Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As you may know, atrial fibrillation (AFib) is a common heart condition that affects millions of people worldwide. AFib is a type of arrhythmia, which is an irregular heartbeat that can lead to serious health complications. For individuals who have been diagnosed with AFib, one of the questions that often arises is whether or not it will be considered heart disease for life insurance purposes.

The answer to this question is not always straightforward, as it can depend on various factors. In this article, we will explore what AFib is, how it can impact your life insurance rates, and what you can do to ensure you get the best coverage possible. So, if you or a loved one has been diagnosed with AFib and are seeking life insurance, keep reading to learn more.

Yes, atrial fibrillation (Afib) is considered a type of heart disease for life insurance purposes. This is because Afib can increase the risk of developing other heart-related conditions, such as stroke or heart failure. Insurance companies will typically ask about any history of Afib when assessing an applicant’s risk and determining their premiums. It’s important to disclose any relevant medical information to ensure that you are properly covered by your life insurance policy.

Contents

- Is Afib Considered Heart Disease for Life Insurance?

- Frequently Asked Questions

- 1. Is Afib considered heart disease for life insurance?

- 2. Can I get life insurance if I have Afib?

- 3. What do life insurance companies look for when evaluating applicants with Afib?

- 4. Will my premiums be higher if I have Afib?

- 5. Can I improve my chances of getting affordable life insurance if I have Afib?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Is Afib Considered Heart Disease for Life Insurance?

Atrial fibrillation (Afib) is a type of heart disorder that affects millions of people worldwide. It is a condition in which the heart’s rhythm becomes irregular, causing the heart to beat too fast or too slow. Afib can be a serious condition that may require medical intervention to manage symptoms and prevent complications. If you have Afib, you may wonder if it is considered heart disease for life insurance purposes.

What is Atrial Fibrillation?

Atrial fibrillation is a type of heart disorder that affects the electrical impulses that control the heart’s rhythm. When these impulses become irregular, the heart may beat too fast, too slow, or irregularly. This can cause symptoms such as palpitations, shortness of breath, chest pain or discomfort, and dizziness.

If left untreated, atrial fibrillation can cause serious complications such as stroke, heart failure, and other heart-related problems. It is important to seek medical attention if you experience any symptoms of Afib.

Is Afib Considered Heart Disease?

Afib is considered a type of heart disease for life insurance purposes. This is because it is a condition that affects the heart’s rhythm and can lead to serious complications. Life insurance companies may consider Afib as a pre-existing medical condition, which means that it could affect your ability to get approved for a policy or may result in higher premiums.

However, the impact of Afib on your life insurance policy will depend on several factors such as your age, overall health, and the severity of your condition. It is best to speak with a licensed insurance agent who can help you understand how Afib may affect your life insurance options.

How Does Afib Affect Life Insurance?

If you have Afib, it may affect your ability to get approved for a life insurance policy or may result in higher premiums. Life insurance companies will consider several factors when evaluating your application, including your age, overall health, and the severity of your condition.

If you have a mild form of Afib that is well-managed and does not cause any complications, you may still be able to qualify for a life insurance policy at standard rates. However, if your Afib is more severe or has led to complications such as stroke or heart failure, you may be considered a higher risk and may need to pay higher premiums or be denied coverage altogether.

Benefits of Life Insurance for People with Afib

Despite the potential challenges of getting life insurance with Afib, there are several benefits to having a policy. Life insurance provides financial protection for your loved ones in the event of your unexpected death. This can help cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

Additionally, some life insurance policies may provide coverage for critical illnesses such as heart disease or stroke. If you have Afib, it is important to explore your life insurance options to find a policy that best meets your needs.

Afib and Term Life Insurance

Term life insurance is a type of policy that provides coverage for a specific period, such as 10, 20, or 30 years. If you have Afib, you may be able to qualify for term life insurance at standard or substandard rates, depending on the severity of your condition.

Term life insurance can provide affordable coverage for people with Afib who are looking to protect their loved ones. However, it is important to remember that term life insurance policies do expire, and you will need to renew your coverage or purchase a new policy when your term ends.

Afib and Whole Life Insurance

Whole life insurance is a type of policy that provides coverage for your entire life, as long as you pay your premiums. If you have Afib, you may be able to qualify for whole life insurance at standard or substandard rates, depending on the severity of your condition.

Whole life insurance can provide lifelong financial protection for your loved ones and can also serve as an investment vehicle, as the policy accumulates cash value over time. However, whole life insurance policies tend to be more expensive than term life insurance policies, and it may not be the best option for everyone.

Afib vs. Other Heart Conditions

Afib is just one type of heart condition that can affect your ability to get life insurance. Other heart conditions may include coronary artery disease, heart attack, or heart failure, among others. Each condition is evaluated differently by life insurance companies, and the impact on your policy will depend on several factors.

If you have a history of heart conditions, it is important to speak with a licensed insurance agent who can help you understand how it may affect your life insurance options.

Final Thoughts

Atrial fibrillation is a type of heart disorder that can affect your ability to get life insurance. If you have Afib, it is important to explore your life insurance options to find a policy that best meets your needs. Speak with a licensed insurance agent who can help you understand how your condition may affect your policy and provide guidance on finding affordable coverage.

Frequently Asked Questions

1. Is Afib considered heart disease for life insurance?

Atrial fibrillation (Afib) is a heart condition that causes an irregular heartbeat. While it is not considered a form of heart disease, it can increase the risk of developing other heart-related conditions. When it comes to life insurance, insurance companies will typically classify Afib as a cardiovascular condition.

When applying for life insurance, having Afib may affect your premiums or eligibility for coverage. Insurance underwriters will typically look at factors such as the severity of your Afib, your age, and your overall health. It’s important to disclose any pre-existing conditions, including Afib, when applying for life insurance.

2. Can I get life insurance if I have Afib?

Yes, it is possible to get life insurance if you have Afib. However, as mentioned earlier, having Afib may affect your premiums or eligibility for coverage. Insurance companies will typically look at factors such as the severity of your Afib, your age, and your overall health when determining your coverage options.

If you have Afib, it’s important to disclose this information to your insurance agent when applying for coverage. This will help ensure that you receive accurate quotes and that your policy covers any pre-existing conditions you may have.

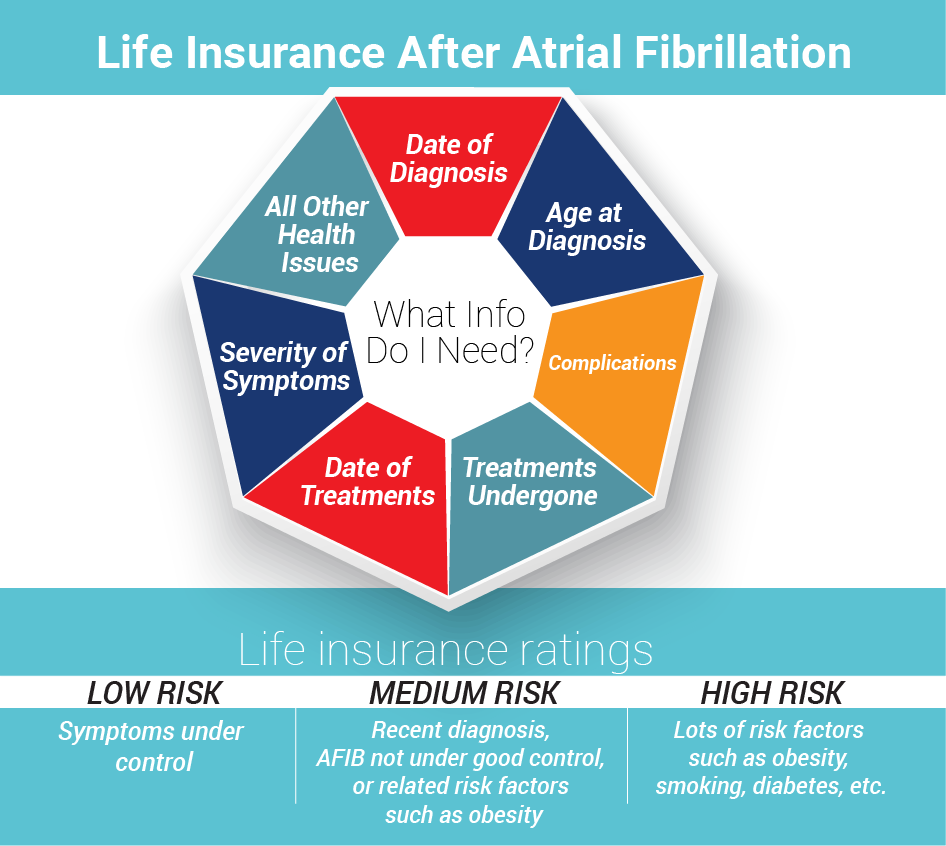

3. What do life insurance companies look for when evaluating applicants with Afib?

When evaluating applicants with Afib, life insurance companies will typically look at several factors. These may include the severity of your Afib, any underlying heart conditions you may have, your age, your overall health, and your lifestyle habits (such as smoking or drinking).

Insurance underwriters will also look at your medical history, including any medications you are taking and any procedures you have had related to your Afib. All of these factors will be used to determine your eligibility for life insurance coverage and your premiums.

If you have Afib, your premiums for life insurance may be higher than someone who does not have this condition. This is because Afib is considered a cardiovascular condition and may increase your risk of developing other heart-related conditions.

However, the exact amount of your premiums will depend on several factors, including the severity of your Afib, your age, and your overall health. It’s important to disclose any pre-existing conditions, including Afib, when applying for life insurance to ensure that you receive accurate quotes.

5. Can I improve my chances of getting affordable life insurance if I have Afib?

If you have Afib, there are several steps you can take to improve your chances of getting affordable life insurance. These may include managing your Afib symptoms through medication or lifestyle changes, improving your overall health through diet and exercise, and quitting smoking or other unhealthy habits.

You may also want to work with an insurance agent who specializes in working with individuals who have pre-existing conditions such as Afib. They can help you find coverage options that fit your needs and budget.

After delving into the topic of whether AFib is considered heart disease for life insurance, it is clear that the answer is not straightforward. AFib, or atrial fibrillation, is a condition that affects the heart’s rhythm and can lead to complications such as stroke and heart failure. While some life insurance companies may classify AFib as a form of heart disease, others may not. The classification may depend on various factors such as the severity of the condition, the age of the applicant, and the treatment plan.

Ultimately, it is essential to understand that the classification of AFib as heart disease for life insurance purposes can vary from company to company. As a professional writer, it is crucial to emphasize the significance of consulting with an experienced life insurance agent who can guide you through the process of finding the right policy for your needs. With proper research and guidance, individuals with AFib can secure life insurance coverage that provides financial protection for their loved ones in the event of an unforeseen tragedy.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts