Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Term life insurance is a popular type of life insurance policy that provides coverage for a set period of time. It is often purchased by individuals who want to ensure that their loved ones are financially protected in the event of their unexpected death. One question that frequently arises when it comes to term life insurance is whether the coverage starts immediately upon purchase. In this article, we will explore this topic in detail and provide you with everything you need to know about term life insurance and its start date.

The answer to whether term life insurance starts immediately or not depends on a few different factors. While some policies may offer immediate coverage, others may have a waiting period before the coverage begins. In this article, we will discuss the factors that determine when term life insurance coverage starts and what you can expect when purchasing a policy. So, let’s dive in and find out everything there is to know about term life insurance and its start date.

Does Term Life Insurance Start Immediately?

Term life insurance is a type of life insurance policy that provides coverage for a fixed period of time. Many people choose term life insurance because it offers affordable premiums and coverage for a specific duration of time. However, a common question that arises is whether term life insurance coverage starts immediately after purchasing the policy. In this article, we will discuss this question in detail.

When Does Term Life Insurance Coverage Start?

When you apply for a term life insurance policy, you will typically need to complete an application and undergo a medical exam. Once the underwriting process is complete, and the policy is issued, the coverage will generally start immediately. However, there are a few exceptions to this rule.

For example, if you have a pre-existing medical condition or engage in risky activities, the insurance company may impose a waiting period before the coverage starts. The waiting period could be anywhere from a few days to several months, depending on the severity of the condition.

Another factor that can impact the start of coverage is when the first premium payment is due. If you select a policy with a deferred premium payment option, the coverage may not start until the first payment is received.

How Long Does Term Life Insurance Coverage Last?

Term life insurance policies provide coverage for a specific duration of time, typically ranging from 10 to 30 years. Once the policy term expires, the coverage ends, and the policyholder would need to purchase a new policy to continue coverage.

It’s important to note that some policies may have a provision for automatic renewal or conversion. Automatic renewal means that the policy will renew for another term without the need for additional underwriting. Conversion allows the policyholder to convert the term policy to a permanent life insurance policy without undergoing additional medical exams.

Benefits of Term Life Insurance

Term life insurance provides many benefits to policyholders, including:

- Affordable premiums – Term life insurance policies are generally more affordable than permanent life insurance policies.

- Flexibility – Policyholders can select the coverage amount and duration that fits their needs.

- Protection – Term life insurance provides financial protection for loved ones if the policyholder were to pass away during the policy term.

Term Life Insurance vs. Permanent Life Insurance

When deciding between term life insurance and permanent life insurance, it’s essential to understand the key differences between the two types of policies.

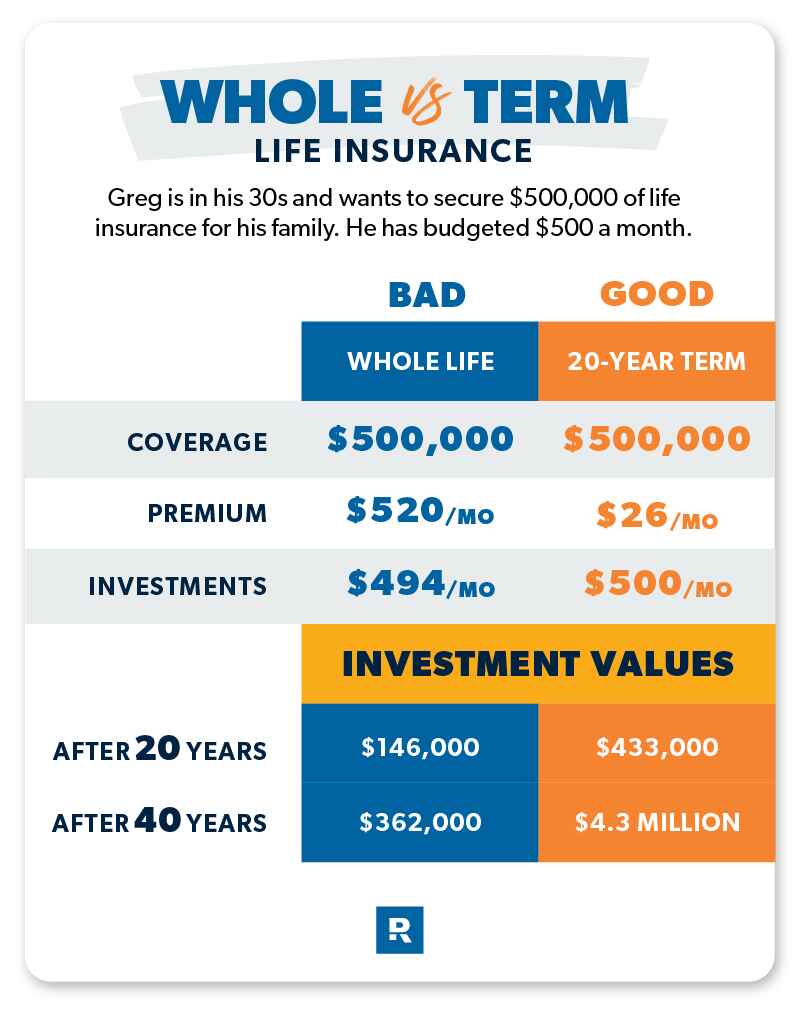

Term life insurance provides coverage for a fixed duration of time and typically has lower premiums than permanent life insurance. Permanent life insurance provides coverage for the policyholder’s entire life and includes a cash value component that grows over time.

While term life insurance may be more affordable, permanent life insurance provides additional benefits such as:

- Guaranteed coverage for life

- Cash value accumulation

- Ability to borrow against the cash value

Conclusion

In conclusion, term life insurance coverage generally starts immediately after the policy is issued. However, there may be exceptions to this rule, such as waiting periods for pre-existing conditions or deferred premium payment options. Term life insurance provides many benefits to policyholders, including affordability, flexibility, and protection. When deciding between term life insurance and permanent life insurance, it’s essential to consider the key differences between the two types of policies and select the one that meets your specific needs.

Contents

- Frequently Asked Questions

- 1. Does term life insurance start immediately?

- 2. Is there a waiting period for term life insurance?

- 3. How long does it take to get term life insurance?

- 4. Can you buy term life insurance online?

- 5. How much does term life insurance cost?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Term life insurance is a popular type of life insurance policy that provides coverage for a specific period of time. Many people have questions about when their coverage starts after purchasing a policy. Here are five common questions and answers about when term life insurance starts.

1. Does term life insurance start immediately?

When you apply for term life insurance and are approved, your coverage typically goes into effect immediately. This means that if anything were to happen to you on the same day that your policy is approved, your beneficiaries would be able to file a claim and receive the death benefit. However, if there are any issues with your application, such as missing information or medical underwriting requirements, your coverage may be delayed until these issues are resolved.

2. Is there a waiting period for term life insurance?

Unlike some other types of insurance, such as disability insurance, there is typically no waiting period for term life insurance. As soon as your policy is approved, you are covered. This is one of the reasons why term life insurance is a popular choice for people who need coverage quickly, such as those who are getting married, having a child, or buying a home.

3. How long does it take to get term life insurance?

The time it takes to get term life insurance can vary depending on the insurance company and the specific policy you are applying for. In some cases, you may be able to get approved and have coverage in place within a few days. In other cases, it may take several weeks for your application to be processed and for your coverage to go into effect.

4. Can you buy term life insurance online?

Yes, many insurance companies allow you to buy term life insurance online. This can be a convenient and easy way to get coverage without having to meet with an insurance agent in person. However, it’s important to make sure that you are buying from a reputable company and that you fully understand the policy you are purchasing before you make a decision.

5. How much does term life insurance cost?

The cost of term life insurance can vary depending on a number of factors, including your age, health, and the amount of coverage you need. Generally, term life insurance is more affordable than other types of life insurance, such as whole life insurance, because it provides coverage for a specific period of time and does not build cash value. To get an accurate idea of how much term life insurance will cost for you, it’s best to get quotes from several different insurance companies.

After researching extensively on the topic of term life insurance, it is evident that the answer to the question “Does term life insurance start immediately?” is not a simple yes or no. The start time of a term life insurance policy depends on various factors such as the underwriting process, the health of the policyholder, and the insurance company’s policies. However, it is safe to say that most term life insurance policies require a waiting period of at least 30 days before the coverage starts.

It is crucial to understand the terms and conditions of a term life insurance policy before purchasing it. As a professional writer, I advise you to read the fine print and ask questions to ensure that you fully understand the policy’s provisions. Ultimately, term life insurance is a valuable investment that provides financial protection to your loved ones in case of your untimely death. Therefore, taking the time to research and understand the policy’s terms and conditions can help you make an informed decision that will benefit you and your family in the long run.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts