Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

For many people, life insurance is an essential part of their financial planning. It provides peace of mind and financial protection for loved ones in the event of an unexpected death. However, with so many different types of life insurance available, it can be challenging to understand the differences between them. One common question that arises is whether universal life insurance is the same as whole life insurance.

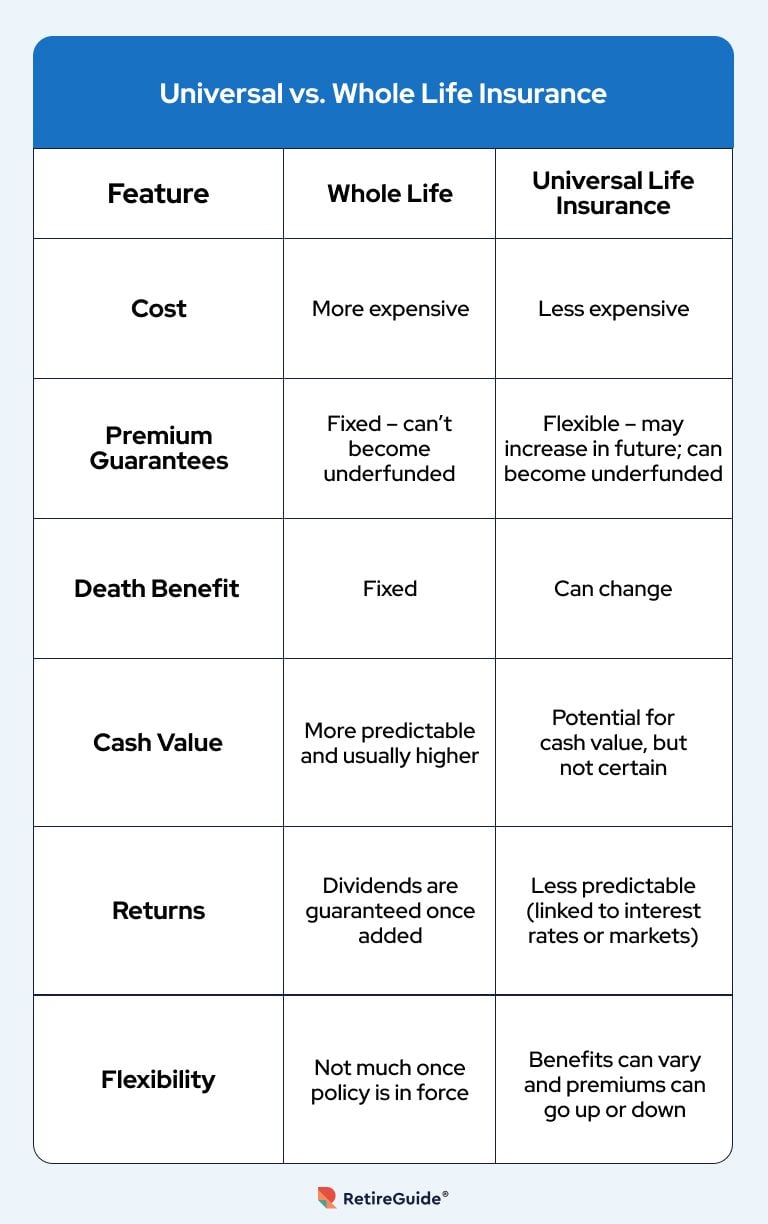

While both universal life insurance and whole life insurance provide lifelong coverage, there are significant differences between the two policies. Understanding these differences is essential when deciding which type of coverage is right for you. In this article, we will explore the similarities and differences between universal life insurance and whole life insurance, helping you make an informed decision about which policy is best suited to your needs.

Is Universal Life Insurance the Same as Whole Life?

No, universal life insurance and whole life insurance are not the same. While both provide lifelong coverage and a savings component, the difference lies in how the savings component is managed. Whole life insurance has a fixed investment component, while universal life insurance offers more flexibility in investment options and premium payments. It’s important to understand the differences and choose the policy that best fits your needs.

Is Universal Life Insurance the Same as Whole Life?

If you are looking for a life insurance policy, you may have come across two popular options: Universal Life Insurance and Whole Life Insurance. While both policies offer a death benefit, they differ in various aspects. It is essential to understand the differences between the two before making a decision on which one to choose. This article will help you understand the differences between Universal Life Insurance and Whole Life Insurance.

Definition of Universal Life Insurance

Universal Life Insurance is a type of permanent life insurance that provides both a death benefit and an investment component. This policy allows you to build cash value over time, which can be used to pay for premiums or taken out as a loan. Unlike Whole Life Insurance, the premiums for Universal Life Insurance are flexible.

The policyholder has the option to adjust the premium and death benefit amount according to their changing needs. The cash value earned in a Universal Life Insurance policy is tax-deferred, meaning the policyholder is not required to pay taxes on the growth until they withdraw the money.

Definition of Whole Life Insurance

Whole Life Insurance is another type of permanent life insurance that provides the policyholder with a death benefit and an investment component. Unlike Universal Life Insurance, the premiums for Whole Life Insurance are fixed. Once the policy is in place, the premium and death benefit amount remain the same over the life of the policy.

The cash value earned in a Whole Life Insurance policy is also tax-deferred, and the policyholder can use it to pay for premiums or take out as a loan. However, the policyholder does not have the option to adjust the premium or death benefit amount.

Pros and Cons of Universal Life Insurance

Pros

- Flexible premium payments

- Higher interest rates compared to savings accounts

- Ability to borrow against the cash value

Cons

- Higher risk due to market fluctuations

- Policyholder may be required to pay more in premiums if investment returns are lower than expected

- Complexity in choosing investment options

Universal Life Insurance is an excellent option for people who want flexibility in their premium payments and the opportunity to earn higher interest rates. However, the policyholder should be prepared to take on some risk due to market fluctuations.

Pros and Cons of Whole Life Insurance

Pros

- Guaranteed death benefit

- Predictable premium payments

- Stable returns

Cons

- Higher premiums compared to term life insurance

- Lower interest rates compared to other investment options

- Less flexibility in adjusting the policy

Whole Life Insurance is an excellent option for people who want a guaranteed death benefit and predictable premium payments. However, the policyholder should be prepared to pay higher premiums compared to term life insurance.

Universal Life Insurance vs. Whole Life Insurance

When deciding between Universal Life Insurance and Whole Life Insurance, it is essential to consider your current financial situation and future needs.

Cost

Universal Life Insurance tends to be more affordable than Whole Life Insurance, especially in the short term. However, the policyholder may end up paying more in premiums if the investment returns are lower than expected.

Flexibility

Universal Life Insurance offers more flexibility in premium payments and death benefit amounts than Whole Life Insurance. The policyholder can adjust their premium payments and death benefit amount to suit their changing needs.

Cash Value

Both Universal Life Insurance and Whole Life Insurance policies offer cash value that can be used to pay for premiums or taken out as a loan. However, the cash value in a Whole Life Insurance policy tends to grow at a slower rate than that in a Universal Life Insurance policy.

Investment Risk

Universal Life Insurance policies are subject to investment risk, while Whole Life Insurance policies are not. The policyholder should be prepared to take on some risk if they choose a Universal Life Insurance policy.

Death Benefit

Both Universal Life Insurance and Whole Life Insurance policies offer a death benefit. However, the death benefit in a Universal Life Insurance policy tends to be more flexible than in a Whole Life Insurance policy.

Conclusion

In conclusion, Universal Life Insurance and Whole Life Insurance are two popular types of permanent life insurance policies. While they share some similarities, they differ in various aspects, such as premium payments, flexibility, investment risk, and death benefit. You should carefully consider your financial situation and future needs before choosing between the two policies. A financial advisor can help you make an informed decision based on your individual circumstances.

Contents

- Frequently Asked Questions

- Is Universal Life Insurance the Same as Whole Life?

- How Does Universal Life Insurance Work?

- What are the Benefits of Universal Life Insurance?

- What are the Drawbacks of Universal Life Insurance?

- How Do I Decide Between Universal Life Insurance and Whole Life Insurance?

- What Is Universal Life Vs. Whole Life?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Is Universal Life Insurance the Same as Whole Life?

Universal life insurance and whole life insurance are both types of permanent life insurance, but they have some key differences. Whole life insurance is a more traditional type of policy that provides a guaranteed death benefit and builds cash value over time. The premiums for whole life insurance are typically higher than those for universal life insurance.

Universal life insurance, on the other hand, offers more flexibility in terms of premiums and death benefits. With universal life insurance, you can adjust your premiums and death benefits as your needs change. Additionally, universal life insurance policies often offer a higher potential return on investment than whole life insurance policies.

Overall, while they are both types of permanent life insurance, universal life insurance and whole life insurance have some important differences that make them unique. It’s important to talk to a financial advisor to determine which type of policy is best for your individual needs and goals.

How Does Universal Life Insurance Work?

Universal life insurance is a type of permanent life insurance that provides a death benefit to your beneficiaries when you pass away. In addition to the death benefit, universal life insurance policies also have a cash value component. This cash value grows over time and can be used to pay premiums or borrowed against.

One of the unique features of universal life insurance is its flexibility. You can adjust your premiums and death benefits as your needs change, which makes it a great choice for those who want more control over their policy. Additionally, the cash value component of a universal life insurance policy can provide a source of tax-free income in retirement.

It’s important to note that universal life insurance policies have fees and expenses that can affect the performance of the policy. It’s important to talk to a financial advisor to determine if universal life insurance is the right choice for your individual needs and goals.

What are the Benefits of Universal Life Insurance?

Universal life insurance offers a number of benefits, including flexibility, potential for higher returns, and tax advantages. With universal life insurance, you have the ability to adjust your premiums and death benefits as your needs change. Additionally, the cash value component of a universal life insurance policy has the potential to earn higher returns than a traditional savings account.

Another benefit of universal life insurance is its tax advantages. The death benefit is generally paid out tax-free to your beneficiaries, and the cash value component can be accessed tax-free in retirement. Additionally, if you need to withdraw money from your policy, you can do so tax-free up to the amount of your premiums paid.

Overall, universal life insurance is a great choice for those who want more flexibility and control over their policy, as well as potential tax advantages and higher returns.

What are the Drawbacks of Universal Life Insurance?

While universal life insurance offers a number of benefits, there are also some potential drawbacks to consider. One of the main drawbacks of universal life insurance is its complexity. Understanding the fees and expenses associated with a universal life insurance policy can be difficult, and it’s important to work with a financial advisor who can help you navigate the details.

Another potential drawback of universal life insurance is its cost. While the premiums for universal life insurance are often lower than those for whole life insurance, they can still be much higher than those for term life insurance. Additionally, if you don’t pay your premiums on time or withdraw too much from the cash value component, you could risk losing your coverage.

Overall, while there are some potential drawbacks to universal life insurance, it can be a great choice for those who want more flexibility and control over their policy, as well as potential tax advantages and higher returns. It’s important to talk to a financial advisor to determine if universal life insurance is the right choice for your individual needs and goals.

How Do I Decide Between Universal Life Insurance and Whole Life Insurance?

When deciding between universal life insurance and whole life insurance, it’s important to consider your individual needs and goals. Whole life insurance offers a guaranteed death benefit and builds cash value over time, but the premiums are typically higher than those for universal life insurance.

Universal life insurance, on the other hand, offers more flexibility in terms of premiums and death benefits. You can adjust your premiums and death benefits as your needs change, and the cash value component of a universal life insurance policy has the potential to earn higher returns than a traditional savings account.

Ultimately, the choice between universal life insurance and whole life insurance will depend on your individual needs and goals. It’s important to talk to a financial advisor who can help you evaluate your options and determine which type of policy is best for you.

What Is Universal Life Vs. Whole Life?

As a professional writer, I can say that the answer to the question “Is Universal Life Insurance the Same as Whole Life?” is a bit more complicated than a simple yes or no. While both policies offer death benefits and cash value accumulation, they operate in different ways. Universal life insurance has more flexibility in terms of premium payments and death benefit amounts, whereas whole life insurance has a fixed premium and death benefit.

Ultimately, the choice between universal life insurance and whole life insurance depends on your individual needs and financial goals. It’s important to consult with a licensed insurance professional to determine which policy is right for you. However, the most important thing is to ensure that you have some form of life insurance in place to protect your loved ones in the event of your passing. Investing in life insurance is a smart and responsible decision that can provide peace of mind for you and your family.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts