Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Auto insurance coverage can be a complex topic to understand, with a variety of terms and options to navigate. However, it is crucial for all drivers to have a comprehensive understanding of their policy to ensure they are properly protected in the event of an accident or other unforeseen circumstances. Whether you are a new driver shopping for your first policy or a seasoned driver looking to update your coverage, learning how to read auto insurance coverage is an essential skill that will benefit you greatly.

In this guide, we will break down the key components of auto insurance coverage and provide you with valuable insights to help you choose the right policy for your needs. From liability coverage to collision and comprehensive coverage, we will explore each type of coverage in depth, explaining what it covers and how it works. By the end of this guide, you will have a much clearer understanding of how to read auto insurance coverage, empowering you to make informed decisions and ensure you are getting the best possible protection for yourself and your vehicle.

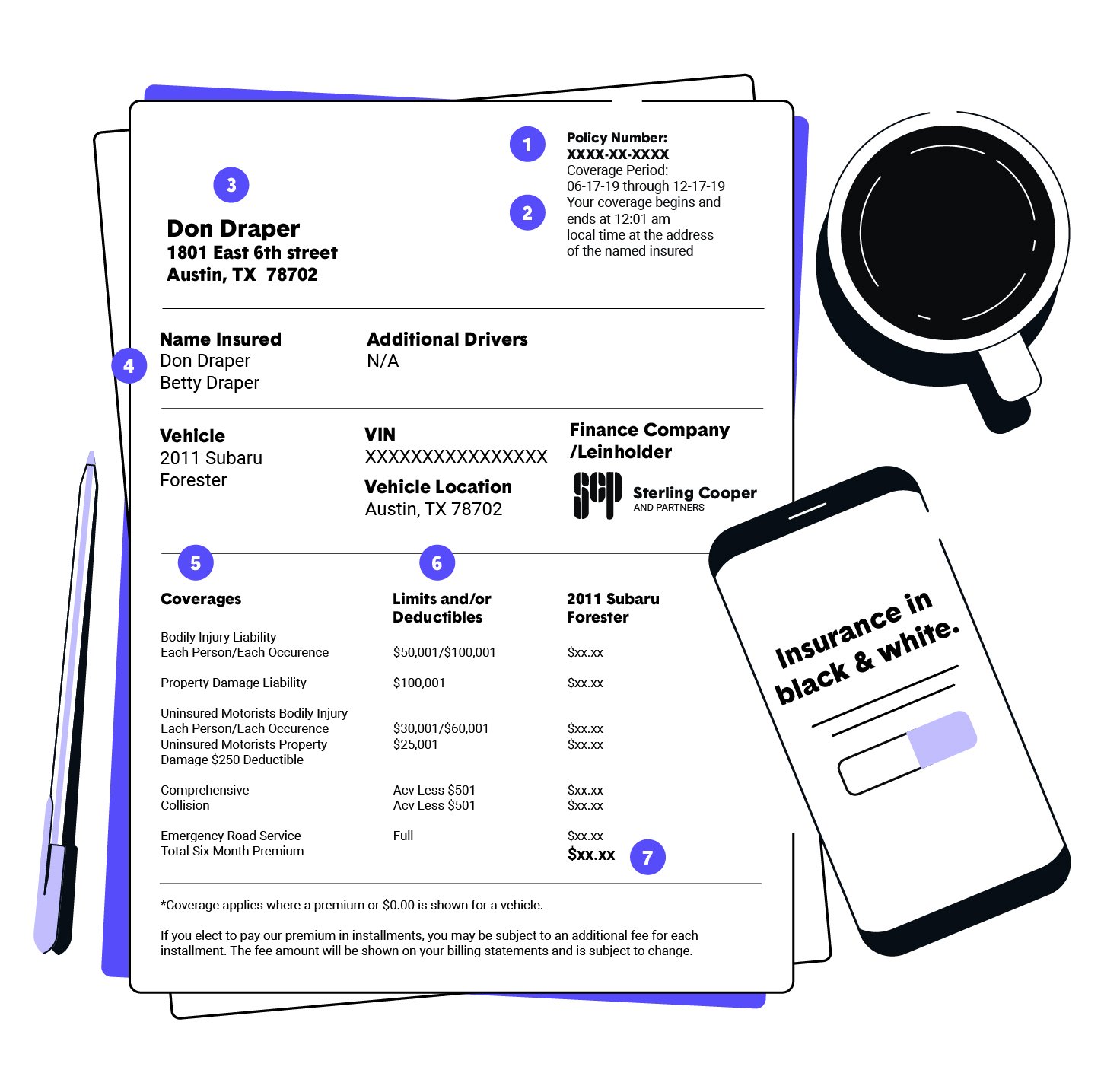

Here is a step-by-step guide on how to read auto insurance coverage:

1. Understand the types of coverage: liability, collision, and comprehensive.

2. Check the limits of each coverage.

3. Look for deductibles and how they apply to each coverage.

4. Understand any exclusions or limitations in the policy.

5. Review any additional benefits or riders included in the policy.

By following these steps, you can have a better understanding of the coverage offered by your auto insurance policy.

How to Read Auto Insurance Coverage?

Auto insurance is a crucial aspect of owning a car. It not only protects you from financial loss in case of an accident but is also mandatory in most states. However, understanding auto insurance coverage can be confusing, especially if you’re a first-time car owner. In this article, we’ll break down everything you need to know about reading auto insurance coverage.

1. Liability Coverage

Liability coverage is the most basic type of auto insurance coverage that every car owner needs to have. It covers the cost of damages and injuries that you may cause to others in an accident. Liability coverage is further divided into two types: bodily injury liability and property damage liability.

Benefits:

- Protects you from financial loss in case of an accident

- Covers the cost of damages and injuries caused to others

- Meets the legal requirement for car insurance

vs

This coverage pays for the medical expenses, lost wages, and other damages resulting from injuries you caused to others in an accident.

Property Damage Liability: This coverage pays for the damages you caused to someone else’s property in an accident.

2. Collision Coverage

Collision coverage pays for the damages to your car in case of an accident, regardless of who was at fault. This coverage is optional but highly recommended if you have a new or expensive car.

Benefits:

- Covers the cost of damages to your car in case of an accident

- Protects your car from damages caused by other drivers

3. Comprehensive Coverage

Comprehensive coverage pays for damages to your car that are not caused by accidents, such as theft, vandalism, or natural disasters. This coverage is also optional but recommended if you live in an area with high crime rates or severe weather conditions.

Benefits:

- Covers the cost of damages to your car caused by theft, vandalism, or natural disasters

- Provides additional protection for your car

4. Personal Injury Protection

Personal injury protection (PIP) coverage pays for the medical expenses and lost wages of you and your passengers in case of an accident, regardless of who was at fault. This coverage is mandatory in some states but optional in others.

Benefits:

- Covers the cost of medical expenses and lost wages for you and your passengers

- Provides additional protection in case of an accident

5. Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage pays for the damages and injuries you sustain in an accident caused by a driver who doesn’t have enough insurance or no insurance at all. This coverage is optional but highly recommended.

Benefits:

- Covers the cost of damages and injuries caused by an uninsured or underinsured driver

- Provides additional protection in case of an accident

6. Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles mean lower premiums, but you’ll have to pay more in case of an accident.

Benefits:

- Lower premiums

- Allows you to customize your coverage

7. Limits

Insurance limits refer to the maximum amount your insurance company will pay for damages and injuries in case of an accident. Higher limits mean more protection but also higher premiums.

Benefits:

- More protection in case of an accident

- Allows you to customize your coverage

8. Exclusions

Exclusions are situations that are not covered under your insurance policy. It’s essential to read your policy carefully to understand what’s excluded and what’s covered.

Benefits:

- Helps you understand what’s covered and what’s not

- Prevents surprises in case of an accident

9. Endorsements

Endorsements are additional coverage options that you can add to your policy to meet your specific needs. Some common endorsements include roadside assistance, rental car coverage, and gap insurance.

Benefits:

- Allows you to customize your coverage

- Provides additional protection for specific situations

10. Renewal and Cancellation

Your auto insurance policy is typically valid for a year and needs to be renewed annually. If you want to cancel your policy, you’ll need to notify your insurance company in writing.

Benefits:

- Keeps your coverage up to date

- Gives you the option to cancel your policy if needed

In conclusion, understanding auto insurance coverage is essential to protect yourself and your car in case of an accident. By reading your policy carefully and understanding the different types of coverage, you can customize your policy to meet your specific needs and budget.

Frequently Asked Questions

What is Auto Insurance Coverage?

Auto insurance coverage is a policy that protects you financially in case of an accident, theft or any other damage caused to your vehicle. It is a contract between you and the insurance company which specifies the terms and conditions of the policy. Auto insurance coverage comes in different types and levels of coverage, depending on your needs and budget.

The most common types of auto insurance coverage are liability, collision, comprehensive, personal injury protection (PIP) and uninsured/underinsured motorist coverage. It is important to understand what each type of coverage entails and how it applies to you in case of an accident or any other incident.

How do I Read Auto Insurance Coverage?

Reading an auto insurance coverage policy can be overwhelming, with all the legal jargon and technical terms used in the document. However, it is important to read and understand the policy before signing it, to avoid any surprises in case of an accident.

Start by reviewing the declarations page, which provides a summary of the policy and lists the coverage types and limits. Then, read the policy language to understand the terms and conditions of the coverage. Pay attention to the exclusions, deductibles, and limitations of the policy, as they can greatly affect the coverage you receive.

What is Liability Coverage?

Liability coverage is a type of auto insurance that covers damages and injuries you cause to others in an accident. It is mandatory in most states, and it has two main components: bodily injury liability and property damage liability.

Bodily injury liability covers medical expenses, lost wages, and damages related to injuries you cause to others in an accident. Property damage liability covers damages you cause to someone else’s property, such as their vehicle, fence or mailbox. Liability coverage limits vary by state and insurer, so make sure you have enough coverage to protect your assets in case of a lawsuit.

What is Collision Coverage?

Collision coverage is a type of auto insurance that covers damages to your vehicle in case of a collision, regardless of who is at fault. It covers the cost of repairs or replacement of your vehicle, up to the actual cash value of the vehicle.

Collision coverage is not mandatory, but it is highly recommended for newer or expensive vehicles. The coverage comes with a deductible, which is the amount you pay out of pocket before the insurance kicks in. Choose a deductible that you can afford to pay in case of an accident.

What is Comprehensive Coverage?

Comprehensive coverage is a type of auto insurance that covers damages to your vehicle that are not caused by a collision, such as theft, vandalism, natural disasters, or falling objects. It also covers damages caused by collision with an animal.

Comprehensive coverage is not mandatory, but it is recommended if you live in an area prone to natural disasters or high crime rates. The coverage comes with a deductible, which is the amount you pay out of pocket before the insurance kicks in. Choose a deductible that you can afford to pay in case of an incident.

Understanding auto insurance coverage is crucial for anyone who owns or operates a vehicle. It is important to know what you are paying for and what your policy covers. By taking the time to read and comprehend your policy, you can avoid any surprises in the event of an accident or claim. Reading auto insurance coverage may seem daunting at first, but with a little patience and attention to detail, it can be easily understood.

In the end, being knowledgeable about your auto insurance coverage can save you time, money, and stress. Remember to review your policy periodically to ensure that it still meets your needs and that you have adequate coverage. As a professional writer, I recommend taking the time to read and understand your insurance policy thoroughly. By doing so, you can have peace of mind knowing that you are adequately protected in the event of an accident or claim.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts