Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Car accidents can be traumatic experiences that can leave individuals with physical and emotional pain. If you have been involved in a car accident, you may be wondering if you can sue your auto insurance for pain and suffering. This is a question that many people ask, and it’s important to understand the legal options available to you.

While auto insurance is designed to protect you in the event of an accident, it may not always be enough to cover the full extent of your damages. If you have suffered significant pain and suffering due to a car accident, you may be entitled to compensation beyond what your insurance company is willing to pay. In this article, we will explore the legal options available to you and help you determine if suing your auto insurance for pain and suffering is the right choice for you.

Can You Sue Auto Insurance for Pain and Suffering?

Understanding Pain and Suffering Claims

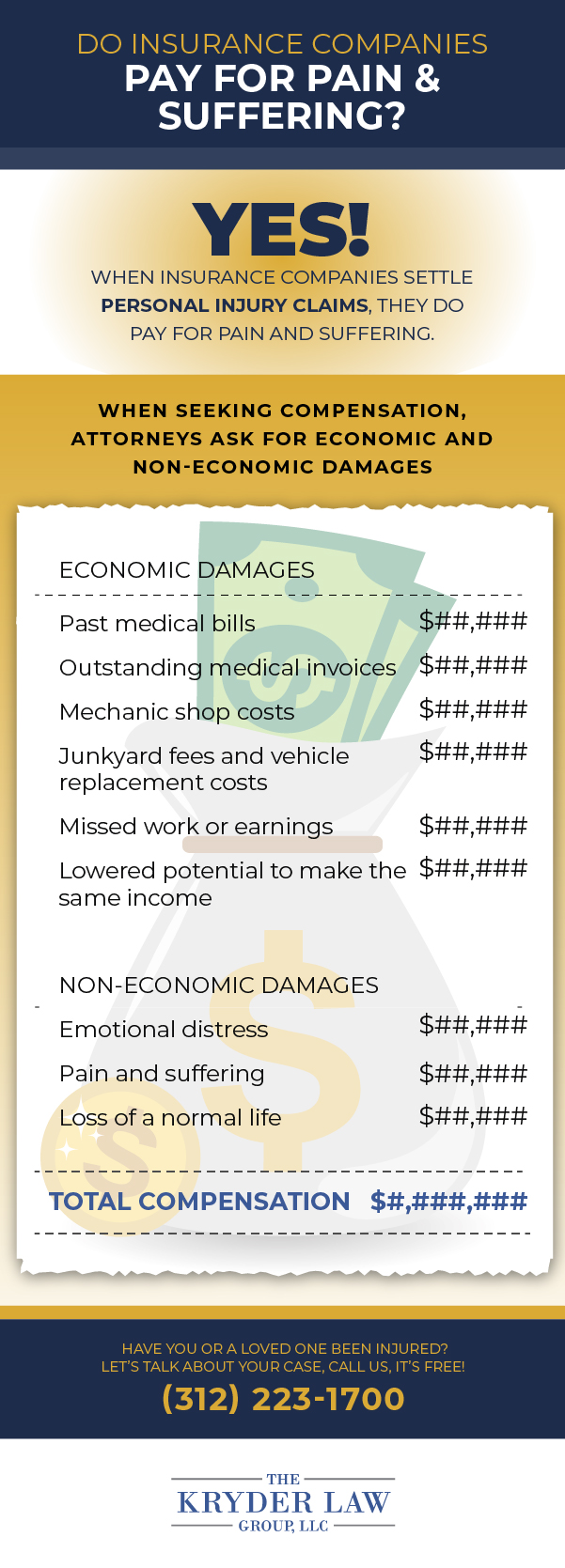

When you are involved in an auto accident, you may experience physical injuries, emotional distress, and mental anguish. These damages are known as pain and suffering, and they can be compensated through a personal injury claim. Pain and suffering claims cover a wide range of damages, including physical pain, emotional distress, mental anguish, loss of enjoyment of life, and loss of consortium. However, not all auto insurance policies offer coverage for pain and suffering claims.

To determine whether you can sue auto insurance for pain and suffering, you need to understand the type of coverage you have. Most states require drivers to carry liability insurance, which covers damages to other drivers, passengers, and property in the event of an accident. Liability insurance does not cover pain and suffering claims. However, if you have a comprehensive or collision insurance policy, you may be able to file a claim for pain and suffering.

When You Can Sue for Pain and Suffering

To sue auto insurance for pain and suffering, you need to meet certain criteria. First, you need to show that the other driver was at fault for the accident. This can be done by gathering evidence, such as police reports, witness statements, and medical records. Second, you need to prove that you have suffered damages as a result of the accident, including physical injuries and emotional distress. Finally, you need to show that the damages you suffered are significant enough to warrant compensation.

If you meet these criteria, you may be able to file a personal injury lawsuit against the other driver’s insurance company. The lawsuit will seek compensation for your pain and suffering, as well as other damages such as medical bills, lost wages, and property damage. If your case is successful, you may be awarded a settlement or a judgment that covers your damages.

The Benefits of Filing a Pain and Suffering Claim

Filing a pain and suffering claim can provide several benefits. First, it can help you recover the damages you have suffered as a result of the accident. This can include compensation for medical bills, lost wages, and property damage, as well as pain and suffering. Second, it can hold the other driver accountable for their actions, and discourage them from engaging in reckless or negligent behavior in the future. Finally, it can provide closure and peace of mind, knowing that justice has been served.

Pain and Suffering Claims vs. No-Fault Insurance

Some states have no-fault insurance laws, which require drivers to carry personal injury protection (PIP) insurance. Under these laws, drivers can file a claim with their own insurance company regardless of who was at fault for the accident. However, no-fault insurance typically does not cover pain and suffering claims. If you live in a no-fault state, you may need to meet certain criteria to sue auto insurance for pain and suffering.

The Role of an Attorney in Pain and Suffering Claims

If you are considering filing a pain and suffering claim, it is important to seek the advice of an experienced personal injury attorney. An attorney can help you understand your rights and options, and guide you through the legal process. They can also help you gather evidence, negotiate with insurance adjusters, and represent you in court if necessary.

The Bottom Line

If you have suffered physical injuries and emotional distress as a result of an auto accident, you may be able to sue auto insurance for pain and suffering. However, you need to meet certain criteria and have the right type of insurance coverage. It is also important to seek the advice of an experienced personal injury attorney to help you navigate the legal process and maximize your chances of success.

Contents

- Frequently Asked Questions

- 1. Can I sue my auto insurance company for pain and suffering?

- 2. What is pain and suffering?

- 3. How are pain and suffering damages calculated?

- 4. What should I do if I want to sue for pain and suffering?

- 5. Can I still sue for pain and suffering if I was partially at fault for the accident?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Auto accidents can result in significant physical, emotional, and financial harm. If you have been injured in an auto accident, you may be wondering whether you can sue your auto insurance company for pain and suffering. Below are some commonly asked questions and answers regarding this topic.

1. Can I sue my auto insurance company for pain and suffering?

It depends on the circumstances of your case. In some states, you may be able to file a lawsuit against your own insurance company for pain and suffering if you have purchased uninsured/underinsured motorist coverage. This coverage is designed to protect you in the event that you are involved in an accident with a driver who does not have enough insurance to cover your damages. If you have this type of coverage, you may be able to sue your own insurance company for pain and suffering if the other driver is uninsured or underinsured.

However, if you do not have uninsured/underinsured motorist coverage, you may not be able to sue your own insurance company for pain and suffering. Instead, you may need to pursue a claim against the at-fault driver’s insurance company.

2. What is pain and suffering?

Pain and suffering refers to the physical and emotional distress that a person experiences as a result of an accident. This can include things like physical pain, emotional trauma, anxiety, depression, and loss of enjoyment of life. Pain and suffering damages are designed to compensate a person for the harm they have suffered as a result of an accident.

In some cases, pain and suffering damages may be awarded in addition to other damages, such as medical expenses and lost wages. The amount of pain and suffering damages that a person may be entitled to will depend on the specific circumstances of their case.

3. How are pain and suffering damages calculated?

Calculating pain and suffering damages can be a complex process. There is no set formula for determining how much a person should receive for pain and suffering damages. Instead, these damages are typically calculated based on the severity of the person’s injuries, the impact of those injuries on their life, and other factors such as the length of their recovery and the amount of medical treatment they require.

To determine the amount of pain and suffering damages that a person may be entitled to, an attorney may consider factors such as the person’s medical bills, lost wages, and other financial losses, as well as the emotional impact of the accident on their life.

4. What should I do if I want to sue for pain and suffering?

If you are considering suing for pain and suffering, it is important to speak with an experienced personal injury attorney. Your attorney can review the circumstances of your case and help you determine whether you have a valid claim. They can also help you understand the legal process and what to expect during your case.

Before filing a lawsuit, it is important to gather evidence to support your claim. This may include medical records, police reports, witness statements, and other documentation related to the accident. Your attorney can help you gather this evidence and build a strong case for damages.

5. Can I still sue for pain and suffering if I was partially at fault for the accident?

It depends on the laws in your state. Some states follow a “comparative negligence” rule, which means that a person can still recover damages even if they were partially at fault for the accident. However, the amount of damages they can recover may be reduced based on their degree of fault.

In other states, a person may be barred from recovering any damages if they were partially at fault for the accident. Your attorney can help you understand the laws in your state and how they may affect your ability to recover damages for pain and suffering.

As a professional writer, I understand the complexities of the legal system and the emotional toll that can come from a car accident. The question of whether you can sue auto insurance for pain and suffering is not a simple one. While some states allow for such lawsuits, others do not, and even in states where it is allowed, there are specific conditions that must be met.

If you have been injured in a car accident and are experiencing physical and emotional pain and suffering, it is important to consult with a qualified personal injury attorney who can help you understand your options. They can help you navigate the complex legal system and fight for the compensation you deserve. In the end, while it may not be easy, it is possible to hold auto insurance companies accountable for the harm they have caused and receive the compensation you need to move forward with your life.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts