Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is one of the most important investments you can make for yourself and your family. It provides financial security and peace of mind in case of any unforeseen circumstances. However, one of the lesser-known aspects of life insurance is the concept of compound interest. Compound interest is a crucial factor in the world of finance and insurance, and it can have a significant impact on your policy’s value over time.

In simple terms, compound interest is the interest earned on the principal amount as well as the accumulated interest. In other words, it is interest on interest, and it can grow your policy’s value exponentially over time. If you’re considering life insurance or already have a policy, understanding compound interest can help you make informed decisions about your financial future. In this article, we’ll explore what compound interest is and how it works in the context of life insurance.

Contents

- Understanding Compound Interest in Life Insurance

- Frequently Asked Questions

- What is Compound Interest in Life Insurance?

- How is Compound Interest Calculated in Life Insurance?

- What are the Benefits of Compound Interest in Life Insurance?

- How does Compound Interest Affect Life Insurance Premiums?

- What are the Risks of Compound Interest in Life Insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Understanding Compound Interest in Life Insurance

Life insurance is an essential investment for anyone who wants to secure their family’s financial future. Compound interest is a critical element that you need to consider when choosing a life insurance policy. In this article, we will discuss what compound interest is and how it works in life insurance policies.

What is Compound Interest?

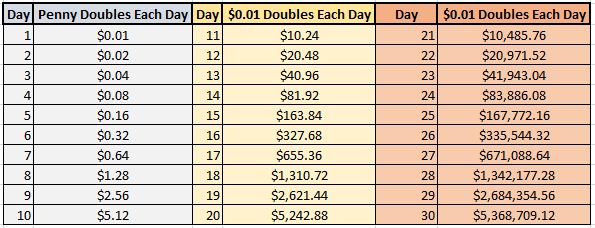

Compound interest is the interest earned not only on the principal amount but also on the accumulated interest. In other words, it is interest on interest. The interest earned in a compound interest scheme is added to the principal amount, and the next interest is calculated on the new total. This process continues, and the interest earned keeps increasing with time.

Compound interest is a powerful tool that helps your money grow at an accelerated pace. It is commonly used in savings accounts, fixed deposits, and other investment schemes. However, it is also an essential factor in determining the benefits of a life insurance policy.

How Does Compound Interest Work in Life Insurance?

Life insurance policies that offer compound interest provide a higher rate of return than those that offer simple interest. The interest earned on the policy is added to the death benefit, which increases the total benefit amount. This means that the longer the policyholder holds the policy, the higher the death benefit amount will be.

For example, let’s say you purchase a life insurance policy with a death benefit of $100,000 and a 5% compound interest rate. After one year, the policy’s value would be $105,000. After five years, the policy’s value would be $127,628. This is because the interest earned in the first year is added to the principal amount, and the interest for the next year is calculated on the new total.

Benefits of Compound Interest in Life Insurance

One of the significant benefits of compound interest in life insurance is that it allows your money to grow at a faster rate. This means that you can accumulate more savings over time, which can be crucial for your family’s financial security. Additionally, life insurance policies that offer compound interest tend to have a higher rate of return than those that offer simple interest.

Another benefit of compound interest in life insurance is that it provides a higher death benefit amount over time. This means that your loved ones will receive a more substantial payout in case of your untimely death, providing them with financial security and peace of mind.

Compound Interest Vs. Simple Interest

When choosing a life insurance policy, it is essential to understand the difference between compound interest and simple interest. Simple interest is calculated only on the principal amount and does not take into account the accumulated interest. This means that the rate of return on a policy that offers simple interest is lower than one that offers compound interest.

For example, let’s say you purchase a life insurance policy with a death benefit of $100,000 and a 5% simple interest rate. After one year, the policy’s value would be $105,000. After five years, the policy’s value would be $125,000. This is because the interest earned is calculated only on the principal amount, and not on the accumulated interest.

Conclusion

Compound interest is a critical factor to consider when choosing a life insurance policy. It allows your money to grow at an accelerated pace, providing you with more savings over time, and a higher death benefit amount. When comparing life insurance policies, make sure to look for one that offers compound interest to maximize your returns and ensure your family’s financial security.

Frequently Asked Questions

In this section, you will find answers to some of the commonly asked questions about Compound Interest in Life Insurance.

What is Compound Interest in Life Insurance?

Compound interest in life insurance refers to the interest that is calculated not only on the principal amount but also on the interest that has been earned in previous periods. In other words, it is the interest that is earned on the interest. Compound interest can be a powerful tool in building wealth as it helps the money to grow at an accelerated rate over time.

In life insurance, compound interest is used to calculate the policy’s cash value, which grows over time based on the premiums paid and the interest earned. The longer the policyholder holds the policy, the higher the cash value will be, making it a valuable asset that can be used for various purposes such as retirement income or education expenses.

How is Compound Interest Calculated in Life Insurance?

The compound interest in life insurance is calculated based on the policy’s cash value, which is the sum of all premiums paid and the interest earned. The interest rate used to calculate compound interest varies from policy to policy and is usually set by the insurance company. The interest is calculated on a daily or monthly basis, and the accumulated interest is added to the policy’s cash value, which earns more interest in the following periods.

For example, suppose a policyholder pays a premium of $1,000 annually in a policy with a 5% interest rate. In the first year, the policy’s cash value will be $1,050, including the interest earned. In the second year, the interest will be calculated on $1,050, resulting in a cash value of $1,102.5, including the interest earned in the second year.

What are the Benefits of Compound Interest in Life Insurance?

The benefits of compound interest in life insurance are numerous. Firstly, it helps the policyholder to accumulate wealth over time, which can be used for various purposes such as retirement income or education expenses. Secondly, it provides a guaranteed rate of return on the premiums paid, which offers a stable and secure investment option. Thirdly, it offers the potential for higher returns than other investment options such as savings accounts or bonds.

Moreover, the compound interest in life insurance is tax-deferred, which means that the policyholder will not have to pay taxes on the interest earned until the policy is surrendered or the death benefit is paid out. This can be a significant advantage for high-income earners who want to minimize their tax liabilities.

How does Compound Interest Affect Life Insurance Premiums?

The compound interest in life insurance does not affect the premiums paid by the policyholder. The premiums are determined based on various factors such as the policyholder’s age, health, and the coverage amount. The interest earned on the premiums paid is used to calculate the policy’s cash value, which grows over time. Therefore, the policyholder can benefit from the compound interest without having to pay higher premiums.

However, it is essential to note that the policyholder must pay the premiums regularly and on time to ensure that the policy remains in force and the cash value continues to grow. Failure to pay the premiums can result in the policy lapsing, which can lead to the loss of the accumulated cash value and the death benefit.

What are the Risks of Compound Interest in Life Insurance?

The risks of compound interest in life insurance are relatively low compared to other investment options. The interest rate is usually guaranteed by the insurance company, which means that the policyholder will earn a stable and predictable rate of return. Moreover, the cash value is protected from market fluctuations, which can cause significant losses in other investment options such as stocks or mutual funds.

However, it is essential to note that the policyholder may face penalties if the policy is surrendered or withdrawn before the maturity date. Moreover, the policyholder must pay the premiums regularly and on time to ensure that the policy remains in force and the cash value continues to grow. Failure to pay the premiums can result in the policy lapsing, which can lead to the loss of the accumulated cash value and the death benefit.

In life insurance, compound interest is an essential concept that can have a significant impact on the policyholder’s financial well-being. It refers to the interest earned on both the original principal amount and the accumulated interest, which is added to the policy’s value over time. This compounding effect can result in substantial growth of the policy’s cash value, providing a powerful financial tool to the policyholder.

Understanding the concept of compound interest and how it applies to life insurance policies is crucial for anyone looking to maximize their financial potential. By taking advantage of the compounding effect, policyholders can build a larger cash value, which can be used to pay premiums or provide a source of income in retirement. Therefore, it is essential to work with a knowledgeable insurance professional who can help you navigate the world of life insurance and make informed decisions that can benefit you and your loved ones in the long run.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts