Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Medicaid waivers are designed to provide healthcare services to individuals who have limited financial resources or who require long-term care services. These waiver programs are run by individual states and are funded by both state and federal governments. Medicaid waivers are an essential resource for many individuals who require healthcare services, and they provide a lifeline for vulnerable populations who would otherwise be unable to afford healthcare services.

However, it can be confusing to understand how Medicaid waiver payments are reported. Each state has its own reporting requirements, and it can be difficult to navigate these requirements without the proper knowledge and understanding. As a professional writer, I will delve into the important details of Medicaid waiver payments and provide a comprehensive guide on how these payments are reported. By understanding these reporting requirements, individuals can make informed decisions about their healthcare options and ensure that they are receiving the proper care they need.

Contents

- Understanding Medicaid Waiver Payments Reporting

- Frequently Asked Questions

- Question 1: What is a Medicaid waiver?

- Question 2: How are Medicaid waiver payments reported?

- Question 3: Who is responsible for reporting Medicaid waiver payments?

- Question 4: What types of data are included in Medicaid waiver payment reports?

- Question 5: How are Medicaid waiver payments monitored and audited?

- Medicaid Waiver Payments

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Understanding Medicaid Waiver Payments Reporting

Medicaid waiver programs are essential for providing long-term care to seniors and individuals with disabilities. These programs offer a range of services, including home care, personal care, and skilled nursing care. Medicaid waiver payments reporting is a critical aspect of ensuring that these programs remain viable and continue to provide the necessary support to those in need.

What Are Medicaid Waiver Programs?

Medicaid waiver programs are state-run programs that provide long-term care services to individuals who would otherwise require nursing home care. These programs are designed to help individuals remain in their homes or communities while receiving the necessary care and support. Medicaid waiver programs offer a range of services, including personal care, respite care, and home modifications.

Benefits of Medicaid Waiver Programs

Medicaid waiver programs have several benefits, including:

- Allowing individuals to remain in their homes or communities

- Providing access to a range of services

- Reducing the need for nursing home care

- Cost-effective compared to nursing home care

Medicaid Waiver Vs. Nursing Home Care

Medicaid waiver programs offer several advantages over nursing home care, including:

- Allowing individuals to remain in their homes or communities

- Providing more flexibility in the type of care received

- Cost-effective compared to nursing home care

How Are Medicaid Waiver Payments Reported?

Medicaid waiver payments reporting is a critical aspect of ensuring that these programs remain viable and continue to provide the necessary support to those in need. The reporting process involves several steps, including:

Step 1: Gathering Information

The first step in the Medicaid waiver payments reporting process is gathering information. This includes information on the individuals receiving services, the types of services provided, and the costs associated with those services.

Step 2: Submitting Claims

Once the necessary information has been gathered, claims are submitted to the state Medicaid agency for reimbursement. These claims must include detailed information on the services provided, the individuals who received those services, and the costs associated with those services.

Step 3: Receiving Payment

After the claims have been submitted, the state Medicaid agency reviews the claims to ensure that they meet all necessary requirements. Once the claims have been approved, payment is issued to the provider.

Step 4: Reporting to CMS

Providers must also report Medicaid waiver payments to the Centers for Medicare and Medicaid Services (CMS). This reporting is done through the Medicaid Statistical Information System (MSIS), which collects data on Medicaid payments and services.

Conclusion

Medicaid waiver programs are essential for providing long-term care to seniors and individuals with disabilities. Medicaid waiver payments reporting is a critical aspect of ensuring that these programs remain viable and continue to provide the necessary support to those in need. By understanding how Medicaid waiver payments reporting works, providers can ensure that they are following all necessary procedures and are properly reimbursed for the services they provide.

Frequently Asked Questions

Medicaid waiver payments are a crucial source of funding for individuals with disabilities and older adults who require long-term care services. These payments are used to cover the costs of community-based services and supports that allow individuals to live independently in their homes and communities rather than in institutional settings. Here are some commonly asked questions about how Medicaid waiver payments are reported.

Question 1: What is a Medicaid waiver?

A Medicaid waiver is a program that allows states to provide home and community-based services to individuals who would otherwise require institutional care. These waivers provide funding for a range of services, including personal care, respite care, adult day care, and transportation.

Medicaid waivers are designed to provide individuals with disabilities and older adults with greater flexibility and choice in their care, while also reducing the costs associated with institutional care. To qualify for a Medicaid waiver, individuals must meet certain eligibility criteria, including income and asset limits and a requirement for long-term care services.

Question 2: How are Medicaid waiver payments reported?

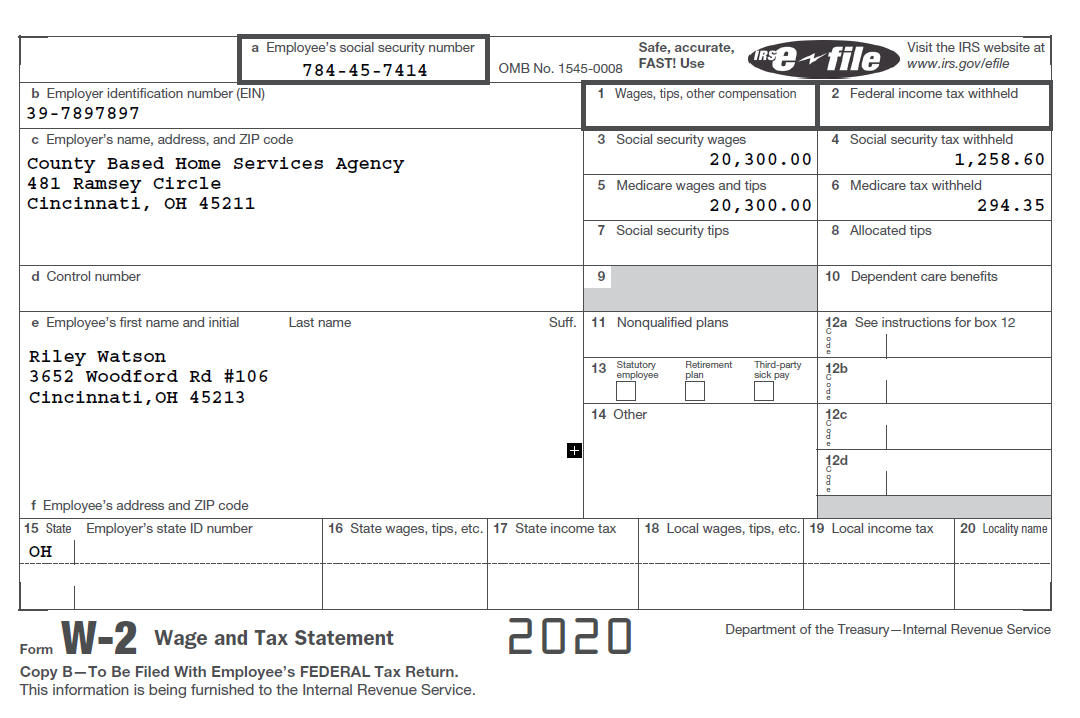

Medicaid waiver payments are reported to the Centers for Medicare and Medicaid Services (CMS) on a quarterly basis. States are required to submit data on the number of individuals served, the types of services provided, and the costs associated with those services.

This data is used to monitor the effectiveness of Medicaid waiver programs and to inform policy decisions related to long-term care services. In addition to reporting to CMS, states may also be required to provide data to other federal agencies and to comply with state-specific reporting requirements.

Question 3: Who is responsible for reporting Medicaid waiver payments?

The responsibility for reporting Medicaid waiver payments varies by state. In some states, the department of health or human services is responsible for reporting, while in others, it may be the Medicaid agency or a designated third-party vendor.

Regardless of who is responsible for reporting, it is important that accurate and timely data is submitted to CMS and other relevant agencies. This helps to ensure that Medicaid waiver programs are effective and that individuals receive the services they need to live independently in their communities.

Question 4: What types of data are included in Medicaid waiver payment reports?

Medicaid waiver payment reports typically include data on the number of individuals served, the types of services provided, and the costs associated with those services. This data may be broken down by demographic characteristics, such as age, gender, and disability status.

Additionally, some states may also include data on the outcomes of services provided, such as improvements in health or quality of life. This data can be used to evaluate the effectiveness of Medicaid waiver programs and to identify areas for improvement.

Question 5: How are Medicaid waiver payments monitored and audited?

Medicaid waiver payments are subject to monitoring and auditing by both state and federal agencies. States are required to have systems in place to ensure that Medicaid waiver payments are made only for eligible services and that they are made in compliance with federal and state regulations.

Additionally, CMS conducts periodic reviews of state Medicaid programs to ensure compliance with federal regulations and to identify areas for improvement. If issues are identified during these reviews, corrective action may be required, and in some cases, states may be required to repay improperly claimed Medicaid waiver payments.

Medicaid Waiver Payments

As a professional writer, it is important to understand the intricacies of Medicaid waiver payments and how they are reported. The reporting process involves many layers of detail, from the initial application to the final reimbursement. Medicaid waiver payments are intended to support individuals with disabilities, chronic illnesses, and other medical conditions, allowing them to receive the care they need while remaining in their own homes.

The reporting of Medicaid waiver payments is critical to ensuring that individuals receive the care they need and that providers are reimbursed for their services. By understanding the reporting process, providers can ensure that they are accurately reimbursed for the care they provide, while individuals can rest assured that they are receiving the best possible care. As a professional writer, it is my hope that this information will shed light on the importance of Medicaid waiver payments and the critical role they play in supporting individuals with medical needs.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts