Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we go through life, we often think about our future and the legacy we want to leave behind. One way to ensure that our loved ones are financially secure after we pass away is through life insurance. However, with so many types of life insurance policies available, it can be overwhelming to choose the right one. One type that has been gaining popularity is indexed universal life insurance, which offers both a death benefit and a cash value component. But the question remains: how much does indexed universal life insurance cost?

The answer is not simple, as the cost of indexed universal life insurance varies depending on several factors, such as the age and health of the policyholder, the amount of coverage needed, and the insurance company offering the policy. In this article, we will delve into these factors and provide you with a better understanding of how much you can expect to pay for indexed universal life insurance. So, if you’re considering this type of policy, read on to learn more!

Contents

- How Much is Indexed Universal Life Insurance?

- Frequently Asked Questions

- What factors impact the cost of Indexed Universal Life Insurance?

- How much does the average Indexed Universal Life Insurance policy cost?

- Is Indexed Universal Life Insurance more expensive than other types of life insurance?

- Can I change the amount of coverage or premiums on my Indexed Universal Life Insurance policy?

- Is Indexed Universal Life Insurance a good investment option?

- Understanding Index Universal Life Insurance (IUL)

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How Much is Indexed Universal Life Insurance?

Indexed Universal Life Insurance is an insurance policy that offers a death benefit to the insured’s beneficiaries, while also building cash value over time. It is a type of permanent life insurance policy that can provide protection for the insured’s entire life. Although it has its advantages, the cost of an indexed universal life insurance policy can be a bit higher than other types of life insurance policies. In this article, we will explore how much it costs to purchase an indexed universal life insurance policy.

Factors that Determine the Cost of Indexed Universal Life Insurance

When it comes to determining the cost of an indexed universal life insurance policy, there are several factors that come into play. These factors include the following:

Age: Age is a significant factor in determining the cost of an indexed universal life insurance policy. The younger you are when you purchase the policy, the less expensive it will be.

Health Status: Your health status will also play a role in the cost of your indexed universal life insurance policy. If you are in good health, you will likely receive a lower premium rate than someone who has health issues.

Gender: Gender is also taken into consideration when determining the cost of an indexed universal life insurance policy. Women generally pay lower premiums than men.

Smoking Habits: If you are a smoker, you can expect to pay more for an indexed universal life insurance policy than a non-smoker.

Policy Coverage Amount: The amount of coverage you want will also determine the cost of the policy. The higher the coverage amount, the more expensive the policy will be.

Investment Strategy: The investment strategy you choose will also play a role in the cost of your policy. If you choose to invest in more aggressive options, your policy may cost more than if you choose a more conservative investment strategy.

The Average Cost of Indexed Universal Life Insurance

The cost of an indexed universal life insurance policy can vary depending on the above-mentioned factors. However, the average cost of an indexed universal life insurance policy for a healthy 35-year-old non-smoker with a coverage amount of $500,000 is typically around $150 to $200 per month.

It is important to note that this is just an average and the cost may be higher or lower depending on the factors mentioned above. It is always recommended to obtain quotes from multiple insurance providers to ensure you are getting the best possible rate.

Benefits of Indexed Universal Life Insurance

Indexed universal life insurance policies offer several benefits, including:

Tax-Advantaged: The cash value within an indexed universal life insurance policy grows tax-deferred, meaning you won’t pay taxes on it until you withdraw the funds.

Flexible Payment Options: Indexed universal life insurance policies offer flexible payment options, allowing you to adjust your premiums as needed.

Death Benefit: An indexed universal life insurance policy provides a death benefit to your beneficiaries, ensuring they are taken care of financially when you pass away.

Investment Options: Indexed universal life insurance policies offer investment options that allow you to build cash value over time.

Indexed Universal Life Insurance vs. Other Types of Life Insurance

Indexed universal life insurance policies are a type of permanent life insurance policy. Compared to other types of life insurance policies, such as term life insurance, indexed universal life insurance policies offer several benefits, including:

Cash Value: Unlike term life insurance policies, indexed universal life insurance policies build cash value over time.

Flexibility: Indexed universal life insurance policies offer more flexibility than term life insurance policies, allowing you to adjust your premiums and coverage amount as needed.

Investment Options: Indexed universal life insurance policies offer investment options that allow you to build cash value over time.

However, indexed universal life insurance policies are typically more expensive than term life insurance policies. If you are looking for a lower cost option, term life insurance may be a better choice.

Conclusion

Indexed universal life insurance policies offer several benefits, including building cash value over time and providing a death benefit to your beneficiaries. The cost of an indexed universal life insurance policy can vary depending on several factors, including age, health status, gender, smoking habits, coverage amount, and investment strategy. It is always recommended to obtain quotes from multiple insurance providers to ensure you are getting the best possible rate.

Frequently Asked Questions

Indexed Universal Life Insurance is a type of permanent life insurance that provides a death benefit and a cash value component. It offers flexibility and the potential for growth, making it an attractive option for many individuals. Here are some common questions about the cost of Indexed Universal Life Insurance:

What factors impact the cost of Indexed Universal Life Insurance?

The cost of Indexed Universal Life Insurance varies based on several factors, including the insured’s age, health, gender, and lifestyle habits. Other factors that can impact the cost include the amount of coverage the insured wants, the length of the policy, and the performance of the underlying index. Generally, the younger and healthier the insured is, the lower the cost of the policy.

Additionally, the cost of Indexed Universal Life Insurance can vary between insurance companies. It’s important to shop around and compare quotes to find the best policy for your needs and budget.

How much does the average Indexed Universal Life Insurance policy cost?

The cost of an Indexed Universal Life Insurance policy can vary greatly depending on the factors mentioned above. However, according to a study by the National Association of Insurance Commissioners, the average cost of a $250,000 Indexed Universal Life Insurance policy for a 40-year-old non-smoking male is around $3,500 per year. Keep in mind that this is just an average and your actual cost may be higher or lower based on your individual circumstances.

It’s important to work with a trusted insurance professional to determine the best policy and coverage amount for your needs and budget.

Is Indexed Universal Life Insurance more expensive than other types of life insurance?

Indexed Universal Life Insurance can be more expensive than term life insurance, but less expensive than whole life insurance. This is because term life insurance only provides a death benefit and does not have a cash value component, while whole life insurance provides both a death benefit and a fixed cash value component.

Indexed Universal Life Insurance offers the potential for growth in the cash value component, making it a middle ground between term and whole life insurance. However, the cost can vary greatly depending on the factors mentioned above, so it’s important to compare quotes and policies before making a decision.

Indexed Universal Life Insurance offers flexibility, allowing policyholders to adjust the amount of coverage and premiums over time. However, making changes to the policy can impact the cash value and growth potential of the policy, so it’s important to work with a trusted insurance professional before making any changes.

Keep in mind that changing the policy may also require additional underwriting or fees, so it’s important to understand the potential impact before making any changes.

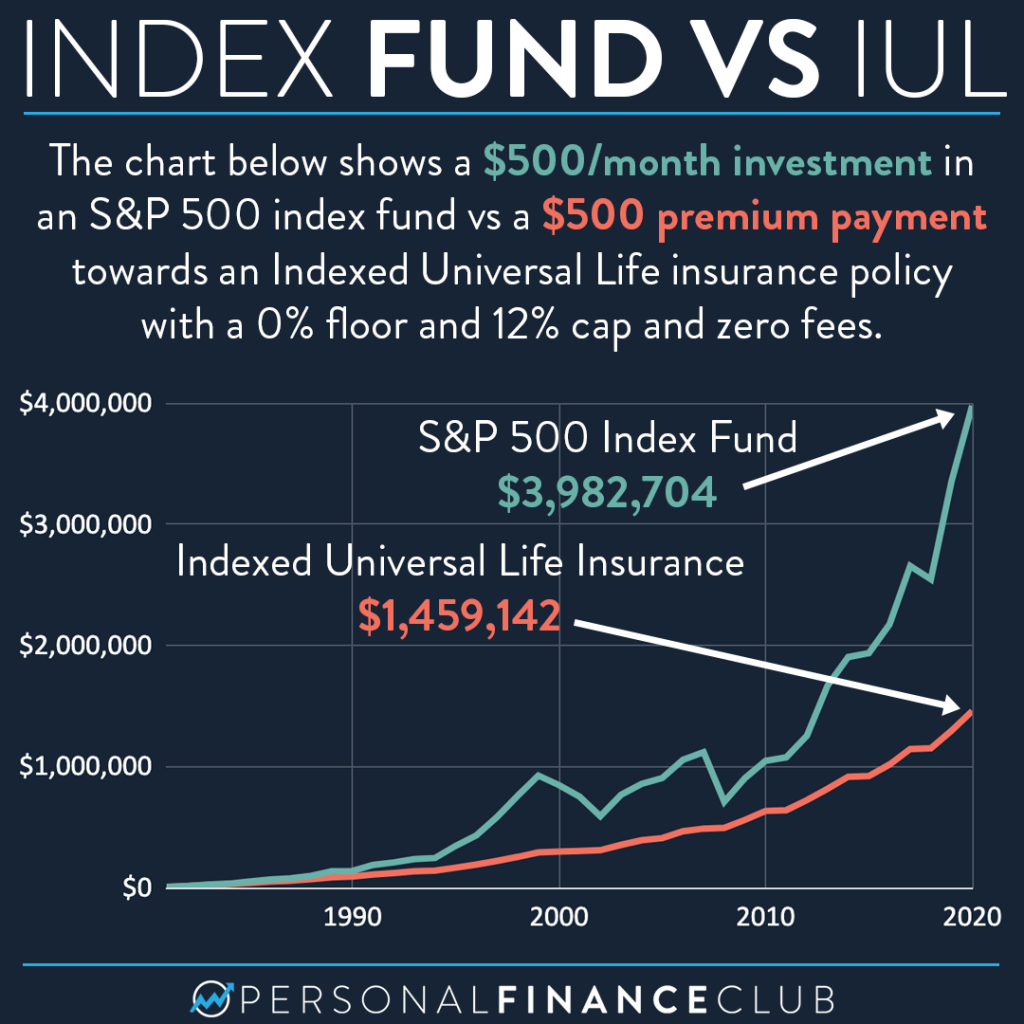

Is Indexed Universal Life Insurance a good investment option?

Indexed Universal Life Insurance offers the potential for growth in the cash value component, making it an attractive option for those looking for a long-term investment. However, it’s important to remember that Indexed Universal Life Insurance is primarily a life insurance product and should be purchased for its death benefit protection first and foremost.

Additionally, the performance of the underlying index can impact the growth potential of the cash value component, so it’s important to work with a trusted insurance professional to understand the risks and potential returns before making a decision.

Understanding Index Universal Life Insurance (IUL)

After delving into the complexities of indexed universal life insurance, it’s clear that determining the cost of such a policy isn’t as straightforward as one might think. Factors such as age, health, and the amount of coverage desired all play a role in determining the premium. With the potential for cash value accumulation and tax-free withdrawals, however, it’s no wonder why indexed universal life insurance is becoming an increasingly popular option for those seeking long-term financial security.

Ultimately, the cost of indexed universal life insurance will vary from person to person. It’s important to shop around and compare quotes from multiple providers to ensure that you’re getting the best possible deal. With the guidance of a knowledgeable insurance agent, you can weigh the potential benefits against the cost and make an informed decision that meets your individual needs and goals.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts