Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life is unpredictable, and so are our life insurance needs. Circumstances may change, and we may find ourselves in a situation where we no longer require a term life insurance policy. Cancelling a term life insurance policy can be a daunting task, but it doesn’t have to be. With the right information and understanding of the process, you can cancel your policy smoothly and without any hassle.

Before you cancel your term life insurance policy, it’s crucial to understand the implications of your decision. Cancelling your policy means you’re walking away from the protection it provides, leaving yourself and your family vulnerable to financial loss in case of unexpected events. However, if you’re sure that cancellation is the right choice for you, this guide will provide you with the necessary steps to take to cancel your term life insurance policy efficiently.

If you want to cancel a term life insurance policy, follow these steps:

- Contact your insurance company and request a cancellation form.

- Fill out the form and provide any necessary documentation, such as a copy of your policy or identification.

- Submit the form to your insurance company either online, by mail, or in person.

- Confirm that your policy has been canceled and inquire about any potential fees or refunds.

Contents

- Canceling a Term Life Insurance Policy: What You Need to Know

- 1. Understanding the Terms and Conditions of Your Policy

- 2. Reasons for Canceling a Term Life Insurance Policy

- 3. How to Cancel Your Term Life Insurance Policy

- 4. Alternatives to Canceling Your Term Life Insurance Policy

- 5. Benefits of Canceling Your Term Life Insurance Policy

- 6. Drawbacks of Canceling Your Term Life Insurance Policy

- 7. Term Life Insurance vs Permanent Life Insurance

- 8. Term Life Insurance vs Whole Life Insurance

- 9. The Importance of Reviewing Your Insurance Coverage Regularly

- 10. Conclusion

- Frequently Asked Questions

- Q: How do I cancel my term life insurance policy?

- Q: Is there a penalty for cancelling a term life insurance policy?

- Q: Can I cancel my term life insurance policy at any time?

- Q: Will I receive a refund if I cancel my term life insurance policy?

- Q: What happens to my beneficiaries if I cancel my term life insurance policy?

- How to Cancel Term Life Insurance

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Canceling a Term Life Insurance Policy: What You Need to Know

1. Understanding the Terms and Conditions of Your Policy

Before you cancel your term life insurance policy, it is important to understand the terms and conditions of your policy. Review your policy documents, including the fine print, to ensure you fully understand the terms of your coverage. This includes the length of the term, the amount of coverage, and any exclusions or limitations that may apply.

In addition, you should also consider any potential penalties or fees associated with canceling your policy early. Some term life insurance policies may have surrender charges, which are fees that are charged if you cancel your policy before the end of the term. Be sure to understand these fees and factor them into your decision.

2. Reasons for Canceling a Term Life Insurance Policy

There are a variety of reasons why you may want to cancel your term life insurance policy. Perhaps you no longer need the coverage, or you have found a better policy elsewhere. Maybe you have experienced a change in your financial situation and can no longer afford the premiums. Whatever the reason, it is important to carefully consider your decision and weigh the pros and cons of canceling your policy.

If you have found a better policy elsewhere, it may be worth considering a policy transfer rather than canceling your existing policy. This can help you avoid surrender charges and other fees associated with canceling your policy.

3. How to Cancel Your Term Life Insurance Policy

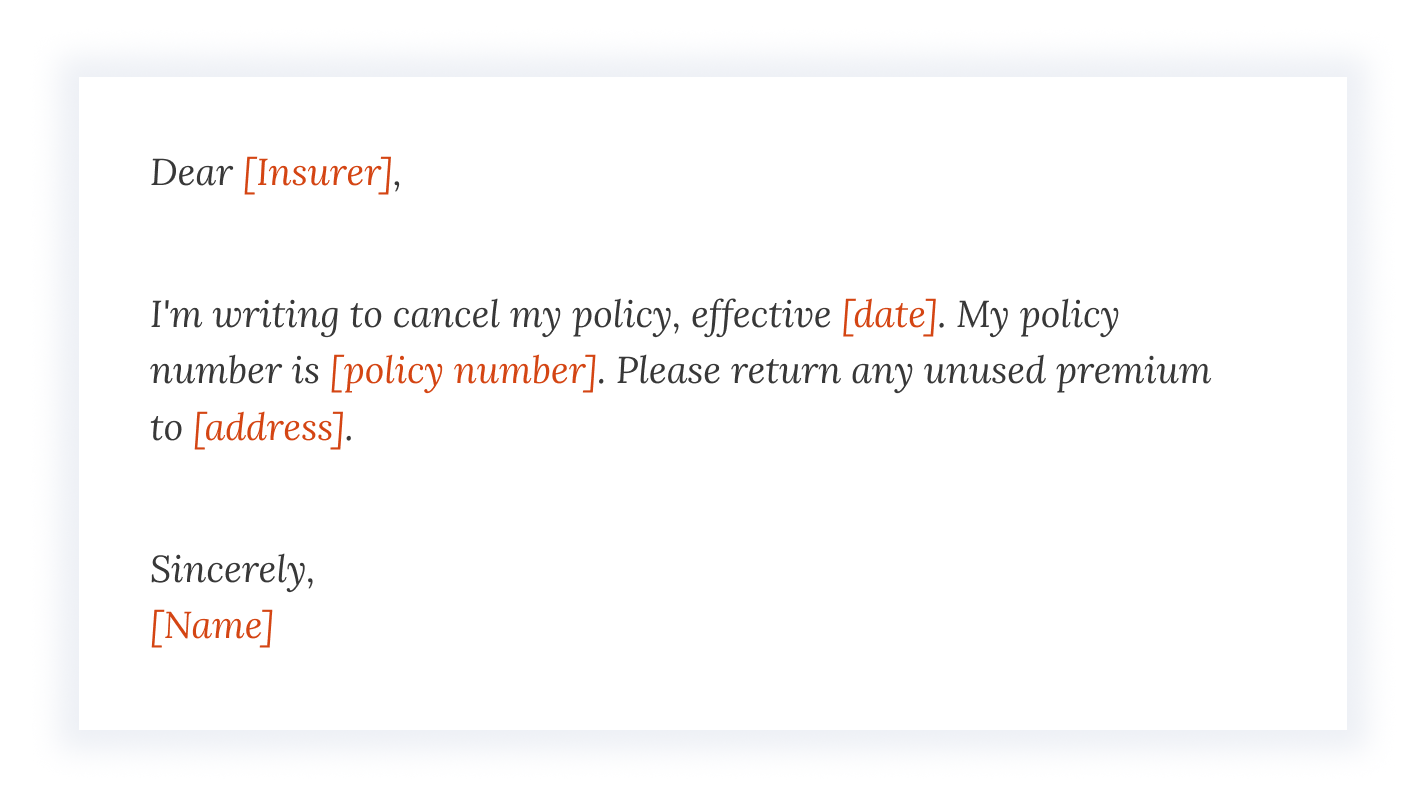

To cancel your term life insurance policy, you will need to contact your insurance provider. Be prepared to provide your policy number and other identifying information to verify your identity. Your insurance provider may also require you to complete a cancellation form or provide written notice of your intent to cancel.

Once you have canceled your policy, you should receive a confirmation letter from your insurance provider. Be sure to keep this letter for your records in case you need to provide proof of cancellation in the future.

4. Alternatives to Canceling Your Term Life Insurance Policy

If you are considering canceling your term life insurance policy, it may be worth exploring alternatives that can help you maintain your coverage. For example, you may be able to convert your policy to a permanent life insurance policy, which can provide lifelong coverage and potentially lower premiums.

Another option is to reduce your coverage amount rather than canceling your policy altogether. This can help you lower your premiums while still maintaining some level of coverage.

5. Benefits of Canceling Your Term Life Insurance Policy

Canceling your term life insurance policy can provide a variety of benefits, depending on your individual circumstances. For example, if you no longer need the coverage, canceling your policy can help you free up funds that can be used for other purposes.

Canceling your policy can also help you avoid paying premiums on a policy that is no longer necessary or affordable. This can provide significant savings over the long term, especially if you are able to invest the money you would have spent on premiums.

6. Drawbacks of Canceling Your Term Life Insurance Policy

While canceling your term life insurance policy can provide benefits, there are also some drawbacks to consider. For example, if you cancel your policy and then experience a change in your health or other circumstances that make it difficult to obtain coverage in the future, you may regret your decision to cancel your policy.

Canceling your policy can also result in surrender charges and other fees, which can eat into any savings you may have realized by canceling your policy.

7. Term Life Insurance vs Permanent Life Insurance

One factor to consider when deciding whether to cancel your term life insurance policy is whether you would be better off with a permanent life insurance policy. Permanent life insurance policies provide lifelong coverage and typically have higher premiums than term life insurance policies.

However, permanent life insurance policies also offer a variety of benefits, such as the ability to build cash value over time and potentially lower premiums as you age. If you are considering canceling your term life insurance policy, it may be worth exploring your options for converting your policy to a permanent life insurance policy.

8. Term Life Insurance vs Whole Life Insurance

Another type of permanent life insurance policy to consider is whole life insurance. Whole life insurance policies provide lifelong coverage and typically have higher premiums than term life insurance policies. However, they also offer a variety of benefits, such as the ability to build cash value over time and potentially lower premiums as you age.

If you are considering canceling your term life insurance policy, it may be worth exploring your options for converting your policy to a whole life insurance policy.

9. The Importance of Reviewing Your Insurance Coverage Regularly

Whether you decide to cancel your term life insurance policy or not, it is important to review your insurance coverage regularly to ensure it still meets your needs. Life changes, such as marriage, children, and changes in your financial situation, can all impact your insurance needs.

By regularly reviewing your insurance coverage, you can ensure that you have the right amount of coverage to protect your loved ones and achieve your financial goals.

10. Conclusion

Canceling a term life insurance policy is a big decision that should not be taken lightly. Before canceling your policy, be sure to carefully review the terms and conditions of your policy, as well as any potential penalties or fees associated with canceling early.

If you are considering canceling your policy, be sure to explore all of your options, such as policy transfers or converting to a permanent life insurance policy. And remember, it is important to regularly review your insurance coverage to ensure it still meets your needs over time.

Frequently Asked Questions

Q: How do I cancel my term life insurance policy?

To cancel your term life insurance policy, you will need to contact your insurance provider. They will likely have a cancellation form or process that you will need to follow. It is important to note that some insurance providers may charge a fee for cancelling your policy prior to its expiration date. It is also important to consider the potential financial impact of cancelling your policy, such as losing any premiums paid or losing coverage for your beneficiaries.

Additionally, if you are cancelling your policy due to financial hardship or other reasons, you may want to consider speaking with a financial advisor or insurance agent to explore other options, such as adjusting your coverage or payment plan.

Q: Is there a penalty for cancelling a term life insurance policy?

Some insurance providers may charge a penalty or fee for cancelling a term life insurance policy prior to its expiration date. The penalty may be a percentage of the premiums paid or a flat fee. It is important to review your policy documents or contact your insurance provider to understand their specific cancellation policy and any associated fees.

It is also important to consider the potential financial impact of cancelling your policy, such as losing any premiums paid or losing coverage for your beneficiaries. If you are cancelling your policy due to financial hardship or other reasons, you may want to consider speaking with a financial advisor or insurance agent to explore other options, such as adjusting your coverage or payment plan.

Q: Can I cancel my term life insurance policy at any time?

In most cases, you can cancel your term life insurance policy at any time. However, it is important to review your policy documents or contact your insurance provider to understand their specific cancellation policy and any associated fees. Some insurance providers may have a waiting period or other restrictions on cancelling your policy.

It is also important to consider the potential financial impact of cancelling your policy, such as losing any premiums paid or losing coverage for your beneficiaries. If you are cancelling your policy due to financial hardship or other reasons, you may want to consider speaking with a financial advisor or insurance agent to explore other options, such as adjusting your coverage or payment plan.

Q: Will I receive a refund if I cancel my term life insurance policy?

If you cancel your term life insurance policy, you may be eligible for a refund of any premiums paid beyond the policy’s effective date. However, some insurance providers may charge a penalty or fee for cancelling a policy prior to its expiration date, which could impact the amount of any refund you receive.

It is important to review your policy documents or contact your insurance provider to understand their specific cancellation policy and any potential refund or penalty. If you are cancelling your policy due to financial hardship or other reasons, you may want to consider speaking with a financial advisor or insurance agent to explore other options, such as adjusting your coverage or payment plan.

Q: What happens to my beneficiaries if I cancel my term life insurance policy?

If you cancel your term life insurance policy, your beneficiaries will no longer be eligible to receive the death benefit in the event of your passing. It is important to consider the potential impact on your beneficiaries before cancelling your policy.

If you are cancelling your policy due to financial hardship or other reasons, you may want to consider speaking with a financial advisor or insurance agent to explore other options, such as adjusting your coverage or payment plan.

How to Cancel Term Life Insurance

Canceling a term life insurance policy can be a daunting task, but sometimes it becomes necessary. Before taking any steps, it’s important to understand the implications of canceling a policy. You may lose the protection and benefits that come with it, or you may face penalties or fees. However, if you have decided to cancel your policy, here are some steps you can follow to make the process as smooth as possible.

First, contact your insurance company and inform them of your decision. They will provide you with the necessary paperwork to cancel your policy. It’s important to review the terms and conditions of your policy to understand any penalties or fees involved in the cancellation process. Once you have completed the paperwork, make sure to keep a copy for your records. Cancelling a term life insurance policy may seem like a daunting task, but with careful consideration and following the proper steps, you can successfully end your coverage.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts