Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we navigate the complexities of life, we are often faced with tough questions regarding our loved ones. One such question is whether or not we can take out life insurance policies on our grandparents. While it may seem like an uncomfortable topic to broach, the truth is that many people choose to do so for various reasons.

In this article, we will explore the ins and outs of putting life insurance on your grandmother. From the legalities of such a decision to the potential benefits and drawbacks, we will provide you with all the information you need to make an informed decision. So, whether you are considering taking out a policy on your grandma or you are simply curious about the topic, read on to learn more.

Yes, you can put life insurance on your grandmother if you have her consent and insurable interest. Insurable interest means that you will suffer a financial loss if your grandmother passes away. You will need to provide her personal and health information to the insurance company and pay the premiums. It’s important to have an open and honest conversation with your grandmother about the reasons for the policy and any potential drawbacks.

Can I Put Life Insurance on My Grandmother?

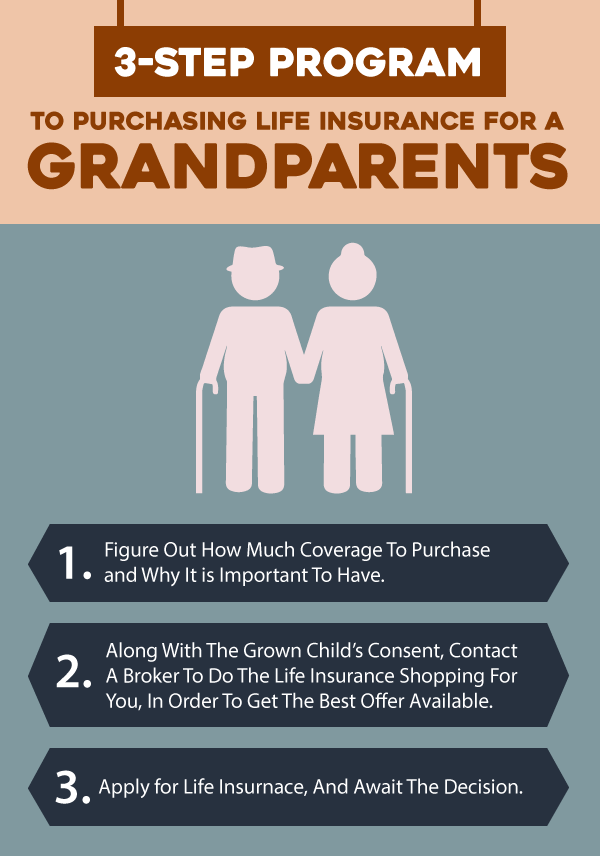

If you are considering purchasing life insurance for your grandmother, there are some important things to consider. While it is possible to put life insurance on your grandmother, you must have her consent to do so. Additionally, there are some legal and financial aspects to consider before making a decision. Here are some things to keep in mind when considering life insurance for your grandmother.

1. Determine if Your Grandmother Needs Life Insurance

Before purchasing life insurance for your grandmother, you should determine if it is necessary. If your grandmother is financially stable and has no dependents, life insurance may not be necessary. However, if your grandmother has dependents or debts, life insurance can provide financial security after her passing.

If your grandmother does need life insurance, it is important to determine the amount of coverage she needs. This will depend on her financial situation, debts, and any funeral expenses.

2. Obtain Your Grandmother’s Consent

Before purchasing life insurance for your grandmother, you must have her consent. Your grandmother must be willing to undergo a medical exam and provide any necessary information for the application process. Additionally, she must sign the policy as the insured.

It is important to have an open and honest conversation with your grandmother about the reasons for purchasing life insurance. Make sure she understands the policy and the benefits it provides.

3. Choose the Type of Life Insurance

There are two main types of life insurance: term life and permanent life. Term life insurance provides coverage for a specific period of time, typically 10-30 years. Permanent life insurance, on the other hand, provides coverage for the insured’s entire life.

When choosing the type of life insurance for your grandmother, consider her age, health, and financial situation. Term life insurance may be more affordable, but permanent life insurance may provide more benefits in the long run.

4. Choose a Beneficiary

When purchasing life insurance for your grandmother, you will need to choose a beneficiary. This is the person or entity who will receive the death benefit after your grandmother passes away. You can choose yourself, another family member, or a charity as the beneficiary.

Make sure your grandmother is aware of the beneficiary designation and that it reflects her wishes.

5. Consider the Cost of Life Insurance

The cost of life insurance for your grandmother will depend on several factors, including her age, health, and the type and amount of coverage. Generally, permanent life insurance is more expensive than term life insurance.

Before purchasing life insurance for your grandmother, consider your own financial situation and whether you can afford the premiums. Make sure your grandmother is aware of the cost and that it fits within her budget.

6. Compare Insurance Providers

When shopping for life insurance for your grandmother, it is important to compare providers. Look for providers with a good reputation, competitive rates, and excellent customer service.

Consider obtaining quotes from several providers and comparing the benefits and drawbacks of each policy.

7. Understand the Policy’s Terms and Conditions

Before purchasing life insurance for your grandmother, make sure you understand the policy’s terms and conditions. Read the fine print and ask questions about anything you don’t understand.

Make sure you understand the policy’s coverage, premiums, and any exclusions or limitations.

8. Consider Other Options

Life insurance is not the only option for providing financial security for your grandmother. Other options include annuities, long-term care insurance, and estate planning.

Consider speaking with a financial advisor or estate planning attorney to determine the best option for your grandmother’s situation.

9. Understand the Benefits of Life Insurance

Life insurance provides several benefits, including financial security for your grandmother’s dependents and covering any outstanding debts or funeral expenses. Additionally, life insurance can provide peace of mind for both you and your grandmother.

Make sure your grandmother understands the benefits of life insurance and how it can provide financial security for her loved ones.

10. Consider the Risks and Limitations

While life insurance can provide many benefits, there are also risks and limitations to consider. For example, if your grandmother has a pre-existing condition, she may not be eligible for coverage. Additionally, the policy may have exclusions or limitations that could affect the payout.

Before purchasing life insurance for your grandmother, make sure you understand the risks and limitations and weigh them against the benefits.

In conclusion, purchasing life insurance for your grandmother can provide financial security and peace of mind. However, it is important to consider all aspects of the decision and obtain your grandmother’s consent before proceeding. By understanding the benefits and risks of life insurance, you can make an informed decision that provides the best outcome for your grandmother and her loved ones.

Contents

- Frequently Asked Questions

- Can I put life insurance on my grandmother?

- What are the benefits of putting life insurance on my grandmother?

- What types of life insurance policies are available for grandparents?

- What should I consider before putting life insurance on my grandmother?

- What happens to the life insurance policy if my grandmother passes away?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Life insurance is a great way to provide financial security for your loved ones. Many people wonder if they can put life insurance on their grandparents. Here are some common questions and answers about this topic.

Can I put life insurance on my grandmother?

Yes, it is possible to put life insurance on your grandmother. However, you will need her consent and insurable interest. Insurable interest means that you will need to show that you will suffer a financial loss if your grandmother passes away. This can be shown through financial dependence or caregiving responsibilities.

It’s important to note that the cost of life insurance for an older individual may be higher due to their age and health status. You may also need to provide medical information and complete a medical exam before the insurance policy is approved.

What are the benefits of putting life insurance on my grandmother?

The benefits of putting life insurance on your grandmother include providing financial support for your family in the event of her passing. This can help cover funeral expenses, outstanding debts, and provide financial support for any dependents. Additionally, life insurance proceeds are typically tax-free.

Another benefit is that some life insurance policies can accumulate cash value over time. This means that your grandmother can borrow against the policy or use it as a source of retirement income if needed.

What types of life insurance policies are available for grandparents?

There are several types of life insurance policies available for grandparents, including term life, whole life, and universal life insurance. Term life insurance provides coverage for a specified period of time, while whole life insurance provides coverage for the duration of your grandmother’s life. Universal life insurance offers flexibility in premiums and death benefits, and can also accumulate cash value.

The type of policy that is best for your grandmother will depend on her individual needs and financial situation, as well as your own financial goals and budget.

What should I consider before putting life insurance on my grandmother?

Before putting life insurance on your grandmother, you should consider her health status, age, and financial situation. You should also consider your own financial goals and budget, as well as your relationship with your grandmother. It’s important to have an open and honest conversation with your grandmother about why you are considering life insurance and how it will benefit her and your family.

You should also compare policies and shop around for the best rates and coverage options. It’s a good idea to work with a licensed insurance agent who can help guide you through the process and answer any questions you may have.

What happens to the life insurance policy if my grandmother passes away?

If your grandmother passes away, the death benefit from the life insurance policy will be paid out to the beneficiary or beneficiaries listed on the policy. The beneficiaries can use the funds in any way they see fit, such as paying for funeral expenses, outstanding debts, or providing financial support for dependents.

If your grandmother outlives the term of a term life insurance policy, the policy will expire and no death benefit will be paid out. If your grandmother has a whole life or universal life insurance policy, the death benefit will be paid out regardless of when she passes away.

When it comes to life insurance, many people wonder if they can put a policy on their grandparents. While it is possible to purchase life insurance for a grandparent, there are some important factors to consider. Firstly, it is important to have the consent and cooperation of the grandparent in question, as they will need to undergo a medical exam and provide personal information for the policy application.

Additionally, it is important to consider the purpose of the life insurance policy. If the goal is to provide financial support for the grandparent’s beneficiaries after their passing, then it can be a wise investment. However, if the intention is to profit off of the grandparent’s death, then it is unethical and potentially illegal. Ultimately, purchasing life insurance for a grandparent can be a thoughtful way to ensure their loved ones are taken care of, but it should be done with careful consideration and respect for the grandparent’s wishes.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts