Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As a small business owner, providing health insurance benefits to your employees is an important consideration. Not only does it show that you value their well-being, but it can also help attract and retain top talent. However, one of the most common questions that small business owners have is how much group health insurance will cost.

The cost of group health insurance for a small business can vary widely depending on a number of factors, including the size of the company, the industry, and the location. It can also depend on the specific plan chosen and the level of coverage provided. In this article, we will explore the different factors that can impact the cost of group health insurance for small businesses and provide some tips on how to find the best plan for your company.

Contents

- Group Health Insurance for Small Businesses: Cost and Benefits

- Frequently Asked Questions

- What is Group Health Insurance for a Small Business?

- How much does Group Health Insurance cost for a Small Business?

- What are the benefits of Group Health Insurance for a Small Business?

- What options are available for Small Businesses when it comes to Group Health Insurance?

- How can Small Businesses find the right Group Health Insurance plan?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Group Health Insurance for Small Businesses: Cost and Benefits

What is Group Health Insurance for Small Businesses?

Group health insurance is an insurance plan that provides coverage for a group of people, typically employees of a company or members of an association. Small businesses can benefit from group health insurance plans by providing their employees with access to affordable health care benefits that they may not be able to afford on their own.

Group health insurance plans typically offer a range of benefits, including hospitalization, prescription drug coverage, and preventative care services. These plans can be customized to meet the specific needs of a small business and its employees.

How Much Does Group Health Insurance Cost for Small Businesses?

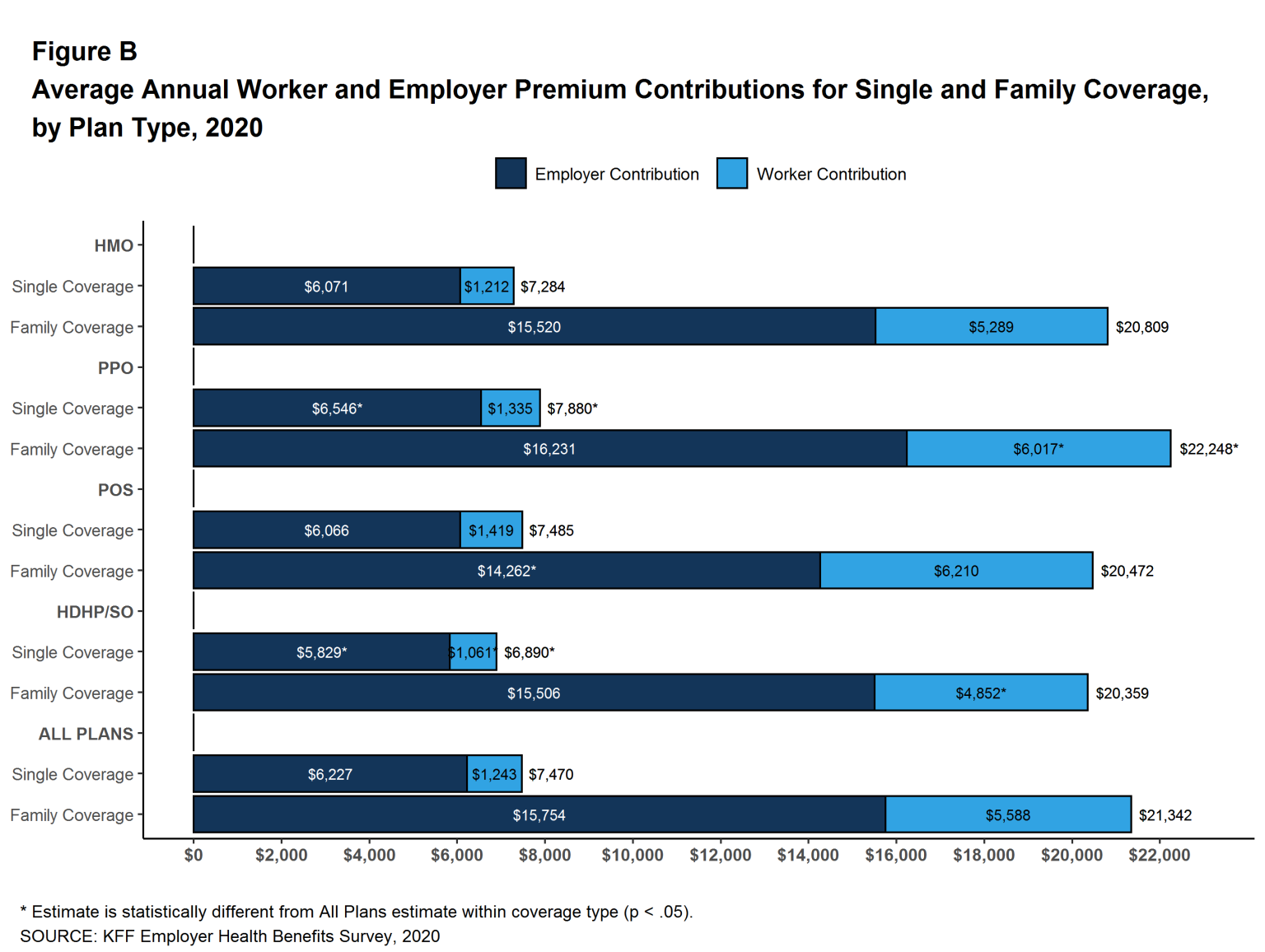

The cost of group health insurance for small businesses varies depending on a number of factors, such as the size of the business, the location of the business, and the type of plan chosen. Generally, group health insurance premiums are lower than individual health insurance premiums because the risk is spread across a larger group of people.

Small businesses can expect to pay anywhere from $200 to $1,000 per employee per month for group health insurance coverage. However, many factors can affect the cost of group health insurance, such as the type of plan chosen, the age and health of the employees, and the company’s location.

Types of Group Health Insurance Plans for Small Businesses

There are several types of group health insurance plans available for small businesses, including:

- Health Maintenance Organizations (HMOs) – These plans require employees to choose a primary care physician who will coordinate their care with other healthcare providers in the network.

- Preferred Provider Organizations (PPOs) – These plans allow employees to choose from a network of healthcare providers, but also allow them to seek care outside the network at a higher cost.

- Point of Service (POS) Plans – These plans combine elements of HMOs and PPOs, requiring employees to choose a primary care physician and allowing them to seek care outside the network at a higher cost.

The type of plan chosen will affect the cost of group health insurance for small businesses.

Benefits of Group Health Insurance for Small Businesses

There are several benefits of group health insurance for small businesses, including:

- Attracting and retaining employees – Offering health care benefits can help attract and retain quality employees who may otherwise seek employment elsewhere.

- Lowering costs – Group health insurance premiums are typically lower than individual health insurance premiums, which can help small businesses save money.

- Tax benefits – Small businesses may be eligible for tax credits for offering health care benefits to their employees.

- Improving employee health – Providing access to preventative care services can help employees stay healthy, which can improve productivity and reduce absenteeism.

Group Health Insurance vs. Individual Health Insurance

Group health insurance and individual health insurance differ in several ways, including:

- Cost – Group health insurance premiums are typically lower than individual health insurance premiums.

- Customization – Group health insurance plans can be customized to meet the specific needs of a small business and its employees.

- Access to care – Group health insurance plans typically provide access to a network of healthcare providers, while individual health insurance plans may only cover care from certain providers.

- Enrollment – Group health insurance plans typically have an open enrollment period, while individual health insurance plans can be purchased at any time.

In conclusion, group health insurance can be an affordable and beneficial option for small businesses looking to provide healthcare benefits to their employees. By understanding the costs, types of plans available, and benefits of group health insurance, small businesses can make an informed decision about which plan is right for them.

Frequently Asked Questions

What is Group Health Insurance for a Small Business?

Group Health Insurance for a Small Business is a type of health insurance coverage that is purchased by an employer for their employees. It is a cost-effective way of providing health insurance to employees, as the premiums are split between the employer and the employees. The coverage provided by Group Health Insurance usually includes medical, dental, and vision benefits.

Group Health Insurance provides a number of benefits for small businesses. Firstly, it helps to attract and retain employees, as health insurance is a highly valued benefit. It also helps to improve employee morale and productivity, as employees are more likely to be healthy and focused if they have access to healthcare. Additionally, Group Health Insurance can help small businesses to save money on healthcare costs, as the premiums are typically lower than individual health insurance plans.

How much does Group Health Insurance cost for a Small Business?

The cost of Group Health Insurance for a Small Business varies depending on a number of factors, such as the size of the business, the level of coverage required, and the location of the business. Generally, the cost of Group Health Insurance for a Small Business is calculated based on the number of employees that will be covered, and the average age and health of those employees.

Small businesses can also take advantage of tax credits to help offset the cost of Group Health Insurance. The Small Business Health Care Tax Credit is available to businesses with fewer than 25 full-time equivalent employees, and can cover up to 50% of the cost of premiums.

What are the benefits of Group Health Insurance for a Small Business?

Group Health Insurance provides a number of benefits for small businesses. Firstly, it helps to attract and retain employees, as health insurance is a highly valued benefit. It also helps to improve employee morale and productivity, as employees are more likely to be healthy and focused if they have access to healthcare. Additionally, Group Health Insurance can help small businesses to save money on healthcare costs, as the premiums are typically lower than individual health insurance plans.

Group Health Insurance also provides benefits for employees. It provides them with access to healthcare, which can help them to stay healthy and productive. It also provides them with financial protection in the event of a medical emergency, as the insurance will cover a portion of their medical expenses.

What options are available for Small Businesses when it comes to Group Health Insurance?

Small businesses have a number of options when it comes to Group Health Insurance. They can choose to purchase a fully-insured plan, which is provided by an insurance company and covers a set range of benefits. Alternatively, they can choose to purchase a self-insured plan, which allows the business to take on the risk of providing healthcare coverage to their employees.

Small businesses can also choose between a number of different plan types, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point of Service (POS) plans. These plans differ in terms of the amount of flexibility and choice that employees have when it comes to choosing healthcare providers.

How can Small Businesses find the right Group Health Insurance plan?

Finding the right Group Health Insurance plan for a Small Business can be a complex process. It is important to consider factors such as the size of the business, the level of coverage required, and the budget available. Small businesses can work with an insurance broker or agent to help them navigate the process of selecting a Group Health Insurance plan.

It is also important to review the plan options carefully, and to consider factors such as the range of benefits provided, the cost of premiums and deductibles, and the network of healthcare providers that are included in the plan. By taking the time to carefully consider these factors, small businesses can find the right Group Health Insurance plan to meet the needs of their employees.

As a small business owner, offering group health insurance to your employees is a crucial decision. It not only benefits your employees’ health but also helps attract and retain top talent by offering a competitive benefits package. The cost of group health insurance for small businesses can vary based on various factors such as the number of employees, age, and location. However, the benefits of providing group health insurance outweigh the cost.

When deciding on group health insurance for your small business, it’s crucial to consider the long-term benefits and the impact it can have on your employees’ well-being. By providing health insurance, you can show your employees that you value their health and are invested in their future. Additionally, group health insurance can lead to increased employee satisfaction and productivity as employees have peace of mind knowing that they have access to quality healthcare. Overall, investing in group health insurance for your small business can be a wise decision that can yield positive returns for both your employees and your business.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts