Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

For many individuals, securing life insurance coverage is an important step in protecting their loved ones financially. Life insurance provides a safety net in case the unexpected occurs, and it can offer peace of mind to policyholders knowing that their family will be taken care of financially if they pass away. One common option for life insurance coverage is a 30-year term policy, which provides protection for a set period of time at a fixed rate.

But is 30-year term life insurance a good choice for everyone? In this article, we will explore the pros and cons of this type of policy and help you determine if it is the right fit for your needs. Whether you are just starting to consider life insurance or are contemplating switching to a 30-year term policy, understanding the benefits and drawbacks can help you make an informed decision about your coverage.

Yes, 30-year term life insurance is a good option for those looking for long-term coverage at an affordable price. It provides coverage for 30 years, ensuring that your loved ones are financially protected if something happens to you during that time. This type of policy is ideal for those who have young children, a mortgage, or other long-term financial obligations.

Is 30 Year Term Life Insurance Good?

If you’re looking for an affordable way to provide financial security for your loved ones, term life insurance may be a good option. Term life insurance is a type of life insurance policy that provides coverage for a specific period of time, usually ranging from 10 to 30 years. In this article, we’ll discuss whether a 30-year term life insurance policy is a good choice for you and your family.

What is 30-year term life insurance?

30-year term life insurance is a type of term life insurance policy that provides coverage for 30 years. This means that if you pass away during the policy’s term, your beneficiaries will receive a death benefit. The death benefit is usually paid out tax-free and can be used to cover expenses such as funeral costs, outstanding debts, and living expenses.

30-year term life insurance policies are typically more expensive than shorter-term policies, such as 10 or 20-year terms. However, they provide longer coverage and may be a good option if you have young children, a mortgage, or other long-term financial obligations.

Benefits of 30-year term life insurance

There are several benefits to choosing a 30-year term life insurance policy:

1. Affordable premiums: While 30-year term life insurance policies are typically more expensive than shorter-term policies, they are still relatively affordable. This makes them a good option for young families who want to provide financial security for their loved ones without breaking the bank.

2. Long-term coverage: 30-year term life insurance policies provide coverage for a longer period of time than shorter-term policies. This means that if you pass away during the policy’s term, your beneficiaries will receive a death benefit.

3. Convertibility: Many 30-year term life insurance policies have a convertibility option. This means that you can convert your term policy to a permanent policy, such as whole life insurance, without having to undergo a medical exam.

4. Flexibility: 30-year term life insurance policies are flexible and can be tailored to meet your specific needs. For example, you can choose the amount of coverage you need and the length of the policy’s term.

Drawbacks of 30-year term life insurance

While there are many benefits to 30-year term life insurance, there are also some drawbacks to consider:

1. Cost: 30-year term life insurance policies are typically more expensive than shorter-term policies. This means that you may have to pay higher premiums to maintain coverage for a longer period of time.

2. Limited coverage: 30-year term life insurance policies only provide coverage for a specific period of time. If you outlive the policy’s term, you will need to purchase a new policy or renew your existing policy at a higher premium.

3. No cash value: 30-year term life insurance policies do not have a cash value. This means that if you cancel your policy or outlive the policy’s term, you will not receive any money back.

30-year term life insurance vs other types of life insurance

When choosing a life insurance policy, it’s important to consider all of your options. Here’s how 30-year term life insurance compares to other types of life insurance:

1. Whole life insurance: Whole life insurance provides coverage for your entire life and has a cash value component. However, it is typically more expensive than term life insurance.

2. Universal life insurance: Universal life insurance is a type of permanent life insurance that offers flexible premiums and death benefits. However, it is also more expensive than term life insurance.

3. Variable life insurance: Variable life insurance is a type of permanent life insurance that allows you to invest your premium payments in a variety of investment options. However, it is also more expensive than term life insurance.

In conclusion, 30-year term life insurance can be a good choice for young families who want to provide financial security for their loved ones. While it may be more expensive than shorter-term policies, it provides longer coverage and may be more affordable than other types of life insurance. However, it’s important to consider all of your options and choose the policy that best meets your needs and budget.

Contents

- Frequently Asked Questions

- What is 30 year term life insurance?

- Is 30 year term life insurance a good option?

- How much does 30 year term life insurance cost?

- Can you renew a 30 year term life insurance policy?

- What happens if you outlive your 30 year term life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

What is 30 year term life insurance?

30 year term life insurance is a type of life insurance policy that provides coverage for 30 years. It is a popular choice for those who want to ensure that their loved ones are financially protected for a specific period of time, such as while their children are still young or until their mortgage is paid off.

During the 30 year term, the policyholder pays a fixed premium amount, and in the event of their death, their beneficiaries receive the death benefit specified in the policy.

Is 30 year term life insurance a good option?

30 year term life insurance can be a good option for many people, depending on their needs and circumstances. If you are looking for a policy that provides coverage for a specific period of time, such as until your children are grown or until your mortgage is paid off, then a 30 year term policy may be a good choice for you.

However, if you are looking for lifelong coverage, or if you are older and may not need coverage for a full 30 years, then a different type of policy may be more appropriate.

How much does 30 year term life insurance cost?

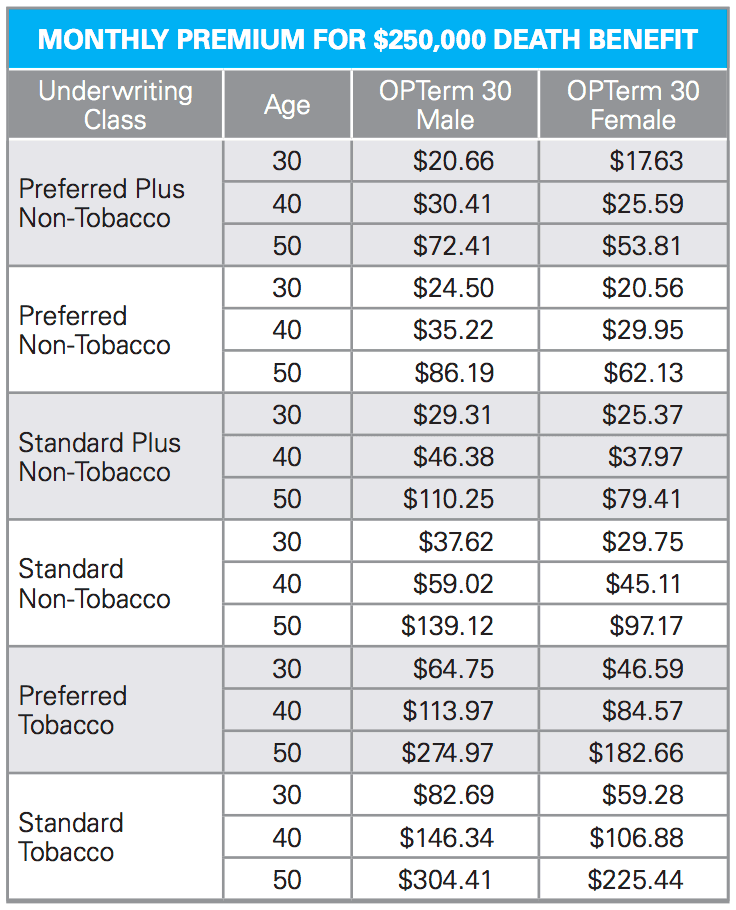

The cost of 30 year term life insurance can vary depending on a number of factors, including your age, health, and the amount of coverage you need. Generally, the younger and healthier you are, the lower your premiums will be.

It’s important to shop around and compare quotes from different insurers to make sure you are getting the best price for your coverage.

Can you renew a 30 year term life insurance policy?

Most 30 year term life insurance policies do not come with a renewal option. Once the 30 year term is up, the policy will expire and you will need to purchase a new policy if you want to continue your coverage.

However, some policies may offer the option to convert to a permanent life insurance policy, which can provide lifelong coverage.

What happens if you outlive your 30 year term life insurance policy?

If you outlive your 30 year term life insurance policy, your coverage will expire and you will no longer be protected by the policy. However, some policies may offer the option to renew or convert to a different type of policy.

If you do not have any other life insurance coverage in place, it may be a good idea to purchase a new policy to ensure that your loved ones are financially protected in the event of your death.

After analyzing the pros and cons of a 30-year term life insurance policy, it is safe to say that it can be a good option for some individuals. The long term coverage and affordable premiums make it an attractive choice for those who need coverage for a specific period. However, it is important to consider one’s individual needs and financial situation before making a decision.

Ultimately, whether or not a 30-year term life insurance policy is good depends on your unique circumstances. It is always a good idea to consult with a financial advisor or insurance agent to determine the best policy for your specific needs. With careful consideration and planning, a 30-year term life insurance policy can provide peace of mind and financial security for you and your loved ones.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts