Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Medicare Railroad Insurance is a unique healthcare coverage option available to certain railroad workers and their families. It is a part of the larger Medicare program, which provides healthcare coverage to millions of Americans. However, Medicare Railroad Insurance has some distinct features that set it apart from other types of Medicare coverage.

One of the most important things to understand about Medicare Railroad Insurance is that it is only available to those who have worked in the railroad industry. This includes current and retired railroad workers, as well as their spouses and dependents. The program was established in the 1970s to provide healthcare coverage to these individuals, who often faced challenges accessing traditional health insurance options. Today, Medicare Railroad Insurance continues to serve as a valuable resource for those in the railroad industry who need affordable and comprehensive healthcare coverage.

Medicare Railroad Insurance is a type of Medicare coverage that’s available to railroad workers, their families, and retirees. This program provides health insurance benefits to those who have worked in the railroad industry and contributed to the Railroad Retirement system. Medicare Railroad Insurance covers hospitalization, medical services, and prescription drugs, and is administered by the Centers for Medicare and Medicaid Services.

Contents

- What is Medicare Railroad Insurance?

- Frequently Asked Questions

- What is Medicare Railroad Insurance?

- Who is eligible for Medicare Railroad Insurance?

- What services are covered by Medicare Railroad Insurance?

- How do I enroll in Medicare Railroad Insurance?

- What are the costs associated with Medicare Railroad Insurance?

- Medicare Facts You Need to Know for Railroad Retirement

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

What is Medicare Railroad Insurance?

Medicare Railroad Insurance is a type of health insurance program that is specifically designed for railroad workers and their families. This program is a part of the Medicare system and is administered by the Centers for Medicare and Medicaid Services (CMS). Medicare Railroad Insurance provides coverage for hospital and medical expenses, as well as prescription drug coverage and other benefits.

Eligibility for Medicare Railroad Insurance

In order to be eligible for Medicare Railroad Insurance, you must be a current or retired railroad worker or the spouse of a railroad worker. You must also have worked for the railroad industry for at least ten years or have been awarded a Railroad Retirement Board (RRB) disability annuity. If you meet these eligibility requirements, you will automatically be enrolled in Medicare Railroad Insurance when you become eligible for Medicare.

Coverage and Benefits

Medicare Railroad Insurance provides coverage for hospital and medical expenses, including doctor visits, hospital stays, and medical procedures. It also covers prescription drugs and other medical services, such as lab tests and X-rays. Medicare Railroad Insurance also offers a variety of benefits, including preventive services, wellness programs, and disease management programs.

Costs and Premiums

The cost of Medicare Railroad Insurance varies depending on your income and the coverage options you choose. However, most railroad workers and their families do not have to pay a premium for Medicare Railroad Insurance, as it is paid for by their employer. If you do have to pay a premium, it will be based on your income level and the coverage options you choose.

Advantages of Medicare Railroad Insurance

One of the main advantages of Medicare Railroad Insurance is that it offers comprehensive coverage for hospital and medical expenses, as well as prescription drugs. Additionally, railroad workers and their families do not have to pay a premium for this insurance, as it is paid for by their employer. Medicare Railroad Insurance also offers a variety of benefits, such as preventive services and wellness programs, which can help you stay healthy and manage chronic conditions.

Disadvantages of Medicare Railroad Insurance

One potential disadvantage of Medicare Railroad Insurance is that it is only available to railroad workers and their families. If you do not meet the eligibility requirements, you will not be able to enroll in this program. Additionally, the coverage and benefits offered by Medicare Railroad Insurance may not be as extensive as those offered by other Medicare plans.

Medicare Railroad Insurance vs. Other Medicare Plans

Medicare Railroad Insurance is just one of several different Medicare plans that are available to eligible individuals. Other Medicare plans include Medicare Advantage, Medicare Supplement, and Medicare Part D. Each of these plans offers different coverage options and benefits, and the best plan for you will depend on your specific healthcare needs and financial situation.

FAQs

- Q: Can I enroll in Medicare Railroad Insurance if I am not a railroad worker or the spouse of a railroad worker?

- A: No, Medicare Railroad Insurance is only available to railroad workers and their families.

- Q: What types of medical expenses are covered by Medicare Railroad Insurance?

- A: Medicare Railroad Insurance covers hospital and medical expenses, as well as prescription drugs and other medical services.

- Q: How much does Medicare Railroad Insurance cost?

- A: The cost of Medicare Railroad Insurance varies depending on your income and the coverage options you choose.

Conclusion

Medicare Railroad Insurance is a valuable healthcare program that provides comprehensive coverage for railroad workers and their families. If you are eligible for this program, it is important to take advantage of the benefits it offers and to make sure you are enrolled in the right plan for your healthcare needs. By understanding the eligibility requirements, coverage options, and benefits of Medicare Railroad Insurance, you can make an informed decision about your healthcare coverage.

Frequently Asked Questions

What is Medicare Railroad Insurance?

Medicare Railroad Insurance is a health insurance program for individuals who are either current or retired railroad workers or their families. This insurance program is a part of the larger Medicare program, which provides health insurance to individuals over the age of 65, as well as to those with certain disabilities.

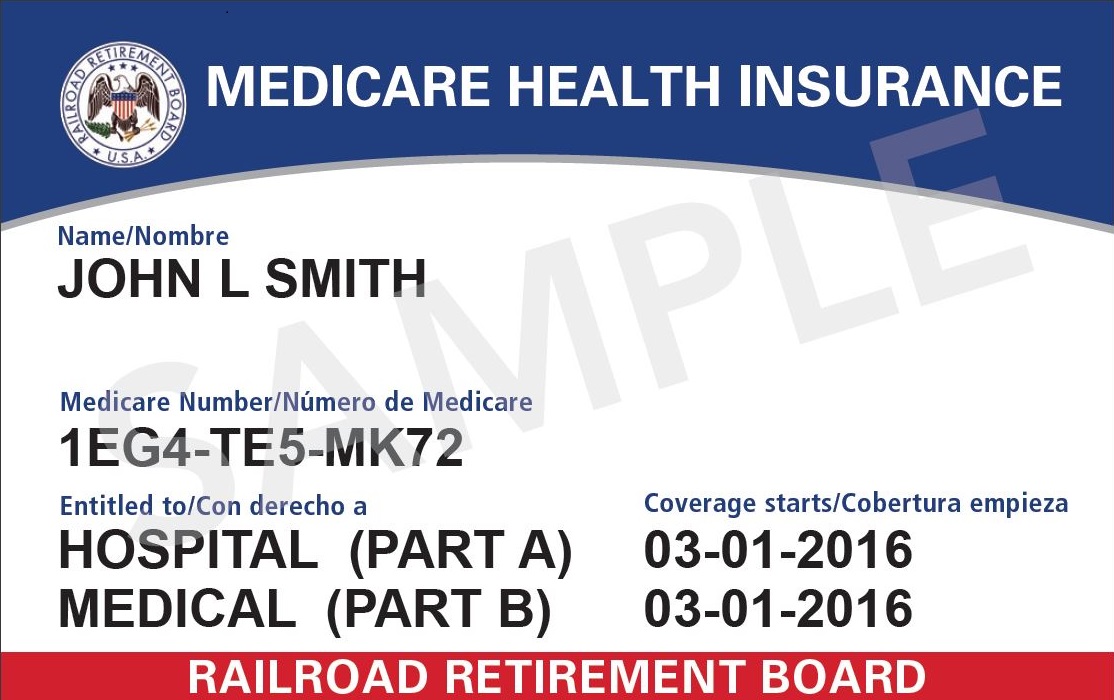

One of the unique features of Medicare Railroad Insurance is that it is administered by the Railroad Retirement Board (RRB), rather than the Social Security Administration. This means that individuals who qualify for this insurance should contact the RRB to enroll, rather than the Social Security Administration.

Who is eligible for Medicare Railroad Insurance?

Individuals who are eligible for Medicare Railroad Insurance include current or retired railroad workers who have worked for a railroad company for at least 10 years or 120 months. This includes individuals who have worked for a railroad company in the past and are now retired, as well as those who are currently employed by a railroad company.

In addition, family members of eligible railroad workers may also be eligible for this insurance program. This includes spouses, divorced spouses, and children of eligible railroad workers.

What services are covered by Medicare Railroad Insurance?

Medicare Railroad Insurance covers many of the same services as traditional Medicare. This includes hospital stays, doctor visits, and prescription drugs. In addition, this insurance program may also cover services specific to railroad workers, such as hearing and vision exams required for employment.

It is important to note that Medicare Railroad Insurance may have different deductibles and copayments than traditional Medicare, so it is important to review the specific details of this insurance program before enrolling.

How do I enroll in Medicare Railroad Insurance?

To enroll in Medicare Railroad Insurance, individuals should contact the Railroad Retirement Board (RRB) directly. This can be done by calling the RRB or by visiting a local RRB office.

In order to enroll, individuals will need to provide documentation of their eligibility, such as proof of employment with a railroad company for at least 10 years. It is important to enroll in Medicare Railroad Insurance as soon as you are eligible, as there may be penalties for enrolling late.

What are the costs associated with Medicare Railroad Insurance?

The costs associated with Medicare Railroad Insurance may vary depending on the individual’s specific plan and coverage. However, like traditional Medicare, individuals may be responsible for paying monthly premiums, deductibles, and copayments.

It is important to review the specific costs associated with Medicare Railroad Insurance before enrolling, in order to ensure that it is the right insurance program for your needs and budget.

Medicare Facts You Need to Know for Railroad Retirement

In summary, Medicare Railroad Insurance is a specialized insurance program designed for individuals who work for the railroad industry and their families. This program is administered by the Centers for Medicare & Medicaid Services and provides similar benefits to those provided by traditional Medicare plans, including hospitalization, medical services, and prescription drug coverage.

For those who work in the railroad industry, Medicare Railroad Insurance is an important benefit that ensures they and their families have access to quality healthcare. By taking advantage of this program, individuals can protect themselves from the high costs of medical care and gain peace of mind knowing that they have adequate coverage. Whether you are already enrolled in Medicare Railroad Insurance or are considering signing up, it’s important to understand the benefits and how they can help you and your loved ones stay healthy and financially secure.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts