Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Auto insurance is a crucial aspect of owning a vehicle. It not only provides financial protection in case of accidents but also ensures peace of mind while on the road. However, with the passage of time, the question arises, how long should one keep auto insurance records? The answer to this question is not straightforward, and it varies based on a few factors.

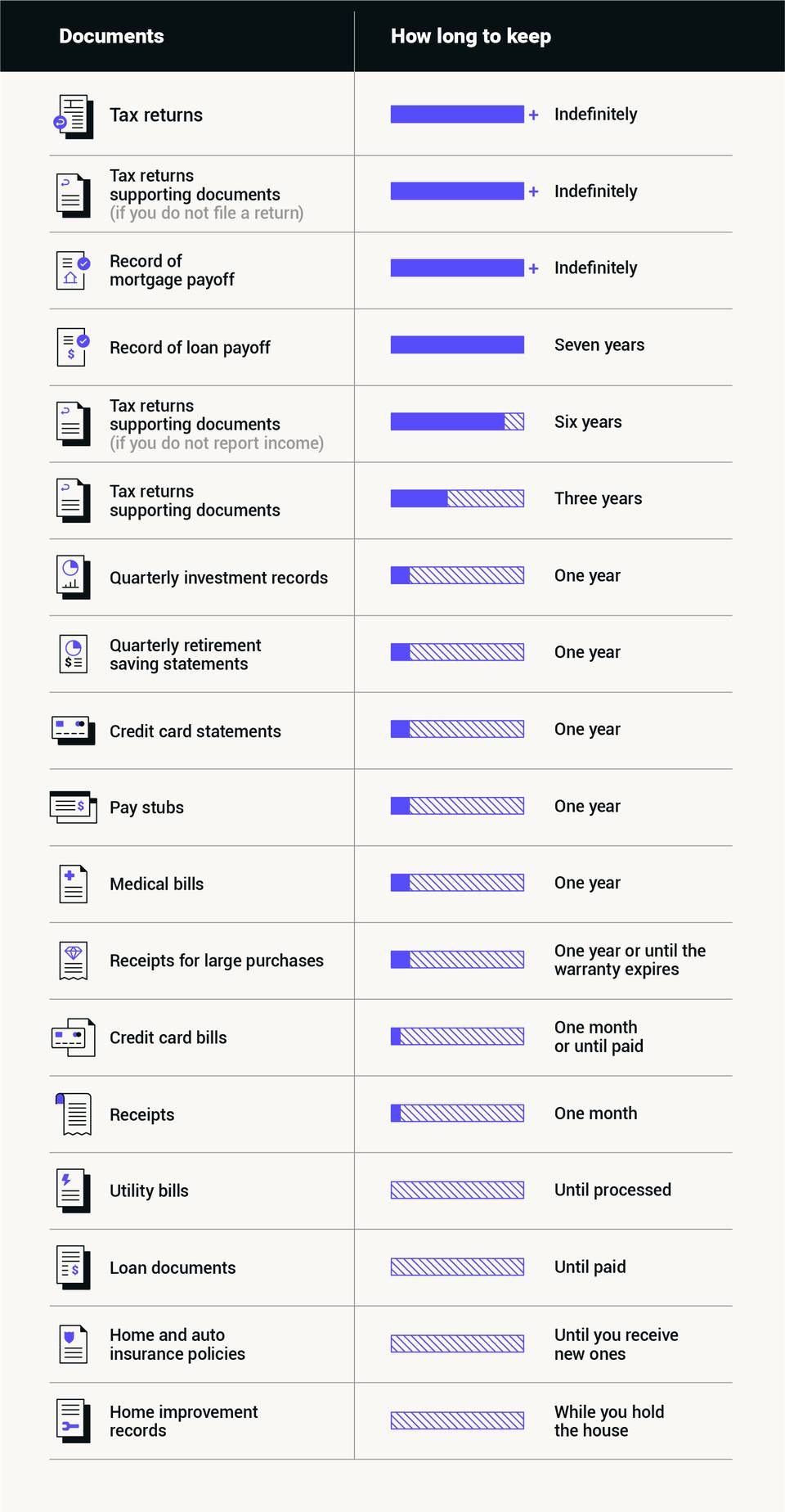

Firstly, it is essential to understand that auto insurance records are legal documents that serve as evidence in case of disputes or legal proceedings. It is recommended to keep these records for at least five years after the policy expires or the claim is settled. Moreover, in case of a severe accident, it is advisable to keep the records for a more extended period, as legal action can be taken up to ten years after the incident. Therefore, it is crucial to know the duration for which auto insurance records should be kept to avoid any legal complications that may arise in the future.

It’s recommended to keep auto insurance records for at least 3 years. This includes policies, claims, and any related documents. However, it’s best to confirm with your insurance provider if they have a specific retention period. Keeping your records longer than necessary can clutter your files and increase the risk of identity theft. You can securely dispose of the documents beyond the retention period by shredding them or using a document destruction service.

Contents

- How Long to Keep Auto Insurance Records?

- Frequently Asked Questions

- How long should you keep auto insurance records?

- What types of auto insurance records should you keep?

- Can you keep auto insurance records in electronic form?

- Where should you keep your auto insurance records?

- Why is it important to keep auto insurance records?

- How long does an accident stay on your insurance

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How Long to Keep Auto Insurance Records?

As a responsible car owner, you know the importance of having auto insurance. But do you know how long you should keep records of your insurance policy and claims? Here’s a guide to help you understand how long to keep your auto insurance records.

Policy Documents

Your auto insurance policy is a legal contract that outlines the terms and conditions of your coverage. You should keep a copy of your policy documents for as long as you own the vehicle. This will help you reference specific details about your policy, such as coverage limits and deductibles.

It’s also a good idea to keep policy documents for a few years after you cancel the policy. This will ensure that you have proof of coverage if any claims or disputes arise in the future.

Insurance Premium Payments

Your insurance premium payments are the amount of money you pay to your insurance company for your coverage. You should keep records of your premium payments for at least three years. This includes receipts, bank statements, or any other proof of payment.

Keeping records of your premium payments can be useful if there is a dispute about your coverage or if you need to prove that you have been paying for your insurance.

Claims Records

If you file a claim with your auto insurance company, you should keep records of the claim for at least seven years. This includes any paperwork related to the claim, such as police reports, repair bills, and medical bills.

Keeping records of your claims can be helpful if you need to reference them in the future or if there are any disputes about your coverage.

Insurance ID Cards

Your insurance ID card is proof that you have insurance coverage for your vehicle. You should keep a copy of your insurance ID card for as long as you own the vehicle.

It’s also a good idea to keep previous versions of your insurance ID cards, as they may have different policy numbers or coverage details.

Vehicle Registration and Title

Your vehicle registration and title are important documents that prove ownership of your vehicle. You should keep these documents for as long as you own the vehicle.

If you sell the vehicle, you should keep records of the sale and transfer of ownership for at least three years.

Benefits of Keeping Auto Insurance Records

Keeping records of your auto insurance policy and claims can help you in several ways. For example:

- You can reference your policy documents to understand your coverage details.

- You can prove that you have been paying for your insurance coverage.

- You can reference your claims records for future disputes or reference.

- You can provide proof of ownership and transfer of ownership when selling your vehicle.

Auto Insurance Record Keeping vs. Online Storage

While it’s important to keep records of your auto insurance policy and claims, you may be wondering whether to keep physical copies or store them online.

Both options have their benefits. Physical copies are tangible and can be quickly accessed, while online storage is convenient and accessible from anywhere.

Ultimately, the decision on whether to keep physical copies or store records online will depend on your personal preference and comfort level with technology.

Conclusion

In conclusion, it’s important to keep records of your auto insurance policy and claims for various lengths of time. By doing so, you can reference specific details about your coverage and claims, prove that you have been paying for your insurance, and provide proof of ownership and transfer of ownership when selling your vehicle. Whether you choose to keep physical copies or store records online, make sure to keep them in a safe and accessible location.

Frequently Asked Questions

How long should you keep auto insurance records?

Auto insurance records are essential documents that you must keep track of for a certain period. You should keep your auto insurance records for at least three years from the date of the policy’s expiration. These records are necessary to serve as evidence in case of any dispute or claim arising from the policy. Moreover, keeping records can help you keep track of your insurance history and premiums paid.

However, it is always better to keep your auto insurance records for longer than three years. If you are unsure of how long to keep them, it is recommended that you keep them for at least seven years. This period is sufficient to cover any statute of limitations for filing a lawsuit or claim, as well as for any audit or tax-related purposes.

What types of auto insurance records should you keep?

You should keep all records related to your auto insurance policy, including your policy documents, payment receipts, and claims records. Policy documents should contain information about your coverage limits, policy duration, and any endorsements or riders that you may have added. Payment receipts should show the amount paid, payment date, and the payment method.

Claims records should also be kept, as they provide crucial information about any claims you have made, including the nature of the claim, the amount paid, and the date of the claim. These records can be useful when renewing your policy or when switching to a new insurance provider. You should also keep any correspondence with your insurance provider, such as emails or letters, as they can provide essential details about your policy.

Can you keep auto insurance records in electronic form?

Yes, you can keep your auto insurance records in electronic form, such as PDFs or scanned copies. Electronic records are acceptable as long as they are legible and show all the necessary information. You should keep electronic records in a safe and secure location, such as a password-protected folder on your computer or cloud storage.

It is also good practice to back up your electronic records regularly to avoid losing them due to computer crashes or other technical issues. You should also keep a hard copy of important documents, such as policy documents, in case of any technical problems.

Where should you keep your auto insurance records?

You should keep your auto insurance records in a safe and secure place, such as a fireproof safe or a safety deposit box. These records contain sensitive information, such as your social security number, policy number, and personal details, and should not be left lying around or easily accessible to others.

If you keep your records electronically, you should also ensure that they are password-protected and that the password is not easily guessable. You should also consider encrypting your electronic records for an extra layer of security.

Why is it important to keep auto insurance records?

Keeping auto insurance records is essential for several reasons. Firstly, these records can serve as evidence in case of any disputes or claims arising from the policy. Secondly, they can help you keep track of your insurance history and premiums paid. Thirdly, they can provide valuable information when renewing your policy or when switching to a new insurance provider.

Moreover, keeping accurate and up-to-date records can help you ensure that you are not overpaying for your auto insurance policy. By tracking your premiums and claims, you can identify any discrepancies or errors and take appropriate action to correct them. Overall, keeping auto insurance records is a crucial aspect of maintaining a healthy and secure financial future.

How long does an accident stay on your insurance

As a professional writer, it is essential to understand the importance of record-keeping when it comes to auto insurance. Knowing how long to keep auto insurance records can save you time, money, and hassle in the long run. While there is no one-size-fits-all answer to this question, there are some general guidelines to follow.

Firstly, it is recommended that you keep your auto insurance records for at least three years. This includes policies, declarations pages, and any other documentation related to your coverage. This timeline allows you to access important information in case of an accident or if you need to file a claim. However, if you have a history of accidents or claims, it may be beneficial to keep your records for a longer period. Ultimately, it is up to your discretion, but keeping your auto insurance records organized and accessible can make a significant difference in the event of an accident or claim.

In conclusion, as a professional writer, I emphasize the importance of record-keeping in the world of auto insurance. Knowing how long to keep auto insurance records can help you navigate the process of filing a claim or accessing important information in the event of an accident. While three years is a general guideline, it is ultimately up to you to decide how long to keep your records. Regardless of your decision, keeping your auto insurance records organized and accessible is a wise investment for any driver.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts