Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Index Universal Life Insurance is one of the most popular insurance policies available today. It offers a unique combination of life insurance coverage and investment opportunities that can help you build wealth and protect your family’s financial future. However, getting an Index Universal Life Insurance policy can be a daunting task if you don’t know where to start.

In this article, we’ll guide you through the process of getting Index Universal Life Insurance. We’ll cover everything from understanding what Index Universal Life Insurance is, to finding the right provider, to choosing the right policy for your needs. So whether you’re looking to protect your family’s financial future, build wealth, or both, read on to learn how you can get started with Index Universal Life Insurance.

How to Get Index Universal Life Insurance?

Index universal life insurance can be obtained through an insurance agent or broker. First, assess your insurance needs and budget to determine the coverage amount and premium payment that works best for you. Then, shop around and compare policies from different insurance companies to find the best fit for your needs. Finally, fill out an application and provide any necessary documentation, such as medical records or financial information, to complete the process.

Contents

- How to Get Index Universal Life Insurance?

- Frequently Asked Questions

- What is Index Universal Life Insurance?

- How do I know if Index Universal Life Insurance is right for me?

- What factors should I consider when choosing an Index Universal Life Insurance policy?

- How much does Index Universal Life Insurance cost?

- How do I apply for Index Universal Life Insurance?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How to Get Index Universal Life Insurance?

Index Universal Life Insurance (IUL) is a popular type of life insurance that offers both protection and investment opportunities. If you’re interested in getting IUL, here’s what you need to know.

1. Understanding Index Universal Life Insurance

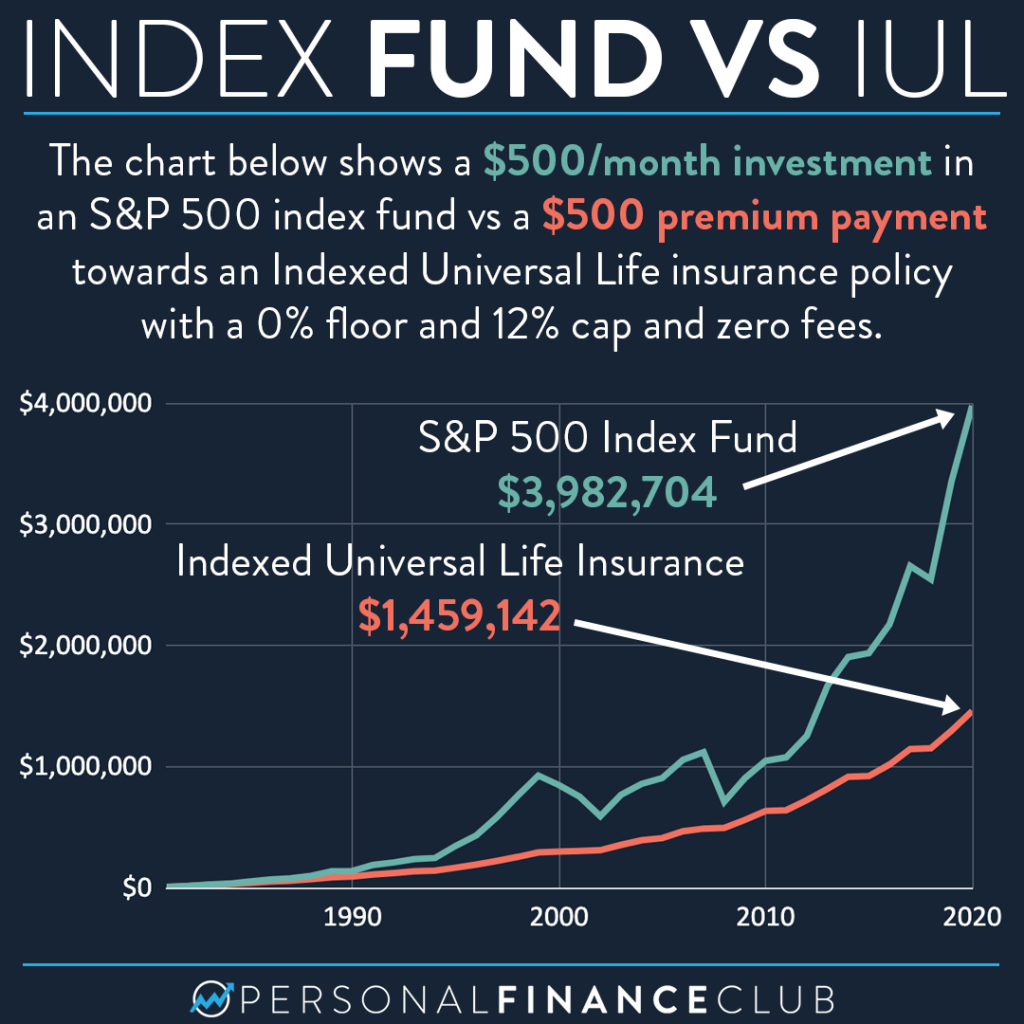

Index Universal Life Insurance is a type of permanent life insurance that allows you to build cash value over time. It’s similar to traditional whole life insurance but with more flexibility and investment opportunities. With IUL, a portion of your premium goes towards a death benefit while the rest is invested in an index, such as the S&P 500.

When the index performs well, your cash value grows along with it. However, if the index performs poorly, your cash value may not grow, but your death benefit is still protected. This makes IUL a good option for those who want to build wealth while still having life insurance protection.

The Benefits of IUL

- Flexible premiums and death benefits

- Tax-free growth on cash value

- Protection against market downturns

- Ability to access cash value for emergencies or retirement

IUL vs. Traditional Life Insurance

| Index Universal Life Insurance | Traditional Life Insurance |

|---|---|

| Flexible premiums and death benefits | Fixed premiums and death benefits |

| Investment opportunities | No investment opportunities |

| Protection against market downturns | No protection against market downturns |

2. Finding an IUL Policy

To find an IUL policy, you’ll need to work with an insurance agent who specializes in life insurance. They can help you determine your coverage needs, understand the investment options, and compare policies from different insurers.

When choosing an IUL policy, it’s important to consider the following:

- The insurer’s financial strength and reputation

- The investment options and index performance

- The fees and charges associated with the policy

- The flexibility of premiums and death benefits

Pros and Cons of Working with an Agent

| Pros | Cons |

|---|---|

| Expert advice and guidance | Potentially biased towards certain policies |

| Access to a variety of policies | May charge a fee or commission |

| Assistance with the application process | May not fully understand your financial situation |

3. Applying for IUL

Once you’ve chosen an IUL policy, you’ll need to fill out an application and undergo a medical exam. The insurer will review your medical history, lifestyle habits, and other factors to determine your risk level and premium rate.

It’s important to be honest and accurate when filling out your application, as any misrepresentations could result in a denied claim or cancellation of your policy.

What to Expect During the Medical Exam

- Height and weight measurements

- Blood pressure and pulse readings

- Blood and urine tests

- Medical history review

Factors That Could Affect Your Premium Rate

- Age and gender

- Health condition and history

- Lifestyle habits (e.g. smoking, drinking)

- Occupation and hobbies

4. Managing Your IUL Policy

After you’ve been approved for an IUL policy, it’s important to regularly review and manage your coverage to ensure it meets your needs.

You may need to adjust your premiums or death benefits over time, depending on changes in your financial situation or life circumstances. You should also review your investment options and index performance to ensure you’re getting the most out of your cash value.

Benefits of Regular Policy Reviews

- Ensure your coverage meets your changing needs

- Maximize your investment opportunities

- Identify any issues or discrepancies

Tips for Managing Your IUL Policy

- Set up automatic premium payments

- Regularly review your investment options and index performance

- Notify your insurer of any changes in your health or lifestyle

- Consider working with a financial advisor to maximize your wealth-building potential

Getting Index Universal Life Insurance can be a smart financial move for those who want both protection and investment opportunities. By understanding the basics of IUL, finding the right policy, and managing it effectively, you can build wealth and secure your family’s financial future.

Frequently Asked Questions

Index Universal Life Insurance is a type of permanent life insurance that allows you to build cash value while also providing death benefit protection. Here are some common questions about how to get Index Universal Life Insurance:

What is Index Universal Life Insurance?

Index Universal Life Insurance is a type of permanent life insurance that provides a death benefit to your beneficiaries while also allowing you to build cash value over time. This type of policy is tied to a particular stock market index, and your cash value can grow based on the performance of that index.

To get Index Universal Life Insurance, you’ll need to shop around for policies and work with an insurance agent or broker who can help you select a policy that meets your needs and budget.

How do I know if Index Universal Life Insurance is right for me?

If you’re looking for a permanent life insurance policy that provides death benefit protection and the potential for cash value growth, Index Universal Life Insurance may be a good choice for you. However, this type of policy may not be the best fit for everyone, so it’s important to talk to an insurance professional to determine if it’s the right choice for your individual needs and goals.

Your agent or broker can help you understand the benefits and drawbacks of Index Universal Life Insurance and help you make an informed decision about whether to purchase a policy.

What factors should I consider when choosing an Index Universal Life Insurance policy?

When choosing an Index Universal Life Insurance policy, there are several factors to consider. First, you’ll want to look at the death benefit amount and make sure it’s sufficient to meet the needs of your beneficiaries. You should also consider the policy’s fees and expenses, as well as the potential for cash value growth based on the performance of the index to which it’s tied.

In addition, you’ll want to consider the financial strength and stability of the insurance company offering the policy, as well as any riders or additional features that may be available with the policy. Your insurance agent or broker can help you evaluate all of these factors and choose a policy that meets your needs and budget.

How much does Index Universal Life Insurance cost?

The cost of Index Universal Life Insurance can vary depending on a number of factors, including your age, health, and the amount of death benefit coverage you need. In general, this type of policy may be more expensive than term life insurance, but less expensive than traditional permanent life insurance policies.

Your insurance agent or broker can provide you with quotes from different insurance companies and help you understand the costs and benefits of different policy options.

How do I apply for Index Universal Life Insurance?

To apply for Index Universal Life Insurance, you’ll need to complete an application and provide information about your health, lifestyle, and financial situation. The insurance company may also require you to undergo a medical exam or provide additional documentation.

Your insurance agent or broker can guide you through the application process and help you gather all of the information and documentation you need to apply for a policy. Once your application is submitted, the insurance company will review it and determine if you’re eligible for coverage.

In today’s uncertain times, it’s important to make sure that you and your loved ones are financially protected in the event of unforeseen circumstances. One way to do that is by getting index universal life insurance. This type of insurance offers both life insurance and investment benefits, which can help you build wealth over time.

To get started, it’s important to research different insurance providers and policies to find one that aligns with your financial goals and needs. You’ll also want to work with a knowledgeable financial advisor who can help you navigate the complexities of index universal life insurance and create a personalized plan for your unique situation. By taking these steps, you can feel confident that you’re making an informed decision and securing a brighter financial future for yourself and your loved ones.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts