Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As the baby boomer generation continues to age, the demand for Medicare insurance has skyrocketed. If you’re a licensed insurance agent looking to expand your client base and boost your income, selling Medicare insurance could be the perfect opportunity for you. But where do you start?

Selling Medicare insurance can be a profitable and rewarding career path, but it requires a thorough understanding of the industry and a commitment to providing exceptional service to your clients. In this guide, we’ll cover everything you need to know to get started, from the basics of Medicare coverage to the best strategies for marketing your services and building a successful business. Whether you’re a seasoned insurance professional or just starting out in the industry, this guide will provide you with the knowledge and tools you need to sell Medicare insurance with confidence and success.

Selling Medicare insurance requires obtaining the necessary licenses and certifications, as well as building a network of clients. You can start by contacting Medicare beneficiaries in your area, attending community events, and building relationships with healthcare providers. Additionally, utilizing online marketing strategies like social media and search engine optimization can help you reach a wider audience. It’s important to stay up-to-date on changes in Medicare regulations and coverage options to best serve your clients.

Contents

- How Can I Sell Medicare Insurance?

- Frequently Asked Questions

- What are the requirements for selling Medicare insurance?

- How do I market Medicare insurance products?

- What are the key features of Medicare insurance policies?

- How do I choose which Medicare insurance products to sell?

- What are some common challenges when selling Medicare insurance?

- How To Become An EXPERT At Selling Medicare Insurance!

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How Can I Sell Medicare Insurance?

Selling Medicare insurance can be a lucrative career option, but it requires knowledge and expertise in the field. As a Medicare insurance agent, you’ll need to understand the different types of policies, eligibility requirements, and coverage options available to your clients. In this article, we’ll explore some of the key factors to consider when selling Medicare insurance and provide tips for success.

Understanding Medicare Insurance

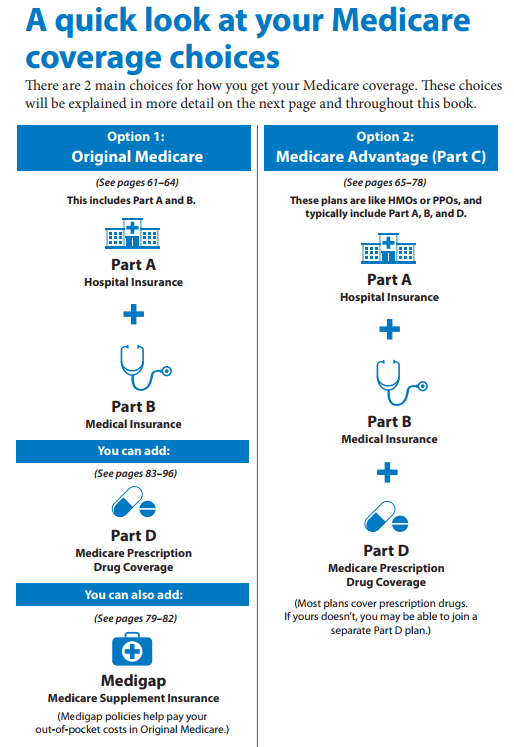

Medicare is a federal health insurance program that provides coverage to individuals aged 65 or older, as well as those with certain disabilities or chronic conditions. There are several different types of Medicare coverage, including:

- Original Medicare (Parts A and B)

- Medicare Advantage (Part C)

- Prescription Drug Plans (Part D)

- Medigap (Supplemental Insurance)

To sell Medicare insurance, you’ll need to have a deep understanding of each of these coverage options, as well as the eligibility requirements for each. You’ll also need to be able to explain the benefits and drawbacks of each type of coverage to your clients.

Obtaining the Necessary Licenses

To sell Medicare insurance, you’ll need to obtain the necessary licenses and certifications. The specific requirements vary by state, but most states require agents to hold a health insurance license and a separate license to sell Medicare products.

In addition to obtaining the necessary licenses, it’s also important to stay up to date on any changes to Medicare regulations and policies. This can be done through continuing education courses and professional development opportunities.

Building a Client Base

One of the biggest challenges of selling Medicare insurance is building a client base. There are a few key strategies that can help you attract new clients, including:

- Networking with other professionals in the healthcare industry

- Offering free seminars or workshops on Medicare insurance

- Advertising through targeted social media campaigns or local publications

- Partnering with community organizations or senior centers

Enrolling in Medicare coverage can be a confusing and overwhelming process for many individuals. As an insurance agent, it’s your job to guide your clients through the enrollment process and help them select the coverage options that best meet their needs.

This may involve helping clients fill out enrollment forms, explaining the different coverage options, and assisting with any issues that arise during the enrollment process.

Providing Excellent Customer Service

Providing excellent customer service is key to building a successful career as a Medicare insurance agent. This means being responsive to your clients’ needs, answering questions promptly and thoroughly, and providing ongoing support throughout the enrollment process and beyond.

It’s also important to stay in touch with your clients on a regular basis, providing updates on any changes to Medicare policies or coverage options and offering additional support as needed.

Marketing Yourself Effectively

In order to succeed as a Medicare insurance agent, you’ll need to be able to effectively market yourself and your services to potential clients. This may involve building a professional website, creating targeted marketing materials, and leveraging social media to reach your target audience.

It’s also important to stay up to date on industry trends and developments, and to position yourself as a trusted expert in the field of Medicare insurance.

Working with Reputable Carriers

When selling Medicare insurance, it’s important to work with reputable carriers that offer high-quality coverage options and excellent customer service. This will help ensure that your clients receive the best possible care and support, and that you are able to build a strong reputation as a trusted agent in the industry.

Understanding the Competition

The Medicare insurance industry is highly competitive, with many agents vying for the same clients. To succeed in this field, it’s important to understand the competition and to differentiate yourself from other agents.

This may involve developing a niche specialty, such as working with a specific demographic or offering unique coverage options. It may also involve leveraging your experience and expertise to provide exceptional service and support to your clients.

Providing Ongoing Support

Once your clients have enrolled in Medicare coverage, it’s important to provide ongoing support and assistance as needed. This may involve helping clients navigate the healthcare system, answering questions about coverage options or claims, and providing additional resources and support as needed.

By providing exceptional service and support to your clients, you’ll be able to build a strong reputation as a trusted expert in the field of Medicare insurance and attract new clients through referrals and word of mouth.

Conclusion

Selling Medicare insurance can be a rewarding and lucrative career option, but it requires knowledge, expertise, and a commitment to providing exceptional service and support to your clients. By following the tips outlined in this article, you can build a successful career as a Medicare insurance agent and help your clients navigate the complex world of healthcare coverage.

Frequently Asked Questions

Here are some commonly asked questions regarding selling Medicare insurance:

What are the requirements for selling Medicare insurance?

Before you can sell Medicare insurance, you must obtain the proper licenses and certifications. This typically involves completing specific coursework and passing an exam. Additionally, you must be appointed with the insurance carriers you wish to sell policies for. Finally, you must comply with all state and federal regulations governing the sale of insurance products.

Once you have met these requirements, you are ready to start selling Medicare insurance. You may choose to work independently, as a broker, or as an agent for an insurance company.

How do I market Medicare insurance products?

Marketing Medicare insurance products requires a targeted approach. You should focus on reaching out to individuals who are nearing retirement age and may be interested in purchasing these policies. This can involve networking with professionals in the retirement planning industry, such as financial advisors and estate planners. You may also consider advertising through print or digital media, attending local events, or hosting educational seminars on Medicare and retirement planning.

When marketing Medicare insurance products, it is important to comply with all state and federal regulations. This includes obtaining necessary approvals for advertising materials and ensuring that all claims made are accurate and truthful.

What are the key features of Medicare insurance policies?

Medicare insurance policies offer a range of benefits, including coverage for hospital stays, doctor visits, and prescription drugs. These policies are designed to help individuals cover their healthcare costs in retirement, when they may no longer have employer-sponsored coverage. Some policies may also include additional benefits, such as dental, vision, or hearing coverage.

When selling Medicare insurance policies, it is important to understand the specific features of each product and be able to explain them clearly to potential customers. This can involve reviewing plan documents, attending training sessions, and staying up-to-date on changes to Medicare regulations.

How do I choose which Medicare insurance products to sell?

When deciding which Medicare insurance products to sell, it is important to consider the needs of your target market. You should research the available options and compare the benefits, costs, and restrictions of each policy. You may also want to consider which insurance carriers you can work with and what commission rates they offer.

Ultimately, the best Medicare insurance products to sell are those that meet the needs of your customers and provide you with a fair commission. This may involve offering a range of policies from multiple carriers to give your clients more options.

What are some common challenges when selling Medicare insurance?

Selling Medicare insurance can be a rewarding career, but it also comes with some challenges. One common issue is the complexity of Medicare regulations, which can make it difficult to understand and explain policy features to customers. Additionally, there may be competition from other insurance agents or brokers in your area.

Other challenges may include finding and retaining clients, navigating the administrative and compliance requirements of selling insurance, and keeping up with changes to Medicare regulations and policies. However, with the right training, support, and dedication, these challenges can be overcome.

How To Become An EXPERT At Selling Medicare Insurance!

In today’s healthcare landscape, selling Medicare insurance can be a lucrative career path for those interested in helping seniors navigate their healthcare options. To be successful in this field, it’s important to have a deep understanding of the Medicare system, as well as strong communication and sales skills. By building relationships with clients, staying up-to-date on industry changes, and offering personalized advice, you can establish yourself as a trusted advisor and help seniors make informed decisions about their healthcare coverage.

While the process of selling Medicare insurance can be complex, the rewards are significant. Not only will you be able to make a meaningful difference in the lives of seniors, but you’ll also have the opportunity to build a successful career in a growing industry. With dedication, hard work, and a commitment to providing exceptional service, you can become a top-performing Medicare insurance agent and help seniors access the care they need to live healthy, fulfilling lives.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts