Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a responsible driver, you may have purchased auto insurance to protect yourself and your vehicle in case of an accident. But what happens if your insurance company denies your claim? Can an auto insurance company actually deny coverage, and if so, what are the reasons for doing so?

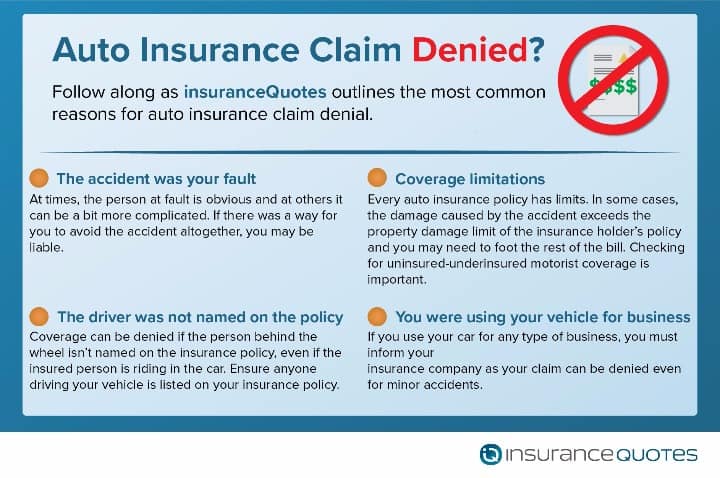

The short answer is yes, an auto insurance company can deny coverage for a variety of reasons. While each insurance company may have their own specific policy language, there are typically several common reasons why a claim may be denied. As a policyholder, it’s important to understand these reasons and make sure you’re fully covered in case of an accident. In this article, we’ll dive into the reasons why an auto insurance company may deny coverage and what steps you can take to protect yourself.

Yes, an auto insurance company can deny coverage based on several factors such as driving history, past claims, and the type of vehicle being insured. It is important to thoroughly read and understand the terms and conditions of your policy to ensure that you are meeting all requirements and are not at risk of having your coverage denied. In some cases, you may be able to appeal the decision or seek coverage from another provider.

Contents

- Can an Auto Insurance Company Deny Coverage?

- Frequently Asked Questions

- Can an Auto Insurance Company Deny Coverage?

- What Should I Do If My Auto Insurance Company Denies Coverage?

- Can I Appeal an Auto Insurance Company’s Decision to Deny Coverage?

- What Can I Do to Prevent My Auto Insurance Company from Denying Coverage?

- What Are My Options if I Cannot Obtain Auto Insurance Coverage?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can an Auto Insurance Company Deny Coverage?

As a responsible driver, you probably have an auto insurance policy in place to protect yourself, your passengers, and other drivers in case of an accident. But what happens when you need to file a claim and your insurance company denies coverage? Can they really do that? Here’s what you need to know.

Reasons for Denying Coverage

Auto insurance companies can deny coverage for a variety of reasons. One of the most common reasons is if you don’t have the appropriate coverage for the type of damage that occurred. For example, if you only have liability coverage and you were at fault for an accident, your insurance company won’t cover the cost of repairs to your own vehicle.

Another reason for denial of coverage is if you were driving under the influence of drugs or alcohol at the time of the accident. This is considered a breach of your insurance contract and your policy will likely be null and void.

Policy Exclusions

Every auto insurance policy has exclusions, which are situations or events that are not covered by the policy. For example, some policies exclude coverage for damage caused by natural disasters like floods or earthquakes. If the damage to your vehicle falls under one of these exclusions, your insurance company won’t cover it.

It’s important to review your policy carefully to understand what is and isn’t covered. If you have questions, don’t hesitate to ask your insurance agent for clarification.

Claim Investigation

When you file a claim with your insurance company, they will conduct an investigation to determine the cause of the accident and the extent of the damage. If they find that you were at fault for the accident or that the damage falls under a policy exclusion, they may deny coverage.

However, if you believe that their decision was incorrect, you have the right to appeal. This may involve providing additional evidence, such as witness statements or police reports, to support your claim.

Benefit of a Lawyer

If you’re having trouble getting your insurance company to pay out on a claim, it may be beneficial to enlist the help of a lawyer. An experienced attorney can help you navigate the appeals process and negotiate with your insurance company to get the coverage you deserve.

However, keep in mind that hiring a lawyer can be expensive and may not always result in a favorable outcome. It’s important to weigh the potential benefits against the costs before making a decision.

Alternatives to Insurance

If your insurance company denies coverage, you may be left to pay for the damages out of pocket. However, there are alternatives to traditional auto insurance that may be more affordable and provide better coverage.

For example, some companies offer pay-per-mile insurance, which charges you based on how much you drive. This can be a good option if you don’t drive very often and want to save money on your insurance premiums.

Conclusion

In conclusion, an auto insurance company can deny coverage for a variety of reasons, including policy exclusions, a breach of contract, or lack of appropriate coverage. If you’re having trouble getting your insurance company to pay out on a claim, it’s important to understand your rights and options. Consider consulting with a lawyer or exploring alternative insurance options to ensure that you’re protected on the road.

Frequently Asked Questions

Can an Auto Insurance Company Deny Coverage?

Yes, an auto insurance company can deny coverage for a variety of reasons. It is important to understand that auto insurance companies are businesses, and they make decisions based on their bottom line. That being said, there are certain situations where an insurance company may deny coverage that are outside of their control.

Some of the most common reasons an auto insurance company may deny coverage include a driver having a poor driving record, not disclosing relevant information on their policy application, or driving an uninsured or underinsured vehicle. Additionally, if a driver is involved in an accident that is not covered under their policy, the insurance company may deny coverage.

What Should I Do If My Auto Insurance Company Denies Coverage?

If your auto insurance company denies coverage, the first step you should take is to contact the company and ask for an explanation of why your claim was denied. It is important to understand the reason for the denial so that you can take the appropriate steps to address the issue.

If the reason for the denial is within your control, such as a failure to disclose information on your policy application, you may need to take corrective action and reapply for coverage. If the reason for the denial is outside of your control, such as a lack of coverage for a specific type of accident, you may need to seek coverage from another insurance company or explore other options for paying for any damages or injuries resulting from the accident.

Can I Appeal an Auto Insurance Company’s Decision to Deny Coverage?

Yes, in some cases, you may be able to appeal an auto insurance company’s decision to deny coverage. If you believe that your claim was unfairly denied or that the reason for the denial was incorrect, you can contact the insurance company and request an appeal.

During the appeal process, the insurance company will review your claim again and make a decision on whether to grant coverage. It is important to provide any additional information or documentation that may support your claim during the appeal process to increase your chances of success.

What Can I Do to Prevent My Auto Insurance Company from Denying Coverage?

To prevent your auto insurance company from denying coverage, it is important to be honest and accurate when completing your policy application. Make sure to disclose all relevant information, such as previous accidents or traffic violations, to ensure that your coverage is valid.

Additionally, it is important to maintain a good driving record and follow all traffic laws to reduce the risk of being involved in an accident. If you do have an accident, make sure to contact your insurance company as soon as possible and provide all necessary information to ensure that your claim is processed quickly and accurately.

What Are My Options if I Cannot Obtain Auto Insurance Coverage?

If you are unable to obtain auto insurance coverage from a traditional insurance company, there are other options available. Some states offer high-risk auto insurance pools for drivers who are considered high-risk due to their driving record or other factors.

Additionally, you may be able to obtain coverage from a non-standard insurance company or through a specialty insurance program. It is important to shop around and compare rates and coverage options to find the best policy for your needs and budget.

After delving into the intricacies of auto insurance policies, it becomes clear that insurance companies do indeed have the right to deny coverage to their clients. This can be due to a variety of reasons, such as false information provided by the client, failure to meet policy requirements, or even a high-risk driving record. It’s important to note that insurance companies are businesses, and their ultimate goal is to minimize their financial risk. Therefore, they may deny coverage to individuals who they deem to be too risky to insure.

However, it’s crucial for individuals to thoroughly research insurance policies and companies before committing to coverage. By understanding the terms and conditions of their policy and ensuring they meet all requirements, they can increase their chances of being approved for coverage. Additionally, maintaining a safe driving record and avoiding high-risk behaviors can also improve one’s chances of being approved for coverage. While an insurance company may have the right to deny coverage, individuals also have the power to take proactive steps to secure the coverage they need to protect themselves and their vehicles on the road.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts