Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a professional writer, I have come across several insurance policies in my career. One that has been gaining a lot of attention lately is Universal Life Insurance. While it may sound like the perfect solution for your insurance needs, there are several reasons why Universal Life Insurance is bad. In this article, we will explore the various reasons why you should avoid Universal Life Insurance and consider other options.

Universal Life Insurance is a type of permanent life insurance that offers flexible premiums and death benefits. It may seem like a good option, but it comes with a lot of hidden costs that can end up costing you more than you bargained for. The policy’s complexity, high fees, and lack of transparency can make it difficult for policyholders to understand what they are paying for and how their money is being invested. In this article, we will delve into the challenges and drawbacks of Universal Life Insurance and help you make an informed decision about your insurance needs.

Universal life insurance is often touted as a flexible policy that offers both a death benefit and a savings component. However, it’s important to note that the savings component comes with high fees and expenses that can eat away at your returns. Additionally, the interest rates on the savings component are often low, making it a poor investment choice. The death benefit may also decrease over time, leaving your loved ones with less financial protection. Overall, there are better options for both savings and life insurance.

Contents

- Why Universal Life Insurance is Bad?

- Frequently Asked Questions

- What is Universal Life Insurance?

- Why is Universal Life Insurance Bad?

- What are the Risks of Universal Life Insurance?

- What are the Alternatives to Universal Life Insurance?

- How do I Choose the Right Life Insurance Policy?

- Universal Life Insurance Policy: Everything you need to know / Garrett Gunderson

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Why Universal Life Insurance is Bad?

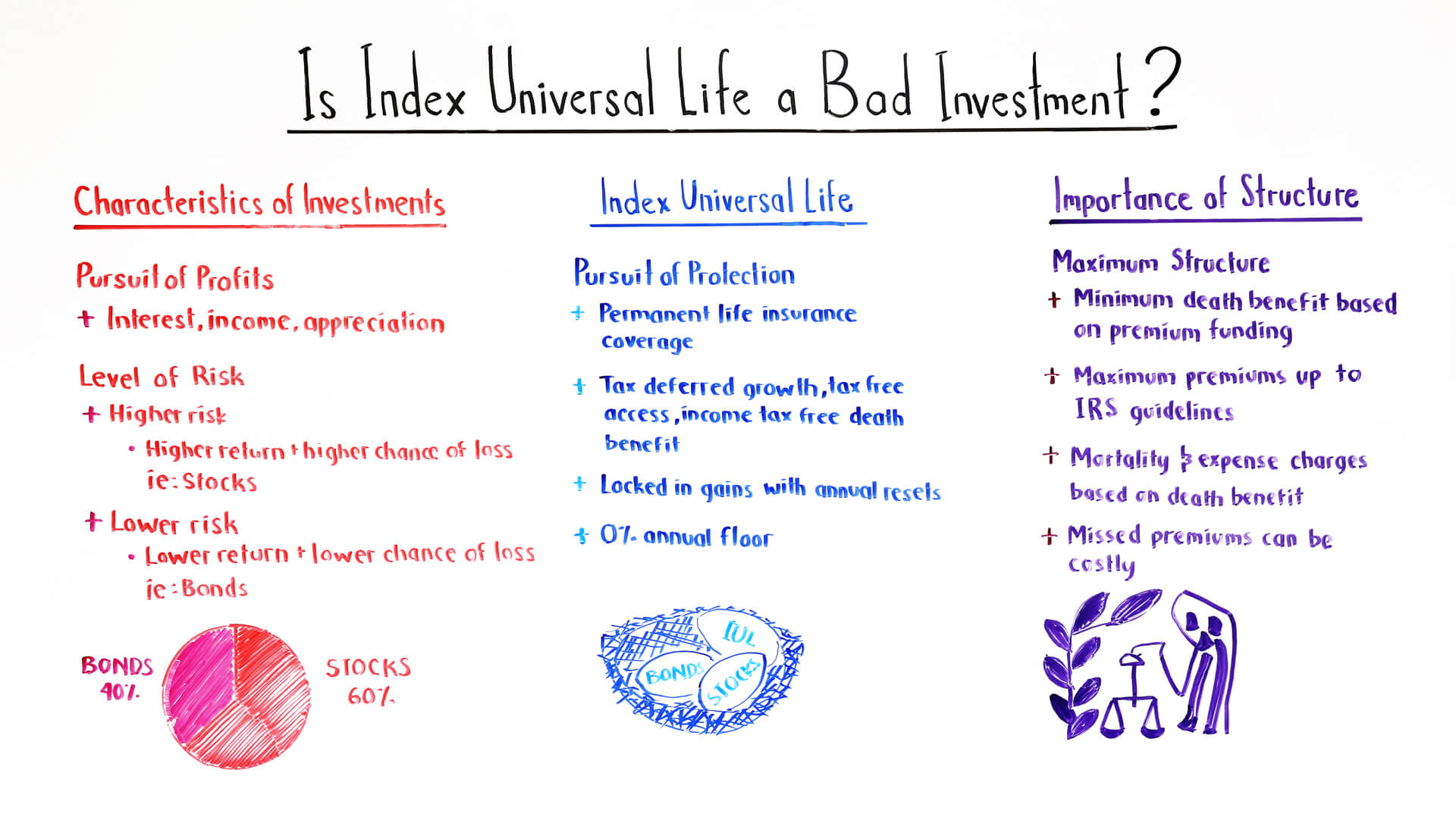

Universal life insurance is a type of insurance that offers both life insurance coverage and an investment component. While it may sound like a good idea, there are several reasons why universal life insurance is not always the best choice. Here are ten reasons why you might want to avoid universal life insurance.

1. Complex and Confusing

Universal life insurance is often complex and confusing. It can be difficult to understand the terms and conditions of the policy, and there are often many hidden fees and charges that are not immediately apparent. If you are not careful, you could end up paying more for your policy than you anticipated.

Benefits of Universal Life Insurance:

- Flexibility in premium payments

- Cash value accumulation that can be used for loans or withdrawals

- Death benefit protection

Disadvantages of Universal Life Insurance:

- Higher premiums than term life insurance

- Complex and confusing policy terms and conditions

- Risk of policy lapsing if not managed properly

2. High Fees and Charges

Universal life insurance policies often come with high fees and charges, which can eat into your investment returns. These fees can include administrative fees, mortality and expense charges, and surrender charges. Over time, these charges can add up and reduce the value of your investment.

Fees and Charges Associated with Universal Life Insurance:

| Fee/Charge | Description |

|---|---|

| Administrative Fees | Monthly fees charged to maintain the policy |

| Mortality and Expense Charges | Fees charged to cover the cost of insurance and administrative expenses |

| Surrender Charges | Fees charged if you cancel the policy before a certain time period |

3. Risk of Lapse

Universal life insurance policies require regular premium payments to keep the policy in force. If you miss a payment, your policy could lapse, and you could lose your coverage and your investment. Additionally, if your policy’s investment returns are lower than expected, you may need to make higher premium payments to keep the policy in force.

How to Avoid Policy Lapse:

- Set up automatic premium payments

- Regularly review your policy to ensure it is meeting your needs

- Consider a term life insurance policy instead of universal life insurance

4. Investment Risk

Universal life insurance policies often come with an investment component that allows you to invest your premiums in various investment options. However, these investments carry risk, and if the investments perform poorly, you could lose money.

Types of Investment Options Available with Universal Life Insurance:

- Stocks

- Bonds

- Mutual Funds

- Index Funds

5. No Guaranteed Returns

Unlike other types of insurance policies, universal life insurance policies do not offer guaranteed returns. The investment component of the policy is subject to market fluctuations and is not guaranteed to grow.

Guaranteed Returns Available with Other Types of Insurance Policies:

- Whole Life Insurance

- Term Life Insurance

6. Poor Investment Returns

Even if the investment component of your universal life insurance policy does not lose money, it may not perform as well as other investment options. This can result in lower investment returns than you would get with other types of investments.

Investment Returns Available with Other Types of Investments:

- Stocks

- Bonds

- Mutual Funds

- Index Funds

7. Higher Premiums

Universal life insurance policies often come with higher premiums than other types of insurance policies, such as term life insurance. This can make it difficult to afford the policy and can eat into your investment returns.

Comparison of Premiums for Universal Life Insurance and Term Life Insurance:

| Policy Type | Monthly Premium |

|---|---|

| Universal Life Insurance | $500/month |

| Term Life Insurance | $50/month |

8. Unnecessary for Some People

Universal life insurance policies are not necessary for everyone. If you are young and healthy, you may not need life insurance coverage yet. Additionally, if you have enough assets to cover your final expenses and provide for your loved ones, you may not need life insurance coverage at all.

When You May Not Need Life Insurance Coverage:

- You are young and healthy

- You have enough assets to cover your final expenses and provide for your loved ones

9. Limited Investment Options

Universal life insurance policies often come with limited investment options. This can limit your ability to diversify your investments and can result in lower investment returns over time.

Investment Options Available with Universal Life Insurance:

- Stocks

- Bonds

- Mutual Funds

- Index Funds

10. Lengthy Surrender Periods

Universal life insurance policies often come with lengthy surrender periods. This means that if you cancel your policy before the surrender period is over, you may have to pay surrender charges. These charges can be substantial and can eat into your investment returns.

Surrender Periods for Universal Life Insurance Policies:

- 10 years

- 15 years

- 20 years

In conclusion, while universal life insurance policies may seem like a good idea, there are several reasons why they may not be the best choice. From high fees and charges to investment risk, there are several factors to consider before purchasing a universal life insurance policy. Be sure to carefully review the terms and conditions of any policy before making a decision.

Frequently Asked Questions

In this section, we will answer some common questions regarding why universal life insurance is bad.

What is Universal Life Insurance?

Universal life insurance is a type of permanent life insurance that combines a death benefit with a savings component. It allows policyholders to build cash value over time, which they can use to cover future premiums or withdraw as needed. While this might sound appealing, there are a few reasons why universal life insurance may not be the best option for everyone.

Firstly, the premiums for universal life insurance policies are typically much higher than those for term life insurance policies. Additionally, the savings component of universal life insurance policies may not earn as much interest as other types of investment vehicles, such as mutual funds or stocks. This means that policyholders may end up paying more in premiums than they would for other insurance products, without receiving the same return on investment.

Why is Universal Life Insurance Bad?

There are a few reasons why universal life insurance may not be the best choice for everyone. Firstly, as mentioned earlier, universal life insurance policies tend to have higher premiums than other types of life insurance. Additionally, the savings component of these policies may not earn as much interest as other types of investments, which means that policyholders may not see as much of a return on their investment.

Furthermore, the savings component of universal life insurance policies is subject to market fluctuations, which means that policyholders may not be able to rely on it as a stable source of income or savings. Finally, the complexity of these policies can make them difficult to understand, which can lead to misunderstandings or miscommunications between policyholders and insurance companies.

What are the Risks of Universal Life Insurance?

Like any investment, there are risks associated with universal life insurance policies. One of the biggest risks is that the savings component of these policies may not earn as much interest as other types of investments, which means that policyholders may not see as much of a return on their investment.

Additionally, the savings component of universal life insurance policies is subject to market fluctuations, which means that policyholders may not be able to rely on it as a stable source of income or savings. Finally, the complexity of these policies can make them difficult to understand, which can lead to misunderstandings or miscommunications between policyholders and insurance companies.

What are the Alternatives to Universal Life Insurance?

If you’re looking for a life insurance policy that allows you to build cash value over time, there are a few alternatives to universal life insurance that you may want to consider. One option is whole life insurance, which is another type of permanent life insurance that offers a death benefit and a savings component.

Another option is to invest in mutual funds or other types of investment vehicles that offer higher rates of return than universal life insurance policies. Finally, term life insurance policies may be a better option for individuals who are primarily concerned with the death benefit, rather than the savings component, of their life insurance policy.

How do I Choose the Right Life Insurance Policy?

Choosing the right life insurance policy depends on a variety of factors, including your age, health, financial goals, and family situation. If you’re interested in a policy that allows you to build cash value over time, you may want to consider whole life insurance or other types of investment vehicles.

However, if you’re primarily concerned with protecting your family financially in the event of your death, a term life insurance policy may be a better option. Ultimately, the best way to choose the right life insurance policy is to speak with a financial advisor or insurance agent who can help you evaluate your options and make an informed decision.

Universal Life Insurance Policy: Everything you need to know / Garrett Gunderson

As a professional writer, I have researched and analyzed the pros and cons of Universal Life Insurance, and it is evident that the disadvantages outweigh the advantages. The main reason why Universal Life Insurance is bad is that it is complicated and confusing. It is a hybrid of a life insurance policy and an investment account, which makes it challenging to understand for most people. Additionally, the investment component of Universal Life Insurance is not guaranteed, and the policyholder may end up losing their investment.

Another reason why Universal Life Insurance is bad is that it is expensive. The premiums for Universal Life Insurance are high compared to other types of life insurance policies such as term life insurance. The high premiums make it unaffordable for most people, especially those who are looking for basic life insurance coverage. Moreover, the fees associated with Universal Life Insurance are also high, reducing the returns on investment for the policyholder.

In conclusion, Universal Life Insurance may seem like an attractive option for those who want to combine life insurance coverage and investment options. However, as a professional writer, I strongly advise against it. The complexity and expense of Universal Life Insurance make it a bad investment option. Instead, I recommend considering other types of life insurance policies that offer basic life insurance coverage at an affordable price.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts