Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Cancer is a disease that affects millions of people worldwide, and the cost of treatment can be enormous. For those over the age of 65, Medicare offers coverage for cancer treatment, but many wonder if it is enough. This leads to the question: do I need cancer insurance if I have Medicare?

The answer is not simple, as it depends on individual circumstances. While Medicare covers many aspects of cancer treatment, there are still out-of-pocket expenses that can quickly add up. In this article, we will explore the benefits and limitations of Medicare coverage for cancer treatment and discuss the advantages of having additional cancer insurance.

Yes, having cancer insurance is recommended even if you have Medicare. While Medicare covers most cancer-related expenses, it doesn’t cover everything. For example, cancer insurance can provide additional financial support for indirect costs like transportation, lodging, and childcare. It can also cover expenses like experimental treatments, which are not covered by Medicare. Therefore, having cancer insurance can give you extra protection against the high costs associated with cancer treatment.

Do I Need Cancer Insurance if I Have Medicare?

If you have Medicare, you may be wondering if you need cancer insurance. After all, Medicare covers a wide range of medical expenses, including cancer treatments. However, there are some things that Medicare does not cover, and having cancer insurance can provide additional protection and peace of mind. In this article, we’ll explore whether or not you need cancer insurance if you have Medicare.

What Does Medicare Cover for Cancer?

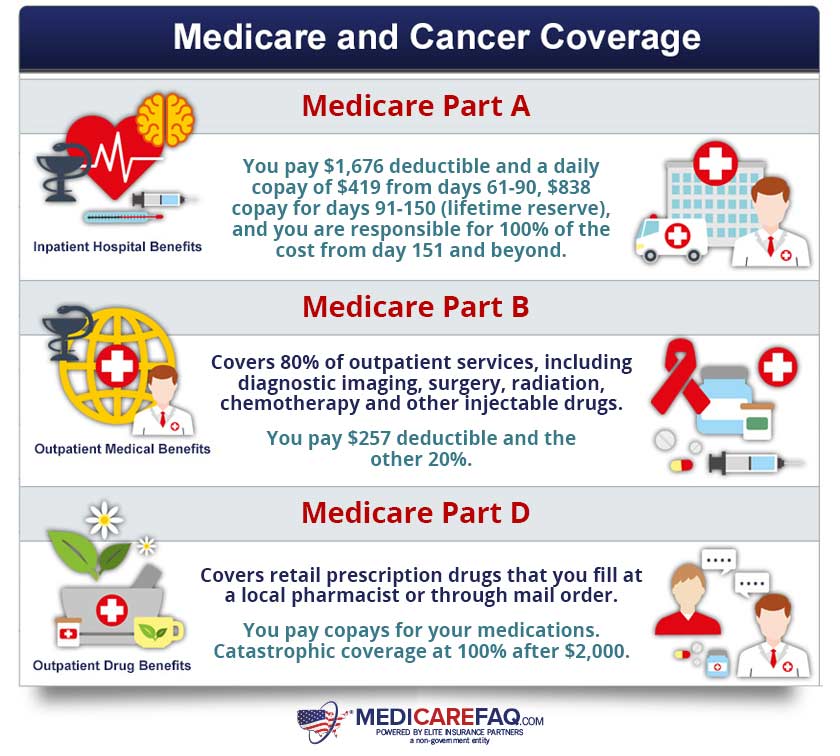

Medicare covers a range of cancer treatments, including chemotherapy, radiation therapy, and surgery. It also covers some cancer screenings, such as mammograms and Pap tests. However, there are some limitations to Medicare’s coverage for cancer. For example, Medicare may not cover all of the costs associated with cancer treatments, such as deductibles, copays, and coinsurance. Additionally, Medicare may not cover certain drugs or treatments that are not considered medically necessary.

Having cancer insurance can help fill in the gaps in Medicare’s coverage. Cancer insurance can provide additional financial support for cancer treatments, such as helping to pay for deductibles, copays, and coinsurance. It can also provide coverage for experimental treatments or alternative therapies that may not be covered by Medicare.

Benefits of Cancer Insurance

In addition to filling in the gaps in Medicare’s coverage, there are several other benefits to having cancer insurance. One of the biggest benefits is the financial protection it provides. Cancer can be a very expensive illness, and having cancer insurance can help alleviate the financial burden of cancer treatments. It can also provide coverage for additional expenses, such as travel costs for out-of-state treatments or home healthcare services.

Another benefit of cancer insurance is the flexibility it provides. Cancer insurance can be tailored to your individual needs and can be used to cover a variety of expenses. For example, you may choose to use your cancer insurance to pay for transportation to and from treatments, or to cover the cost of childcare while you are receiving treatments.

Cancer Insurance vs. Medicare Advantage

Another option to consider is Medicare Advantage plans. These plans are offered by private insurance companies and provide additional coverage beyond what is offered by Original Medicare. Some Medicare Advantage plans may include coverage for cancer treatments and other medical expenses not covered by Original Medicare.

However, it’s important to note that Medicare Advantage plans may have their own limitations and restrictions. For example, you may be restricted to certain doctors or hospitals, and there may be additional costs associated with these plans, such as monthly premiums or higher out-of-pocket expenses.

Conclusion

In conclusion, while Medicare does provide coverage for cancer treatments, having cancer insurance can provide additional protection and peace of mind. Cancer insurance can help fill in the gaps in Medicare’s coverage, provide financial support for cancer treatments, and offer flexibility in covering a variety of cancer-related expenses. When deciding whether or not to purchase cancer insurance, it’s important to consider your individual needs and circumstances, and to explore all of your options, including Medicare Advantage plans.

Contents

- Frequently Asked Questions

- Question 1: Do I need cancer insurance if I have Medicare?

- Question 2: What does cancer insurance cover that Medicare doesn’t?

- Question 3: How much does cancer insurance cost?

- Question 4: Can I get cancer insurance if I already have cancer?

- Question 5: How do I know if cancer insurance is right for me?

- Why You Need a Cancer Plan with Medicare Advantage

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Question 1: Do I need cancer insurance if I have Medicare?

If you have Medicare, you may think you don’t need cancer insurance, but it’s important to understand that Medicare doesn’t cover all cancer-related costs. For example, Medicare doesn’t cover many of the newer cancer treatments that can be extremely expensive. Cancer insurance, on the other hand, can help cover these costs and provide additional benefits such as cash payments for lost income during treatment.

That being said, whether or not you need cancer insurance depends on your individual circumstances. If you have a family history of cancer or other risk factors, you may want to consider cancer insurance to help protect yourself from the financial burden of a cancer diagnosis.

Question 2: What does cancer insurance cover that Medicare doesn’t?

Cancer insurance can help cover a wide range of cancer-related costs that Medicare doesn’t, including experimental treatments, travel expenses for treatment, and lost income during treatment. Additionally, cancer insurance can provide a lump sum payment upon diagnosis that can be used to cover any expenses related to your cancer treatment or recovery.

It’s important to note that the specific benefits of cancer insurance can vary depending on the policy you choose. Be sure to carefully review the details of any policy you’re considering to ensure it meets your individual needs.

Question 3: How much does cancer insurance cost?

The cost of cancer insurance can vary widely depending on a number of factors, including your age, health, and the level of coverage you choose. Generally, cancer insurance premiums are lower for younger individuals and those who are in good health.

It’s important to shop around and compare policies from multiple insurance providers to find the best coverage at the most affordable price. Be sure to carefully review the details of each policy you’re considering to ensure it meets your individual needs.

Question 4: Can I get cancer insurance if I already have cancer?

If you’ve already been diagnosed with cancer, it may be more difficult to obtain cancer insurance. Insurance providers may view you as a higher risk and charge higher premiums or deny coverage altogether.

That being said, it’s still possible to obtain cancer insurance in some cases. You may need to work with an insurance broker to find a provider that is willing to offer you coverage. Be prepared to provide detailed information about your diagnosis and treatment history to the insurance provider.

Question 5: How do I know if cancer insurance is right for me?

Deciding whether or not to purchase cancer insurance is a personal decision that depends on your individual circumstances. Factors to consider include your family history of cancer, your overall health, and your financial situation.

If you’re unsure whether cancer insurance is right for you, consider speaking with a financial advisor or insurance agent who can help you evaluate your options. They can help you determine whether cancer insurance makes sense for your individual needs and budget.

Why You Need a Cancer Plan with Medicare Advantage

As a professional writer, I understand the importance of protecting oneself against any unforeseen circumstances. When it comes to healthcare, the need for insurance coverage becomes even more significant. The question of whether one needs cancer insurance if they have Medicare is a valid concern. Although Medicare covers a vast range of medical services and treatments, it may not cover all the expenses one may incur while undergoing cancer treatment.

Cancer is a serious illness that requires comprehensive treatment, which can be financially draining. Cancer insurance can provide an additional layer of financial protection to individuals with Medicare. It can help cover the cost of treatments, medications, and other related expenses that Medicare may not cover. Ultimately, the decision of whether to invest in cancer insurance depends on individual circumstances and preference. However, having cancer insurance can offer peace of mind and financial security during a challenging time.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts