Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

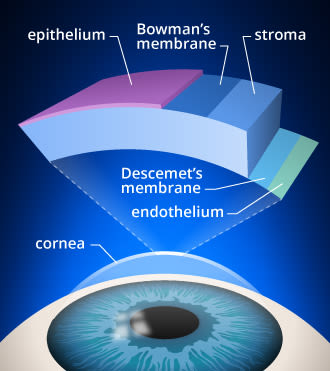

Medicaid is a government-funded program that provides healthcare coverage to low-income individuals and families. The program covers a range of medical services, including hospitalization, doctor visits, prescription drugs, and more. However, when it comes to certain specialized procedures, many people are left wondering whether their Medicaid plan will cover the cost. One such procedure is corneal cross-linking, a treatment for a condition called keratoconus that affects the cornea of the eye. So, does Medicaid cover corneal cross-linking? Let’s find out.

Keratoconus is a progressive disease that causes the cornea to become thinner and weaker, leading to vision problems such as blurred or distorted vision. Corneal cross-linking is a non-invasive treatment option that uses ultraviolet light and riboflavin to strengthen the cornea and slow down the progression of keratoconus. While this procedure has been shown to be effective in treating keratoconus, it is considered a specialized treatment and may not be covered by all Medicaid plans. In the following paragraphs, we will explore the criteria for Medicaid coverage of corneal cross-linking and what patients can do to access this treatment.

Unfortunately, Medicaid does not cover Corneal Cross Linking, a procedure used to treat keratoconus, a progressive eye disease. However, some states may offer coverage under their Medicaid programs, while others may have limited coverage options. It is recommended to check with your local Medicaid office or healthcare provider to determine the coverage options available in your state.

Contents

- Does Medicaid Cover Corneal Cross Linking?

- Frequently Asked Questions

- What is Corneal Cross Linking?

- Is Corneal Cross Linking Covered by Medicaid?

- What are the Benefits of Corneal Cross Linking?

- What are the Risks of Corneal Cross Linking?

- How Long Does it Take to Recover from Corneal Cross Linking?

- Does medicare cover corneal cross-linking?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Does Medicaid Cover Corneal Cross Linking?

Corneal cross-linking (CXL) is a medical procedure that can help to strengthen the cornea and prevent further damage from conditions such as keratoconus. However, one question that many patients have is whether Medicaid covers corneal cross-linking. In this article, we will explore this question in more detail.

What is Corneal Cross-Linking?

Corneal cross-linking is a medical procedure that involves the use of UV light and a photosensitizer to strengthen the cornea. This procedure is most commonly used to treat keratoconus, a condition in which the cornea becomes thin and cone-shaped, leading to vision problems. During the procedure, the photosensitizer is applied to the cornea, and then UV light is used to activate the photosensitizer and create new cross-links in the cornea, which help to strengthen it.

Does Medicaid Cover Corneal Cross-Linking?

Medicaid is a government-funded healthcare program that provides coverage for a wide range of medical procedures and treatments. However, whether Medicaid covers corneal cross-linking can vary depending on the state in which you live. In some states, Medicaid may cover the procedure for certain patients, while in other states, it may not be covered at all.

If you are considering corneal cross-linking and are covered by Medicaid, it is important to check with your healthcare provider to determine whether the procedure is covered under your plan. Your healthcare provider can also help you to understand the costs associated with the procedure and any other requirements that may need to be met before the procedure can be performed.

Benefits of Corneal Cross-Linking

Corneal cross-linking can offer a number of benefits to patients with keratoconus or other conditions that affect the cornea. Some of these benefits include:

– Strengthening the cornea and preventing further damage

– Improving vision and reducing the need for corrective lenses

– Stabilizing the cornea and preventing the need for more invasive procedures in the future

Corneal Cross-Linking vs. Other Treatments

There are several other treatments available for conditions such as keratoconus, and it’s important to understand the differences between them when considering your options. Some of the most common alternatives to corneal cross-linking include:

– Corneal transplant surgery

– Intacs corneal inserts

– Rigid contact lenses

While each of these treatments has its own pros and cons, corneal cross-linking is often the preferred option for patients with mild to moderate keratoconus, as it is less invasive than other procedures and can offer long-term benefits.

Conclusion

In conclusion, whether Medicaid covers corneal cross-linking can vary depending on the state in which you live. If you are considering this procedure and are covered by Medicaid, it is important to check with your healthcare provider to determine whether the procedure is covered under your plan. Additionally, it’s important to understand the benefits of corneal cross-linking compared to other treatments, as well as any potential risks or side effects associated with the procedure. Ultimately, working closely with your healthcare provider can help you to make an informed decision about the best treatment option for your individual needs.

Frequently Asked Questions

What is Corneal Cross Linking?

Corneal Cross Linking (CXL) is a medical procedure used to treat keratoconus, a condition that causes the cornea to become thin and weak. During the procedure, a riboflavin solution is applied to the cornea and activated with ultraviolet light. This causes the collagen in the cornea to stiffen, making it stronger and more resistant to further change.

Is Corneal Cross Linking Covered by Medicaid?

The answer to whether Medicaid covers Corneal Cross Linking varies depending on the state. In some states, Medicaid may cover the procedure if it is deemed medically necessary. However, in other states, Medicaid may not cover the procedure at all. It is important to check with your specific state’s Medicaid program to determine if Corneal Cross Linking is covered.

What are the Benefits of Corneal Cross Linking?

Corneal Cross Linking has been shown to be an effective treatment option for keratoconus. It can help stabilize the cornea and prevent further deterioration, which can ultimately prevent the need for a corneal transplant. Additionally, the procedure is minimally invasive and can be done on an outpatient basis.

What are the Risks of Corneal Cross Linking?

Like any medical procedure, Corneal Cross Linking does carry some risks. These can include infection, corneal haze, and loss of vision. However, these risks are relatively rare and can be minimized by choosing an experienced and qualified surgeon.

How Long Does it Take to Recover from Corneal Cross Linking?

The recovery time for Corneal Cross Linking can vary depending on the individual and the extent of the procedure. Most patients can resume normal activities within a few days, but full recovery can take several weeks. During this time, it is important to avoid rubbing the eyes and to follow all post-operative instructions provided by the surgeon.

Does medicare cover corneal cross-linking?

In summary, while Medicaid does cover a variety of eye-related treatments, including some forms of corneal surgery, there is currently no definitive answer as to whether or not Medicaid covers corneal cross-linking. This is due to a variety of factors, including the lack of standardized pricing for the procedure, as well as the fact that some states may have different policies regarding Medicaid coverage for corneal cross-linking.

However, for those who are in need of corneal cross-linking and are unable to afford the procedure out of pocket, there may still be options available. Some states may offer assistance programs to help cover the cost of the procedure, while others may be able to provide referrals to clinics or specialists who offer discounted rates. Ultimately, while the answer to whether or not Medicaid covers corneal cross-linking may not be clear-cut, there are still resources available to help those in need access the care they require.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts