Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As you navigate the complex world of insurance, you may have come across the term “indexed whole life insurance.” This unique type of life insurance offers a combination of lifelong coverage and investment opportunities, making it an attractive option for those looking to secure their financial future.

Indexed whole life insurance policies are different from traditional life insurance policies in that they are tied to the performance of a stock market index, such as the S&P 500. This means that as the index performs well, so does your policy’s cash value. With the potential for high returns, indexed whole life insurance can be an appealing choice for those who want to grow their wealth while also protecting their loved ones with a life insurance policy. But, as with any financial decision, it’s important to understand the pros and cons before making a commitment.

Understanding Indexed Whole Life Insurance

Indexed whole life insurance is a form of permanent life insurance that offers a death benefit as well as savings or investment features. Unlike term life insurance, which only provides coverage for a specific period of time, indexed whole life insurance provides coverage for the entirety of your life. This type of insurance policy can offer policyholders the opportunity to accumulate cash value, which can be used for a variety of purposes, including funding retirement or paying for unexpected expenses.

What is Indexed Whole Life Insurance?

Indexed whole life insurance is a type of insurance policy that combines a death benefit with a savings or investment component. The savings component of the policy is tied to a stock market index, such as the S&P 500. This means that the policyholder’s savings grow based on the performance of the stock market index.

Indexed whole life insurance policies typically have a minimum guaranteed interest rate, which means that even if the stock market index performs poorly, policyholders will still earn a minimum return on their savings. Additionally, many policies have a cap on the amount of interest that can be earned, which means that if the stock market index performs exceptionally well, the policyholder’s returns may be limited.

Indexed whole life insurance policies typically have higher premiums than term life insurance policies because they offer both a death benefit and a savings component. However, the cash value that accumulates in the savings component of the policy can be used to pay premiums in the future or withdrawn as a tax-free loan.

How Does Indexed Whole Life Insurance Work?

Indexed whole life insurance policies typically work by allocating a portion of the policyholder’s premium payments to a savings or investment account. This account is tied to a stock market index, which means that the policyholder’s savings will grow based on the performance of the index.

The policyholder can typically choose the percentage of their premium payment that is allocated to the savings or investment account. This means that policyholders can adjust their savings component to meet their individual needs and goals.

Indexed whole life insurance policies typically have a set minimum interest rate, which means that policyholders will earn a minimum return on their savings, regardless of how the stock market index performs. Additionally, many policies have a cap on the amount of interest that can be earned, which means that policyholders may be limited in the amount of interest that they can earn if the stock market index performs exceptionally well.

Benefits of Indexed Whole Life Insurance

Indexed whole life insurance policies offer a number of benefits to policyholders. These benefits include:

– Guaranteed death benefit: Indexed whole life insurance policies offer a guaranteed death benefit, which means that policyholders can rest assured that their loved ones will be provided for in the event of their death.

– Cash value accumulation: The savings component of indexed whole life insurance policies allows policyholders to accumulate cash value over time. This cash value can be used for a variety of purposes, including funding retirement or paying for unexpected expenses.

– Tax-free withdrawals: Policyholders can typically withdraw funds from the savings component of their policy as a tax-free loan. This means that they can access their cash value without having to pay taxes or penalties.

– Premium flexibility: Policyholders can typically adjust the percentage of their premium payment that is allocated to the savings component of their policy. This means that they can adjust their policy to meet their individual needs and goals.

Indexed Whole Life Insurance vs. Other Types of Insurance

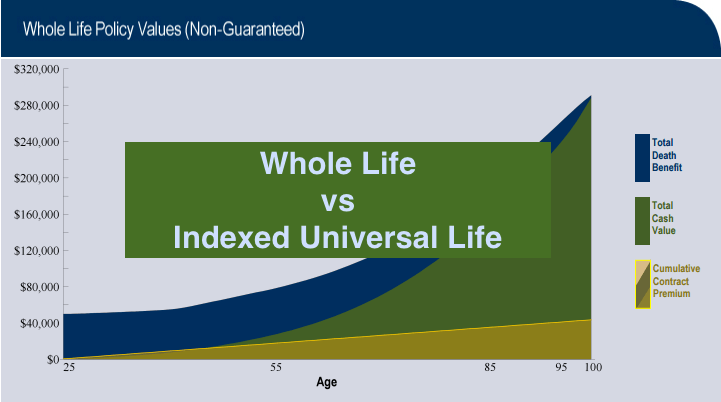

Indexed whole life insurance is just one type of life insurance policy. Other types of life insurance include term life insurance and universal life insurance. Here are some of the key differences between indexed whole life insurance and these other types of insurance:

– Indexed whole life insurance vs. term life insurance: Term life insurance only provides coverage for a specific period of time, whereas indexed whole life insurance provides coverage for the entirety of your life. Additionally, term life insurance does not offer a savings component.

– Indexed whole life insurance vs. universal life insurance: Universal life insurance also offers a savings component, but the interest rate on the savings component is typically not tied to a stock market index. Additionally, universal life insurance policies typically have more flexibility when it comes to premium payments and death benefit amounts.

Conclusion

Indexed whole life insurance is a type of permanent life insurance policy that offers a death benefit as well as a savings or investment component. The savings component of the policy is tied to a stock market index, which means that policyholders’ savings grow based on the performance of the index. This type of policy offers a number of benefits, including a guaranteed death benefit, cash value accumulation, tax-free withdrawals, and premium flexibility. While indexed whole life insurance is not the right choice for everyone, it may be a good option for those who are looking for a way to provide for their loved ones while also building up savings over time.

Contents

- Frequently Asked Questions

- What is indexed whole life insurance?

- How does indexed whole life insurance work?

- What are the benefits of indexed whole life insurance?

- Who should consider indexed whole life insurance?

- How do I choose an indexed whole life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Indexed whole life insurance is a type of permanent life insurance that offers both a death benefit and a savings component. It is a popular option for those who want to protect their loved ones financially while also building cash value over time. Here are some common questions and answers about indexed whole life insurance.

What is indexed whole life insurance?

Indexed whole life insurance is a type of permanent life insurance that combines a death benefit with a savings component. The savings component earns interest based on the performance of a stock market index, such as the S&P 500. This means that the cash value of the policy can grow over time if the index performs well, but it is also protected from market downturns. Indexed whole life insurance policies typically have level premiums and a guaranteed death benefit.

Indexed whole life insurance can be a good option for those who want to build cash value over time while also protecting their loved ones financially. However, it is important to understand the risks and potential rewards of investing in the stock market before choosing an indexed whole life insurance policy.

How does indexed whole life insurance work?

Indexed whole life insurance works by combining a death benefit with a savings component that earns interest based on the performance of a stock market index. The policyholder pays a level premium throughout the life of the policy, and a portion of that premium goes towards the death benefit while the rest goes towards the savings component. The savings component earns interest based on the performance of a stock market index, such as the S&P 500. If the index performs well, the cash value of the policy can grow over time. However, if the index performs poorly, the policyholder is protected from market downturns.

The cash value of an indexed whole life insurance policy can be used for a variety of purposes, such as paying for college tuition or supplementing retirement income. However, it is important to remember that withdrawing cash from the policy can reduce the death benefit and may also result in tax consequences.

What are the benefits of indexed whole life insurance?

Indexed whole life insurance offers several benefits, including a death benefit that is guaranteed as long as premiums are paid, a savings component that earns interest based on the performance of a stock market index, and level premiums that do not increase over time. The cash value of the policy can be used for a variety of purposes, such as paying for college tuition or supplementing retirement income. Additionally, the policyholder is protected from market downturns, as the savings component is shielded from losses. Indexed whole life insurance can be a good option for those who want to build cash value over time while also protecting their loved ones financially.

However, it is important to understand that indexed whole life insurance policies can be more expensive than other types of life insurance, and the returns on the savings component are not guaranteed. Additionally, withdrawing cash from the policy can reduce the death benefit and may also result in tax consequences.

Who should consider indexed whole life insurance?

Indexed whole life insurance can be a good option for those who want to build cash value over time while also protecting their loved ones financially. It may be a particularly good choice for those who are comfortable with risk and want to invest in the stock market without taking on significant risk. Additionally, indexed whole life insurance can be a good option for those who want a policy with level premiums that do not increase over time.

However, indexed whole life insurance policies may not be the best choice for everyone. They can be more expensive than other types of life insurance, and the returns on the savings component are not guaranteed. Additionally, those who are not comfortable with market risk may want to consider other options.

How do I choose an indexed whole life insurance policy?

Choosing an indexed whole life insurance policy requires careful consideration of a variety of factors, such as the cost of the policy, the performance of the stock market index used to calculate the savings component, and the financial stability of the insurance company. It is important to work with a reputable insurance agent who can help you understand the options and choose a policy that meets your specific needs and financial goals.

Additionally, it is important to understand the risks and potential rewards of investing in the stock market before choosing an indexed whole life insurance policy. Those who are comfortable with market risk and want to invest in the stock market without taking on significant risk may find that an indexed whole life insurance policy is a good option for them.

Indexed whole life insurance is a unique type of life insurance policy that offers a combination of lifelong coverage and investment opportunities. Unlike traditional life insurance policies, indexed whole life insurance allows policyholders to earn a return on their premiums based on the performance of a stock market index, such as the S&P 500. This means that policyholders have the potential to earn higher returns on their investments, while also benefiting from the security of a guaranteed death benefit.

In conclusion, indexed whole life insurance can be a smart investment for those who are looking for a long-term insurance policy that also provides investment opportunities. While it may not be the right choice for everyone, it can be a great option for those who want to ensure that their loved ones are financially secure after their passing. With its unique blend of lifelong coverage and investment potential, indexed whole life insurance should be considered by anyone who wants to build a secure financial future for themselves and their family.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts