Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a driver, it is vital to understand the various types of auto insurance policies available to you. Two of the most popular options are comprehensive auto insurance and collision insurance. Although both policies provide coverage for damages to your vehicle, they differ in the types of incidents they cover.

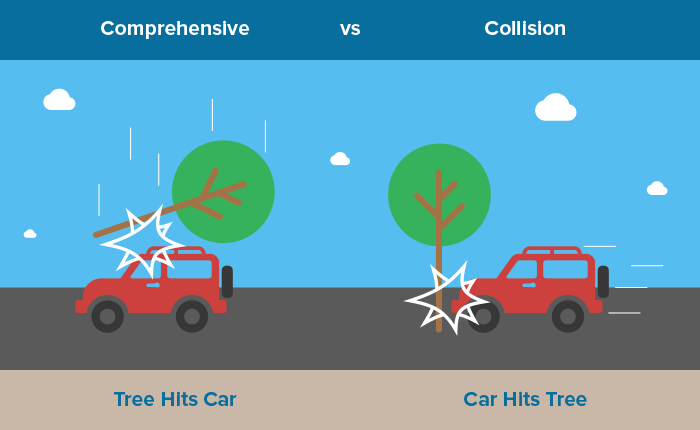

Comprehensive auto insurance offers protection for damages resulting from incidents such as theft, natural disasters, vandalism, and animal collisions. On the other hand, collision insurance specifically covers damages to your vehicle caused by a collision with another car or object. It is crucial to understand the differences between these policies and determine which one best suits your needs to ensure you have adequate coverage and peace of mind while on the road.

Comprehensive auto insurance and collision coverage are two common types of car insurance. Comprehensive coverage protects against non-collision incidents such as theft, vandalism, or natural disasters. Collision coverage, on the other hand, pays for damages caused by collisions with other cars or objects. While both provide protection for your vehicle, comprehensive insurance covers a broader range of incidents, making it a more expensive option. Collision coverage is typically required if you are financing or leasing your vehicle, while comprehensive coverage is optional.

Contents

- Comprehensive Auto Insurance Vs Collision: What You Need To Know

- Frequently Asked Questions

- What is Comprehensive Auto Insurance?

- What is Collision Insurance?

- What is the Difference Between Comprehensive and Collision Insurance?

- Do I Need Comprehensive or Collision Insurance?

- How Much Does Comprehensive or Collision Insurance Cost?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Comprehensive Auto Insurance Vs Collision: What You Need To Know

Comprehensive Auto Insurance

Comprehensive auto insurance is a type of coverage that protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or natural disasters. This coverage can also include coverage for damages caused by hitting an animal, such as a deer or a moose. Comprehensive coverage is optional, but many lenders require it if you are financing or leasing a vehicle.

One of the benefits of comprehensive coverage is that it can provide peace of mind knowing that your vehicle is protected in a wide variety of situations. However, it is important to note that comprehensive coverage typically comes with a higher premium than collision coverage.

If you are considering comprehensive coverage, it is important to understand what is covered and what is not. In general, comprehensive coverage does not cover the cost of regular maintenance or wear and tear on your vehicle. It also does not cover damages caused by collisions with other vehicles.

Collision Coverage

Collision coverage, on the other hand, is a type of insurance that covers damages to your vehicle caused by collisions with other vehicles or objects. This coverage is also optional, but lenders may require it if you are financing or leasing a vehicle.

Collision coverage can help pay for repairs or replacement of your vehicle if it is damaged in an accident. This coverage can also cover damages caused by hitting a pothole or a tree. However, collision coverage does not cover damages caused by events other than collisions, such as theft or vandalism.

One of the benefits of collision coverage is that it can provide financial protection in the event of an accident. However, it is important to understand that collision coverage typically comes with a higher premium than comprehensive coverage.

Comprehensive Vs Collision Coverage

When deciding between comprehensive and collision coverage, it is important to consider your individual needs and circumstances. If you live in an area prone to natural disasters or theft, comprehensive coverage may be a better option for you. If you are more concerned about accidents on the road, collision coverage may be a better fit.

It is also important to consider the cost of each type of coverage. Comprehensive coverage is typically more expensive than collision coverage, but it can provide more comprehensive protection. Collision coverage may be a more affordable option, but it only covers damages caused by collisions.

Benefits of Comprehensive Coverage

One of the main benefits of comprehensive coverage is that it provides protection against a wide range of events that can cause damage to your vehicle. This can include theft, vandalism, natural disasters, and more. Comprehensive coverage can also cover damages caused by hitting an animal, such as a deer or a moose.

Another benefit of comprehensive coverage is that it can provide peace of mind knowing that your vehicle is protected in a variety of situations. This can be especially important if you live in an area prone to natural disasters or theft.

Benefits of Collision Coverage

The main benefit of collision coverage is that it provides financial protection in the event of an accident. If your vehicle is damaged in a collision with another vehicle or object, collision coverage can help pay for repairs or replacement. This can be especially important if you do not have the financial means to cover these costs on your own.

Another benefit of collision coverage is that it can provide peace of mind knowing that you are protected in the event of an accident. If you are involved in an accident, collision coverage can help reduce your out-of-pocket expenses and provide financial protection.

When Should You Consider Comprehensive Coverage?

Comprehensive coverage is a good option for those who are looking for more comprehensive protection for their vehicle. If you live in an area prone to natural disasters or theft, comprehensive coverage can provide valuable protection. It can also be a good option if you have a newer or more expensive vehicle that you want to protect.

It is important to note that comprehensive coverage typically comes with a higher premium than collision coverage. However, if you are concerned about protecting your vehicle in a variety of situations, comprehensive coverage may be worth the additional cost.

When Should You Consider Collision Coverage?

Collision coverage is a good option for those who are concerned about protecting their vehicle in the event of an accident. If you do not have the financial means to cover the cost of repairs or replacement on your own, collision coverage can provide valuable financial protection.

It is important to note that collision coverage only covers damages caused by collisions with other vehicles or objects. If you are concerned about protecting your vehicle from other types of damage, such as theft or natural disasters, comprehensive coverage may be a better option.

The Bottom Line

Deciding between comprehensive and collision coverage can be a difficult decision. It is important to consider your individual needs and circumstances, as well as the cost of each type of coverage. Comprehensive coverage can provide more comprehensive protection, while collision coverage can provide financial protection in the event of an accident. Ultimately, the best option for you will depend on your individual needs and circumstances.

Frequently Asked Questions

What is Comprehensive Auto Insurance?

Comprehensive auto insurance is a type of insurance policy that covers damage to your car that is not the result of a collision. This can include damage from theft, vandalism, weather-related incidents, and other non-collision events.

Comprehensive auto insurance is typically optional, but it can provide valuable protection for your vehicle in the event of unexpected damage. It is important to carefully consider your coverage options and choose the policy that best meets your needs.

What is Collision Insurance?

Collision insurance is a type of insurance policy that covers damage to your car that is the result of a collision with another vehicle or object. This can include damage from accidents, collisions with stationary objects, and other similar incidents.

Collision insurance is typically required by lenders if you are financing or leasing a car, but it is also optional in other situations. It is important to carefully consider your coverage options and choose the policy that best meets your needs.

What is the Difference Between Comprehensive and Collision Insurance?

The main difference between comprehensive and collision insurance is the type of damage that is covered. Comprehensive insurance covers damage from non-collision events, while collision insurance covers damage from collisions with other vehicles or objects.

In some cases, comprehensive and collision insurance may be purchased together as part of a comprehensive auto insurance policy. It is important to carefully consider your coverage options and choose the policy that best meets your needs.

Do I Need Comprehensive or Collision Insurance?

Whether you need comprehensive or collision insurance depends on your individual situation and the level of protection you want for your vehicle. If you are financing or leasing a car, collision insurance may be required by your lender.

If you own your car outright, you may be able to choose whether to purchase comprehensive or collision insurance, or both. It is important to carefully consider your coverage options and choose the policy that best meets your needs.

How Much Does Comprehensive or Collision Insurance Cost?

The cost of comprehensive or collision insurance can vary depending on a number of factors, including your driving record, the type of car you have, and the amount of coverage you need. It is important to shop around and compare rates from different insurance providers to find the best policy for your budget.

In the world of auto insurance, it’s essential to understand the differences between comprehensive and collision coverage. Comprehensive insurance provides coverage for non-collision incidents, such as theft, vandalism, and natural disasters, while collision insurance covers damages caused by a collision with another vehicle or object. One way to think of it is that comprehensive insurance covers everything that collision insurance doesn’t.

When deciding on which type of insurance to choose, it’s important to consider your individual needs and budget. If you live in an area prone to natural disasters or where car theft is common, comprehensive coverage may be a wise investment. On the other hand, if you have an older car that isn’t worth much, collision coverage may not be necessary. Ultimately, it’s up to you to weigh the pros and cons of each type of coverage and make an informed decision. As a professional writer, I encourage you to do your research and consult with an insurance agent to determine which option is best for you.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts