Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Whole life insurance is a popular type of insurance policy that provides coverage for the entirety of a person’s life. It is designed to provide a guaranteed death benefit payout to the policyholder’s beneficiaries upon their passing. However, what happens to whole life insurance when the policyholder reaches the age of 100? This is a question that many people may have, and the answer may surprise you.

In this article, we will explore what happens to whole life insurance at the age of 100. We will discuss the different options available to policyholders and the implications of each option. Whether you are a current policyholder or considering purchasing whole life insurance, understanding what happens at age 100 is important for your financial planning and peace of mind.

At age 100, the policyholder of a whole life insurance policy receives the full death benefit in cash. This payment is usually tax-free and can be used for any purpose. However, some policies may have a maximum age limit for coverage, and the death benefit may be reduced if the policyholder has taken loans against the policy or if there are outstanding premiums due. It is important to review the terms of the policy to understand the coverage at age 100.

Contents

- What Happens to Whole Life Insurance at Age 100?

- Frequently Asked Questions

- 1. What happens to whole life insurance at age 100?

- 2. What is the face value of a whole life insurance policy?

- 3. Can the face value of a whole life insurance policy increase over time?

- 4. What happens if a policyholder dies before age 100?

- 5. How much does whole life insurance cost?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

What Happens to Whole Life Insurance at Age 100?

If you have a whole life insurance policy, you may be wondering what happens to it when you reach the age of 100. After all, most people don’t live that long, so it’s not something that comes up very often. However, if you are fortunate enough to reach this milestone, there are a few things you should be aware of when it comes to your policy.

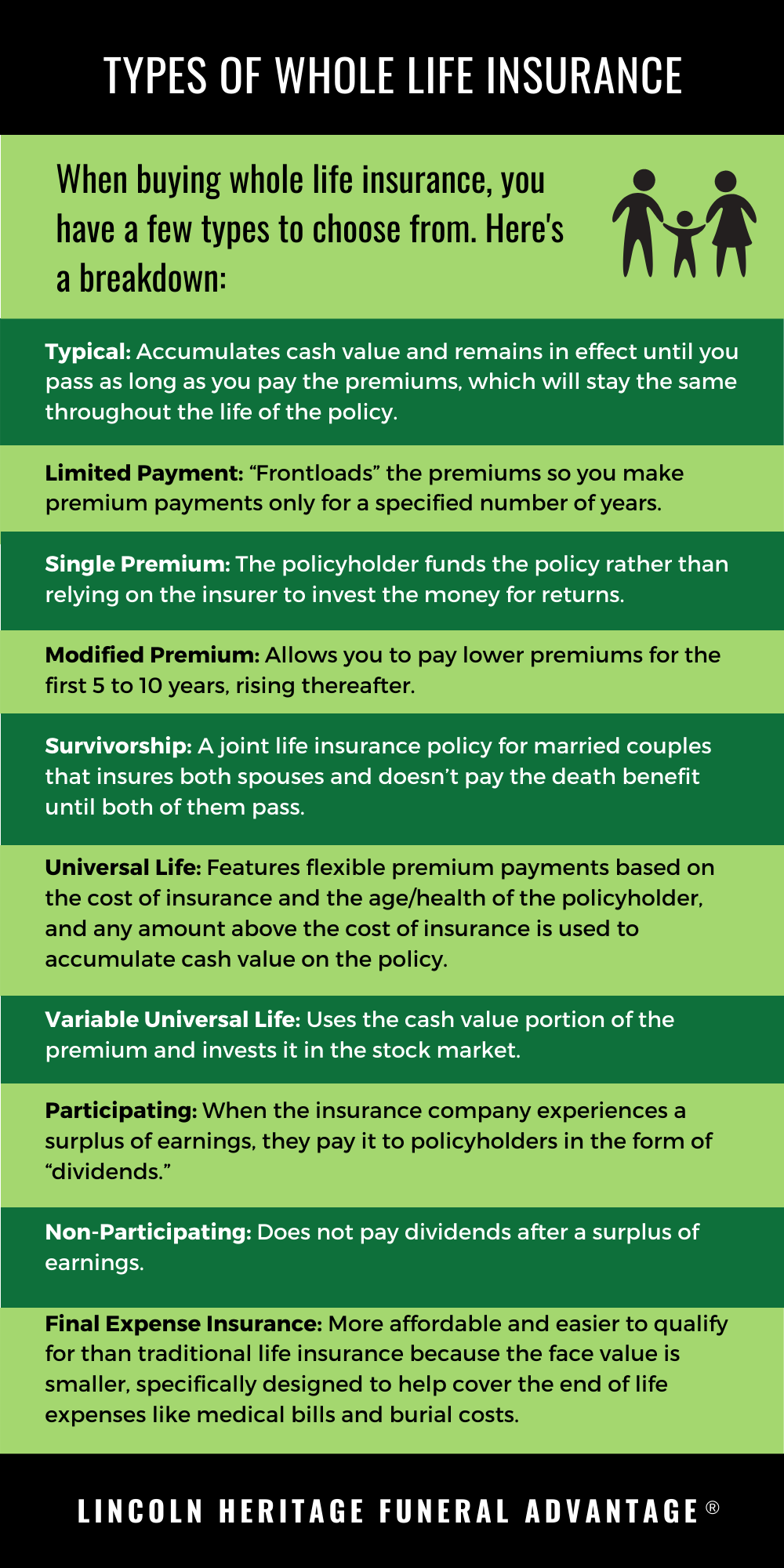

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you continue to pay your premiums. Unlike term life insurance, which only provides coverage for a specific period of time, whole life insurance has no expiration date. In addition to providing a death benefit to your beneficiaries when you pass away, whole life insurance also has a cash value component that grows over time.

How Does the Cash Value Component Work?

When you pay your premiums for whole life insurance, a portion of the money goes toward the death benefit, and a portion goes into the cash value component. The cash value grows over time, and you can borrow against it or withdraw it if you need to. However, doing so will reduce the death benefit, so it’s important to consider the long-term impact before making any decisions.

What Happens to the Cash Value at Age 100?

When you reach the age of 100, your whole life insurance policy will typically pay out the cash value to you in a lump sum. This is because the policy is designed to provide coverage for your entire life, and at this point, the insurance company assumes that you will not live much longer.

What Are the Benefits of Whole Life Insurance?

There are several benefits to having a whole life insurance policy, including:

Lifetime Coverage

Unlike term life insurance, whole life insurance provides coverage for your entire life. This means that your beneficiaries will receive a death benefit regardless of when you pass away.

Cash Value Growth

The cash value component of whole life insurance grows over time, providing a source of savings that you can borrow against or withdraw if needed.

Stable Premiums

The premiums for whole life insurance are typically fixed, which means that you won’t have to worry about them increasing over time.

Whole Life Insurance vs. Term Life Insurance

When it comes to choosing between whole life insurance and term life insurance, there are a few key differences to consider.

Cost

Term life insurance is typically less expensive than whole life insurance, especially for younger individuals. However, the cost of term life insurance increases as you get older, whereas the premiums for whole life insurance are typically fixed.

Coverage Length

Term life insurance provides coverage for a specific period of time, such as 10, 20, or 30 years. Once the term ends, the coverage expires. Whole life insurance, on the other hand, provides coverage for your entire life.

Cash Value Component

Only whole life insurance has a cash value component that grows over time, providing a source of savings that you can borrow against or withdraw if needed.

Conclusion

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you continue to pay your premiums. When you reach the age of 100, your policy will typically pay out the cash value component in a lump sum. While whole life insurance is more expensive than term life insurance, it provides lifetime coverage and a source of savings that can be accessed if needed.

Frequently Asked Questions

Whole life insurance is a popular type of life insurance that provides coverage for the entire life of the policyholder. It is important to understand what happens to whole life insurance at age 100, as this is a common question among policyholders.

1. What happens to whole life insurance at age 100?

At age 100, the policyholder will receive the face value of the policy in a lump sum payment. This is known as the policy’s “maturity benefit.” The policy will then terminate, and the insurance company will no longer provide coverage.

It is important to note that some policies may have a “reduced paid-up” option, which allows the policyholder to stop paying premiums before age 100 and receive a reduced death benefit instead of the full face value of the policy at age 100.

2. What is the face value of a whole life insurance policy?

The face value of a whole life insurance policy is the amount of money that the policy will pay out to the beneficiary upon the death of the policyholder. This amount is typically determined at the time the policy is purchased and remains fixed for the life of the policy.

For example, if a policyholder purchases a whole life insurance policy with a face value of $100,000, the policy will pay out $100,000 to the beneficiary upon the policyholder’s death, regardless of when that occurs.

3. Can the face value of a whole life insurance policy increase over time?

No, the face value of a whole life insurance policy is typically fixed at the time the policy is purchased and does not increase over time. However, some policies may offer a “dividend” option, which allows policyholders to receive a portion of the insurance company’s profits as a cash payment or as an increase in the face value of the policy.

It is important to note that dividends are not guaranteed and are dependent on the financial performance of the insurance company.

4. What happens if a policyholder dies before age 100?

If a policyholder dies before age 100, the policy will pay out the face value of the policy to the beneficiary. The beneficiary can use the proceeds from the policy to cover funeral expenses, pay off outstanding debts, or provide financial support for loved ones.

The death benefit is typically tax-free and can be paid out in a lump sum or in regular installments, depending on the preferences of the beneficiary.

5. How much does whole life insurance cost?

The cost of whole life insurance varies depending on a number of factors, including the age and health of the policyholder, the face value of the policy, and the length of the policy term. Generally, whole life insurance premiums are higher than term life insurance premiums, as they provide coverage for the entire life of the policyholder.

It is important to shop around and compare quotes from multiple insurance companies to find the best policy and premium for your individual needs and budget.

As a professional writer, I understand the importance of planning for the future. When it comes to whole life insurance, many people may wonder what happens when they reach the age of 100. The answer may surprise you – at that age, the policyholder receives the full death benefit of the policy, tax-free.

This means that if you have whole life insurance and live to the age of 100, your beneficiaries will receive the full amount of your policy. This can provide peace of mind and financial security for both you and your loved ones. It’s important to remember that whole life insurance is designed to provide lifelong coverage, and reaching the age of 100 does not change that. So if you’re considering purchasing a whole life insurance policy, know that it can provide benefits not just for you, but for generations to come.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts