Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Term life insurance is a popular option for individuals who want to protect their loved ones financially in the event of their unexpected passing. However, many people are unaware that term life insurance policies can also be a valuable tool while they are still alive. This type of insurance can provide a range of benefits, from paying off debt to supplementing retirement income.

If you have a term life insurance policy, it’s important to understand how to use it to your advantage while you’re still alive. In this article, we’ll explore the different ways you can leverage your term life insurance policy, including converting it to a permanent policy, using it to pay off debt, and even using it as a form of savings. With this knowledge, you can make informed decisions about how to best utilize your policy to meet your financial goals.

- Choose a policy amount and term length that aligns with your financial goals.

- Purchase the policy and pay the premiums.

- In the event of your unexpected death, your beneficiaries will receive a tax-free death benefit payout.

- If you outlive the policy term, you can either renew the policy, convert it to a permanent life insurance policy, or let it expire.

Contents

- Using Term Life Insurance While Alive: A Comprehensive Guide

- Conclusion

- Frequently Asked Questions

- What is term life insurance?

- Can term life insurance be used while alive?

- What are the benefits of converting a term life insurance policy?

- What is a life settlement?

- What are the risks of a life settlement?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Using Term Life Insurance While Alive: A Comprehensive Guide

Term life insurance is a valuable tool for protecting your family’s financial future after you pass away. However, did you know that it can also be used while you’re still alive? In this guide, we’ll explore the many ways that term life insurance can benefit you and your loved ones during your lifetime.

1. Supplementing Retirement Income

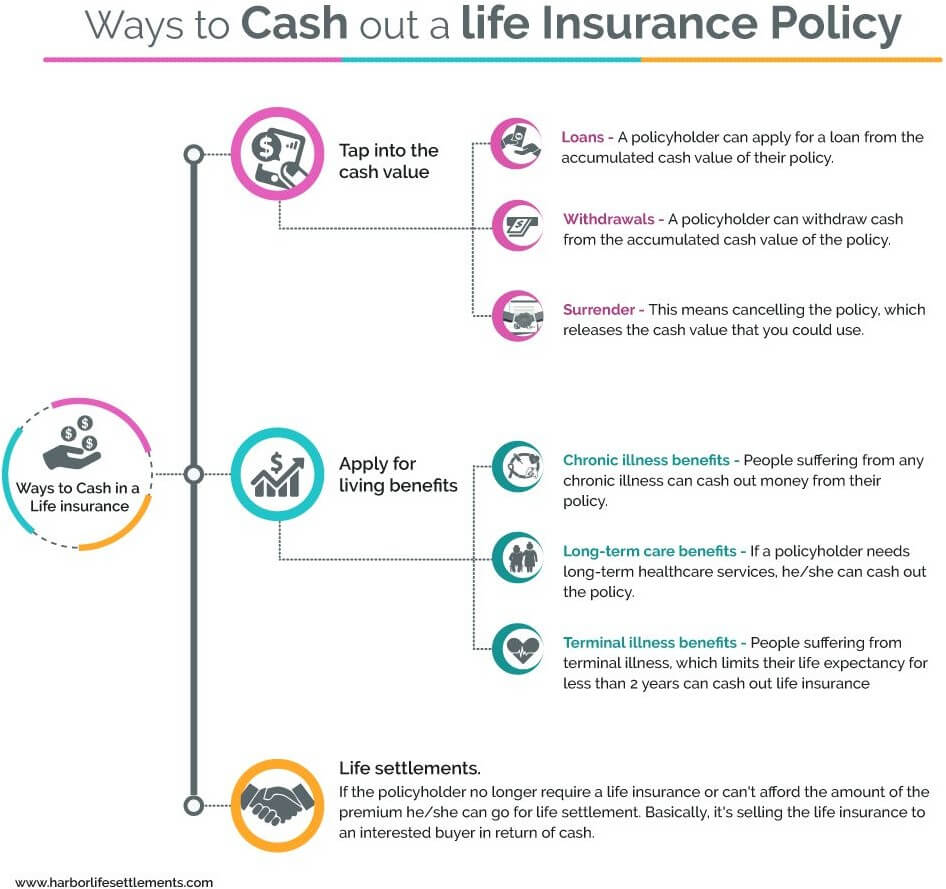

As you near retirement age, you may be concerned about whether your savings will be enough to support you throughout your golden years. Term life insurance can provide an additional source of income through a policy loan or partial surrender. By tapping into the cash value of your policy, you can supplement your retirement income without having to sell assets or dip into your savings.

It’s important to note that any outstanding loans or withdrawals will reduce the death benefit paid to your beneficiaries upon your passing. Careful consideration should be taken when deciding to use your policy for retirement income.

- Pros:

- Provides an additional source of income during retirement

- Policy loans and partial surrender allow you to access cash value without selling assets

- Cons:

- Reduced death benefit for beneficiaries

2. Paying for Education Expenses

College tuition and other education expenses can be a significant financial burden for families. If you have children, term life insurance can help cover these costs in the event of your passing. However, it can also be used while you’re still alive.

By taking out a policy loan or partial surrender, you can use the cash value of your policy to pay for education expenses. This can help alleviate some of the financial stress of sending your children to college or paying for your own continued education.

- Pros:

- Provides a source of funding for education expenses

- Policy loans and partial surrender allow you to access cash value without selling assets

- Cons:

- Reduced death benefit for beneficiaries

3. Estate Planning

Term life insurance can be an effective tool for estate planning. By naming a beneficiary, you can ensure that your assets and property are distributed according to your wishes after your passing. However, it can also be used while you’re still alive.

If you have significant assets, you may be concerned about estate taxes and other expenses that could reduce the value of your estate. By using your term life insurance policy to pay for these expenses, you can ensure that your beneficiaries receive the full value of your estate.

- Pros:

- Can help reduce estate taxes and other expenses

- Ensures that beneficiaries receive the full value of your estate

- Cons:

- Reduced death benefit for beneficiaries

4. Business Planning

Term life insurance can also be a valuable tool for business planning. If you own a business, you may want to ensure that your partners or employees are protected in the event of your passing. However, it can also be used while you’re still alive.

By using your policy as collateral for a loan, you can access the cash value of your policy to fund business expenses or expansion. You can also use the death benefit to fund a buy-sell agreement or key person insurance.

- Pros:

- Provides protection for business partners and employees

- Can be used to fund business expenses or expansion

- Cons:

- Reduced death benefit for beneficiaries

5. Long-Term Care Planning

As you age, you may require long-term care for a chronic illness or disability. Long-term care can be expensive and can quickly deplete your savings. Term life insurance can be used to help cover these costs.

Some term life insurance policies offer a long-term care rider that allows you to access a portion of your death benefit to pay for long-term care expenses. This can provide much-needed financial support during a difficult time.

- Pros:

- Provides financial support for long-term care expenses

- Long-term care rider allows you to access a portion of your death benefit

- Cons:

- Reduced death benefit for beneficiaries

6. Charitable Giving

Term life insurance can also be used to support charitable causes. By naming a charity as your beneficiary, you can ensure that your legacy lives on through your support of their mission. However, it can also be used while you’re still alive.

By gifting a portion of your policy to a charity, you can receive a tax deduction for the value of your gift. This can be a valuable way to support causes that are important to you and your family.

- Pros:

- Allows you to support charitable causes during your lifetime

- Gifts of policy value can provide tax deductions

- Cons:

- Reduced death benefit for beneficiaries

7. Protecting Your Family’s Finances

The primary purpose of term life insurance is to protect your family’s finances in the event of your passing. However, it can also be used to protect your finances while you’re still alive.

If you become disabled or unable to work, your term life insurance policy can provide a source of income through a policy loan or partial surrender. This can help you cover expenses and maintain your standard of living during a difficult time.

- Pros:

- Provides a source of income during disability or inability to work

- Policy loans and partial surrender allow you to access cash value without selling assets

- Cons:

- Reduced death benefit for beneficiaries

8. Legacy Planning

Term life insurance can also be used for legacy planning. By naming a beneficiary, you can ensure that your loved ones are provided for after your passing. However, it can also be used while you’re still alive.

By gifting a portion of your policy to your beneficiaries, you can help them achieve their financial goals and provide for their future. This can be a valuable way to leave a lasting legacy for your family.

- Pros:

- Allows you to support your loved ones during your lifetime

- Gifts of policy value can provide financial support for beneficiaries

- Cons:

- Reduced death benefit for beneficiaries

9. Supplementing Disability Insurance

Disability insurance is an important tool for protecting your finances in the event that you become disabled and unable to work. However, disability insurance may not cover all of your expenses.

Term life insurance can be used to supplement your disability insurance coverage. By taking out a policy loan or partial surrender, you can access the cash value of your policy to cover additional expenses.

- Pros:

- Provides additional financial support during disability

- Policy loans and partial surrender allow you to access cash value without selling assets

- Cons:

- Reduced death benefit for beneficiaries

10. Providing for Your Loved Ones

The primary purpose of term life insurance is to provide for your loved ones after your passing. However, it can also be used to provide for them while you’re still alive.

By taking out a policy loan or partial surrender, you can access the cash value of your policy to cover expenses and provide for your family’s financial needs. This can help ensure that your loved ones are taken care of during difficult times.

- Pros:

- Provides financial support for your loved ones during your lifetime

- Policy loans and partial surrender allow you to access cash value without selling assets

- Cons:

- Reduced death benefit for beneficiaries

Conclusion

Term life insurance is a versatile tool that can provide valuable financial support during your lifetime. From supplementing retirement income to providing for your loved ones, there are many ways that you can use your policy to meet your financial needs.

However, it’s important to remember that any outstanding loans or withdrawals will reduce the death benefit paid to your beneficiaries upon your passing. Careful consideration should be taken when deciding to use your policy for any of the purposes outlined in this guide.

Frequently Asked Questions

What is term life insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specific period of time, usually between 10 and 30 years. If the policyholder dies during the term of the policy, the death benefit is paid out to the beneficiary. However, if the policyholder outlives the term of the policy, the coverage ends and there is no payout.

Term life insurance is often used to provide financial protection for loved ones in the event of the policyholder’s premature death. It is typically less expensive than other types of life insurance, such as whole life insurance, and can be a good option for those on a budget.

Can term life insurance be used while alive?

Yes, term life insurance can be used while the policyholder is still alive. There are a few ways to do this. First, some term life insurance policies offer a conversion option that allows the policyholder to convert their term policy into a permanent life insurance policy, such as whole life insurance. This can be beneficial for those who want lifelong coverage and the ability to build cash value.

Another way to use term life insurance while alive is to sell the policy through a process called a life settlement. This involves selling the policy to a third-party investor for a lump sum payment. The investor takes over the premium payments and receives the death benefit when the policyholder passes away.

What are the benefits of converting a term life insurance policy?

Converting a term life insurance policy to a permanent policy, such as whole life insurance, can offer several benefits. First, the policyholder will have lifelong coverage and won’t have to worry about the policy expiring. Additionally, permanent life insurance policies often build cash value over time, which can be used as a source of savings or to take out loans against.

Converting a term policy can also be beneficial for those who have experienced a change in health since they first purchased the policy. With a conversion option, the policyholder can convert to a permanent policy without having to undergo a new medical exam and potentially facing higher premiums.

What is a life settlement?

A life settlement is a process in which a policyholder sells their life insurance policy to a third-party investor for a lump sum payment. The investor takes over the premium payments and receives the death benefit when the policyholder passes away. The lump sum payment is typically more than the policy’s cash surrender value but less than the death benefit.

Life settlements can be a good option for those who no longer need their life insurance policy or can no longer afford the premiums. It can also be a good option for those who want to use the funds for other purposes, such as paying for medical expenses or long-term care.

What are the risks of a life settlement?

There are some risks associated with a life settlement. First, the lump sum payment will be less than the death benefit, so the policyholder’s beneficiaries will receive less money when they pass away. Additionally, the policyholder will no longer have life insurance coverage, which could be a concern if they have dependents or outstanding debts.

There is also the risk that the investor may not be able to keep up with the premium payments or may go bankrupt, which could result in the policy being cancelled. It’s important to work with a reputable life settlement provider and to fully understand the terms of the agreement before selling a life insurance policy.

In today’s world, we are all looking for ways to secure our lives and protect our loved ones. Term life insurance is one such way that can provide financial protection to our families in case of our untimely demise. But did you know that term life insurance can also be used while you are alive? Yes, you read that right! In this article, we explored the different ways in which you can use term life insurance while you are still living.

From taking a loan against the policy to using it as collateral for a mortgage, term life insurance can be a valuable asset that can provide financial support during tough times. Moreover, with the option to convert your term life insurance policy to a permanent one in the future, you can enjoy lifelong protection and benefits. So, whether you are looking to secure your family’s future or want to ensure financial stability during emergencies, using term life insurance while alive can be a smart choice that can benefit you and your loved ones in the long run.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts