Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

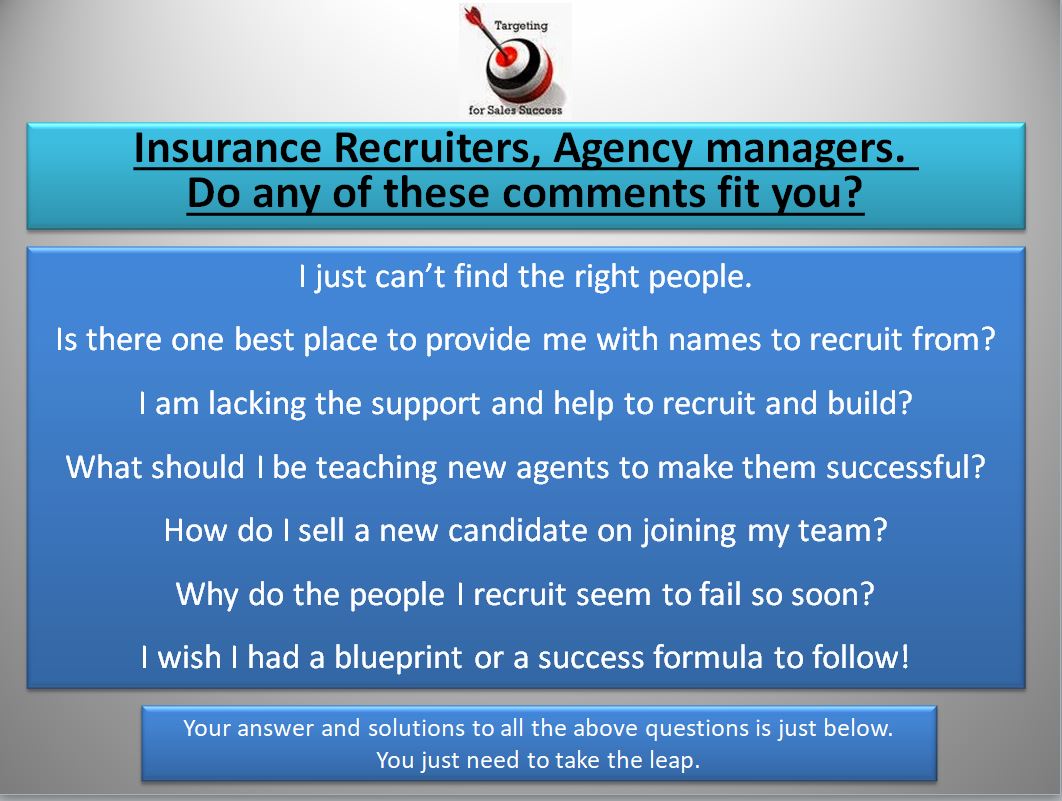

Recruiting life insurance agents is a crucial task for any insurance company. Finding the right candidate who can effectively promote the company’s products and services, build strong relationships with clients, and meet sales targets can be a challenging process. However, with the right recruitment strategies and techniques, companies can identify and attract the best talent in the industry.

To recruit life insurance agents, companies need to have a clear understanding of the qualities, skills, and experience required for the role. This may include having excellent communication and interpersonal skills, a strong sales background, and a deep understanding of the insurance industry. Additionally, companies may need to create a comprehensive recruitment plan that includes job postings on relevant job boards, networking with industry professionals, and conducting thorough interviews to assess each candidate’s potential. With these strategies in place, companies can attract and recruit the best life insurance agents to help grow their business and serve their clients.

Recruiting life insurance agents can be a challenging task. Here are some steps to help you recruit potential agents:

- Create a job description that highlights the qualities you are looking for in an agent.

- Advertise the job on job boards, social media, and your company website.

- Offer incentives such as bonuses and commissions to attract potential candidates.

- Screen candidates through phone or in-person interviews.

- Provide training and support to help agents succeed in their role.

Contents

- How to Recruit Life Insurance Agents?

- 1. Define Your Ideal Candidate

- 2. Use Multiple Recruitment Channels

- 3. Create a Compelling Job Description

- 4. Screen Candidates Carefully

- 5. Provide Training and Support

- 6. Set Realistic Goals and Expectations

- 7. Foster a Positive Work Environment

- 8. Use Technology to Streamline the Recruitment Process

- 9. Measure and Analyze Your Recruitment Efforts

- 10. Continuously Improve Your Recruitment Strategy

- Frequently Asked Questions

- What are the best ways to recruit life insurance agents?

- What should I look for in a potential life insurance agent?

- What are some common mistakes to avoid when recruiting life insurance agents?

- What is the best way to onboard new life insurance agents?

- How can I motivate and retain my life insurance agents?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

How to Recruit Life Insurance Agents?

Recruiting life insurance agents is a crucial task for any insurance agency. Agents are the backbone of an insurance company, and recruiting the right agents can help the company grow and achieve success. However, finding and recruiting the right agents is not an easy task. It requires a lot of effort, planning, and resources. In this article, we will discuss some effective strategies for recruiting life insurance agents.

1. Define Your Ideal Candidate

Before you start recruiting, it is important to define your ideal candidate. You need to identify the skills, experience, and qualities that you are looking for in an agent. This will help you to create a job description that attracts the right candidates. You can also use this information to screen the candidates during the interview process.

When defining your ideal candidate, consider the following:

- Experience in the insurance industry

- Sales experience

- Excellent communication skills

- Positive attitude

- Ability to work independently and in a team

2. Use Multiple Recruitment Channels

To attract a large pool of candidates, you need to use multiple recruitment channels. This includes job boards, social media, referrals, and industry events. Posting job ads on job boards and social media can help you to reach a wider audience. Referrals from current agents can also be a great source of quality candidates. Attending industry events can help you to network with potential candidates and build relationships.

3. Create a Compelling Job Description

Your job description should be clear, concise, and compelling. It should highlight the benefits of working for your company and the opportunities for growth and development. Use bullet points to make the job requirements and responsibilities easy to read. Include information about the compensation package, such as salary, commission, and benefits.

4. Screen Candidates Carefully

Screening candidates is an important step in the recruitment process. You need to ensure that the candidates meet the requirements and have the skills and experience you are looking for. You can use phone interviews, online assessments, and in-person interviews to screen candidates. During the interview process, ask open-ended questions to learn more about the candidate’s skills, experience, and personality.

5. Provide Training and Support

Once you have recruited the right agents, you need to provide them with training and support. This will help them to succeed in their role and achieve their goals. Provide them with product training, sales training, and ongoing support. Make sure they have access to the resources they need to be successful, such as marketing materials and customer databases.

6. Set Realistic Goals and Expectations

It is important to set realistic goals and expectations for your agents. This will help them to stay motivated and focused on their tasks. Set achievable sales targets and provide them with the tools and resources they need to meet those targets. Provide feedback and encouragement to help them improve their performance.

7. Foster a Positive Work Environment

A positive work environment is essential for the success of your agents. Create a culture of teamwork, collaboration, and support. Recognize and reward the achievements of your agents. Provide them with opportunities for personal and professional growth.

8. Use Technology to Streamline the Recruitment Process

Technology can be a powerful tool to streamline the recruitment process. Use applicant tracking software to manage the recruitment process and track the progress of candidates. Use video interviews to save time and resources. Use social media to reach a wider audience of potential candidates.

9. Measure and Analyze Your Recruitment Efforts

Measuring and analyzing your recruitment efforts can help you to improve your recruitment strategy. Use metrics such as time-to-hire, cost-per-hire, and quality-of-hire to evaluate the effectiveness of your recruitment efforts. Analyze the data to identify areas for improvement and make changes to your strategy accordingly.

10. Continuously Improve Your Recruitment Strategy

Recruiting is an ongoing process, and it is important to continuously improve your recruitment strategy. Stay up-to-date with the latest trends and best practices in recruitment. Ask for feedback from your agents and candidates to identify areas for improvement. Continuously refine your strategy to attract and retain the best talent.

Conclusion

Recruiting life insurance agents is a challenging task, but with the right strategy and resources, it can be a rewarding one. By defining your ideal candidate, using multiple recruitment channels, creating a compelling job description, screening candidates carefully, providing training and support, setting realistic goals and expectations, fostering a positive work environment, using technology, measuring and analyzing your recruitment efforts, and continuously improving your strategy, you can attract and retain the best agents and achieve success for your company.

Frequently Asked Questions

What are the best ways to recruit life insurance agents?

Recruiting life insurance agents requires a strategic approach. One of the best ways to recruit life insurance agents is by creating an attractive compensation plan. Agents are motivated by money, so offering a competitive commission structure can help you attract top talent. Another effective way to recruit life insurance agents is by leveraging your existing network. Reach out to colleagues, friends, and family members to inquire about potential candidates or ask for referrals.

Additionally, attending job fairs, advertising on job boards, and utilizing social media platforms can help you reach a wider audience. It’s also important to provide ongoing training and support to your agents to help them achieve success in their roles. By creating a positive work environment and investing in your agents, you can attract and retain top talent.

What should I look for in a potential life insurance agent?

When recruiting life insurance agents, it’s important to look for individuals who possess strong communication and interpersonal skills. Agents should be able to effectively communicate complex insurance products and policies to clients in a way that is easy to understand. Additionally, successful agents are typically self-motivated and driven, with a strong work ethic and a desire to help others.

It’s also important to look for individuals who are coachable and willing to learn. Insurance is a constantly evolving industry, so agents who are open to ongoing training and development are more likely to achieve success. Finally, look for candidates who have a proven track record of sales or customer service experience, as these skills are valuable in the insurance industry.

What are some common mistakes to avoid when recruiting life insurance agents?

One common mistake when recruiting life insurance agents is focusing solely on experience or education. While these factors are important, they don’t necessarily guarantee success in the insurance industry. Instead, it’s important to look for candidates who possess the personality traits and soft skills that are essential for success, such as strong communication and interpersonal skills.

Another mistake is failing to provide adequate training and support to new agents. Without proper training, new agents may struggle to understand complex insurance products and policies, which can lead to frustration and low performance. Finally, it’s important to avoid rushing the recruitment process. Take the time to carefully screen and interview potential candidates to ensure they are a good fit for your organization.

What is the best way to onboard new life insurance agents?

The best way to onboard new life insurance agents is to provide them with comprehensive training and support. This can include both classroom and on-the-job training, as well as ongoing coaching and mentoring from experienced agents. It’s also important to provide new agents with the tools and resources they need to be successful, such as access to client databases, marketing materials, and sales training materials.

In addition to training and support, it’s important to set clear expectations and goals for new agents. This can help them stay on track and motivated as they work to build their client base and achieve success in their roles. Finally, be sure to provide ongoing feedback and recognition to new agents to help them stay engaged and motivated.

How can I motivate and retain my life insurance agents?

Motivating and retaining life insurance agents requires a multifaceted approach. One of the best ways to motivate agents is by offering a competitive compensation plan that rewards high performance. This can include bonuses, incentives, and commission structures that incentivize agents to achieve specific goals.

Additionally, providing ongoing training and development opportunities can help agents stay engaged and motivated in their roles. This can include access to industry conferences, mentorship programs, and leadership development training. Finally, creating a positive work environment that values teamwork and collaboration can help agents feel valued and supported, which can lead to higher levels of job satisfaction and retention.

Recruiting life insurance agents is a crucial aspect of any successful insurance business. It is not just about finding someone who is good at selling insurance policies, but it is also about finding someone who has a passion for helping people protect their future. To recruit life insurance agents, you need to have a clear understanding of your company’s values, goals, and expectations. Once you have a clear understanding of what you are looking for, you need to use the right recruitment strategies that will attract the right candidates.

One of the most effective ways to recruit life insurance agents is to leverage the power of social media. Social media platforms like LinkedIn, Facebook, and Twitter can help you reach a wider audience and connect with potential candidates. Another effective way to recruit life insurance agents is to attend job fairs, industry conferences, and networking events. These events provide an opportunity to meet potential candidates face-to-face and learn more about their skills and experience. With the right recruitment strategies in place, you can find the best life insurance agents who will be an asset to your business and help it grow.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts