Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

The rising cost of healthcare in the United States has made group health insurance coverage a valuable asset for many employees. This type of insurance offers a range of benefits, including access to medical care, prescription drugs, and other health-related services. However, many employees who work part-time or on a temporary basis may wonder if they are eligible for group health insurance coverage.

The answer to this question can vary depending on a number of factors, including the size of the company, the employee’s work status, and the specific policy offered by the employer. In this article, we will explore the eligibility requirements for part-time employees seeking group health insurance coverage and provide tips on how to navigate the complex world of healthcare benefits.

Contents

- Are Part Time Employees Eligible for Group Health Insurance?

- Frequently Asked Questions

- Are part-time employees eligible for group health insurance?

- What is the Affordable Care Act’s definition of full-time employee?

- What are the benefits of offering group health insurance to part-time employees?

- What are the potential drawbacks of offering group health insurance to part-time employees?

- Can part-time employees purchase health insurance on the individual market instead?

- Group Health Insurance vs HRAs

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Are Part Time Employees Eligible for Group Health Insurance?

If you’re working part-time, you may be wondering if you’re eligible for group health insurance. The answer to this question depends on several factors, including the size of your employer, the type of plan they offer, and the number of hours you work per week. In this article, we’ll explore the different scenarios in which part-time employees may or may not be eligible for group health insurance.

Size of Your Employer

One of the most important factors that determine your eligibility for group health insurance is the size of your employer. Under the Affordable Care Act (ACA), companies with 50 or more full-time equivalent (FTE) employees are required to offer health insurance to their full-time workers. However, the law doesn’t mandate employers to provide coverage to their part-time employees.

That said, some employers may choose to offer health insurance to their part-time employees as a benefit. If your company has less than 50 FTE employees, they’re not required to offer health insurance to anyone, regardless of their status as full-time or part-time employees. However, many small businesses may still choose to provide health insurance to attract and retain talent.

Type of Plan Offered

If your employer offers health insurance to part-time employees, the type of plan they provide may vary. In general, the same rules that apply to full-time employees also apply to part-time employees when it comes to the type of plan offered. For instance, if your employer offers a group health insurance plan that meets the ACA’s minimum essential coverage requirements, you may be eligible to enroll in it, even if you’re working part-time.

That said, some employers may offer different health insurance plans to their part-time employees than they do to their full-time workers. For example, they may offer a high-deductible health plan (HDHP) to their part-time employees, while their full-time employees have access to a more comprehensive plan. In this case, you’ll want to weigh the benefits and drawbacks of each plan to determine which one is right for you.

Number of Hours Worked per Week

The number of hours you work per week can also affect your eligibility for group health insurance. In general, employers consider part-time employees to be those who work less than 30 hours per week. However, this number may vary depending on your employer’s policies and the state you live in.

If you work less than 30 hours per week, your employer may not offer you health insurance as a benefit. However, they may still be required to provide you with certain benefits under state and federal law, such as workers’ compensation and unemployment insurance.

Benefits of Group Health Insurance for Part-Time Employees

If you’re eligible for group health insurance as a part-time employee, there are several benefits to enrolling in the plan. For one, group health insurance tends to be more affordable than individual health insurance, as your employer may subsidize part of the premium cost. Additionally, group health insurance may offer more comprehensive coverage than individual health insurance plans.

Another benefit of group health insurance is that it may cover pre-existing conditions, which individual health insurance plans may not. This means that if you have a chronic health condition, you may be able to receive coverage for it under your employer’s group health insurance plan.

Group Health Insurance vs. Individual Health Insurance

If you’re not eligible for group health insurance as a part-time employee, you may need to consider purchasing individual health insurance on your own. While individual health insurance plans may offer more flexibility and choice, they tend to be more expensive than group health insurance plans.

Additionally, individual health insurance plans may not offer the same level of coverage as group health insurance plans. For instance, they may exclude coverage for pre-existing conditions, or they may have higher deductibles and copays.

Conclusion

In summary, part-time employees may be eligible for group health insurance depending on the size of their employer, the type of plan offered, and the number of hours they work per week. If you’re eligible for group health insurance, it may offer more affordable and comprehensive coverage than individual health insurance plans. However, if you’re not eligible for group health insurance, you may need to consider purchasing individual health insurance on your own. Either way, it’s important to weigh the benefits and drawbacks of each option to determine which one is right for you.

Frequently Asked Questions

Are part-time employees eligible for group health insurance?

It depends on the employer’s policies. Some employers offer group health insurance coverage to part-time employees, while others do not. Employers may also have different eligibility requirements for part-time employees, such as a minimum number of hours worked per week or month.

If you are a part-time employee, you should check with your employer to see if you are eligible for group health insurance. You may also want to ask about the costs and benefits of the coverage, as well as any waiting periods or other restrictions that may apply.

What is the Affordable Care Act’s definition of full-time employee?

The Affordable Care Act (ACA) defines a full-time employee as someone who works an average of 30 hours or more per week, or 130 hours or more per month. This definition is used to determine whether an employer is required to offer health insurance coverage to their employees under the ACA’s employer mandate.

It’s important to note that the ACA’s definition of full-time employee is different from some employers’ definitions, which may set a higher threshold for eligibility for health insurance coverage.

What are the benefits of offering group health insurance to part-time employees?

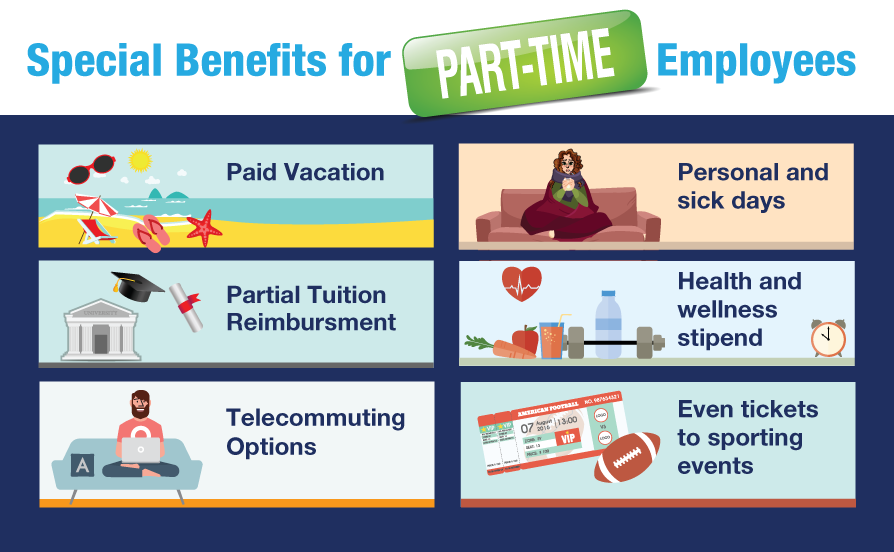

Offering group health insurance to part-time employees can have several benefits for both the employer and the employees. For the employer, it can help attract and retain talented employees, improve employee morale and productivity, and potentially lower the cost of healthcare for the entire workforce.

For part-time employees, group health insurance can provide access to affordable healthcare coverage, which may not be available to them otherwise. It can also provide peace of mind and financial security in the event of a serious illness or injury.

What are the potential drawbacks of offering group health insurance to part-time employees?

One potential drawback of offering group health insurance to part-time employees is the cost. Providing coverage to more employees can increase the overall cost of the employer’s healthcare plan. Additionally, some employers may be hesitant to offer healthcare coverage to part-time employees due to concerns about administrative complexity or compliance with healthcare regulations.

Another potential drawback is that offering group health insurance to part-time employees may not be cost-effective if the employees do not work enough hours to justify the cost of the coverage. Employers may need to carefully evaluate the costs and benefits of offering coverage to part-time employees before making a decision.

Can part-time employees purchase health insurance on the individual market instead?

Yes, part-time employees can purchase health insurance on the individual market instead of enrolling in their employer’s group plan. However, individual market plans may be more expensive than group plans, and they may not provide the same level of coverage or benefits.

Additionally, if an employer offers group health insurance coverage that meets certain requirements under the Affordable Care Act, their employees may not be eligible for premium tax credits or other financial assistance to purchase coverage on the individual market.

Group Health Insurance vs HRAs

In today’s modern work environment, the number of part-time employees has been on the rise. One question that frequently arises is whether part-time employees are eligible for group health insurance. The short answer is that it depends on the company’s policies.

Many companies offer group health insurance to their employees as part of their benefits package. However, not all part-time employees may be eligible for this benefit. Some companies may require a minimum number of hours worked before an employee is eligible for group health insurance. It’s important for part-time employees to understand their company’s policies and to communicate with their employer about their eligibility for group health insurance.

In conclusion, part-time employees may or may not be eligible for group health insurance, depending on their employer’s policies. It’s crucial for employees to communicate with their employer and understand their rights and benefits as part-time employees. As a professional writer, it’s important to emphasize the importance of being informed and proactive in advocating for one’s own benefits and well-being.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts