Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

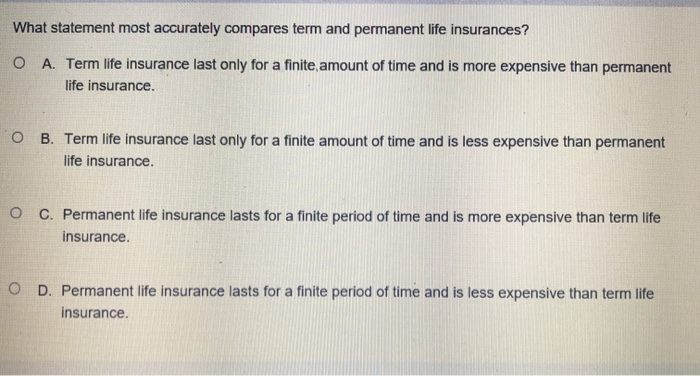

When it comes to securing your financial future, life insurance is an important consideration. However, there are different types of life insurance policies available in the market, and it can be overwhelming to decide which one is suitable for you. Two popular options are term life insurance and permanent life insurance. But what statement most accurately compares these two types of policies?

Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years, with a fixed premium rate. On the other hand, permanent life insurance offers lifelong coverage and also includes a savings component that grows over time. While both offer death benefits, the key difference between the two lies in their duration and cost. In this article, we will delve into the details of both types of life insurance policies and compare them to help you make an informed decision about which one is right for you.

Comparing Term and Permanent Life Insurances

What is Term Life Insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specific period of time, usually ranging from 10 to 30 years. During this period, your beneficiaries will receive a death benefit if you pass away. Term life insurance policies are typically less expensive than permanent life insurance policies and offer more flexibility in terms of coverage amounts and duration.

Term life insurance policies have a set premium that stays the same throughout the policy term. This makes it easier to budget for your insurance costs. Once the policy term ends, you have the option to renew your policy, but your premiums may increase based on your age and health.

Benefits of Term Life Insurance

– Lower premiums compared to permanent life insurance

– Flexible coverage amounts and duration

– Set premiums for the policy term

– Option to renew the policy at the end of the term

Drawbacks of Term Life Insurance

– No cash value accumulation

– Premiums may increase upon renewal

– Coverage ends after the policy term

What is Permanent Life Insurance?

Permanent life insurance policies provide coverage for your entire life, as long as you pay your premiums. There are different types of permanent life insurance, including whole life, universal life, and variable life insurance. These policies are typically more expensive than term life insurance, but they offer additional benefits.

Permanent life insurance policies have a cash value component that accumulates over time. This means that as you pay your premiums, a portion of the money goes towards a savings account that earns interest. You can borrow against the cash value or use it to pay your premiums.

Benefits of Permanent Life Insurance

– Coverage for your entire life

– Cash value accumulation

– Option to borrow against the cash value or use it to pay premiums

Drawbacks of Permanent Life Insurance

– Higher premiums compared to term life insurance

– Less flexibility in coverage amounts and duration

– Cash value may not earn high returns compared to other investment options

Comparing Term and Permanent Life Insurance

When comparing term and permanent life insurance policies, there are several factors to consider, including:

Cost

Term life insurance policies are generally less expensive than permanent life insurance policies. However, if you need coverage for your entire life, a permanent policy may be a better option.

Coverage Duration

If you only need coverage for a specific period of time, such as until your children are grown and financially independent, a term life insurance policy may be a better option. However, if you want coverage for your entire life, a permanent policy may be a better choice.

Cash Value

Permanent life insurance policies have a cash value component that accumulates over time. If you need access to cash in the future, a permanent policy may be a better option. However, if you don’t need the cash value component, a term policy may be a more cost-effective option.

Flexibility

Term life insurance policies offer more flexibility in terms of coverage amounts and duration. Permanent policies are less flexible but offer coverage for your entire life.

Beneficiaries

Both term and permanent life insurance policies allow you to choose your beneficiaries. However, if you want to change your beneficiaries in the future, a permanent policy may be a better option.

Conclusion

When it comes to choosing between term and permanent life insurance policies, there is no one-size-fits-all answer. It’s important to consider your individual needs and budget to determine which policy is right for you. A financial advisor can help you navigate the options and find the best policy for your situation.

Contents

- Frequently Asked Questions

- What is term life insurance?

- What is permanent life insurance?

- What are the main differences between term and permanent life insurance?

- Which type of life insurance is the best?

- Can I switch from term to permanent life insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Choosing the right life insurance policy can be a challenging task. With so many options available, it can be difficult to decide which one is the best fit for your needs. Two of the most common types of life insurance are term and permanent life insurance. Here are some commonly asked questions about the difference between the two.

What is term life insurance?

Term life insurance is a type of policy that provides coverage for a specific period of time, usually 10, 20, or 30 years. During the term, the policyholder pays a fixed premium, and if they pass away during that time, their beneficiaries receive a death benefit payout. Once the term ends, the policy expires, and there is no payout. This type of policy is typically less expensive than permanent life insurance because there is no cash value component.

Term life insurance is a good option for those who need coverage for a specific period of time, such as when they have children or a mortgage. It is also a good option for those who may not be able to afford a permanent policy but still want to ensure their loved ones are taken care of in the event of their passing.

What is permanent life insurance?

Permanent life insurance is a type of policy that provides coverage for the entire lifetime of the policyholder. It has a cash value component that grows over time, and the policyholder can borrow against this cash value if needed. The premiums for permanent life insurance are typically higher than those for term life insurance because of the cash value component.

Permanent life insurance is a good option for those who want coverage for their entire life and want to build cash value that can be used in the future. It is also a good option for those who want to leave a legacy for their loved ones or want to ensure their final expenses are covered.

What are the main differences between term and permanent life insurance?

The main difference between term and permanent life insurance is the length of coverage and the cash value component. Term life insurance provides coverage for a specific period of time, while permanent life insurance provides coverage for the entire lifetime of the policyholder. Additionally, permanent life insurance has a cash value component that grows over time, while term life insurance does not.

Another difference is the cost. Term life insurance is typically less expensive than permanent life insurance because there is no cash value component. However, term life insurance expires at the end of the term, and there is no payout if the policyholder passes away after the term ends. Permanent life insurance is more expensive, but it provides coverage for the entire lifetime of the policyholder and has a cash value component that can be used in the future.

Which type of life insurance is the best?

The type of life insurance that is best for you depends on your individual needs and circumstances. If you need coverage for a specific period of time, such as when you have children or a mortgage, term life insurance may be the best option. If you want coverage for your entire life and want to build cash value that can be used in the future, permanent life insurance may be the best option.

Ultimately, the best way to determine which type of life insurance is right for you is to speak with a licensed insurance agent who can help you evaluate your needs and make an informed decision.

Can I switch from term to permanent life insurance?

Yes, it is possible to switch from term to permanent life insurance. However, it is important to note that there may be fees or penalties associated with the switch. Additionally, the premiums for permanent life insurance are typically higher than those for term life insurance, so the monthly cost may increase.

If you are considering switching from term to permanent life insurance, it is important to speak with a licensed insurance agent who can help you evaluate your options and determine if it is the right decision for you.

After diving deep into the world of life insurance, we have come to a conclusion that there is no one-size-fits-all answer to the question of which is better, term or permanent life insurance. It ultimately depends on your individual needs and circumstances. If you are seeking life insurance for a specific period of time, such as until your children are grown or until a mortgage is paid off, then term life insurance may be the more cost-effective option. However, if you are looking for a policy that provides lifelong coverage, builds cash value, and has more flexibility, then permanent life insurance may be the better choice.

Regardless of which type of life insurance you choose, it is important to carefully consider your options and consult with a professional to ensure that you are making the best decision for you and your loved ones. Life insurance is an essential part of financial planning and can provide peace of mind knowing that your loved ones will be taken care of in the event of your passing. With the right policy in place, you can rest assured that your legacy will be protected for years to come.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts