Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a motorcycle rider, it’s important to consider the potential risks that come with hitting the open road. While riding can be an exhilarating experience, it also poses dangers that can lead to serious injury or even death. With this in mind, many riders wonder if their life insurance policy will cover them in the event of a motorcycle accident.

The answer to this question is not a straightforward one. While life insurance policies can provide financial protection for loved ones in the event of a rider’s death, the specifics of coverage can vary depending on the policy and the circumstances of the accident. In this article, we’ll explore the nuances of life insurance coverage for motorcycle riders and help you understand what you can do to ensure that you and your family are protected in case the worst happens.

Yes, life insurance policies can cover motorcycle deaths, as long as the policyholder has listed it as a covered scenario. It’s important to note that some insurance providers may exclude motorcycle deaths from their coverage, so it’s crucial to read the policy details carefully before purchasing. Additionally, riders may need to pay higher premiums for coverage due to the increased risk associated with riding motorcycles.

Contents

- Does Life Insurance Cover Motorcycle Death?

- Frequently Asked Questions

- Does life insurance cover motorcycle accidents?

- How does life insurance work in the event of a motorcycle death?

- Do I need to tell my life insurance company that I ride a motorcycle?

- Can I purchase additional coverage for motorcycle accidents?

- What should I do if my loved one dies in a motorcycle accident?

- Does Life Insurance cover Suicide death? #shorts

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Does Life Insurance Cover Motorcycle Death?

Riding a motorcycle can be a thrilling experience, but it also comes with inherent risks. Unfortunately, accidents can happen, and sometimes they can be fatal. If you or a loved one ride a motorcycle, you may be wondering if your life insurance policy would provide coverage in the event of a motorcycle-related death. Here’s what you need to know.

Understanding Life Insurance Coverage

Life insurance policies are designed to provide financial protection in the event of the policyholder’s death. Generally, these policies pay out a lump sum to the policy’s beneficiary upon the policyholder’s death. The beneficiary can use the funds to pay for expenses such as funeral costs, outstanding debts, and living expenses.

There are several types of life insurance policies available, including term life, whole life, and universal life insurance. Each type of policy has its own set of terms, conditions, and exclusions, so it’s important to review your policy carefully to understand what is covered.

Does Life Insurance Cover Motorcycle-Related Deaths?

Whether life insurance covers motorcycle-related deaths depends on the policy’s terms and conditions. In general, most life insurance policies cover deaths that occur as a result of accidents, regardless of the mode of transportation. This means that if the policyholder dies in a motorcycle accident, the policy’s beneficiary would likely be eligible to receive the death benefit.

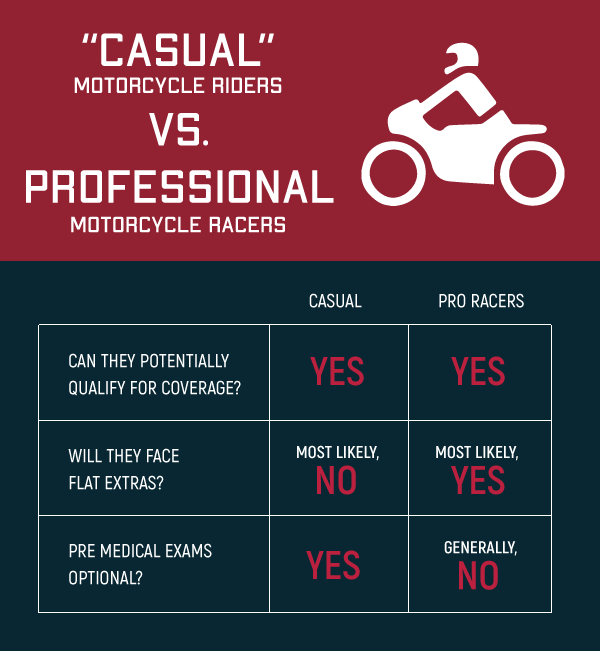

However, there are some exceptions. Some life insurance policies contain exclusions for deaths that occur while the policyholder is engaging in high-risk activities, such as motorcycle riding. If your policy includes this type of exclusion, it’s important to understand what it means and how it could affect your coverage.

Benefits of Having Life Insurance for Motorcycle Riders

If you ride a motorcycle, having a life insurance policy can provide peace of mind for both you and your loved ones. In the event of your unexpected death, your policy’s death benefit can help cover expenses such as funeral costs, outstanding debts, and living expenses.

Additionally, some life insurance policies offer riders that can provide additional coverage for accidental death and dismemberment. These riders can provide an extra layer of protection in the event of a motorcycle accident.

Life Insurance vs. Accidental Death and Dismemberment Insurance

Accidental death and dismemberment (AD&D) insurance is another type of insurance that can provide coverage in the event of a motorcycle-related death. Unlike life insurance, AD&D insurance only pays out in the event of an accidental death or dismemberment.

While AD&D insurance can be a valuable addition to your insurance portfolio, it’s important to understand that it does not provide the same level of coverage as a traditional life insurance policy. AD&D insurance typically only pays out a fraction of the death benefit provided by a life insurance policy, and it may not cover expenses such as funeral costs or outstanding debts.

Factors to Consider When Choosing Life Insurance for Motorcycle Riders

When choosing a life insurance policy as a motorcycle rider, there are several factors to consider. These include:

- The policy’s death benefit amount

- The policy’s premium

- Any exclusions or riders that may affect coverage

- The policy’s term

It’s important to review each of these factors carefully to ensure that you are selecting a policy that meets your needs and provides adequate coverage for your loved ones.

Conclusion

In summary, life insurance can provide coverage for motorcycle-related deaths, but it’s important to review your policy carefully to understand what is covered. Additionally, riders such as accidental death and dismemberment insurance can provide extra protection in the event of an accident. When selecting a life insurance policy, be sure to consider factors such as the policy’s death benefit, premium, and term to ensure that you are choosing the right policy for your needs.

Frequently Asked Questions

Here are some common questions regarding the coverage of life insurance in the event of a motorcycle death:

Does life insurance cover motorcycle accidents?

Yes, life insurance typically covers death from a motorcycle accident, as long as the policy was in force at the time of the accident. However, it’s important to note that some policies may have exclusions for high-risk activities like motorcycle riding. This means that if the policyholder died while riding a motorcycle, the insurance company may not pay out the death benefit.

It’s important to review your life insurance policy carefully to see if there are any exclusions or limitations. If you have any questions or concerns, you should contact your insurance agent or the insurance company directly.

How does life insurance work in the event of a motorcycle death?

If the policyholder dies in a motorcycle accident, the death benefit will be paid out to the designated beneficiary or beneficiaries. The amount of the death benefit will depend on the coverage amount of the policy. The beneficiary can use the money for any purpose, such as paying for funeral expenses, paying off debts, or covering living expenses.

It’s important to note that if the policyholder died while engaging in risky behavior, such as driving under the influence or not wearing a helmet, the insurance company may investigate the circumstances of the death before paying out the death benefit.

Do I need to tell my life insurance company that I ride a motorcycle?

Yes, it’s important to disclose any risky activities, such as motorcycle riding, to your life insurance company when applying for coverage. Failing to disclose this information could result in a denial of benefits if the policyholder dies in a motorcycle accident. It’s better to be upfront about your hobbies and activities to ensure that your policy provides adequate coverage.

Keep in mind that disclosing that you ride a motorcycle may result in higher premiums, as insurance companies view motorcycle riding as a high-risk activity. However, it’s important to have adequate coverage in case of an accident.

Can I purchase additional coverage for motorcycle accidents?

Yes, some life insurance policies offer additional coverage for accidental death and dismemberment, which can provide extra protection in the event of a motorcycle accident. This coverage typically pays out a lump sum if the policyholder dies or suffers a serious injury in an accident, such as losing a limb or becoming permanently disabled.

If you’re a frequent motorcycle rider, it may be worth considering adding this coverage to your life insurance policy to ensure that you have adequate protection.

What should I do if my loved one dies in a motorcycle accident?

If your loved one dies in a motorcycle accident, you should contact the insurance company as soon as possible to file a claim for the death benefit. The insurance company will provide you with the necessary forms and information to submit the claim.

You may also want to consider hiring an attorney or financial advisor to help you navigate the claims process and ensure that you receive the full benefit amount. They can also help you plan for the future and make any necessary financial decisions in the wake of your loved one’s death.

Does Life Insurance cover Suicide death? #shorts

As a professional writer, it is important to understand the intricacies of life insurance policies and their coverage options. The question of whether life insurance covers motorcycle death is a common one, and the answer is not straightforward. While most life insurance policies do cover accidental death, the specific terms and conditions of the policy may vary depending on the insurance provider.

In the end, it is essential to carefully read and understand the terms of your life insurance policy to ensure that you have adequate coverage for yourself and your loved ones. If you are an avid motorcycle rider, it may be worth considering an additional accidental death policy to provide extra protection in case of a motorcycle accident. Regardless of your decision, it is crucial to prioritize the safety of yourself and others on the road while enjoying the thrill of riding a motorcycle.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts