Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we go through life, we all have different financial obligations that we need to take care of, whether it’s paying off a mortgage, supporting our families or saving for retirement. One way to make sure that these financial obligations are taken care of, even in the event of an unexpected death, is through a life insurance policy. One type of policy that has been gaining in popularity in recent years is the target life insurance policy.

A target life insurance policy is a type of life insurance policy that is designed to meet specific financial needs. Unlike traditional life insurance policies, which typically provide a lump sum payment to the beneficiary upon the policyholder’s death, target life insurance policies are designed to provide a specific amount of coverage over a set period of time. In this article, we’ll take a closer look at what a target life insurance policy is, how it works, and whether it might be the right choice for you.

**Target Life Insurance Policy: Protecting Your Future**

Life insurance is a critical component of financial planning. Among the different types of life insurance policies, a target life insurance policy is one of the most popular choices. It is a flexible and personalized policy that can cater to your unique needs and financial goals. In this article, we will explore what a target life insurance policy is, how it works, and its benefits.

**What is a Target Life Insurance Policy?**

A target life insurance policy is a type of life insurance that provides coverage for a specific period. It is also known as term life insurance. Target life insurance policies have a set term or duration during which the policyholder pays premiums. If the policyholder passes away within the term, the insurance company pays a death benefit to the beneficiaries named in the policy.

**How Does a Target Life Insurance Policy Work?**

A target life insurance policy works similarly to other term life insurance policies. The policyholder pays regular premiums for the duration of the term. If the policyholder passes away within the term, the insurance company pays a death benefit to the beneficiaries named in the policy. The death benefit is typically tax-free and can be used to cover funeral expenses, pay off debts, or provide financial support to the beneficiaries.

A target life insurance policy can have a level premium, which means the premium remains the same throughout the term. Alternatively, it can have a decreasing premium, which means the premium decreases over time as the risk of death decreases. Some target life insurance policies also allow the policyholder to convert the policy into a permanent life insurance policy at the end of the term.

**Benefits of a Target Life Insurance Policy**

1. Affordable premiums: Target life insurance policies are typically more affordable than permanent life insurance policies. This makes them an attractive option for those who want coverage but have a limited budget.

2. Flexibility: Target life insurance policies are flexible and can be tailored to your specific needs. You can choose the term, death benefit, and premium payment frequency that suits your financial goals.

3. Peace of mind: Life is unpredictable, and nobody knows what the future holds. A target life insurance policy provides peace of mind, knowing that your loved ones will be financially protected if something happens to you.

**Target Life Insurance Policy vs. Permanent Life Insurance Policy**

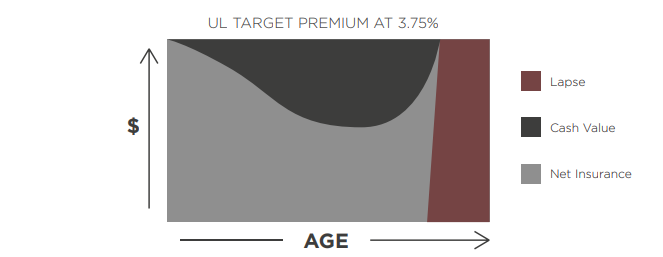

Target life insurance policies differ from permanent life insurance policies in several ways. Permanent life insurance policies provide coverage for the policyholder’s entire life, while target life insurance policies provide coverage for a specific term. Permanent life insurance policies also have a cash value component, which means the policyholder can build up savings over time. Target life insurance policies do not have a cash value component.

Permanent life insurance policies have higher premiums than target life insurance policies. However, they provide lifetime coverage and can be used as an investment tool. Target life insurance policies are more affordable and provide coverage for a specific period.

**Conclusion**

In conclusion, a target life insurance policy is an excellent option for those who want affordable and flexible coverage. It provides peace of mind, knowing that your loved ones will be financially protected if something happens to you. When choosing a life insurance policy, it is essential to consider your specific financial goals and needs. It is recommended to consult a financial advisor to determine the best life insurance policy for you.

Contents

- Frequently Asked Questions

- What is a target life insurance policy?

- What are the benefits of a target life insurance policy?

- Who should consider a target life insurance policy?

- How is the death benefit calculated for a target life insurance policy?

- What is the difference between a target life insurance policy and a traditional life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

In this section, we will answer some common questions about target life insurance policies.

What is a target life insurance policy?

A target life insurance policy is a type of life insurance that is designed to provide coverage for a specific period of time, typically 10, 15, or 20 years. The policy is structured so that the death benefit decreases over time, which means that the premiums are typically lower than those for a traditional life insurance policy. The purpose of this type of policy is to provide coverage during a specific period when the policyholder has financial obligations, such as a mortgage or children’s education, that will eventually be paid off.

Target life insurance policies are generally more affordable than traditional policies because the death benefit decreases over time. However, it is important to note that if the policyholder dies after the period of coverage has ended, there will be no death benefit paid out to the beneficiaries. Therefore, it is important to carefully consider the length of coverage when purchasing a target life insurance policy.

What are the benefits of a target life insurance policy?

One of the main benefits of a target life insurance policy is that it can be more affordable than traditional life insurance policies. The premiums are typically lower because the death benefit decreases over time. Additionally, a target life insurance policy can provide coverage during a specific period when the policyholder has financial obligations, such as a mortgage or children’s education, that will eventually be paid off.

Another benefit of a target life insurance policy is that it can be a good option for people who only need coverage for a specific period of time. For example, if a person has young children who will eventually graduate from college and become financially independent, a target life insurance policy can provide coverage during that period without the need for a more expensive traditional policy.

Who should consider a target life insurance policy?

A target life insurance policy can be a good option for people who have financial obligations that will eventually be paid off, such as a mortgage or children’s education. It can also be a good option for people who only need coverage for a specific period of time. For example, if a person has young children who will eventually graduate from college and become financially independent, a target life insurance policy can provide coverage during that period without the need for a more expensive traditional policy.

However, it is important to carefully consider the length of coverage when purchasing a target life insurance policy. If the policyholder dies after the period of coverage has ended, there will be no death benefit paid out to the beneficiaries. Therefore, it is important to ensure that the length of coverage aligns with the policyholder’s financial obligations and needs.

How is the death benefit calculated for a target life insurance policy?

The death benefit for a target life insurance policy is typically calculated based on the policyholder’s age, health, and expected lifespan. The policy is structured so that the death benefit decreases over time, which means that the premiums are typically lower than those for a traditional life insurance policy. The purpose of this type of policy is to provide coverage during a specific period when the policyholder has financial obligations, such as a mortgage or children’s education, that will eventually be paid off.

It is important to note that if the policyholder dies after the period of coverage has ended, there will be no death benefit paid out to the beneficiaries. Therefore, it is important to carefully consider the length of coverage when purchasing a target life insurance policy.

What is the difference between a target life insurance policy and a traditional life insurance policy?

The main difference between a target life insurance policy and a traditional life insurance policy is that the death benefit for a target policy decreases over time, while the death benefit for a traditional policy remains the same. This means that the premiums for a target policy are typically lower than those for a traditional policy.

Additionally, a target life insurance policy is designed to provide coverage for a specific period of time, typically 10, 15, or 20 years. The purpose of this type of policy is to provide coverage during a specific period when the policyholder has financial obligations, such as a mortgage or children’s education, that will eventually be paid off. Traditional life insurance policies, on the other hand, are designed to provide coverage for the policyholder’s entire life.

In today’s world, having a life insurance policy is an essential aspect of financial planning. It provides peace of mind to individuals and their loved ones, knowing that they are financially secure in case of any unforeseen events. One type of life insurance policy that has gained popularity in recent years is the target life insurance policy.

A target life insurance policy is a type of life insurance that provides coverage for a specific period. It is a flexible policy that allows individuals to choose the coverage amount and the length of the policy term. The policyholder pays a premium throughout the policy term, and in case of their demise, the death benefit is paid to the beneficiaries. It is an excellent option for individuals who have short-term financial goals or need coverage for a specific period. In conclusion, a target life insurance policy is an excellent option for individuals who have short-term financial goals or need coverage for a specific period. It is a flexible policy that can be customized to meet the individual’s needs, providing financial security to their loved ones in case of any unforeseen events. As a professional writer, I highly recommend considering a target life insurance policy as a part of your financial planning.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts