Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Many people struggle with the decision of whether or not to purchase whole life insurance. On one hand, it offers a lifetime of coverage and potential cash value accumulation. On the other hand, it often comes with high premiums and fees. So, is whole life insurance ever a good idea?

The answer is not a simple one. It depends on various factors, including your financial goals, risk tolerance, and current financial situation. In this article, we will dive into the pros and cons of whole life insurance and help you determine if it is the right choice for you.

Is Whole Life Insurance Ever a Good Idea?

Whole life insurance is a type of life insurance policy that provides coverage for the entire lifetime of the insured person, as opposed to term life insurance which provides coverage for a specific period of time. While whole life insurance can provide a range of benefits, it is not always the best choice for everyone. In this article, we will explore the pros and cons of whole life insurance and help you decide if it is the right option for you.

What is Whole Life Insurance?

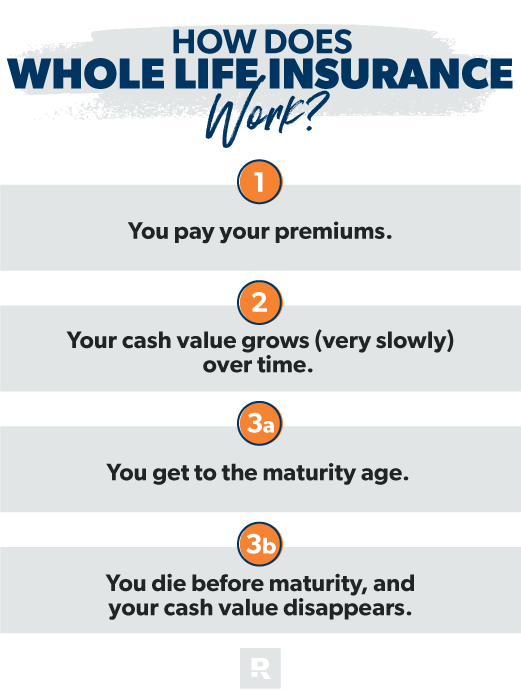

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured person. This means that as long as you pay your premiums, your policy will remain in force until you pass away. Whole life insurance policies also have a cash value component, which can grow over time and can be accessed by the policyholder.

There are different types of whole life insurance policies available, including traditional whole life insurance, universal life insurance, and variable life insurance. Each type of policy has different features and benefits, which we will explore further in this article.

Benefits of Whole Life Insurance

One of the main benefits of whole life insurance is that it provides lifelong coverage. This means that your beneficiaries will receive a death benefit payout regardless of when you pass away, as long as your policy is in force. Whole life insurance can also provide a source of savings, as the cash value component of the policy can grow over time.

Whole life insurance policies also typically have a fixed premium, which means that your premium payments will remain the same throughout the life of the policy. This can be beneficial for those who want to budget for their insurance expenses over the long term.

Drawbacks of Whole Life Insurance

One of the main drawbacks of whole life insurance is that it can be more expensive than term life insurance. This is because whole life insurance provides lifelong coverage and has a cash value component, which can make it more complex and costly to administer.

Another potential drawback of whole life insurance is that the cash value component may not grow as quickly as you expect. This can be due to a range of factors, including fluctuations in the stock market or changes in the policy’s interest rate.

Whole Life Insurance vs. Term Life Insurance

When deciding between whole life insurance and term life insurance, it is important to consider your individual needs and circumstances. Term life insurance provides coverage for a specific period of time, typically between 10 and 30 years, and is generally less expensive than whole life insurance.

However, term life insurance does not have a cash value component and does not provide lifelong coverage. If you want coverage for your entire lifetime and want to build savings through your life insurance policy, whole life insurance may be a better choice for you.

Types of Whole Life Insurance

There are different types of whole life insurance policies available, including traditional whole life insurance, universal life insurance, and variable life insurance.

Traditional whole life insurance provides a fixed death benefit and a fixed premium payment, which remains the same throughout the life of the policy.

Universal life insurance provides more flexibility than traditional whole life insurance, allowing you to adjust your premium payments and death benefit as needed.

Variable life insurance allows you to invest the cash value component of your policy in a range of investment options, which can potentially provide higher returns but also come with greater risk.

Is Whole Life Insurance Right for You?

Deciding whether or not whole life insurance is the right choice for you depends on a range of factors, including your individual needs, budget, and goals.

If you want lifelong coverage and want to build savings through your life insurance policy, whole life insurance may be a good option. However, if you are looking for more affordable coverage and do not need lifelong coverage, term life insurance may be a better choice.

It is important to carefully evaluate your options and consult with a financial advisor or insurance professional before making a decision.

Contents

- Frequently Asked Questions

- Question 1: What are the benefits of whole life insurance?

- Question 2: Who should consider whole life insurance?

- Question 3: How do I determine how much coverage I need?

- Question 4: Can I change my coverage amount or cancel my policy?

- Question 5: How do I choose the right whole life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Whole life insurance is a type of life insurance that provides coverage for your entire lifetime and also has a savings component. Many people wonder if this type of insurance is ever a good idea. Here are some frequently asked questions and answers to help you decide if whole life insurance is right for you.

Question 1: What are the benefits of whole life insurance?

Whole life insurance has several benefits. First, it provides coverage for your entire lifetime, so you don’t have to worry about renewing your policy or losing coverage as you get older. Second, it has a savings component that allows you to build cash value over time. This cash value can be used for things like paying premiums, taking out a loan, or even as a source of retirement income. Finally, whole life insurance provides peace of mind knowing that your loved ones will be taken care of financially in the event of your death.

However, it’s important to note that whole life insurance premiums can be higher than other types of life insurance, and the savings component may not provide the same return as other investment options.

Question 2: Who should consider whole life insurance?

Whole life insurance may be a good option for those who want lifelong coverage and a savings component. It can also be a good option for those who want to leave an inheritance for their loved ones or have estate planning needs. Additionally, those who have a high net worth and are looking for ways to minimize their estate taxes may find whole life insurance beneficial.

However, those who are looking for lower premiums or higher investment returns may want to consider other options, such as term life insurance or investing in the stock market.

Question 3: How do I determine how much coverage I need?

The amount of coverage you need depends on your individual circumstances. Factors to consider include your income, debt, and the number of dependents you have. A general rule of thumb is to have coverage that is 10-12 times your annual income. However, it’s important to speak with a financial advisor or insurance agent to determine the appropriate amount of coverage for your specific situation.

It’s also important to periodically review your coverage to ensure it still meets your needs as your circumstances change over time.

Question 4: Can I change my coverage amount or cancel my policy?

Yes, you can typically change your coverage amount or cancel your policy. However, there may be fees or penalties associated with doing so. Additionally, if you cancel your policy, you may lose any cash value that has accumulated. It’s important to speak with your insurance agent or financial advisor before making any changes to your policy.

It’s also important to note that if you cancel your policy and then decide you want coverage again in the future, you may have to go through the underwriting process again, which could result in higher premiums or being denied coverage altogether.

Question 5: How do I choose the right whole life insurance policy?

Choosing the right whole life insurance policy can be a daunting task. It’s important to consider factors such as the premiums, death benefit, cash value, and the financial strength of the insurance company. Additionally, it’s important to work with a reputable insurance agent or financial advisor who can help guide you through the process and provide you with options that meet your needs and budget.

Be sure to review the policy carefully and ask any questions you may have before making a decision. You want to make sure you fully understand the policy and what it entails before signing on the dotted line.

As a professional writer, I understand that the decision to purchase whole life insurance is a complex one that requires careful consideration of individual circumstances. While it may offer lifelong coverage and a savings component, it often comes with higher premiums and lower returns compared to other investment options. Ultimately, whether or not whole life insurance is a good idea depends on your specific financial goals and needs.

Before deciding on any insurance policy, it is important to assess your overall financial situation and determine what kind of coverage is necessary to protect yourself and your loved ones. For some individuals, whole life insurance may be a valuable investment that provides peace of mind and long-term financial security. For others, it may not be the best option. As with any financial decision, it is crucial to research and consult with a professional to make an informed choice that aligns with your goals and values.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts