Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a responsible citizen, you may be wondering about the potential impacts of life insurance on your eligibility for food stamps. While life insurance is an important investment for securing the financial future of your loved ones, it is also crucial to understand its potential implications on government assistance programs such as food stamps. In this article, we will explore the relationship between life insurance and food stamps to help you make informed decisions about your financial planning.

Food stamps, officially known as the Supplemental Nutrition Assistance Program (SNAP), is a federal program designed to provide food assistance to low-income families and individuals. The program is intended to help eligible recipients purchase nutritious food and improve their well-being. However, eligibility for SNAP is determined based on several factors, including income, assets, and expenses. Therefore, it is important to determine whether life insurance affects your eligibility for food stamps, and how you can ensure that you are not disqualified from this vital assistance program.

Contents

- Does Life Insurance Affect Food Stamps?

- Frequently Asked Questions

- Does Life Insurance Affect Food Stamps?

- Can You Get Life Insurance While Receiving Food Stamps?

- What Types of Life Insurance Policies Affect Food Stamps?

- Do Life Insurance Death Benefits Affect SSI Benefits?

- How Does Life Insurance Affect Medicaid Eligibility?

- NEW 2023 SNAP UPDATE (APRIL): 40% STATE INCREASE, New Minimum Benefits & CALIFORNIA Extra Benefits

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Does Life Insurance Affect Food Stamps?

Life insurance is a vital aspect of financial planning, especially for families with dependents. It offers peace of mind that loved ones will be taken care of financially in the event of your untimely demise. However, many individuals who rely on government assistance programs like food stamps wonder if their life insurance policy will affect their eligibility for these benefits. In this article, we’ll explore the relationship between life insurance and food stamps and answer the question, “Does life insurance affect food stamps?”.

Understanding Food Stamps

Food stamps, officially known as the Supplemental Nutrition Assistance Program (SNAP), is a federal program that provides assistance to low-income individuals and families to purchase food. Eligibility for SNAP is based on income and household size. To qualify, your household income must be at or below 130% of the federal poverty level.

How Are Food Stamp Benefits Calculated?

Once you qualify for SNAP benefits, the amount of assistance you receive is based on several factors, including your household size, income, and expenses. Your monthly benefit amount is calculated by subtracting 30% of your net income from the maximum benefit amount for your household size.

What Assets Are Considered When Determining SNAP Eligibility?

When determining your eligibility for SNAP benefits, the government considers your income and assets. Assets that are considered when determining eligibility include cash, bank accounts, stocks, bonds, and property that is not your primary residence. However, certain assets are exempt, such as your primary residence and personal possessions.

How Does Life Insurance Affect SNAP Eligibility?

Cash Value Life Insurance

Cash value life insurance policies, such as whole life or universal life insurance, accumulate cash value over time. This cash value can be borrowed against or surrendered for cash. For the purposes of SNAP eligibility, the cash value of a life insurance policy is considered an asset and must be included when determining eligibility.

Term Life Insurance

Term life insurance policies do not accumulate cash value and therefore do not affect SNAP eligibility. The death benefit paid out to beneficiaries is also not considered income and does not affect eligibility for government assistance programs.

The Benefits of Life Insurance

While life insurance may affect SNAP eligibility for some individuals, the benefits of having life insurance outweigh the potential impact on government assistance programs. Life insurance provides financial security for your loved ones in the event of your death. It can cover expenses such as funeral costs, outstanding debts, and provide ongoing support for your family.

Term Life Insurance vs. Cash Value Life Insurance

When choosing a life insurance policy, it’s important to consider your individual financial situation and needs. Term life insurance is a more affordable option and provides coverage for a specific period of time. Cash value life insurance, on the other hand, is more expensive but offers a savings component in addition to life insurance coverage.

Other Government Assistance Programs

It’s important to note that while life insurance may affect SNAP eligibility, it does not affect eligibility for other government assistance programs such as Medicaid, Temporary Assistance for Needy Families (TANF), or Social Security Disability Insurance (SSDI).

Conclusion

In conclusion, life insurance policies can affect SNAP eligibility for individuals with cash value life insurance policies. However, the benefits of having life insurance far outweigh the potential impact on government assistance programs. When choosing a life insurance policy, it’s important to consider your individual financial situation and needs. It’s also important to note that life insurance does not affect eligibility for other government assistance programs such as Medicaid, TANF, or SSDI.

Frequently Asked Questions

Does Life Insurance Affect Food Stamps?

Life insurance is a contract between an individual and an insurance company that pays out a sum of money to the designated beneficiaries upon the death of the policyholder. The benefits of a life insurance policy are not counted as income and do not affect eligibility for food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP).

However, if the policyholder cashes out the life insurance policy or takes a loan against it, the resulting cash value may be considered as a resource and could affect eligibility for food stamps. This is because the cash value of the policy is considered an asset and can be used to purchase food, which could reduce the need for food stamp benefits.

Can You Get Life Insurance While Receiving Food Stamps?

Yes, it is possible to get life insurance while receiving food stamps. Life insurance is not counted as a resource and does not affect eligibility for food stamp benefits. However, it is important to notify the insurance company and the Department of Social Services about any changes in income, resources, or household composition to ensure that eligibility for food stamps is not affected.

It is also important to note that life insurance premiums are considered a household expense and can be deducted from income for the purpose of determining eligibility for food stamp benefits. Therefore, it is recommended that individuals receiving food stamps consider purchasing life insurance to provide financial security for their families in case of unexpected death.

What Types of Life Insurance Policies Affect Food Stamps?

As mentioned earlier, life insurance policies do not affect eligibility for food stamps. However, if the policyholder cashes out the policy or takes a loan against it, the resulting cash value may be considered an asset and could affect eligibility for food stamps. Therefore, it is recommended that individuals consult with an insurance professional before making any changes to their life insurance policies.

It is also important to note that some types of life insurance, such as whole life insurance and universal life insurance, have a cash value component that can be accessed by the policyholder. Term life insurance, on the other hand, does not have a cash value component and therefore does not affect eligibility for food stamps.

Do Life Insurance Death Benefits Affect SSI Benefits?

Life insurance death benefits, like the benefits from a life insurance policy, are not counted as income and do not affect eligibility for Supplemental Security Income (SSI). However, if the death benefit is paid in a lump sum, it may be considered an asset and could affect eligibility for SSI.

If the death benefit is paid out in installments, it is not considered an asset and does not affect eligibility for SSI. It is important to note that SSI is a needs-based program and eligibility is determined based on income and resources. Therefore, it is recommended that individuals consult with a financial advisor before making any changes to their life insurance policies.

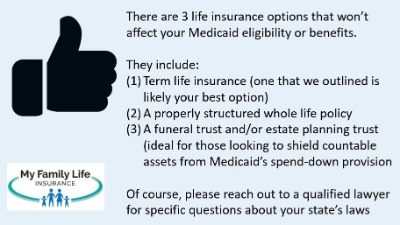

How Does Life Insurance Affect Medicaid Eligibility?

Life insurance policies, like the benefits from a life insurance policy, are not counted as income and do not affect eligibility for Medicaid. However, if the policyholder cashes out the policy or takes a loan against it, the resulting cash value may be considered an asset and could affect eligibility for Medicaid.

It is important to note that Medicaid is a needs-based program and eligibility is determined based on income and resources. Therefore, it is recommended that individuals consult with a financial advisor before making any changes to their life insurance policies to ensure that eligibility for Medicaid is not affected.

NEW 2023 SNAP UPDATE (APRIL): 40% STATE INCREASE, New Minimum Benefits & CALIFORNIA Extra Benefits

In summary, the impact of life insurance on food stamps is not straightforward, and there is no one-size-fits-all answer. It depends on the type of life insurance policy, its value, and the state where the beneficiary resides. While some states may consider the cash value of a life insurance policy as a countable asset, others may exempt it from the resource limit for food stamp eligibility. Therefore, it’s crucial to consult with a financial advisor or an attorney before making any decisions about life insurance policies and their impact on government benefits.

Overall, life insurance is an essential tool for protecting your loved ones financially in the event of your death. However, it’s crucial to understand its implications on government benefits such as food stamps. By doing so, you can make informed decisions about the type and value of life insurance policies you need, and how they fit into your overall financial plan. With the right guidance, you can ensure that you and your family are financially secure, and your government benefits are not jeopardized.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts