Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Auto insurance is a necessary component for all drivers. It is a contract between an individual and their insurance company that protects them financially in the event of an accident or other covered losses. However, before the official insurance policy is issued, an auto insurance binder may be provided as a temporary proof of coverage.

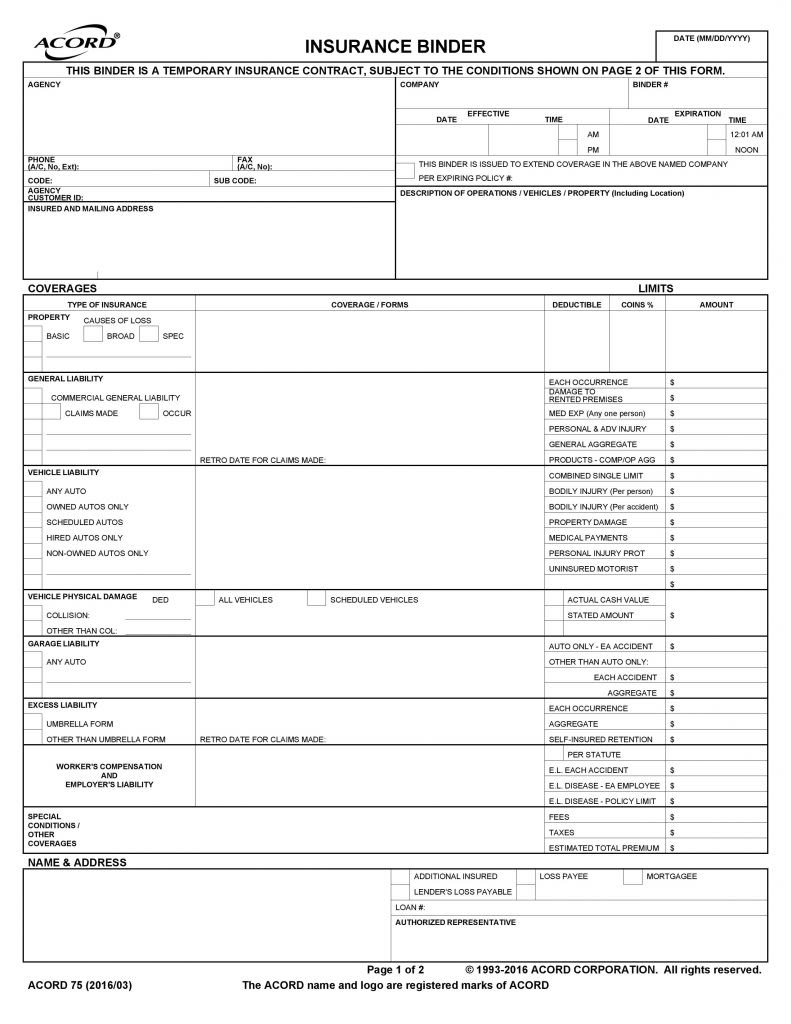

An auto insurance binder is a document that serves as a temporary proof of insurance until the official policy is issued. It is typically provided by the insurance company or agent and contains important information such as the policy number, effective date, and coverage limits. The binder is usually valid for a short period of time, such as 30 days, and allows the driver to legally operate their vehicle while waiting for the official policy to be processed. Understanding the purpose of an auto insurance binder is essential for all drivers to ensure they are properly covered on the road.

An auto insurance binder is a temporary document that serves as proof of insurance coverage until the official insurance policy is issued. It is usually used when purchasing a new car or switching insurance providers. The binder includes the same information as the official policy, such as coverage limits and deductibles. It typically lasts for about 30 days, giving the policyholder enough time to finalize the insurance policy.

Contents

- Understanding Auto Insurance Binders

- Frequently Asked Questions

- What is an Auto Insurance Binder?

- How long does an Auto Insurance Binder last?

- How do I get an Auto Insurance Binder?

- What does an Auto Insurance Binder cover?

- Can I drive without an Auto Insurance Binder?

- What is an Insurance Binder?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Understanding Auto Insurance Binders

Auto insurance binders are temporary insurance policies that provide proof of insurance until a permanent policy is issued. These binders are typically issued by an insurance agent or company and are used to provide immediate coverage for a new or existing vehicle. In this article, we’ll take a closer look at what an auto insurance binder is and how it works.

What is an Auto Insurance Binder?

An auto insurance binder is a temporary insurance policy that provides proof of insurance until a permanent policy is issued. It is usually issued by an insurance agent or company and is used to provide immediate coverage for a new or existing vehicle. Binders are commonly used in situations where a vehicle has just been purchased or leased, or when an existing policy has expired and a new policy has not yet been issued.

How Does an Auto Insurance Binder Work?

When you purchase or lease a new vehicle, you will typically need to provide proof of insurance before you can take possession of the vehicle. In some cases, your existing auto insurance policy may provide coverage for the new vehicle for a short period of time. However, if you do not have coverage, you may need to obtain an auto insurance binder.

An auto insurance binder is a temporary policy that provides coverage for a specific period of time, usually 30 days. The binder will include the same coverage and limits as your permanent policy, but will only be in effect for the specified time period. Once the binder expires, you will need to obtain a permanent policy to continue your coverage.

Benefits of an Auto Insurance Binder

There are several benefits to obtaining an auto insurance binder. First and foremost, it provides immediate coverage for your new or existing vehicle. This means that you can legally drive your vehicle off the lot or continue to drive your existing vehicle without fear of being pulled over and ticketed for not having insurance.

In addition, an auto insurance binder allows you to shop around for a permanent policy without having to rush into a decision. You can take your time to compare rates and coverage options from different insurance companies to find the policy that best meets your needs and budget.

Auto Insurance Binder vs. Permanent Policy

While an auto insurance binder provides immediate coverage for your vehicle, it is important to note that it is not a permanent solution. Binders are designed to be temporary policies that provide coverage until a permanent policy is issued. As such, they usually have a shorter coverage period than a permanent policy and may not include all of the same coverage options.

On the other hand, a permanent policy provides long-term coverage for your vehicle and typically includes a wider range of coverage options. While it may take longer to obtain a permanent policy, it provides greater peace of mind knowing that you are fully protected in the event of an accident or other covered event.

How to Obtain an Auto Insurance Binder

Obtaining an auto insurance binder is a relatively simple process. You can typically obtain a binder from your insurance agent or company by providing some basic information about yourself and your vehicle. This may include the make and model of your vehicle, your driving record, and your personal information, such as your name and address.

Once you have provided this information, your insurance agent or company will issue a binder that provides immediate coverage for your vehicle. It is important to review the binder carefully to ensure that it includes the coverage and limits that you need.

What Information is Included in an Auto Insurance Binder?

An auto insurance binder will typically include the same information as a permanent policy, but it will only be in effect for a specific period of time. The binder will include the following information:

– Policy number

– Effective date and time

– Expiration date and time

– Coverage options and limits

– Premium amount

What Happens When the Binder Expires?

When the auto insurance binder expires, you will need to obtain a permanent policy to continue your coverage. This may involve shopping around for a new policy or renewing an existing policy. It is important to obtain a permanent policy before the binder expires to ensure that you are not driving without insurance.

Conclusion

In conclusion, an auto insurance binder is a temporary insurance policy that provides immediate coverage for a new or existing vehicle. It is typically issued by an insurance agent or company and is used to provide proof of insurance until a permanent policy is issued. While a binder provides immediate coverage, it is important to obtain a permanent policy to ensure that you are fully protected in the event of an accident or other covered event.

Frequently Asked Questions

What is an Auto Insurance Binder?

An auto insurance binder is a temporary proof of insurance that is provided by an insurance company. It is usually issued when someone purchases a new car or needs to add a car to their existing policy. The binder provides immediate insurance coverage until the actual policy is issued.

The binder typically includes important information such as the insured’s name, the make and model of the car, the policy number, and the effective dates of coverage. It is important to note that the binder is only temporary and the insured will need to obtain a full policy as soon as possible.

How long does an Auto Insurance Binder last?

An auto insurance binder typically lasts for a short period of time, usually 30 days. This is because it is only meant to provide temporary coverage until the actual policy is issued. It is important to obtain a full policy as soon as possible to ensure continued coverage.

If the insured does not obtain a full policy within the 30-day period, their coverage will expire and they will no longer be insured. It is important to be aware of the expiration date of the binder and to make arrangements for a full policy before it expires.

How do I get an Auto Insurance Binder?

To obtain an auto insurance binder, you will need to contact your insurance company. They will be able to provide you with the necessary information and issue the binder if required. You may need to provide some basic information such as the make and model of the car and the effective date of coverage.

It is important to note that the binder is only temporary and you will need to obtain a full policy as soon as possible. Your insurance company can help you with this process and provide you with the necessary information to get your full policy in place.

What does an Auto Insurance Binder cover?

An auto insurance binder typically provides the same coverage as a full insurance policy. This includes liability coverage, which covers damages to other people’s property or injuries they sustain in an accident that is your fault. It also includes collision coverage, which covers damages to your own vehicle in the event of an accident.

The binder may also include other optional coverages such as comprehensive coverage, which covers damages to your vehicle from non-collision incidents such as theft or weather-related damage. It is important to review the terms of your binder carefully to ensure that you have the coverage you need.

Can I drive without an Auto Insurance Binder?

No, it is illegal to drive without insurance or proof of insurance. If you are caught driving without insurance, you may face fines, license suspension, and other penalties. It is important to obtain an auto insurance binder or a full policy before driving your vehicle. This will ensure that you are in compliance with the law and protected in the event of an accident.

What is an Insurance Binder?

In summary, an auto insurance binder serves as a temporary proof of insurance until the official policy is processed and mailed out to the policyholder. This document is typically issued by the insurance company or agent and contains important details such as the policyholder’s name, vehicle information, coverage limits, and effective dates.

As a professional writer, I highly recommend that individuals who are purchasing a new vehicle or switching insurance providers to request an auto insurance binder. This will ensure that they have immediate proof of insurance and can legally operate their vehicle while waiting for the official policy to arrive. It is important to note that auto insurance binders typically have a limited duration, so it is crucial to follow up with the insurance company or agent to ensure that the official policy is processed and received in a timely manner.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts