Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As an employee, you may be familiar with group term life insurance, a common benefit offered by many employers. Group term life insurance is a type of life insurance that provides coverage for a group of people, typically employees of a company or members of an organization. While group term life insurance can provide financial protection for your loved ones in the event of your death, one question many people have is whether this type of insurance has a cash value.

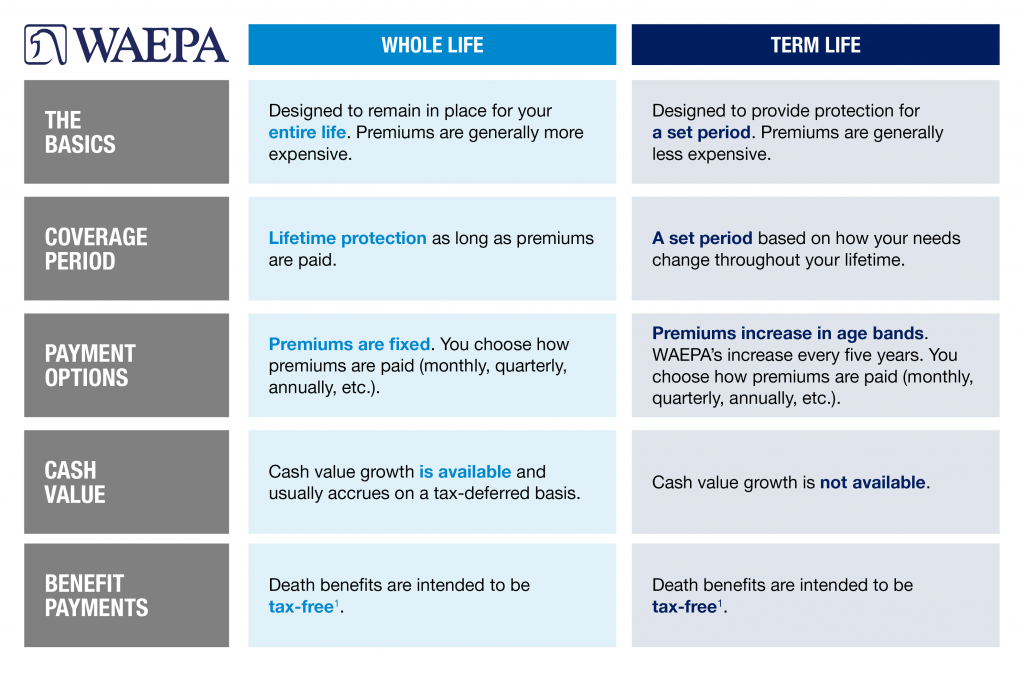

The short answer is no, group term life insurance does not have a cash value. Unlike other types of life insurance, such as whole life insurance or universal life insurance, group term life insurance is designed solely to provide a death benefit to your beneficiaries in the event of your passing. However, there are some important factors to consider when it comes to group term life insurance and how it can benefit you and your loved ones. Let’s explore these factors in more detail.

Contents

- Does Group Term Life Insurance Have a Cash Value?

- Frequently Asked Questions

- Does Group Term Life Insurance Have a Cash Value?

- Can You Convert Group Term Life Insurance to a Permanent Policy?

- How is the Premium for Group Term Life Insurance Determined?

- Is Group Term Life Insurance Taxable?

- How Much Group Term Life Insurance Coverage Do I Need?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Does Group Term Life Insurance Have a Cash Value?

Group term life insurance is a type of life insurance that’s offered to a group of people, typically employees of a company, at a lower cost than individual policies. But unlike some other types of life insurance, group term life insurance does not have a cash value component. In this article, we’ll explore what group term life insurance is, how it differs from other types of life insurance, and whether or not it has a cash value.

What is Group Term Life Insurance?

Group term life insurance is a type of life insurance that’s purchased by an employer and offered to its employees as a benefit. This type of insurance provides coverage for a specified period of time, typically one year, and is renewable on an annual basis. The premiums for group term life insurance are often lower than those for individual policies because the risk is spread across a larger group of people.

Group term life insurance policies typically have a death benefit that’s equal to a multiple of the employee’s salary, such as one or two times their annual salary. The death benefit is paid to the employee’s beneficiaries if the employee passes away while the policy is in force.

How is Group Term Life Insurance Different from Other Types of Life Insurance?

Group term life insurance differs from other types of life insurance in several key ways. First and foremost, it’s offered as a benefit by an employer, rather than being purchased by an individual. This means that the employer pays the premiums for the policy, although the employee may be responsible for a portion of the cost.

Another key difference is that group term life insurance does not have a cash value component. Unlike whole life insurance, which has a savings component that can be borrowed against or withdrawn, group term life insurance is purely a death benefit. This means that if the employee leaves the company or the policy is cancelled, there is no cash value that can be recovered.

What Are the Benefits of Group Term Life Insurance?

Despite the lack of a cash value component, group term life insurance can still provide valuable benefits to employees. First and foremost, it provides a death benefit that can help ensure that an employee’s loved ones are taken care of if the worst happens. This is especially important for employees who have dependents who rely on their income.

Group term life insurance can also be a valuable benefit for employees who may have difficulty obtaining individual life insurance policies due to health issues or other factors. Because the risk is spread across a larger group of people, group term life insurance can be more accessible and affordable for employees who might not be able to qualify for individual policies.

What Are the Drawbacks of Group Term Life Insurance?

While group term life insurance can be a valuable benefit, there are also some drawbacks to consider. One of the biggest drawbacks is that the coverage is typically not portable. This means that if an employee leaves the company, they may lose their coverage and have to find alternative insurance options.

Another drawback is that the coverage is often limited to a multiple of the employee’s salary, which may not be sufficient for employees with higher salaries or more dependents. Additionally, because the policy is owned by the employer, employees may not have as much control over the policy or the ability to customize it to their needs.

Group Term Life Insurance vs. Individual Life Insurance

When deciding between group term life insurance and individual life insurance, there are several factors to consider. Group term life insurance may be more affordable and accessible, but it also has limitations in terms of coverage and portability. Individual life insurance policies can be more customizable and offer more coverage options, but they may also be more expensive and difficult to obtain.

Ultimately, the decision between group term life insurance and individual life insurance will depend on an employee’s individual needs and circumstances. It’s important to carefully consider the options and choose the policy that provides the best coverage and value.

Conclusion

In conclusion, group term life insurance does not have a cash value component, but it can still provide valuable benefits to employees. It’s important to understand the differences between group term life insurance and other types of life insurance, as well as the benefits and drawbacks of each option. By carefully considering the options and choosing the right policy, employees can ensure that their loved ones are protected in the event of their passing.

Frequently Asked Questions

Does Group Term Life Insurance Have a Cash Value?

Group term life insurance, unlike many other types of life insurance, does not accumulate cash value. This is because group term life insurance is a type of term insurance, which means that it only provides coverage for a specified period of time, typically one year.

Because group term life insurance does not accumulate cash value, it is generally less expensive than other types of life insurance. However, it is important to note that group term life insurance provides coverage only while the policyholder is a member of the group. If the policyholder leaves the group or the group discontinues coverage, the policy will terminate and the policyholder will no longer have coverage.

Can You Convert Group Term Life Insurance to a Permanent Policy?

Many group term life insurance policies offer the option to convert to a permanent policy, such as whole life or universal life insurance. This can be a valuable option for individuals who want to maintain coverage beyond the term of the group policy or who want to accumulate cash value over time.

It is important to note that there may be restrictions and limitations on the conversion option, such as a time limit or a cap on the amount of coverage that can be converted. Additionally, converting to a permanent policy may result in higher premiums, so it is important to carefully consider the cost and benefits before making a decision.

How is the Premium for Group Term Life Insurance Determined?

The premium for group term life insurance is determined based on a variety of factors, including the size of the group, the age and health of the members, and the amount of coverage provided.

In general, the larger the group, the lower the premium per member. Additionally, younger and healthier members will typically pay lower premiums than older or less healthy members. The amount of coverage provided may also impact the premium, with higher coverage amounts resulting in higher premiums.

Is Group Term Life Insurance Taxable?

In general, group term life insurance is not taxable as income to the policyholder. However, there are some exceptions to this rule.

If the policyholder pays for the coverage with pre-tax dollars, such as through a cafeteria plan or flexible spending account, the death benefit may be taxable. Additionally, if the policyholder is a highly compensated employee and the coverage exceeds certain limits, the excess coverage may be taxable. It is important to consult with a tax professional to determine the tax implications of group term life insurance.

How Much Group Term Life Insurance Coverage Do I Need?

The amount of group term life insurance coverage needed will depend on a variety of factors, including the policyholder’s income, debts, and dependents.

As a general rule of thumb, many financial advisors recommend purchasing coverage equal to 10-12 times the policyholder’s annual income. Additionally, it is important to consider any outstanding debts, such as a mortgage or car loan, as well as the needs of any dependents in the event of the policyholder’s death. A financial advisor can help determine the appropriate amount of coverage for individual needs.

In conclusion, group term life insurance is a valuable benefit for employees that provides financial protection for their loved ones in the event of their untimely death. While it does not have a cash value, it is still an important investment for employers to offer as a part of their benefits package. Employees can typically choose to purchase additional coverage or convert their group policy to an individual policy if they leave the company.

It is important for both employers and employees to fully understand the details of group term life insurance policies, including the coverage amount and any exclusions or limitations. By providing this benefit, employers can show their commitment to their employees’ well-being and provide peace of mind for their loved ones. In the end, group term life insurance is a valuable investment that can help protect employees and their families during difficult times.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts