Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Auto insurance is a crucial aspect of any vehicle owner’s life. It provides financial security in case of accidents, theft, or damage caused to the vehicle. However, the requirements for auto insurance coverage vary from state to state. As a vehicle owner in Oregon, it is important to know what the minimum auto insurance coverage is to comply with the state’s laws.

In Oregon, the minimum auto insurance coverage includes liability insurance, personal injury protection (PIP), and uninsured motorist coverage. Liability insurance covers the damages caused to the other party in case of an accident where you are at fault. PIP covers medical expenses for you and your passengers, regardless of who is at fault. Uninsured motorist coverage provides coverage in case you are in an accident with an uninsured driver. Understanding the minimum auto insurance coverage requirements in Oregon is essential to ensure that you are protected and comply with the state’s laws.

In Oregon, the minimum auto insurance coverage required by law is liability coverage of 25/50/20. This means $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage per accident. However, it is recommended to get additional coverage to protect yourself and your assets in case of an accident.

Contents

- What is the Minimum Auto Insurance Coverage in Oregon?

- Frequently Asked Questions

- What is the minimum auto insurance coverage required in Oregon?

- What happens if I don’t have the minimum required auto insurance coverage in Oregon?

- What other types of auto insurance coverage are available in Oregon?

- How can I find the best auto insurance coverage in Oregon?

- Can I use my out-of-state auto insurance coverage in Oregon?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

What is the Minimum Auto Insurance Coverage in Oregon?

Auto insurance is mandatory in Oregon. The minimum auto insurance coverage required in Oregon is liability coverage. This type of coverage pays for damages and injuries you cause to other people and their property in a car accident. It does not cover damages to your own car or injuries to you or your passengers.

What is Liability Coverage?

Liability coverage is the minimum auto insurance coverage required in Oregon. It pays for damages and injuries you cause to others in a car accident. The two types of liability coverage are:

- Bodily Injury Liability Coverage: This pays for injuries to others in a car accident that you caused.

- Property Damage Liability Coverage: This pays for damages to other people’s property in a car accident that you caused.

The minimum liability coverage required in Oregon is:

| Liability Coverage | Minimum Required |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person / $50,000 per accident |

| Property Damage Liability Coverage | $20,000 per accident |

If you cause a car accident that exceeds the limits of your liability coverage, you may be held personally responsible for the remaining damages and injuries.

What are the Benefits of Liability Coverage?

Liability coverage protects you from financial loss in case you cause damages or injuries to other people in a car accident. It can also protect your assets if you are sued for damages that exceed your liability coverage limits. Liability coverage can also provide peace of mind knowing that you are financially protected in case of an accident.

How does Liability Coverage Compare to Other Types of Coverage?

Liability coverage is the minimum auto insurance coverage required in Oregon. However, there are other types of coverage you can add to your policy for additional protection. These include:

- Collision Coverage: This pays for damages to your car in a car accident, regardless of who is at fault.

- Comprehensive Coverage: This pays for damages to your car caused by events such as theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: This pays for damages and injuries you incur in a car accident caused by someone who does not have enough insurance or no insurance at all.

Adding these types of coverage to your policy can provide additional protection, but they also increase your insurance premiums.

Conclusion

Liability coverage is the minimum auto insurance coverage required in Oregon. It provides protection for damages and injuries you cause to others in a car accident. While it may be tempting to only get the minimum coverage required, it is important to consider adding additional coverage for more protection. Contact your insurance agent to discuss your options and find the coverage that best fits your needs and budget.

Frequently Asked Questions

What is the minimum auto insurance coverage required in Oregon?

In Oregon, drivers are required to have a minimum liability coverage of 25/50/20. This means that you must have at least $25,000 coverage for bodily injury or death of one person, $50,000 coverage for bodily injury or death of two or more people, and $20,000 coverage for property damage per accident. It is important to note that this is only the minimum required coverage and drivers may want to consider higher coverage limits for better protection.

It is also mandatory to carry personal injury protection (PIP) coverage in Oregon. PIP covers medical expenses and other related expenses for the driver and passengers involved in an accident, regardless of who is at fault. The minimum required PIP coverage in Oregon is $15,000 per person per accident.

What happens if I don’t have the minimum required auto insurance coverage in Oregon?

Driving without the minimum required auto insurance coverage in Oregon can result in serious consequences. If you are caught driving without insurance, you may face fines up to $1,000 and/or suspension of your driver’s license for up to one year. Additionally, you may be required to file an SR-22 form, which is a document that proves you have liability insurance. This form is required for three years and failure to maintain insurance during that period can result in license suspension or revocation.

If you are involved in an accident and do not have the minimum required insurance coverage, you may be personally responsible for any damages or injuries that occur. This can result in significant financial hardship, so it is important to maintain the minimum required insurance coverage in Oregon.

What other types of auto insurance coverage are available in Oregon?

In addition to the minimum required liability and PIP coverage, there are several other types of auto insurance coverage available in Oregon. Collision coverage pays for damages to your vehicle if you are involved in an accident, regardless of who is at fault. Comprehensive coverage covers damages to your vehicle from non-collision incidents, such as theft, vandalism, or natural disasters.

Uninsured/underinsured motorist coverage provides protection if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. Rental reimbursement coverage pays for a rental car if your vehicle is in the shop for repairs after an accident.

How can I find the best auto insurance coverage in Oregon?

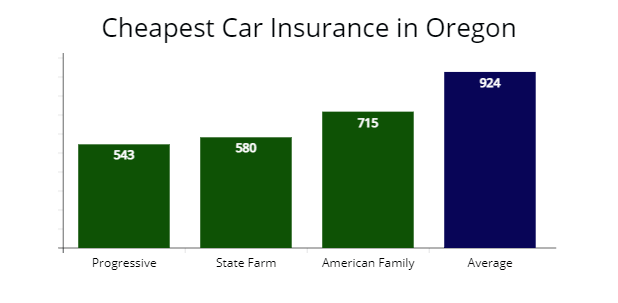

To find the best auto insurance coverage in Oregon, it is important to shop around and compare quotes from multiple insurance providers. Consider factors such as coverage limits, deductibles, and premiums when making your decision.

You may also want to consider working with an independent insurance agent who can help you find the right coverage for your needs and budget. Independent agents work with multiple insurance providers and can provide personalized recommendations based on your unique situation.

Can I use my out-of-state auto insurance coverage in Oregon?

If you are moving to Oregon from another state, your out-of-state auto insurance coverage may not meet the minimum requirements in Oregon. It is important to contact your insurance provider and inquire about the minimum required coverage in Oregon.

If your out-of-state insurance does not meet Oregon’s minimum requirements, you will need to obtain new insurance coverage in Oregon. It is also important to notify your previous insurance provider of your move and cancel your policy with them to avoid any overlap in coverage.

After reading through the details of the minimum auto insurance coverage in Oregon, it is clear that having the minimum coverage may not be enough to protect you in the event of an accident. While it is important to have insurance to comply with the state law, it is equally important to consider the potential risks and damages that may occur from an accident.

As a professional writer, I would suggest taking the time to assess your specific needs and consider purchasing additional coverage to ensure that you are fully protected. It is better to be safe than sorry when it comes to accidents on the road, and having comprehensive coverage can provide you with peace of mind and financial protection. So, take the time to review your policy and make any necessary adjustments to ensure that you are adequately covered.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts