Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is a crucial aspect of financial planning, and it is essential to understand the various types of policies available before making any investment decisions. Two of the most common types of life insurance policies are whole life and universal life insurance. While both types of policies offer lifelong coverage, there are significant differences between them that can have a significant impact on your finances.

Whole life insurance is a traditional type of policy that provides coverage for your entire life, with fixed premiums and a guaranteed cash value. Universal life insurance, on the other hand, is a more flexible policy that allows you to adjust your premiums and death benefit to suit your changing needs. If you are considering purchasing life insurance, it is essential to understand the differences between these two policies to make an informed decision that best meets your financial goals and objectives. In this article, we will explore the differences between whole life and universal life insurance in depth and discuss the pros and cons of each type of policy.

Contents

- Whole Life vs. Universal Life Insurance: Understanding the Key Differences

- Frequently Asked Questions

- What is whole life insurance?

- What is universal life insurance?

- What are the differences between whole life and universal life insurance?

- Which type of policy is right for me?

- Can I switch from whole life to universal life insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Whole Life vs. Universal Life Insurance: Understanding the Key Differences

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured. It is sometimes referred to as straight life, ordinary life or traditional life insurance. The premiums for whole life insurance are generally higher than those of term insurance because the policy provides lifelong coverage and includes a savings component known as cash value.

The cash value component of whole life insurance policy accumulates over time and grows tax-deferred. It can be borrowed against, used to pay premiums or surrendered for cash. However, borrowing against the cash value will reduce the death benefit, and any unpaid loans will be deducted from the death benefit.

Universal Life Insurance

Universal life insurance is also a type of permanent life insurance, but it offers greater flexibility than whole life insurance. It provides death benefit protection and a cash value component. However, the policyholder can adjust the premiums and death benefit as their needs change over time.

Unlike whole life insurance, universal life insurance policies usually offer a lower premium than whole life policies. This is because the policyholder has the option to pay more or less than the premium depending on their financial situation. The cash value component of universal life insurance grows based on the interest rate of the policy, which can be adjusted periodically.

Benefits of Whole Life Insurance

Whole life insurance offers several benefits, including:

- Lifetime coverage

- Cash value accumulation

- Fixed premiums

- Guaranteed minimum interest rate on cash value

Whole life insurance can be a good option for those who want to ensure their beneficiaries receive a death benefit regardless of when they pass away. It can also serve as an investment vehicle because of the cash value component.

Benefits of Universal Life Insurance

Universal life insurance also offers several benefits, including:

- Flexible premiums and death benefit

- Cash value accumulation

- Ability to adjust policy over time

Universal life insurance may be a good option for those who want the flexibility to adjust their premiums and death benefit as their financial situation changes. The cash value component can also provide additional savings and investment opportunities.

Whole Life vs. Universal Life Insurance: Which is Better?

Both whole life and universal life insurance have their pros and cons, and the right choice depends on individual circumstances. Whole life insurance may be a better option for those who want guaranteed coverage and a fixed premium. Universal life insurance may be a better option for those who want flexibility and the ability to adjust their policy over time.

It is important to note that both types of policies can be complex, and it is essential to carefully consider all options and consult with a financial advisor before making a decision.

Frequently Asked Questions

When it comes to life insurance, there are different types of policies available. Among these policies, whole life insurance and universal life insurance are two popular options. Here are some frequently asked questions about the difference between whole life and universal life insurance.

What is whole life insurance?

Whole life insurance is a type of life insurance that provides coverage for the entire life of the insured. It is a permanent life insurance policy that offers a fixed premium and a guaranteed death benefit. Whole life insurance policies also have a cash value component that grows over time. The cash value can be borrowed against or used to pay premiums or other expenses.

Whole life insurance policies are usually more expensive than term life insurance policies, but they provide lifelong protection and offer a savings component. This type of policy is ideal for people who want to ensure that their loved ones will be financially secure after they pass away, and who also want to build up a cash value over time.

What is universal life insurance?

Universal life insurance is a type of permanent life insurance that offers more flexibility and options than whole life insurance. Like whole life insurance, universal life insurance also has a cash value component that grows over time. However, the policyholder can adjust the premiums and death benefit to meet their changing needs.

Universal life insurance policies offer more flexibility in terms of premium payments and death benefit options. The policyholder can increase or decrease the premium payments, and can also adjust the death benefit as needed. This type of policy is ideal for people who want the protection of a permanent life insurance policy, but also want the flexibility to adjust their coverage over time.

What are the differences between whole life and universal life insurance?

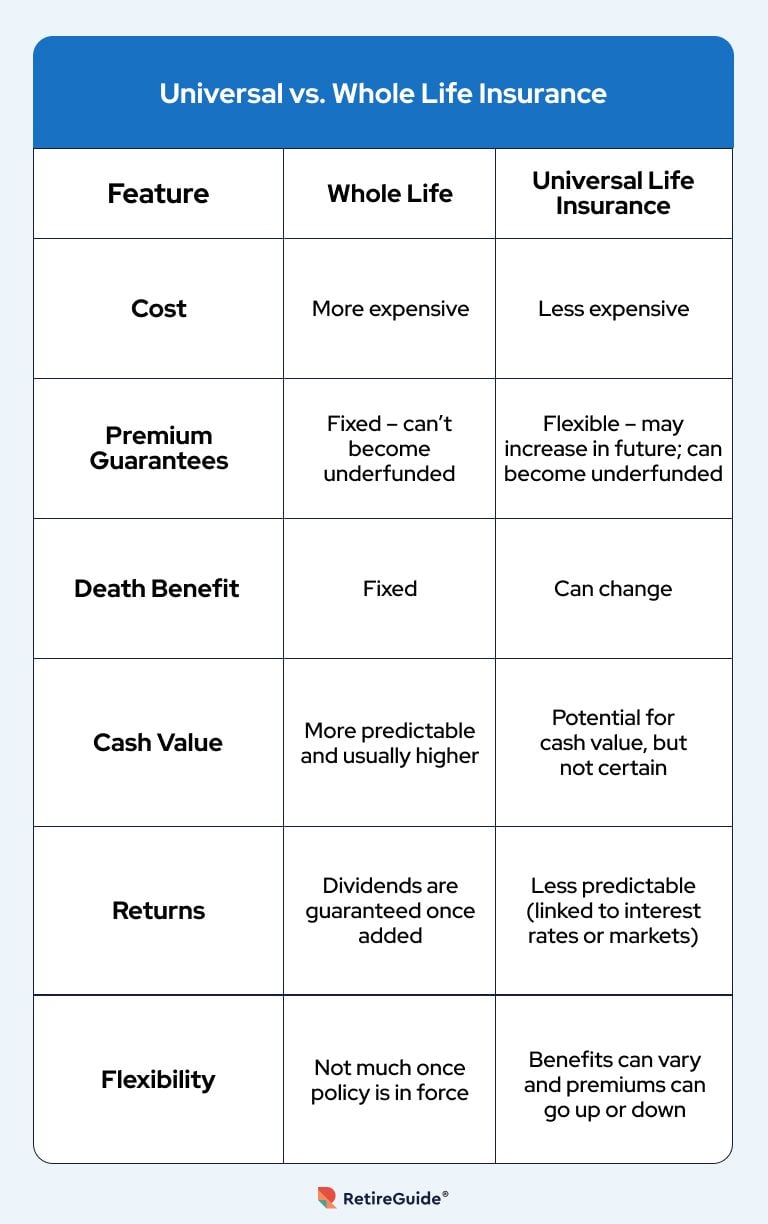

One of the main differences between whole life and universal life insurance is the flexibility that universal life insurance offers. With universal life insurance, the policyholder can adjust the premiums and death benefit to meet their changing needs. Whole life insurance, on the other hand, offers a fixed premium and death benefit.

Another difference is the cost. Whole life insurance policies are usually more expensive than universal life insurance policies. This is because whole life insurance offers a savings component that grows over time, while universal life insurance policies may not have as much cash value.

Which type of policy is right for me?

The type of policy that is right for you depends on your individual needs and goals. If you want lifelong protection and the option to build up a cash value over time, whole life insurance may be the right choice. If you want more flexibility and the ability to adjust your coverage over time, universal life insurance may be the better option.

It’s important to work with an experienced insurance agent who can help you understand the differences between these policies and determine which type of policy is best for you.

Can I switch from whole life to universal life insurance?

Yes, it is possible to switch from a whole life insurance policy to a universal life insurance policy. However, it’s important to understand the potential costs and benefits of doing so. Switching policies may result in higher premiums or lower death benefits, depending on the specifics of your policy.

Before making any changes to your life insurance policy, it’s important to consult with your insurance agent and carefully consider your options.

As a professional writer, it’s important to understand the key differences between whole life and universal life insurance. Both policies offer lifetime coverage, but the way they accumulate cash value and pay out benefits is unique to each type of policy. Whole life insurance offers a fixed premium and guaranteed cash value, while universal life insurance allows for more flexibility in premium payments and potential for higher cash value growth.

Ultimately, the decision between whole life and universal life insurance depends on individual circumstances and financial goals. It’s important to carefully consider factors such as premium payments, cash value growth, and flexibility in policy management before making a decision. Consulting with a financial advisor or insurance professional can also help in determining the best type of policy for your needs. By understanding the key differences between these two types of life insurance, individuals can make an informed decision and secure their financial future.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts