Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As the opioid epidemic continues to ravage communities across the globe, the question of life insurance coverage for accidental overdose is becoming increasingly prevalent. Families of those who have lost their lives to drug overdoses are often left with many unanswered questions, including whether or not their loved one’s life insurance policy will provide any financial support. In this article, we will explore the topic of life insurance coverage for accidental overdose and shed light on some of the key considerations that policyholders should keep in mind.

While the answer to whether or not life insurance covers accidental overdose may seem straightforward, the reality is far more complex. The terms and conditions of life insurance policies can vary widely, and the circumstances surrounding the overdose can also play a significant role in determining whether or not the policy will provide coverage. By examining some of the factors that can impact life insurance coverage for accidental overdose, we hope to provide readers with a clearer understanding of this important issue.

Yes, most life insurance policies will cover accidental overdose. However, coverage may be denied if the overdose was intentional or the result of illegal drug use. It is important to review your policy and speak with your insurance provider to fully understand your coverage and any exclusions.

Contents

- Does Life Insurance Cover Accidental Overdose?

- Frequently Asked Questions

- Does life insurance cover accidental overdose?

- What types of accidental overdose are covered by life insurance?

- What should I do if my loved one dies from accidental overdose?

- What if the policyholder had a history of drug or alcohol abuse?

- Do I need to disclose my history of drug or alcohol abuse when applying for life insurance?

- 🚨Does Life Insurance Pays Out For Deaths Due To Drug Overdose?🤔‼️

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Does Life Insurance Cover Accidental Overdose?

Accidental overdose is a growing problem in the United States. According to the Centers for Disease Control and Prevention (CDC), drug overdose deaths have been on the rise since the early 2000s. The majority of these deaths are due to accidental overdoses, which occur when a person takes too much of a substance or mixes drugs that react poorly together. In the event of an accidental overdose, many people wonder if their life insurance policy will cover the costs associated with treatment or death.

What is Accidental Overdose?

Accidental overdose occurs when a person takes too much of a drug, whether it’s a prescription medication or an illegal substance. It can happen to anyone, regardless of age, gender, or socioeconomic status. Accidental overdoses can be caused by a number of factors, including:

- Taking too much of a medication

- Mixing drugs that react poorly together

- Using drugs in a way that is not prescribed

- Using drugs in combination with alcohol

Does Life Insurance Cover Accidental Overdose?

The short answer is yes, life insurance policies typically cover accidental overdose. However, there are some important factors to consider.

First, most life insurance policies have a waiting period before accidental death is covered. This waiting period can vary from policy to policy, but it’s usually between one and two years. If the policyholder dies from an accidental overdose during the waiting period, the death may not be covered.

Second, if the policyholder knowingly takes illegal drugs, the death may not be covered. This is because most life insurance policies have exclusions for deaths caused by illegal activity.

Benefits of Life Insurance for Accidental Overdose

While no one wants to think about the possibility of an accidental overdose, it’s important to consider the financial impact it could have on your loved ones. If you have a life insurance policy that covers accidental death, your beneficiaries will receive a lump sum payment in the event of your death. This payment can be used to cover medical expenses, funeral costs, and any other expenses associated with your death.

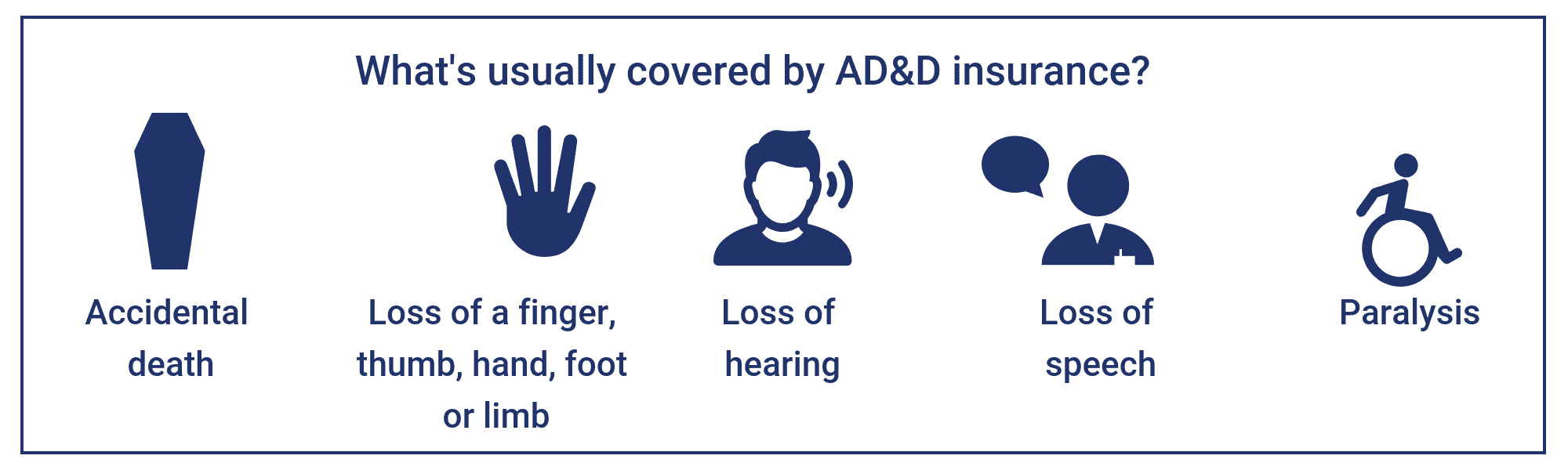

Additionally, some life insurance policies offer accidental death and dismemberment (AD&D) coverage. This type of coverage provides additional benefits if the policyholder is injured or disabled as a result of an accident.

Life Insurance vs. Accidental Death and Dismemberment Insurance

It’s important to understand the difference between life insurance and accidental death and dismemberment insurance. While both types of policies can provide financial protection in the event of an accidental overdose, they work differently.

Life insurance is designed to provide financial support to your beneficiaries after you die. It can cover a range of expenses, including medical bills, funeral costs, and outstanding debts.

Accidental death and dismemberment insurance, on the other hand, only provides benefits if the policyholder dies or is injured as a result of an accident. This type of policy may provide a lump sum payment to the policyholder or their beneficiaries, depending on the terms of the policy.

Conclusion

Accidental overdose is a serious problem in the United States, and it’s important to understand how your life insurance policy can provide financial protection in the event of an overdose. While most policies do cover accidental death, it’s important to be aware of any waiting periods or exclusions that may apply. Additionally, it’s important to consider the benefits of both life insurance and accidental death and dismemberment insurance, and choose the policy that best meets your needs.

Frequently Asked Questions

Does life insurance cover accidental overdose?

Yes, life insurance can cover accidental overdose, but it depends on the policy’s terms and conditions. If the policyholder dies due to an accidental overdose, the beneficiary can receive the death benefit. However, certain exclusions may apply, such as if the policyholder intentionally took an excessive amount of medication or drugs.

It’s important to review the policy’s terms and conditions, including any exclusions, before purchasing life insurance. If you already have a policy and have questions about coverage for accidental overdose, you can contact your insurance provider for more information.

What types of accidental overdose are covered by life insurance?

Life insurance can cover accidental overdose from various sources, including prescription medications, illegal drugs, and alcohol. However, the policy’s terms and conditions will determine the coverage. For example, some policies may exclude coverage for overdose from illegal drugs.

It’s important to review the policy’s terms and conditions carefully to understand the coverage limitations and exclusions for accidental overdose. If you have questions or concerns about the coverage, you can contact your insurance provider for assistance.

What should I do if my loved one dies from accidental overdose?

If your loved one dies from accidental overdose, you should contact your insurance provider as soon as possible to file a claim. The insurance provider will require documentation, such as a death certificate, to process the claim.

It’s important to review the policy’s terms and conditions to understand the requirements for filing a claim. If you have questions or need assistance with the claims process, you can contact your insurance provider or a licensed insurance agent.

What if the policyholder had a history of drug or alcohol abuse?

If the policyholder had a history of drug or alcohol abuse, it may impact the coverage for accidental overdose. Some policies may exclude coverage for accidental overdose if the policyholder had a history of substance abuse.

It’s important to review the policy’s terms and conditions carefully to understand any exclusions or limitations on coverage. If you have questions or concerns about the coverage, you can contact your insurance provider for assistance.

Do I need to disclose my history of drug or alcohol abuse when applying for life insurance?

Yes, it’s important to disclose any history of drug or alcohol abuse when applying for life insurance. Failure to disclose this information could result in the policy being voided or denied.

Disclosing this information may impact the policy’s premiums or coverage limitations, but it’s important to be honest with the insurance provider. If you have questions about how your history of drug or alcohol abuse may impact your life insurance application, you can contact a licensed insurance agent for assistance.

🚨Does Life Insurance Pays Out For Deaths Due To Drug Overdose?🤔‼️

In today’s world, where the drug epidemic is wreaking havoc, accidental overdose has become a common occurrence. The death of a loved one due to an overdose is not only emotionally traumatizing but also financially draining. This leads to the question, does life insurance cover accidental overdose? The answer is not as straightforward as one might think.

While most life insurance policies do cover accidental death, the circumstances surrounding the overdose will determine if the claim can be honored. If the insured individual dies due to an overdose of illicit drugs or after consuming more than the prescribed amount of medication, the insurance company may deny the claim. However, if the overdose was accidental and occurred as a result of a medical error or due to a pre-existing health condition, the policy may cover it. It is crucial to read the fine print of the policy and understand the exclusions to avoid any confusion or disappointment during the claims process.

In conclusion, life insurance may cover accidental overdose, but it depends on the specific circumstances surrounding the death. As a professional writer, I implore readers to carefully review their policies and consider purchasing additional coverage, such as accidental death and dismemberment insurance, to ensure that their loved ones are protected in the event of an accidental overdose. We cannot predict the future, but we can take steps to safeguard our families’ financial well-being.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts