Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Term life insurance is a popular insurance option that many people consider when planning for their future. It offers a certain level of financial security and peace of mind, knowing that your loved ones will be taken care of in case of an unfortunate event. However, as with any insurance policy, there are some important factors to consider before signing up. One of the most common questions people ask when considering term life insurance is whether or not their premiums will increase over time.

In this article, we will explore the topic of term life insurance premiums and answer the question of whether or not they increase over time. We’ll delve deep into the factors that affect your premiums, including your age, health, and lifestyle choices. By the end of this article, you’ll have a clear understanding of how term life insurance works and whether or not it’s the right choice for you.

Do Term Life Insurance Premiums Increase Over Time?

Term life insurance is a popular form of insurance that provides coverage for a specific period, usually 10, 20, or 30 years. Many people opt for term life insurance because it is affordable and offers significant coverage. However, one of the most common questions people ask is whether the premium of term life insurance increases over time. In this article, we will take a closer look at this question and provide you with all the information you need to know about term life insurance premiums.

Understanding Term Life Insurance

Term life insurance is a type of insurance policy that provides coverage for a specific period, known as the term. The term can be anywhere from 10 to 30 years, depending on the policy you choose. If the policyholder passes away during the term, the beneficiaries will receive the death benefit. However, if the policyholder outlives the term, the policy will expire, and there will be no payout.

Term life insurance is typically more affordable than other types of life insurance because it provides coverage for a limited time. The premiums are generally lower because the insurance company assumes that the risk of the policyholder passing away during the term is relatively low.

Factors That Affect Term Life Insurance Premiums

Several factors can affect term life insurance premiums. These include:

1. Age: The younger you are when you purchase term life insurance, the lower your premiums will be.

2. Health: Your health plays a significant role in determining your premiums. If you have pre-existing medical conditions or engage in risky behaviors, such as smoking, your premiums will be higher.

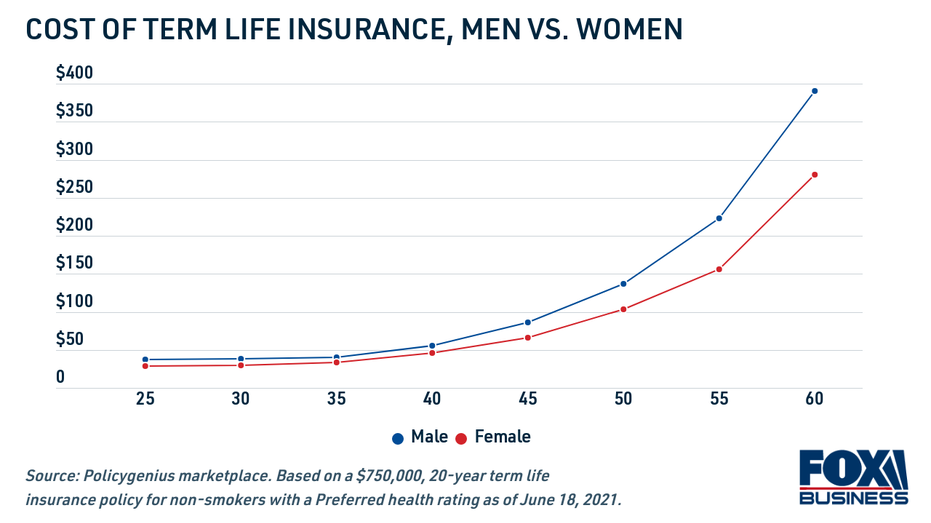

3. Gender: Women generally pay lower premiums than men because they tend to live longer.

4. Term Length: The longer the term, the higher the premiums.

5. Coverage Amount: The higher the death benefit, the higher the premiums.

Do Term Life Insurance Premiums Increase Over Time?

One of the most common questions people ask about term life insurance is whether the premiums increase over time. The answer to this question is that it depends on the policy you choose. Some term life insurance policies have level premiums, which means that the premium remains the same throughout the term. However, other policies have premiums that increase over time.

If you opt for a policy with increasing premiums, the increase is usually gradual and predictable. The premium increase is typically based on your age, and it is designed to keep up with the increased risk of mortality as you get older. The premium increase may also be based on changes in the cost of providing insurance coverage.

Benefits of Term Life Insurance with Level Premiums

If you are concerned about the potential for increasing premiums, you may want to consider a term life insurance policy with level premiums. Here are some benefits of choosing a policy with level premiums:

1. Predictable Costs: With level premiums, you will know exactly how much you will be paying each month for the duration of the policy.

2. Budget-Friendly: Level premiums are often more budget-friendly than policies with increasing premiums.

3. Long-Term Savings: Level premiums may save you money in the long run because you lock in a lower rate when you are younger and healthier.

Term Life Insurance vs. Permanent Life Insurance

When choosing a life insurance policy, it is essential to understand the difference between term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance provides coverage for the policyholder’s entire life.

Permanent life insurance is typically more expensive than term life insurance because it provides lifelong coverage and has a cash value component. However, it may be a better option for individuals who want to leave a legacy or have long-term financial goals.

Conclusion

In conclusion, term life insurance premiums may or may not increase over time, depending on the policy you choose. It is essential to understand the factors that affect term life insurance premiums and choose a policy that meets your needs and budget. Whether you opt for a policy with level premiums or increasing premiums, term life insurance is an affordable way to protect your loved ones financially.

Contents

- Frequently Asked Questions

- Do term life insurance premiums increase over time?

- What is the difference between level term and increasing term life insurance?

- How can I keep my term life insurance premiums low?

- What happens if I miss a premium payment?

- Can I convert my term life insurance policy to a permanent life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Term life insurance is a popular type of life insurance coverage that provides financial protection to individuals and their families. However, many people are unsure about the cost of term life insurance and whether premiums increase over time. Here are some frequently asked questions and answers about term life insurance premiums.

Term life insurance policies provide coverage for a specific period of time, which can range from 1 to 30 years. During this time, the premiums are usually fixed and do not increase. However, once the term of the policy is over, the premiums may increase if the policy is renewed or converted into a permanent life insurance policy.

The increase in premiums is due to several factors, such as the insured’s age, health status, and the risk of death. As the insured gets older, the risk of death increases, which means that the premiums will also increase. Additionally, if the insured’s health status changes, such as developing a chronic illness, the premiums may also increase.

What is the difference between level term and increasing term life insurance?

Level term life insurance is a type of term life insurance policy where the premiums and death benefit remain the same throughout the duration of the policy. This means that the premiums do not increase over time, and the death benefit is fixed for the term of the policy.

Increasing term life insurance, on the other hand, is a type of policy where the death benefit increases over time, while the premiums remain the same. This type of policy is typically more expensive than level term life insurance, but it provides more coverage over time as the death benefit increases.

There are several ways to keep your term life insurance premiums low. First, you can choose a shorter term length, such as 10 or 15 years, which will typically have lower premiums than longer terms. Additionally, you can maintain a healthy lifestyle and avoid risky behaviors, such as smoking or excessive drinking, which can increase your premiums.

You can also shop around and compare quotes from different insurance companies to find the best rates. Finally, you can consider purchasing your policy at a younger age, as premiums are typically lower for younger individuals who are in good health.

If you miss a premium payment, your policy may lapse or be canceled. This means that you will no longer have coverage under the policy, and your beneficiaries will not receive a death benefit if you pass away.

However, many insurance companies offer a grace period of 30 days or more for premium payments. If you make the payment within this time frame, your policy will usually be reinstated. If you are unable to make the payment within the grace period, you may be able to reinstate the policy by paying the overdue premium and any applicable fees or interest.

Can I convert my term life insurance policy to a permanent life insurance policy?

Many term life insurance policies offer the option to convert to a permanent life insurance policy, such as whole life or universal life insurance. This allows you to maintain coverage beyond the term of the policy without having to reapply for a new policy.

The conversion option typically has certain requirements and restrictions, such as a specific time frame for conversion and a minimum amount of coverage. Additionally, the premiums for the permanent policy may be higher than the premiums for the term policy, as the permanent policy provides coverage for the insured’s entire life rather than a specific term.

As a professional writer, I understand the importance of planning for the future and protecting your loved ones. Term life insurance is a popular option for those looking for affordable coverage for a specific period of time. However, one common concern is whether the premiums will increase over time. While some policies may offer level premiums, meaning the cost remains the same throughout the term, others may increase over time.

It’s important to thoroughly research and compare policies before choosing the right one for you. Be sure to understand the terms and conditions of the policy, including any potential increases in premiums. With careful planning and consideration, you can find a term life insurance policy that fits your needs and budget, providing peace of mind for you and your loved ones. Remember, the most important thing is to protect your family’s future, and term life insurance can be a valuable tool in achieving that goal.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts