance program that provides coverage for hospital stays, doctor visits, and prescription drugs. While it covers a lot of medical expenses, it does not cover everything. That’s where PIP insurance comes in. In this article, we’ll take a closer look at Medicare and PIP insurance, and help you determine whether or not you need both.

If you have Medicare, you may be wondering if you need Personal Injury Protection (PIP) insurance. PIP insurance is not required for those with Medicare, as it provides primary medical coverage. However, if you have a high-deductible Medicare plan, PIP insurance could provide additional coverage for medical expenses and lost wages in the event of an accident.

Contents

- Do I Need Pip Insurance if I Have Medicare?

- Frequently Asked Questions

- Do I Need PIP Insurance if I Have Medicare?

- What is PIP Insurance?

- Is PIP Insurance Required?

- What Does Medicare Cover for Car Accidents?

- Can I Use PIP Insurance and Medicare Together?

- Michigan PIP Coverage: Should I Opt Out If I Have Medicare? | Attorney Christopher Hunter

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Do I Need Pip Insurance if I Have Medicare?

If you’re covered by Medicare, you may be wondering if you need Personal Injury Protection (PIP) insurance. PIP is a type of insurance that covers medical expenses and lost wages in the event of an accident, regardless of who’s at fault. While Medicare provides health insurance coverage for seniors and some people with disabilities, it doesn’t cover all expenses related to an accident. Here’s what you need to know about PIP insurance and Medicare.

What is PIP insurance?

Personal Injury Protection (PIP) insurance is a type of car insurance that covers medical expenses, lost wages, and other expenses related to an accident. PIP insurance is no-fault coverage, which means that it covers your expenses regardless of who caused the accident. PIP insurance is required in some states, while in others it’s optional.

Benefits of PIP insurance

PIP insurance can provide several benefits, including:

- Coverage for medical expenses

- Coverage for lost wages

- Coverage for other expenses related to an accident

- No-fault coverage

Drawbacks of PIP insurance

While PIP insurance can provide valuable coverage, there are also some drawbacks to consider, including:

- Additional cost

- May duplicate coverage if you have health insurance

- May not be necessary if you have other insurance coverage

Does Medicare cover PIP expenses?

Medicare provides health insurance coverage for seniors and some people with disabilities. However, Medicare doesn’t cover all expenses related to an accident. Medicare may cover some medical expenses related to an accident, but it doesn’t cover lost wages or other expenses.

Benefits of Medicare

Medicare provides several benefits, including:

- Health insurance coverage for seniors and people with disabilities

- Covers many medical expenses

- Helps reduce out-of-pocket costs

Drawbacks of Medicare

While Medicare provides valuable coverage, there are also some drawbacks to consider, including:

- May not cover all medical expenses

- May not cover lost wages or other expenses related to an accident

- May require copayments or deductibles

Do I need PIP insurance if I have Medicare?

Whether or not you need PIP insurance if you have Medicare depends on your individual situation. If you have other insurance coverage that provides similar benefits, such as health insurance or disability insurance, you may not need PIP insurance. However, if you don’t have other insurance coverage or if you’re concerned about the cost of medical expenses and lost wages, PIP insurance may provide valuable coverage.

Benefits of having both PIP insurance and Medicare

If you have both PIP insurance and Medicare, you can enjoy several benefits, including:

- More comprehensive coverage for medical expenses and lost wages

- May help reduce out-of-pocket costs

Drawbacks of having both PIP insurance and Medicare

While having both PIP insurance and Medicare can provide valuable coverage, there are also some drawbacks to consider, including:

- Additional cost for PIP insurance

- May duplicate coverage for medical expenses

Conclusion

If you’re covered by Medicare, you may be wondering if you need PIP insurance. While Medicare provides health insurance coverage for seniors and some people with disabilities, it doesn’t cover all expenses related to an accident. Whether or not you need PIP insurance depends on your individual situation, but it can provide valuable coverage for medical expenses and lost wages. Consider your options and consult with an insurance professional to determine the best coverage for your needs.

Frequently Asked Questions

Do I Need PIP Insurance if I Have Medicare?

If you are enrolled in Medicare, you may wonder if you need to purchase personal injury protection (PIP) insurance. PIP insurance is a type of auto insurance that pays for medical expenses and lost wages if you are injured in a car accident. While it is not required in all states, some states mandate PIP coverage.

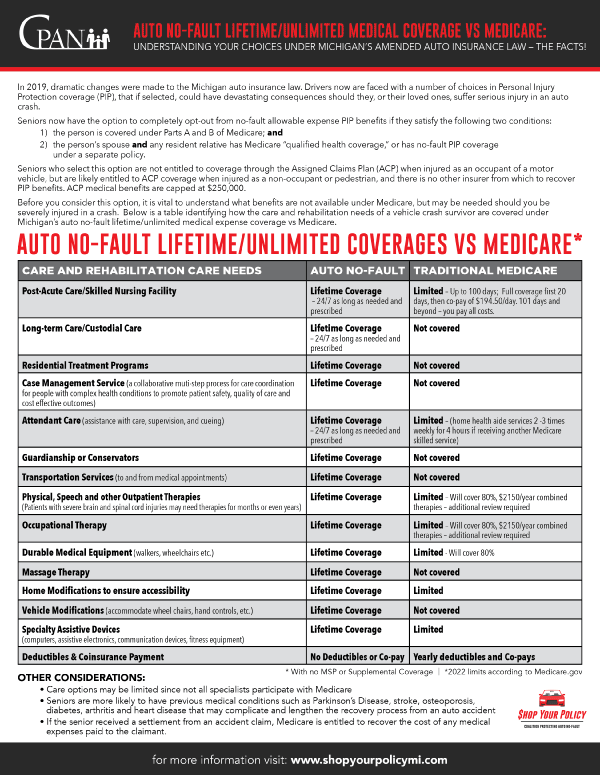

If you have Medicare, you may think that you do not need PIP insurance because Medicare covers medical expenses. However, it is important to note that Medicare only covers medical expenses related to car accidents if there is no other insurance available to pay for those expenses. This means that if you have PIP insurance, Medicare will only cover expenses that exceed your PIP coverage.

What is PIP Insurance?

Personal injury protection (PIP) insurance is a type of auto insurance that pays for medical expenses and lost wages if you are injured in a car accident. PIP insurance is designed to cover expenses not covered by other forms of insurance, such as health insurance or disability insurance.

PIP insurance can cover medical expenses like hospital bills, doctor’s visits, and rehabilitation. It can also cover lost wages if you are unable to work due to your injuries. Some PIP policies may also cover expenses like childcare and housekeeping services that you are unable to perform due to your injuries.

Is PIP Insurance Required?

The requirement for PIP insurance varies by state. Some states mandate PIP coverage, while others do not require it at all. In states where PIP insurance is required, it is typically a minimum amount that must be carried by every driver.

Even if PIP insurance is not required in your state, it may still be a good idea to purchase it. PIP insurance can provide additional coverage for medical expenses and lost wages that may not be covered by other types of insurance.

What Does Medicare Cover for Car Accidents?

Medicare is a federal health insurance program that covers medical expenses for individuals who are 65 years of age or older, as well as those with certain disabilities. If you are enrolled in Medicare and are injured in a car accident, Medicare may cover medical expenses related to the accident.

However, Medicare only covers expenses that are not covered by other forms of insurance. This means that if you have other insurance, like PIP insurance, Medicare will only cover expenses that exceed your other insurance coverage. Additionally, Medicare may only cover certain medical expenses, so it is important to check with your healthcare provider to see what is covered.

Can I Use PIP Insurance and Medicare Together?

If you have both PIP insurance and Medicare, you may wonder if you can use them together to cover medical expenses related to a car accident. The answer is yes, you can use PIP insurance and Medicare together.

In most cases, PIP insurance will pay for medical expenses and lost wages up to the policy limit. Medicare will then cover any expenses that exceed the PIP coverage. This means that having both PIP insurance and Medicare can provide additional coverage and help ensure that you are not left with high medical bills after a car accident.

Michigan PIP Coverage: Should I Opt Out If I Have Medicare? | Attorney Christopher Hunter

After exploring the topic of whether you need PIP insurance if you have Medicare, it is clear that the answer is not straightforward. It depends on your individual circumstances, such as where you live and what type of coverage you have. It is important to do your research and speak with insurance professionals to determine the best course of action for you.

However, one thing is certain – having adequate insurance coverage is crucial for protecting yourself and your loved ones in the event of an accident. Whether it is PIP insurance, Medicare, or other types of coverage, it is important to make informed decisions and ensure that you have the protection you need. As a professional writer, I urge you to take the time to assess your insurance needs and make the necessary adjustments to ensure you are fully covered.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts