Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As grandparents, we always want to ensure the well-being of our grandchildren. While spoiling them with gifts and affection is a natural part of being a grandparent, have you ever considered buying life insurance for them? It may not be the first thing that comes to mind, but it’s a thoughtful investment that can offer peace of mind for both you and your family.

Life insurance for children is a topic that has sparked debate over the years. Some argue that it’s an unnecessary expense, while others believe it’s a wise investment. However, when it comes to grandparents buying life insurance for their grandchildren, the decision can be even more complex. In this article, we’ll explore the potential benefits and drawbacks of grandparents purchasing life insurance for their grandchildren, and provide some insights to help you make an informed decision.

Contents

- Can Grandparents Buy Life Insurance for Grandchildren?

- Frequently Asked Questions

- Can grandparents buy life insurance for grandchildren?

- What are the benefits of grandparents buying life insurance for their grandchildren?

- What types of life insurance policies are available for grandchildren?

- Can grandparents be the beneficiaries of a grandchild’s life insurance policy?

- What factors should grandparents consider before buying life insurance for their grandchildren?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can Grandparents Buy Life Insurance for Grandchildren?

As a grandparent, you want to protect and provide for your grandchildren. One way to ensure their financial security is by purchasing life insurance for them. But can grandparents buy life insurance for their grandchildren? The answer is yes, and in this article, we will explore the reasons why it can be a smart move.

Why Buy Life Insurance for Grandchildren?

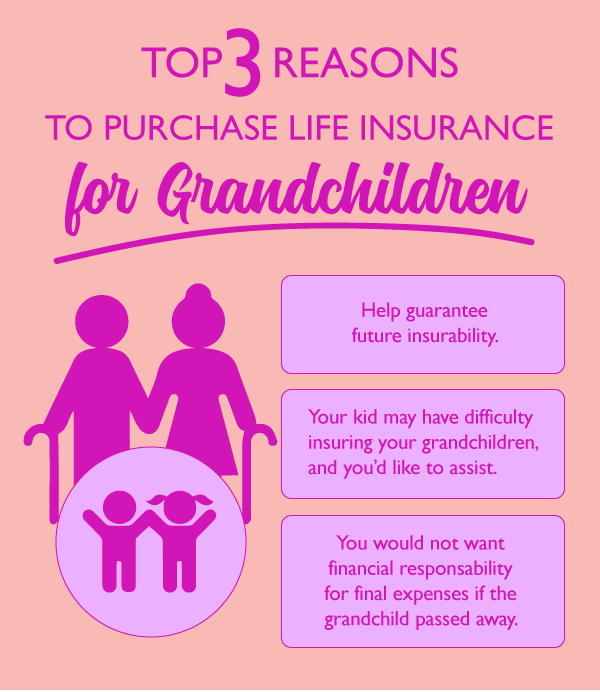

Life insurance is not just for adults. Children can also benefit from having coverage. Here are some reasons why grandparents might want to consider buying life insurance for their grandchildren:

1. Financial Protection

Life insurance can provide financial protection for your grandchildren in case of unexpected circumstances such as illness, injury, or death. It can help pay for medical bills, funeral costs, and other expenses.

2. Future Insurability

By purchasing life insurance for your grandchildren at a young age, you can lock in their insurability. This means they will have coverage regardless of any health issues that may arise in the future.

3. Cash Value

Some life insurance policies offer a cash value component that can grow over time. This can provide your grandchildren with a valuable asset that they can access later in life.

4. Educational Expenses

If you want to help your grandchildren with their education expenses, life insurance can be a smart way to do so. You can use the cash value of the policy to pay for college or other educational expenses.

Types of Life Insurance for Grandchildren

There are two main types of life insurance policies that grandparents can purchase for their grandchildren:

1. Whole Life Insurance

Whole life insurance provides coverage for the entire life of the insured and has a cash value component. Premiums are typically higher than other types of life insurance, but the policy can provide lifelong protection and savings.

2. Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. Premiums are typically lower than whole life insurance, but the policy does not have a cash value component.

Benefits of Buying Life Insurance for Grandchildren

Here are some benefits of buying life insurance for your grandchildren:

1. Peace of Mind

Knowing that your grandchildren are financially protected can give you peace of mind. You can rest easy knowing that they will be taken care of in case of unexpected circumstances.

2. Tax Benefits

Life insurance policies can provide tax benefits, such as tax-free death benefits and tax-deferred growth of cash value. Consult with a tax professional to learn more about the tax advantages of purchasing life insurance for your grandchildren.

Grandparents vs. Parents Buying Life Insurance

While both grandparents and parents can purchase life insurance for their children, there are some differences to consider:

1. Insurability

Grandparents can often purchase life insurance for their grandchildren regardless of their health status. Parents may have more difficulty obtaining coverage for their children if they have pre-existing health conditions.

2. Ownership

If grandparents purchase life insurance for their grandchildren, they typically own the policy and have control over it. If parents purchase the policy, they own it and have control over it.

3. Premiums

Grandparents may be able to purchase life insurance for their grandchildren at a lower premium than parents. This is because grandparents are typically older and may have a better understanding of the life insurance market.

Conclusion

Buying life insurance for your grandchildren can be a smart decision that provides financial protection and peace of mind. Consider the type of policy that best suits your needs and consult with a financial advisor to determine the best course of action. With the right policy in place, you can ensure that your grandchildren are protected and provided for in the future.

Frequently Asked Questions

Can grandparents buy life insurance for grandchildren?

Yes, grandparents can purchase life insurance for their grandchildren, but there are some things to consider before doing so. One option is to purchase a policy that will last the child’s entire life, which will provide them with financial security and protection for their future. Another option is to purchase a term life insurance policy that will expire after a specified number of years, such as when the child turns 18 or 21.

It’s important to note that the cost of life insurance for children is generally lower than for adults because children are considered to be low-risk policyholders. However, it’s still important to shop around for the best rates and coverage options. Additionally, grandparents should consider the child’s parents’ wishes and financial situation before purchasing life insurance for their grandchild.

What are the benefits of grandparents buying life insurance for their grandchildren?

There are several benefits to grandparents purchasing life insurance for their grandchildren. First, it provides the child with financial protection and security for their future. In the event of the child’s unexpected death, the policy payout can help cover funeral expenses, outstanding debts, or provide a financial cushion for the child’s family.

Additionally, purchasing life insurance for a child can provide them with a financial safety net as they grow older. The policy can be used to help pay for college, a down payment on a home, or other major expenses. Finally, life insurance can also be a valuable estate planning tool for grandparents, as it can help transfer wealth to their grandchildren tax-free.

What types of life insurance policies are available for grandchildren?

There are several types of life insurance policies available for grandparents to purchase for their grandchildren. The most common types are whole life insurance and term life insurance. Whole life insurance provides coverage for the child’s entire life and includes a savings component that can accumulate cash value over time.

Term life insurance, on the other hand, provides coverage for a specified period of time, such as 10, 20, or 30 years. These policies are generally less expensive than whole life insurance and may be a good option for grandparents who want to provide their grandchildren with financial protection while they are young.

Can grandparents be the beneficiaries of a grandchild’s life insurance policy?

Yes, grandparents can be named as beneficiaries on their grandchild’s life insurance policy. However, it’s important to note that the child’s parents typically have the final say on who is named as the beneficiary. Grandparents should have a conversation with their grandchild’s parents to ensure that everyone is on the same page about the policy and who will receive the payout in the event of the child’s death.

It’s also important to note that if the grandchild is a minor, a legal guardian will need to be appointed to manage the policy and the payout. Grandparents should work with an attorney to ensure that their wishes are properly documented and that the policy is structured in a way that aligns with their estate planning goals.

What factors should grandparents consider before buying life insurance for their grandchildren?

Before purchasing life insurance for their grandchildren, grandparents should consider several factors. First, they should assess the child’s parent’s financial situation and determine whether or not the parents are able to purchase life insurance for the child themselves. If the parents are unable to afford life insurance, the grandparents may want to consider purchasing a policy on the child’s behalf.

Additionally, grandparents should consider the child’s age and health status when determining the type and amount of coverage to purchase. Younger children generally require less coverage than older children, and children with pre-existing medical conditions may require more coverage or may be ineligible for certain types of policies.

Finally, grandparents should shop around for the best rates and coverage options. Life insurance policies can vary significantly in terms of cost and coverage, so it’s important to do your research and compare multiple policies before making a decision.

As a professional writer, I understand the importance of planning for the future, and that includes protecting our loved ones. Life insurance is a vital component of this plan, and while it may be common for parents to purchase life insurance policies for their children, it’s also worth considering grandparents taking on this responsibility.

Grandparents can have a significant impact on their grandchildren’s lives, and purchasing life insurance is a way to provide a lasting legacy. Life insurance can help cover the cost of funeral expenses, outstanding debts, and provide a financial cushion for their future. It’s a gift that will continue to give long after they’re gone, and also shows their commitment and love towards their grandchildren. So, it’s worth considering if grandparents want to leave a lasting impact on their grandchildren’s lives.

In conclusion, grandparents have a unique opportunity to provide financial security for their grandchildren by purchasing life insurance policies. It’s a way to show their love and commitment by providing a lasting legacy that will continue to support their grandchildren long after they’re gone. It’s a decision that requires careful consideration and planning, but the potential benefits can make it a worthwhile investment for both the grandparents and their beloved grandchildren.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts