Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a responsible individual, you may have decided to purchase umbrella insurance to provide additional protection for your assets. However, you may be wondering if it’s possible to get umbrella insurance without having auto insurance. Umbrella insurance is designed to provide an extra layer of liability coverage over your primary insurance policies, such as home or auto insurance. But is it possible to purchase umbrella insurance without auto insurance?

The answer to this question is not straightforward. While it is possible to purchase umbrella insurance without auto insurance, it might not be the best decision for you. In this article, we will explore the pros and cons of getting umbrella insurance without auto insurance and help you make an informed decision about your insurance needs.

Contents

- Can I Get Umbrella Insurance Without Auto Insurance?

- Frequently Asked Questions

- Can I Get Umbrella Insurance Without Auto Insurance?

- What Are the Benefits of Getting Umbrella Insurance?

- How Much Umbrella Insurance Should I Get?

- How Much Does Umbrella Insurance Cost?

- How Do I Purchase Umbrella Insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Can I Get Umbrella Insurance Without Auto Insurance?

If you’re looking to protect yourself from potential financial losses, you may be considering umbrella insurance. This type of policy provides additional liability coverage beyond what your other insurance policies offer. But can you get umbrella insurance without auto insurance? Let’s explore this question in more detail.

Understanding Umbrella Insurance

Umbrella insurance is a type of liability insurance that provides coverage beyond what your other insurance policies offer. It’s designed to protect you from financial losses that exceed the limits of your auto, home, or other insurance policies. Umbrella insurance can cover a wide range of incidents, from car accidents to slip-and-fall accidents on your property.

Benefits of Umbrella Insurance

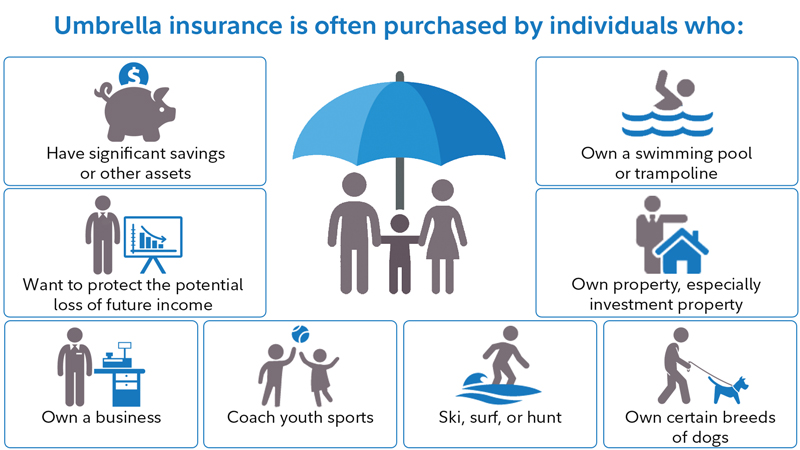

One of the main benefits of umbrella insurance is that it can provide additional liability coverage at a relatively low cost. For a few hundred dollars a year, you can get millions of dollars in coverage. This can be especially valuable if you have significant assets that you want to protect.

Another benefit of umbrella insurance is that it can cover you for incidents that your other insurance policies may not. For example, if you’re sued for libel or slander, your umbrella policy may provide coverage beyond what your homeowners’ policy offers.

Umbrella Insurance Vs. Auto Insurance

Umbrella insurance and auto insurance provide different types of coverage. Auto insurance covers damages and injuries that you may cause while driving, while umbrella insurance provides additional liability coverage for a wide range of incidents. While you can purchase umbrella insurance without auto insurance, it’s important to note that many insurance companies require you to have underlying insurance policies in place before you can purchase umbrella insurance.

Do You Need Auto Insurance to Get Umbrella Insurance?

While you can technically purchase umbrella insurance without auto insurance, it may be difficult to find an insurance company that will sell you a policy. Many insurance companies require you to have underlying insurance policies in place before you can purchase umbrella insurance. This is because umbrella insurance is designed to provide additional coverage beyond what your other insurance policies offer.

What Insurance Policies Do You Need?

To qualify for umbrella insurance, you typically need to have underlying insurance policies in place, such as auto insurance, homeowners’ insurance, or renters’ insurance. The amount of coverage you need will depend on your assets and your level of risk. For example, if you have a lot of assets, you may want to have higher limits on your auto and homeowners’ insurance policies.

What Happens If You Don’t Have Auto Insurance?

If you don’t have auto insurance, you may have difficulty finding an insurance company that will sell you an umbrella policy. This is because auto insurance is typically one of the underlying insurance policies that insurance companies require you to have in place before you can purchase umbrella insurance. If you’re unable to find an insurance company that will sell you an umbrella policy without auto insurance, you may need to purchase auto insurance first.

The Bottom Line

While you can technically purchase umbrella insurance without auto insurance, it may be difficult to find an insurance company that will sell you a policy. Many insurance companies require you to have underlying insurance policies in place before you can purchase umbrella insurance. If you’re considering umbrella insurance, it’s important to speak with an insurance agent to determine what types of coverage you need and how much coverage is appropriate for your situation. Remember, umbrella insurance is designed to provide additional liability coverage beyond what your other insurance policies offer, so it’s important to have those policies in place first.

Frequently Asked Questions

Can I Get Umbrella Insurance Without Auto Insurance?

Yes, you can get umbrella insurance without auto insurance. In fact, umbrella insurance is meant to provide additional liability coverage on top of your existing insurance policies, including auto insurance. However, most insurance companies require you to have a certain amount of liability coverage on your underlying policies before you can purchase an umbrella policy. This means that if you don’t have auto insurance or any other underlying policy, you may not be eligible for umbrella insurance.

It’s important to note that umbrella insurance is not a standalone policy and it does not cover your personal property or damages to your own car. It only provides additional liability coverage beyond the limits of your underlying policies. So, if you don’t have any underlying policies, there may not be any liability coverage to supplement with an umbrella policy.

What Are the Benefits of Getting Umbrella Insurance?

Umbrella insurance provides additional liability coverage beyond the limits of your underlying policies. This means that if you are ever sued for damages that exceed the limits of your underlying policies, your umbrella policy will kick in and provide additional coverage. Without umbrella insurance, you would be responsible for paying the remaining damages out of your own pocket.

Another benefit of umbrella insurance is that it can provide coverage for incidents that are not covered by your underlying policies, such as libel and slander. Umbrella insurance can also provide coverage for legal fees and other related expenses that you may incur in the event of a lawsuit.

How Much Umbrella Insurance Should I Get?

The amount of umbrella insurance you should get depends on your individual needs and circumstances. You should consider factors such as your assets, income, and potential liability risks when determining how much coverage you need. It’s important to have enough coverage to protect your assets in the event of a lawsuit.

Most insurance companies offer umbrella policies in increments of $1 million, so you can choose the amount of coverage that best fits your needs. Your insurance agent can help you determine how much coverage you need based on your individual situation.

How Much Does Umbrella Insurance Cost?

The cost of umbrella insurance varies depending on several factors, such as the amount of coverage you need, your location, and your individual risk factors. On average, umbrella insurance costs between $200 and $400 per year for $1 million in coverage. However, the cost can be higher or lower depending on your specific situation.

It’s important to note that umbrella insurance is a relatively inexpensive way to provide additional liability coverage. The cost of a lawsuit can be much higher than the cost of an umbrella policy, so it’s worth considering as a way to protect your assets.

How Do I Purchase Umbrella Insurance?

To purchase umbrella insurance, you will need to contact an insurance agent or broker. They can help you determine how much coverage you need and provide you with quotes from multiple insurance companies. You will need to provide information about your assets, income, and other relevant factors to determine your eligibility for umbrella insurance.

Once you have chosen a policy and made a payment, your umbrella coverage will begin. It’s important to review your policy carefully and understand the terms and conditions of your coverage, including any exclusions or limitations. Your insurance agent can help you understand your policy and answer any questions you may have.

In today’s unpredictable world, it is essential to consider all the options that can protect you and your assets. Umbrella insurance is one such option that can provide additional coverage beyond your existing policies. However, many people wonder if they can purchase umbrella insurance without having auto insurance.

The answer is yes, you can get umbrella insurance without auto insurance. Umbrella insurance is a standalone policy that covers you for any liability that exceeds the coverage limits of your primary insurance policies, such as home, auto, or boat insurance. Therefore, even if you do not have an auto insurance policy, you can still purchase umbrella insurance to protect your assets and provide added peace of mind. However, it is always recommended to have primary insurance policies in place before considering an umbrella policy to ensure comprehensive coverage.

In conclusion, umbrella insurance is a valuable option for anyone looking to protect themselves and their assets from potential lawsuits and liability. While having primary insurance policies is recommended, it is possible to purchase umbrella insurance without auto insurance. As a professional writer, I urge you to consider all the available options and consult with an insurance agent to determine the best policy for your unique situation.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts