Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Auto insurance is a necessary expense for all car owners. It provides financial protection against unexpected accidents and damages that may occur while driving. However, there are times when an auto insurance claim may be denied, leaving the car owner in a difficult situation. If you have been in such a situation, you might be wondering what you can do to appeal a denied auto insurance claim.

Appealing a denied auto insurance claim can be a daunting task, but it is not impossible. It requires a thorough understanding of the insurance policy and the reasons for the denial. In this guide, we will take you through the process of appealing a denied auto insurance claim, step by step. Whether you are dealing with a minor fender bender or a major collision, this guide will equip you with the knowledge and tools to fight for the compensation you deserve.

How to Appeal a Denied Auto Insurance Claim?

If your auto insurance claim has been denied, you have the right to appeal the decision. Here are the steps to follow:

- Contact your insurance company and ask for the reason for the denial.

- Review your policy to understand your coverage and your rights.

- Collect all necessary documents, such as photos, police reports, and medical bills.

- Prepare a written appeal that includes a summary of the incident and why you believe the claim should be approved.

- Send the appeal, along with supporting documents, to your insurance company.

- Consider hiring an attorney, if necessary.

How to Appeal a Denied Auto Insurance Claim?

If you have been involved in an accident and your auto insurance claim has been denied, you may feel frustrated and confused. However, it is important to know that you have options. You can appeal the decision and fight for the compensation you deserve. This article will guide you through the steps you need to take to appeal a denied auto insurance claim.

Understand Why Your Claim Was Denied

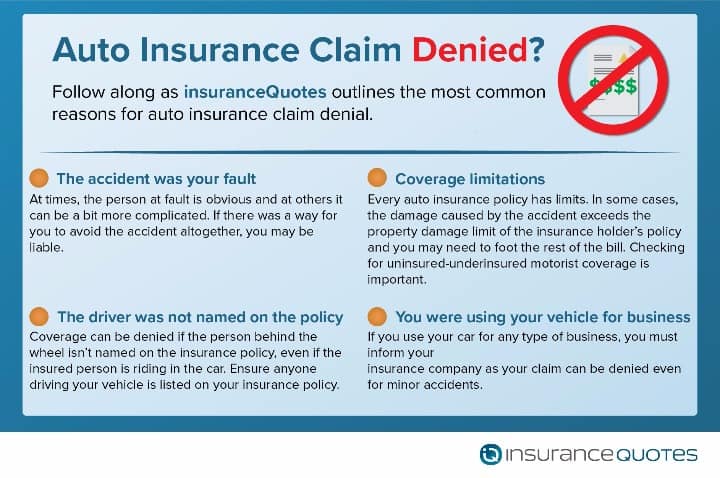

The first step in appealing a denied auto insurance claim is to understand why your claim was denied in the first place. There are several reasons why an insurance company may deny a claim, including:

- The accident was not covered by your policy.

- The damages were below your deductible.

- You missed a deadline for filing your claim.

- The insurance company believes you were at fault for the accident.

Once you understand why your claim was denied, you can begin to build your case for appeal.

Gather Evidence

The next step in appealing a denied auto insurance claim is to gather evidence to support your case. This may include:

- Police reports

- Witness statements

- Photographs of the accident scene and damage

- Medical records

Make sure you have all the necessary documentation to prove your case.

Review Your Policy

Before you appeal a denied auto insurance claim, it is important to review your policy to ensure that the accident is covered. Make sure you understand the terms and conditions of your policy, including your deductible and coverage limits.

Contact Your Insurance Company

Once you have gathered all the necessary evidence, you should contact your insurance company to appeal the decision. Be prepared to explain why you believe the claim should not have been denied and present your evidence.

File a Complaint with Your State Insurance Commissioner

If your insurance company still denies your claim, you may want to file a complaint with your state insurance commissioner. The commissioner will investigate your complaint and may be able to help you resolve the issue.

Hire an Attorney

If all else fails, you may want to consider hiring an attorney to help you with your appeal. An experienced attorney can help you navigate the appeals process and fight for the compensation you deserve.

The Benefits of Appealing a Denied Auto Insurance Claim

Appealing a denied auto insurance claim can be a long and frustrating process, but it can also be worth it in the end. If you are successful in your appeal, you may be able to receive compensation for your damages and injuries. Additionally, appealing a denied claim can help improve your chances of getting insurance coverage in the future.

Appealing vs. Filing a New Claim

If your auto insurance claim has been denied, you may be wondering if it is better to appeal the decision or file a new claim. In most cases, it is better to appeal the decision. Filing a new claim may result in higher premiums or even a cancellation of your policy. Appealing the decision shows that you are willing to fight for what you believe is rightfully yours.

Conclusion

Appealing a denied auto insurance claim can be challenging, but it is not impossible. If you follow the steps outlined in this article, you can increase your chances of success. Remember to gather all the necessary evidence, review your policy, and contact your insurance company to begin the appeals process. If all else fails, consider hiring an attorney to help you with your case.

Contents

- Frequently Asked Questions

- What is an auto insurance claim denial?

- How do I appeal a denied auto insurance claim?

- What are my options if my appeal is denied?

- How long does the appeals process take?

- What are some common reasons for auto insurance claim denials?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Dealing with a denied auto insurance claim can be frustrating and overwhelming. However, it is important to know that you have options for appealing the decision. Here are some frequently asked questions about how to appeal a denied auto insurance claim.

What is an auto insurance claim denial?

An auto insurance claim denial is when your insurance company refuses to pay for damages or injuries sustained in a car accident. This can happen for a variety of reasons, such as a lack of coverage or a dispute about fault. When you receive a denial, it means that the insurance company will not cover the costs of the claim.

If you believe that the denial was made in error, you have the right to appeal the decision. This involves submitting additional information or evidence to support your claim and convince the insurance company to reconsider their decision.

How do I appeal a denied auto insurance claim?

The first step in appealing a denied auto insurance claim is to carefully review the denial letter from your insurance company. This will provide you with information about why the claim was denied and what steps you can take to appeal the decision.

Once you have reviewed the denial letter, you should gather any additional information or evidence that supports your claim. This may include witness statements, police reports, or medical records. You should then submit this information to your insurance company along with a written explanation of why you believe the claim should be reconsidered.

What are my options if my appeal is denied?

If your appeal is denied, you still have options for pursuing compensation for your damages or injuries. You may be able to file a complaint with your state insurance commissioner, who can investigate the denial and potentially order the insurance company to pay your claim.

You may also want to consider consulting with a personal injury attorney who can help you explore your legal options for pursuing compensation. An attorney can provide you with valuable guidance and representation throughout the claims process.

How long does the appeals process take?

The length of the appeals process can vary depending on the complexity of your case and the responsiveness of your insurance company. In some cases, the appeals process may be resolved within a few weeks. However, in more complex cases, it may take several months or even years to reach a resolution.

It is important to be patient and persistent throughout the appeals process. Keep track of all correspondence with your insurance company and any other parties involved in your case to ensure that you have a clear record of the process.

What are some common reasons for auto insurance claim denials?

Auto insurance claim denials can happen for a variety of reasons, including a lack of coverage, a dispute about fault, or a failure to meet the requirements of your policy. Some common reasons for auto insurance claim denials include driving under the influence of drugs or alcohol, driving without a license, or failing to report the accident in a timely manner.

If you have received a denial for your auto insurance claim, it is important to carefully review the reasons for the denial and gather any additional information or evidence that may support your case. By appealing the decision and pursuing all available options, you can increase your chances of receiving the compensation you deserve.

When an auto insurance claim is denied, it can be a frustrating and confusing experience for policyholders. However, there are steps you can take to appeal the decision and potentially receive the coverage you deserve. First, it’s important to review the denial letter carefully to understand the reason for the denial. This will help you to gather the necessary evidence and information to support your appeal.

Next, you should contact your insurance company and initiate the appeals process. This may involve submitting additional documentation or working with an independent adjuster to dispute the denial. It’s important to stay persistent and advocate for your rights as a policyholder. By following these steps and working with your insurance company, you may be able to successfully appeal a denied auto insurance claim and receive the coverage you need to get back on the road.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts