Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

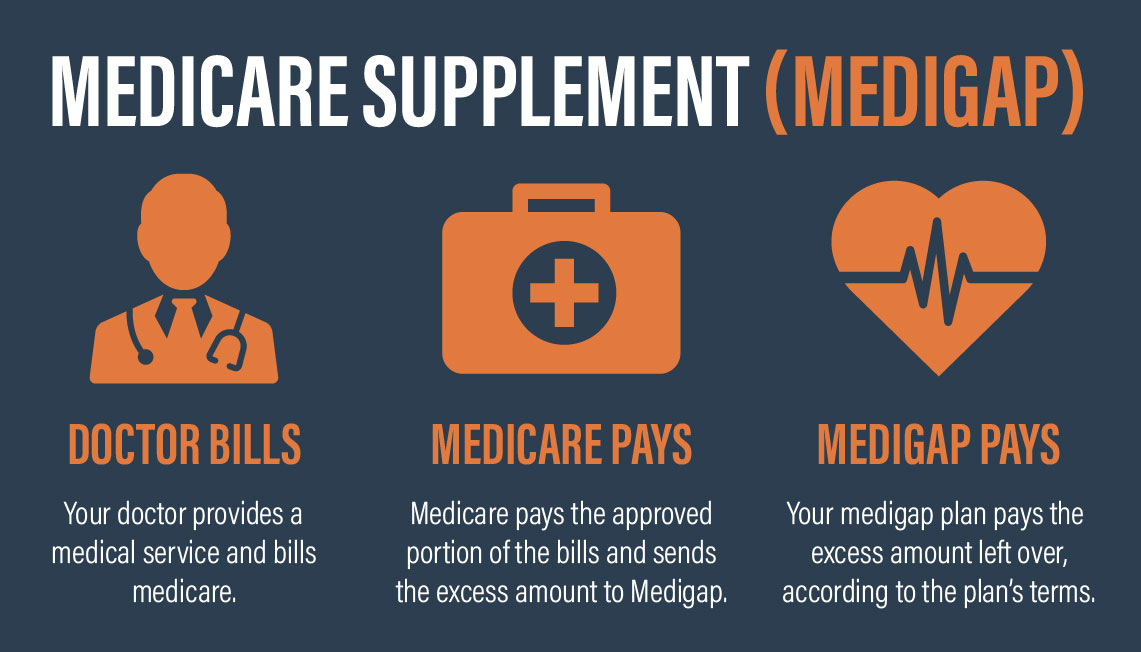

Medicare is a vital program for millions of Americans, providing health insurance coverage for those over 65 years old, as well as those with certain disabilities or chronic conditions. However, despite the benefits that Medicare offers, there may still be gaps in coverage that could leave seniors vulnerable to high medical bills. This is where Medicare supplemental insurance, also known as Medigap, comes into play.

If you are already enrolled in Medicare, you may be wondering if it’s too late to get supplemental insurance. The good news is that, in most cases, you can still sign up for a Medigap policy even if you’ve been enrolled in Medicare for several years. In this article, we’ll explore the various aspects of Medicare supplemental insurance and answer some common questions to help you make an informed decision about whether or not it’s right for you.

Contents

- Is It Too Late to Get Medicare Supplemental Insurance?

- Frequently Asked Questions

- Is It Too Late to Get Medicare Supplemental Insurance?

- What Does Medicare Supplemental Insurance Cover?

- How Much Does Medicare Supplemental Insurance Cost?

- Can I Switch Medigap Plans?

- Do I Need Medicare Supplemental Insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Is It Too Late to Get Medicare Supplemental Insurance?

As you approach your golden years, you’re likely to start thinking about your healthcare options. Medicare is a government-funded health insurance program that provides coverage for seniors, but many people choose to supplement their coverage with a Medicare Supplemental Insurance plan. If you’re wondering whether it’s too late to get Medicare Supplemental Insurance, the short answer is no.

Understanding Medicare Supplemental Insurance

Medicare Supplemental Insurance, also known as Medigap, is private insurance that can help cover some of the costs that Medicare does not. This can include things like copays, coinsurance, and deductibles. There are ten types of Medigap plans, each providing different levels of coverage.

It’s important to note that you must have Original Medicare, which includes both Part A and Part B, in order to enroll in a Medigap plan. You cannot have a Medicare Advantage plan and a Medigap plan at the same time.

When Can You Enroll in Medicare Supplemental Insurance?

The best time to enroll in a Medigap plan is during the six-month open enrollment period that begins the month you turn 65 and are enrolled in Medicare Part B. During this time, insurance companies cannot deny you coverage or charge you more based on pre-existing conditions.

If you miss the open enrollment period, you may still be able to enroll in a Medigap plan, but you may be subject to medical underwriting. This means that the insurance company can review your medical history and potentially deny you coverage or charge you a higher premium based on any pre-existing conditions.

Benefits of Medicare Supplemental Insurance

There are many benefits to enrolling in a Medigap plan. For one, it can provide peace of mind knowing that you have additional coverage for healthcare costs. It can also help you budget for healthcare expenses, as you know exactly what your out-of-pocket costs will be.

Additionally, some Medigap plans offer coverage for things that Original Medicare does not, such as foreign travel emergency coverage. This can be particularly beneficial for seniors who like to travel.

Medicare Supplemental Insurance vs. Medicare Advantage

Medicare Advantage, also known as Medicare Part C, is another option for seniors looking to supplement their Medicare coverage. Unlike Medigap, Medicare Advantage is not a separate insurance policy. Instead, it replaces your Original Medicare coverage with a private insurance plan.

Medicare Advantage plans may offer additional benefits, such as vision, dental, and prescription drug coverage. However, they also typically have more restrictions, such as requiring you to choose healthcare providers within a certain network.

How to Choose a Medigap Plan

When choosing a Medigap plan, there are a few things to consider. First, you’ll want to make sure the plan is available in your state. Then, you’ll want to compare the coverage provided by each plan to determine which one best meets your needs.

Additionally, you’ll want to consider the cost of the plan. Medigap premiums can vary widely, so it’s important to shop around and compare prices. Keep in mind that while a lower premium may seem appealing, it may also mean less coverage.

The Bottom Line

It’s never too late to enroll in a Medicare Supplemental Insurance plan. However, it’s important to do your research and choose a plan that meets your needs and budget. Whether you opt for a Medigap plan or a Medicare Advantage plan, supplementing your Medicare coverage can provide valuable peace of mind and help you manage your healthcare costs.

Frequently Asked Questions

Is It Too Late to Get Medicare Supplemental Insurance?

It is never too late to get Medicare Supplemental Insurance, also known as Medigap. However, there are certain timeframes in which you can enroll without being subject to medical underwriting. If you enroll during your Medigap Open Enrollment Period, which is the six-month period that starts the month you turn 65 and are enrolled in Medicare Part B, you cannot be denied coverage or charged more based on your health status. If you miss this period, you may still be able to enroll in a Medigap plan, but you may be subject to medical underwriting, which means the insurance company can charge you more or deny you coverage based on your health history.

There are also certain circumstances that can trigger a Guaranteed Issue Right, which allows you to enroll in a Medigap plan without medical underwriting. These include losing employer-based coverage, moving out of your plan’s service area, or having your plan terminate its contract with Medicare. If you have a Guaranteed Issue Right, you have a limited time to enroll in a Medigap plan.

What Does Medicare Supplemental Insurance Cover?

Medicare Supplemental Insurance, or Medigap, is designed to help cover the costs that Original Medicare does not pay for, such as deductibles, copayments, and coinsurance. There are 10 standardized Medigap plans available in most states, each labeled with a letter from A to N. Each plan offers a different set of benefits, and the benefits are the same for all insurance companies that offer that plan. For example, Medigap Plan F offers the most comprehensive coverage, while Medigap Plan A offers the least amount of coverage.

It is important to note that Medigap plans do not cover prescription drugs. If you want prescription drug coverage, you will need to enroll in a Medicare Part D prescription drug plan.

How Much Does Medicare Supplemental Insurance Cost?

The cost of Medicare Supplemental Insurance, or Medigap, varies depending on the plan you choose and where you live. Insurance companies can charge different premiums for the same plan, so it is important to shop around and compare prices. In general, the more comprehensive the plan, the higher the premium. However, the cost of a Medigap plan may be worth it if it helps you avoid high out-of-pocket costs for medical services.

In addition to the monthly premium, some Medigap plans may require you to pay a deductible before the plan begins to pay for your medical expenses. You will also need to continue paying your Medicare Part B premium in addition to the Medigap premium.

Can I Switch Medigap Plans?

Yes, you can switch Medigap plans at any time. However, if you switch plans outside of your Medigap Open Enrollment Period or a Guaranteed Issue Right, you may be subject to medical underwriting, which means the insurance company can charge you more or deny you coverage based on your health history. It is important to compare the benefits and costs of each plan before switching to ensure that you are getting the coverage you need at a price you can afford.

If you are currently enrolled in a Medicare Advantage plan and want to switch to a Medigap plan, you will need to first disenroll from your Medicare Advantage plan and enroll in Original Medicare. Once you are enrolled in Original Medicare, you can then enroll in a Medigap plan.

Do I Need Medicare Supplemental Insurance?

Whether or not you need Medicare Supplemental Insurance, or Medigap, depends on your individual healthcare needs and budget. If you have a chronic health condition or expect to need frequent medical services, a Medigap plan may help you avoid high out-of-pocket costs. However, if you are in good health and have few medical expenses, you may not need a Medigap plan.

It is also important to consider the costs of a Medigap plan compared to the potential benefits. In some cases, the cost of a Medigap plan may be higher than the amount you would pay for out-of-pocket expenses without a Medigap plan. It is important to compare the costs and benefits of each plan before enrolling to ensure that you are getting the coverage you need at a price you can afford.

As a professional writer, I can confidently say that it is never too late to get Medicare Supplemental Insurance. Many seniors worry that they have missed the open enrollment window, and they are no longer eligible for additional coverage. However, the truth is that there are many options available to those who want to supplement their Medicare coverage. Whether you are new to Medicare or have been enrolled for years, it is always a good idea to explore your options and see if there is a plan that better suits your needs.

One of the benefits of Medicare Supplemental Insurance is that it can provide coverage for things that Medicare does not cover, such as deductibles, copays, and coinsurance. Additionally, some plans may offer coverage for prescription drugs, hearing aids, and vision care. By enrolling in a supplemental plan, you may be able to save money on healthcare costs and have peace of mind knowing that you have additional coverage if you need it. So if you are considering Medicare Supplemental Insurance, don’t hesitate to explore your options and find the plan that is right for you.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts