Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Auto insurance is a necessary expense for every car owner, but sometimes we need to cancel our policies due to various reasons. If you’re a AAA auto insurance policyholder and you’re wondering how to cancel your coverage, you’re in the right place. Cancelling your AAA auto insurance policy might seem daunting, but it’s a straightforward process that can be done in a few simple steps.

In this article, we will guide you through the steps to cancel your AAA auto insurance policy with ease. We will explore the reasons why you might need to cancel your policy, the steps to take to cancel your policy, and the possible consequences of cancelling your policy. Whether you’re seeking to cancel your policy because you’ve found a better deal elsewhere, or you’re selling your car, we’ve got you covered. So, let’s dive in and learn how to cancel AAA auto insurance.

If you want to cancel AAA auto insurance, follow these simple steps:

- Call AAA customer service at 1-800-222-4357.

- Provide your policy number and reason for cancellation.

- Confirm the effective date of cancellation and any refund due.

- Return any policy documents and plates to your local AAA branch.

How to Cancel AAA Auto Insurance: A Step-by-Step Guide

Step 1: Determine the Reason for Cancellation

AAA Auto Insurance offers a wide range of coverage options to its customers. If you have decided to cancel your AAA Auto Insurance policy, the first step is to determine the reason for cancellation. Perhaps you have found a better deal with another insurance company, or you no longer need to drive as much as you used to. Whatever the reason, it is important to understand why you want to cancel your policy before moving forward.

Once you have determined your reason for cancellation, you can proceed to the next step.

Step 2: Contact AAA Auto Insurance

Once you have determined the reason for cancellation, the next step is to contact AAA Auto Insurance. You can do this by calling their customer service hotline or by visiting a local AAA office in person.

When you contact AAA, be prepared to provide your policy number and any other relevant information. Also, be sure to explain the reason for cancellation so that the representative can assist you more efficiently.

Step 3: Review Your Policy

Before canceling your policy, it is important to review the terms and conditions to ensure that you fully understand the cancellation process. You should also review any potential fees or penalties associated with canceling your policy.

Additionally, you should ask the representative about any potential refunds or credits that you may be eligible for, depending on the terms of your policy.

Step 4: Provide Written Confirmation

Once you have spoken with a representative and agreed to cancel your policy, you should request written confirmation of the cancellation. This can be in the form of an email or a letter sent to your home address.

Be sure to keep this confirmation in a safe place, as you may need it in the future.

Step 5: Return Any AAA Auto Insurance Materials

After canceling your policy, you should return any AAA Auto Insurance materials that you may have, such as your insurance card or policy booklet. You can do this in person at a local AAA office or by mailing the materials to the address provided by the representative.

Step 6: Confirm the Cancellation

After returning any materials, be sure to confirm the cancellation with AAA Auto Insurance. This can be done by calling their customer service hotline or by checking your policy status online.

Step 7: Consider Alternatives

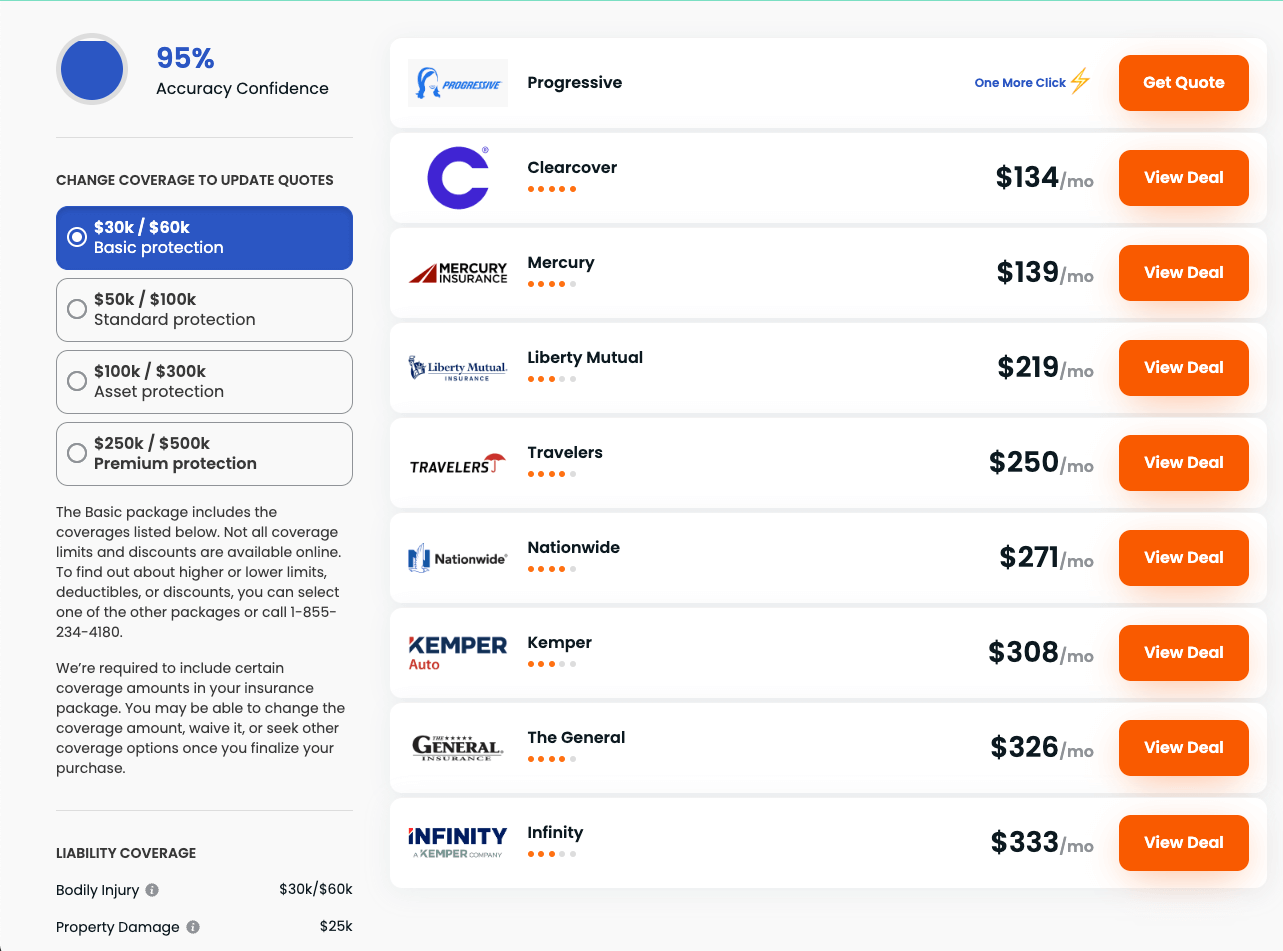

If you are canceling your AAA Auto Insurance policy because you have found a better deal with another insurance company, it is important to consider all of your options before making a final decision. Be sure to compare prices, coverage options, and customer service ratings before choosing a new insurance provider.

Step 8: Review Your Insurance Needs

If you are canceling your AAA Auto Insurance policy because you no longer need to drive as much as you used to, it is important to review your insurance needs. You may be able to switch to a different type of coverage, such as a low-mileage policy, that better fits your current situation.

Step 9: Stay Up-to-Date

Even after canceling your AAA Auto Insurance policy, it is important to stay up-to-date on your insurance needs. Be sure to review your policy regularly and make any necessary changes as your situation changes.

Step 10: Consider Reinstatement

If you decide that you need auto insurance again in the future, you may be able to reinstate your AAA Auto Insurance policy. Be sure to contact AAA for more information on the reinstatement process and any potential fees or penalties.

Contents

- Frequently Asked Questions

- How do I cancel my AAA auto insurance policy?

- Can I cancel my policy mid-term?

- Will cancelling my policy affect my credit score?

- What happens if I cancel my policy before it expires?

- Can I cancel my policy online?

- How to Cancel an Auto Insurance Policy : Auto Insurance Basics

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

AAA auto insurance is a popular choice for many drivers, but sometimes circumstances change and you may need to cancel your policy. Here are some common questions and answers to help you navigate the cancellation process.

How do I cancel my AAA auto insurance policy?

To cancel your AAA auto insurance policy, you can call the company’s customer service hotline or visit a local office in person. You should have your policy number and personal information ready to make the process smoother. Be sure to ask about any cancellation fees or refunds you may be entitled to.

It’s important to note that cancelling your policy before the end of the term may result in a penalty or loss of any discounts you were receiving. Before cancelling, be sure to consider your options and make sure it’s the right decision for you.

Can I cancel my policy mid-term?

Yes, you can cancel your AAA auto insurance policy mid-term. However, there may be a penalty or fee for doing so, and you may not be entitled to a refund for any unused portion of your premium. If you’re switching to a new insurance provider, make sure you have coverage in place before cancelling your AAA policy to avoid any gaps in coverage.

If you’re cancelling due to a change in your circumstances, such as selling your car or moving to a new state, be sure to let AAA know so they can help you transition smoothly and avoid any penalties or fees.

Will cancelling my policy affect my credit score?

No, cancelling your AAA auto insurance policy should not have an impact on your credit score. However, if you have outstanding balances or unpaid fees, those may be sent to collections and could negatively affect your credit. Be sure to resolve any outstanding issues before cancelling your policy.

If you’re concerned about how cancelling your policy may affect your credit, you can contact AAA’s customer service team to discuss your options and any potential impact on your credit score.

What happens if I cancel my policy before it expires?

If you cancel your AAA auto insurance policy before it expires, you may be subject to a cancellation fee or penalty. Additionally, you may not be entitled to a refund for any unused portion of your premium. Before cancelling your policy, make sure you understand any potential financial consequences and have a plan in place for alternative coverage.

If you’re switching to a new insurance provider, be sure to have coverage in place before cancelling your AAA policy to avoid any gaps in coverage.

Can I cancel my policy online?

At this time, AAA does not offer online cancellation of auto insurance policies. To cancel your policy, you will need to call their customer service hotline or visit a local office in person. Be sure to have your policy number and personal information ready to make the process smoother.

If you’re cancelling due to a change in your circumstances, such as selling your car or moving to a new state, be sure to let AAA know so they can help you transition smoothly and avoid any penalties or fees.

How to Cancel an Auto Insurance Policy : Auto Insurance Basics

Canceling your AAA auto insurance can be a daunting task, but it is often necessary for various reasons. Whether you’ve found a better deal with another insurance provider or you’re no longer in need of coverage, the process can be relatively straightforward if you follow the right steps. By taking your time and following the appropriate procedures, you can cancel your AAA auto insurance with minimal stress and hassle.

In conclusion, canceling your AAA auto insurance requires a bit of time and effort, but it is a necessary step that many people take. Remember to check for any potential fees or penalties, and ensure that you have secured new insurance coverage before canceling your policy. By following these steps, you can cancel your AAA auto insurance and move on to a new chapter with confidence and peace of mind.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts