Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Auto insurance can be a confusing topic, with different states having different laws and regulations governing it. Georgia is no exception to this, and many drivers in the state are often left wondering whether it is a no fault state for auto insurance. Understanding the laws and regulations that govern auto insurance in Georgia is important for any driver in the state, as it can help them make informed decisions about their coverage and ensure that they are protected in the event of an accident.

In this article, we will explore the question of whether Georgia is a no fault state for auto insurance. We will examine the state’s auto insurance laws and regulations, including those that govern liability, personal injury protection, and other key aspects of auto insurance coverage. By the end of this article, you will have a better understanding of how auto insurance works in Georgia and whether it is a no fault state or not.

Is Georgia a No Fault State for Auto Insurance?

If you’re a driver in Georgia, you might be wondering whether your state is a no-fault state for auto insurance. No-fault auto insurance is a type of coverage that pays for your medical expenses and other damages, regardless of who is at fault for an accident. In this article, we’ll explore whether Georgia is a no-fault state for auto insurance.

Understanding No-Fault Auto Insurance

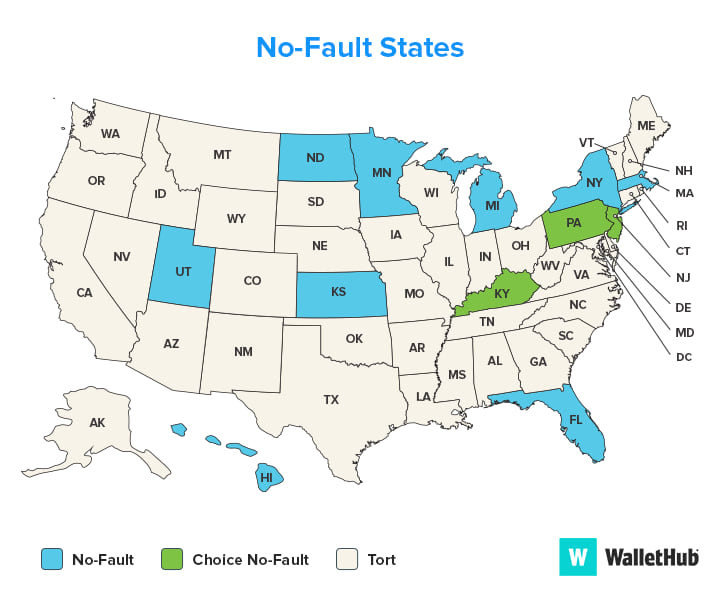

No-fault auto insurance is a type of coverage that’s available in some states in the US. The idea behind no-fault insurance is to ensure that drivers and passengers can get the medical care they need after an accident without having to worry about who was at fault. Under no-fault insurance, each driver’s insurance company pays for their medical expenses and other damages, up to a certain limit.

How No-Fault Insurance Works

Under no-fault insurance, each driver’s insurance company pays for their medical expenses and other damages, up to a certain limit. This means that if you’re injured in an accident, you’ll file a claim with your own insurance company, rather than with the other driver’s insurance company. Your insurance company will then pay for your medical expenses and other damages, up to the limit of your policy.

Benefits of No-Fault Insurance

One of the main benefits of no-fault insurance is that it can help you get the medical care you need after an accident, regardless of who was at fault. This can be especially important if you’re injured in an accident and need medical care right away. With no-fault insurance, you can get the care you need without having to wait for the other driver’s insurance company to pay for your medical expenses.

Another benefit of no-fault insurance is that it can help reduce the number of lawsuits filed after accidents. Since each driver’s insurance company pays for their own medical expenses and other damages, there’s less need for drivers to sue each other after an accident.

Is Georgia a No-Fault State?

Now that we’ve explained what no-fault insurance is, let’s dive into whether Georgia is a no-fault state. The short answer is no, Georgia is not a no-fault state for auto insurance. Georgia is what’s known as a “fault” state, which means that drivers are responsible for paying for the damages they cause in an accident.

How Fault Insurance Works

Under a fault insurance system, the driver who caused the accident is responsible for paying for the damages they caused. This means that if you’re injured in an accident that was caused by another driver, you’ll file a claim with that driver’s insurance company. The other driver’s insurance company will then pay for your medical expenses and other damages, up to the limit of their policy.

Pros and Cons of Fault Insurance

One of the main benefits of fault insurance is that it can help ensure that drivers are held accountable for the damages they cause in an accident. This can be especially important if you’re injured in an accident and need long-term medical care or other support.

However, one of the downsides of fault insurance is that it can be difficult to determine who was at fault for an accident. This can lead to lengthy and expensive legal battles, as each driver tries to prove that the other driver was responsible for the accident.

Conclusion

In conclusion, Georgia is not a no-fault state for auto insurance. If you’re a driver in Georgia, you’ll need to have liability insurance to cover the damages you cause in an accident. While no-fault insurance can be beneficial in some situations, fault insurance is the system that’s currently in place in Georgia.

Contents

- Frequently Asked Questions

- Is Georgia a No Fault State for Auto Insurance?

- What are the Minimum Auto Insurance Requirements in Georgia?

- What Happens if I’m in a Car Accident in Georgia?

- Can I Sue the At-Fault Driver in Georgia?

- What Factors Affect My Auto Insurance Rates in Georgia?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Is Georgia a No Fault State for Auto Insurance?

Yes, Georgia is a no-fault state for auto insurance. This means that each driver’s insurance company is responsible for paying their own policyholder’s medical expenses and lost wages up to a certain limit, regardless of who was at fault for the accident. The no-fault law in Georgia is designed to reduce the number of lawsuits and claims that arise from auto accidents.

However, it’s important to note that Georgia’s no-fault law only applies to personal injury claims. If there is property damage as a result of the accident, the at-fault driver’s insurance is responsible for paying for the damage. Additionally, if your medical expenses and other damages exceed the limits of your no-fault coverage, you may be able to file a claim against the at-fault driver’s insurance.

What are the Minimum Auto Insurance Requirements in Georgia?

In Georgia, drivers are required to carry liability insurance to cover damages and injuries that they may cause to other drivers, passengers, or pedestrians. The minimum liability coverage requirements are:

– $25,000 for bodily injury per person

– $50,000 for bodily injury per accident

– $25,000 for property damage per accident

It’s important to note that these are just the minimum requirements, and drivers may want to consider purchasing additional coverage to protect themselves in the event of an accident.

What Happens if I’m in a Car Accident in Georgia?

If you’re in a car accident in Georgia, you should first make sure that everyone involved is safe and call 911 if necessary. You should also exchange insurance and contact information with the other driver(s) involved in the accident.

Under Georgia law, you’re required to report the accident to the police if there is property damage or injuries. You should also report the accident to your insurance company as soon as possible.

Can I Sue the At-Fault Driver in Georgia?

Yes, you can sue the at-fault driver in Georgia if you’ve been injured in an accident. However, because Georgia is a no-fault state, you may be limited in the amount that you can recover in a lawsuit. In most cases, you’ll be restricted to recovering damages for medical expenses and lost wages, rather than pain and suffering.

It’s also worth noting that Georgia has a statute of limitations for personal injury lawsuits, which means that you have a limited amount of time to file a lawsuit after an accident. If you miss this deadline, you may lose your right to sue the at-fault driver.

What Factors Affect My Auto Insurance Rates in Georgia?

There are several factors that can affect your auto insurance rates in Georgia, including your age, driving record, credit score, and the type of car you drive. Younger drivers and those with poor driving records are typically considered higher risk, and may be charged higher rates.

Additionally, insurance companies may consider factors such as the crime rate in your area, the number of miles you drive each year, and whether you’ve completed a defensive driving course when determining your rates. Shopping around for insurance and comparing quotes from different companies can help you find the best rates for your situation.

After delving into the intricacies of Georgia’s auto insurance laws, it is clear that the state operates under a modified comparative negligence system, which means that fault can be assigned to both parties involved in an accident. However, Georgia is not considered a pure no-fault state. Drivers in Georgia are required to carry liability insurance to cover damages to other parties in the event of an accident, but they can also choose to purchase additional coverage to protect themselves and their own vehicles.

It is crucial for Georgia drivers to understand the nuances of the state’s auto insurance laws to ensure they have adequate coverage in the event of an accident. Whether you are a new driver or a seasoned pro, taking the time to understand the state’s laws and regulations can save you time, money, and stress in the long run. So, while Georgia may not be a pure no-fault state, it is still essential to be aware of the state’s unique system of assigning fault and carrying proper insurance coverage to protect yourself on the road.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts