Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Possible introduction:

Life insurance is a crucial financial tool that can provide peace of mind and financial security for your loved ones after you pass away. If you have dependents, debts, or estate taxes, life insurance can help ensure that they don’t suffer financial hardship or loss of assets when you’re no longer there to provide for them. However, choosing the right amount of coverage can be challenging, especially if you have a high net worth or complex financial situation. In this article, we’ll explore one common question that many wealthy individuals ask: How much does a 2 million life insurance policy cost?

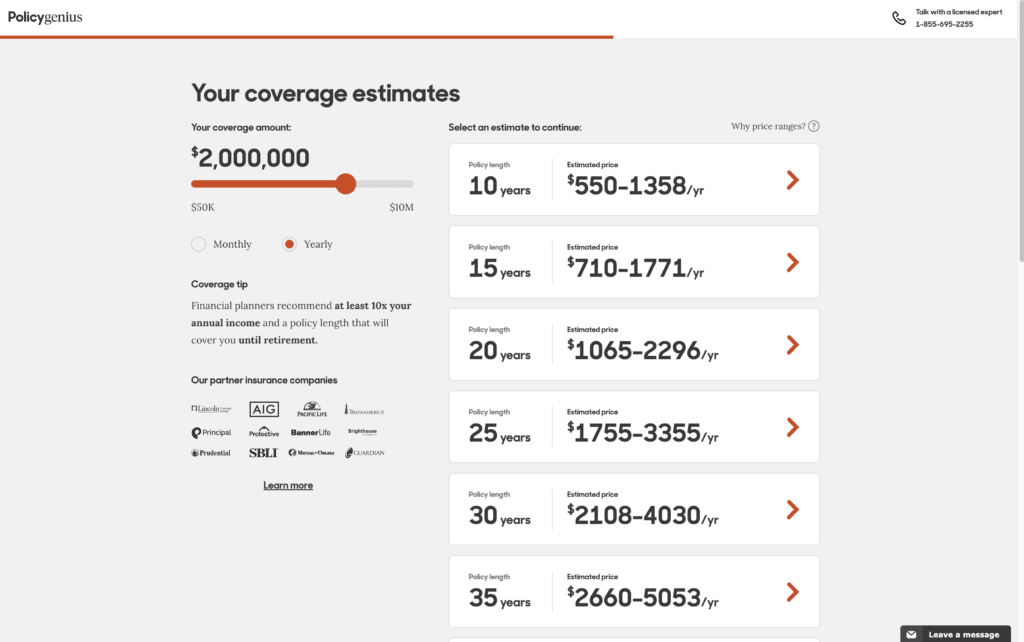

First, it’s important to understand that the cost of life insurance depends on various factors, such as your age, health, lifestyle, occupation, hobbies, and family history. Generally, the older you are and the more health issues or risky activities you have, the more you’ll pay for life insurance. Moreover, the amount of coverage you need and the type of policy you choose will also affect the cost. For example, a 2 million term life insurance policy, which provides coverage for a specific period (e.g., 10, 20, or 30 years), will typically cost less than a 2 million permanent life insurance policy, which lasts for your lifetime and may have cash value or investment features. Thus, the cost of a 2 million life insurance policy can vary widely depending on your unique circumstances and preferences.

A 2 million life insurance policy can cost anywhere from a few hundred to thousands of dollars per year, depending on various factors such as age, health, and lifestyle. Generally, younger and healthier individuals will pay lower premiums than older or less healthy individuals. Other factors that can affect the cost include the type of policy, the length of the term, and the insurance provider. It is important to shop around and compare quotes from different insurance companies to find the best policy for your needs and budget.

How Much Does a 2 Million Life Insurance Policy Cost?

When it comes to life insurance, the amount of coverage you need will depend on your unique circumstances. For some, a 2 million dollar policy may be necessary to ensure their loved ones are taken care of in the event of their passing. However, many people may wonder what the cost of a 2 million dollar life insurance policy would be. Here we will explore the factors that can impact the cost of this type of policy.

Age and Health

One of the biggest factors that will affect the cost of a 2 million dollar life insurance policy is your age and health. Generally, the younger and healthier you are, the lower your premiums will be. This is because the insurance company is taking on less risk when insuring someone who is less likely to pass away during the term of the policy.

However, if you are older or have pre-existing health conditions, the cost of your policy may be higher. This is because the insurance company is taking on more risk when insuring someone who is more likely to pass away during the term of the policy.

It is important to note that many insurance companies will require you to undergo a medical exam before they will issue a policy. This exam will assess your overall health and help determine your risk level, which will impact your premiums.

Term Length

Another factor that can impact the cost of a 2 million dollar life insurance policy is the length of the term. Term life insurance policies typically come in terms of 10, 20, or 30 years. The longer the term, the higher the premium will be.

This is because the insurance company is taking on more risk by insuring you for a longer period of time. Additionally, as you age, the cost of insurance increases, so policies with longer terms will generally have higher premiums.

Smoking and Other Risk Factors

If you smoke or have other risk factors, such as a dangerous job or hobbies, the cost of your 2 million dollar life insurance policy may be higher. This is because the insurance company is taking on more risk by insuring someone who engages in activities that increase their likelihood of passing away during the term of the policy.

If you smoke, it is important to note that some insurance companies will classify you as a smoker even if you only smoke occasionally or have quit smoking recently. This can significantly impact the cost of your policy.

Insurance Company

The insurance company you choose can also impact the cost of your 2 million dollar life insurance policy. Different insurance companies have different underwriting guidelines and may place different weights on various risk factors.

It is important to shop around and compare quotes from multiple insurance companies to ensure you are getting the best possible rate for your policy.

Benefits of a 2 Million Dollar Life Insurance Policy

While the cost of a 2 million dollar life insurance policy may seem high, there are many benefits to having this amount of coverage. For one, it can provide peace of mind knowing that your loved ones will be taken care of in the event of your passing.

Additionally, a 2 million dollar policy can help cover any outstanding debts or expenses, such as a mortgage or college tuition, that your loved ones may be responsible for.

2 Million Dollar Life Insurance vs. Other Coverage Amounts

When deciding on the amount of life insurance coverage you need, it is important to consider your unique circumstances. While a 2 million dollar policy may be necessary for some, others may only need a fraction of that amount.

It is important to consider factors such as your income, debts, and the needs of your loved ones when deciding on the amount of coverage you need.

How to Get a 2 Million Dollar Life Insurance Policy

To get a 2 million dollar life insurance policy, you will need to apply for coverage with an insurance company. This will typically involve filling out an application and undergoing a medical exam.

It is important to shop around and compare quotes from multiple insurance companies to ensure you are getting the best possible rate for your policy.

Conclusion

A 2 million dollar life insurance policy can provide valuable protection for your loved ones in the event of your passing. However, the cost of this type of policy can vary depending on factors such as age, health, term length, smoking, and the insurance company you choose.

By considering your unique circumstances and shopping around for the best rates, you can find a 2 million dollar life insurance policy that fits your needs and budget.

Contents

- Frequently Asked Questions

- What is a 2 million life insurance policy?

- How much does a 2 million life insurance policy cost?

- What are some factors that affect the cost of a 2 million life insurance policy?

- What are the benefits of a 2 million life insurance policy?

- How can I get a 2 million life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

What is a 2 million life insurance policy?

A 2 million life insurance policy is a type of life insurance coverage that provides a death benefit of 2 million dollars to your beneficiaries upon your death. It is a significant amount of coverage that can help your loved ones cover expenses such as funeral costs, outstanding debts, and everyday living expenses.

The cost of a 2 million life insurance policy will depend on various factors, including your age, health, occupation, and lifestyle habits. Generally, the younger and healthier you are, the lower the cost of your premiums.

How much does a 2 million life insurance policy cost?

The cost of a 2 million life insurance policy can range from a few hundred dollars to several thousand dollars per year. It will depend on various factors, such as your age, health, occupation, and lifestyle habits. Generally, the younger and healthier you are, the lower the cost of your premiums.

To get an accurate quote for a 2 million life insurance policy, you will need to speak with a licensed insurance agent or broker. They can help you determine the best coverage options for your needs and provide you with an estimate of how much your premiums will cost.

What are some factors that affect the cost of a 2 million life insurance policy?

Several factors can affect the cost of a 2 million life insurance policy, including your age, health, occupation, and lifestyle habits. Generally, the younger and healthier you are, the lower the cost of your premiums.

Other factors that can affect the cost of your policy include your gender, family medical history, and whether or not you smoke or use tobacco products. Additionally, some occupations may be considered more high-risk than others and may result in higher premiums.

What are the benefits of a 2 million life insurance policy?

A 2 million life insurance policy provides a significant amount of coverage that can help your loved ones cover expenses such as funeral costs, outstanding debts, and everyday living expenses. It can also provide financial security and peace of mind knowing that your loved ones will be taken care of in the event of your unexpected death.

Additionally, some life insurance policies offer cash value accumulation, which can be used as a source of savings or investment. This can be beneficial for those looking to grow their wealth over time while also protecting their loved ones.

How can I get a 2 million life insurance policy?

To get a 2 million life insurance policy, you will need to speak with a licensed insurance agent or broker. They can help you determine the best coverage options for your needs and provide you with an estimate of how much your premiums will cost.

During the application process, you will need to provide information about your health, lifestyle habits, and occupation. You may also need to undergo a medical exam or provide medical records to prove your insurability.

Once your application is approved, you will need to pay your premiums on time to keep your coverage in force. If you pass away while your policy is in force, your beneficiaries will receive a death benefit of 2 million dollars.

As a professional writer, it’s important to understand the significance of life insurance policies. They offer peace of mind and financial security to your loved ones, protecting them in case of your untimely demise. The cost of a 2 million life insurance policy can vary depending on various factors such as age, health, and lifestyle.

However, it’s important to note that the benefits of a 2 million life insurance policy far outweigh the costs. The premium may seem high, but it is a small price to pay for the peace of mind that comes with knowing that your family will be taken care of in the event of your unexpected passing. Whether you’re just starting your career, planning for retirement, or looking to protect your family’s future, investing in a 2 million life insurance policy is a wise decision that you won’t regret. So, take the time to carefully consider your options and choose the right policy that meets your needs and budget.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts