Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we age and approach retirement, healthcare costs become a growing concern. Medicare is a government-sponsored health insurance program that provides coverage for people over 65 years of age, as well as for those with certain disabilities or chronic illnesses. While Medicare can be a great source of relief for seniors, it can also be quite expensive. As such, many people wonder if Medicare insurance is tax deductible.

The answer to this question is not a simple one. It depends on a number of factors, including your income, the type of Medicare coverage you have, and whether you choose to itemize your deductions. In this article, we will take a closer look at the tax implications of Medicare insurance, so that you can make an informed decision about your retirement healthcare costs.

Yes, certain parts of Medicare insurance premiums are tax-deductible. If you’re self-employed, you can deduct Medicare premiums you pay for yourself and your spouse as a business expense. If you’re not self-employed, you can deduct Medicare premiums as part of your medical expenses, but only if they exceed 7.5% of your adjusted gross income. However, Medicare supplement premiums are not tax-deductible.

Is Medicare Insurance Tax Deductible?

Medicare is a federal health insurance program for people aged 65 and above, as well as some younger people with certain disabilities. Medicare provides several types of coverage, including hospital insurance, medical insurance, and prescription drug coverage. One question that often arises is whether Medicare insurance premiums are tax-deductible. This article explores the tax implications of Medicare insurance premiums and provides useful information for taxpayers.

Understanding Medicare Insurance Premiums

Medicare Part A (hospital insurance) is generally free for most people who have paid Medicare taxes while working. However, Medicare Part B (medical insurance) and Part D (prescription drug coverage) require monthly premiums. The amount of the premium varies depending on the person’s income and the plan they choose. Medicare Part C (Medicare Advantage) also requires a premium, but it is usually combined with Part B premium.

Medicare Part B Premiums

Medicare Part B premiums are generally tax-deductible. If you itemize your deductions on your federal tax return, you can deduct the amount of your Medicare Part B premiums from your taxable income. However, the amount that you can deduct may be limited if your income exceeds certain thresholds.

For example, for tax year 2021, if your modified adjusted gross income (MAGI) is above $88,000 for individuals or $176,000 for married couples filing jointly, your Medicare Part B premium deduction may be reduced or eliminated. You can use IRS Form 1040 to calculate your deduction and determine if you are eligible for the deduction.

Medicare Part D Premiums

Medicare Part D premiums are also tax-deductible if you itemize your deductions. However, the same income limits that apply to Part B premiums also apply to Part D premiums. If your MAGI is above the threshold, your Part D premium deduction may be reduced or eliminated.

Benefits of Deducting Medicare Premiums

Deducting your Medicare premiums can provide significant tax savings, especially if you have high medical expenses. By deducting your premiums, you can reduce your taxable income, which can lower your tax liability. Additionally, if you have high medical expenses, you may be able to deduct those expenses as well, which can further reduce your tax liability.

Medical Expense Deduction

If your medical expenses exceed 7.5% of your adjusted gross income (AGI), you may be able to deduct them on your tax return. Medical expenses can include Medicare premiums, as well as other healthcare costs such as doctor’s visits, hospital stays, and prescription drugs. You can use IRS Form 1040 to calculate your medical expense deduction.

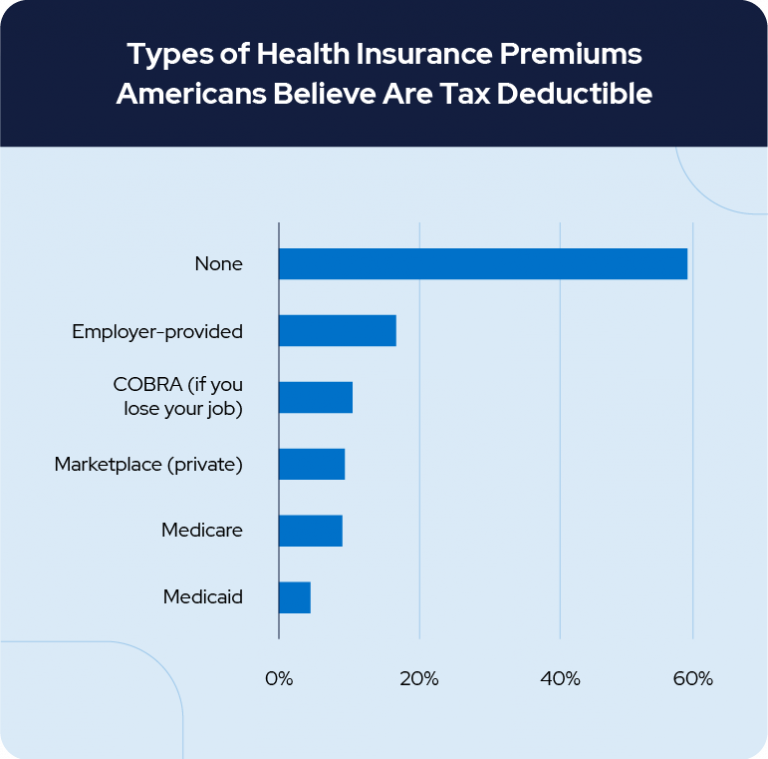

Medicare vs. Private Health Insurance

While Medicare premiums may be tax-deductible, private health insurance premiums are generally not tax-deductible. This is because private health insurance is not a government program and is not eligible for tax benefits. However, private health insurance may offer other benefits that Medicare does not, such as more comprehensive coverage, lower out-of-pocket costs, and greater flexibility in choosing doctors and hospitals.

Medicare Advantage vs. Private Health Insurance

Medicare Advantage plans are private health insurance plans that provide Medicare benefits. While Medicare Advantage premiums are generally tax-deductible, they may not offer the same level of coverage as private health insurance plans. Private health insurance plans may offer more comprehensive coverage for certain services, such as dental and vision care, that are not covered by Medicare Advantage plans.

Conclusion

In conclusion, Medicare insurance premiums may be tax-deductible if you itemize your deductions on your tax return. However, the amount of the deduction may be limited if your income exceeds certain thresholds. Deducting your Medicare premiums can provide significant tax savings, especially if you have high medical expenses. While Medicare may offer comprehensive coverage, private health insurance may offer greater flexibility and more comprehensive coverage for certain services. It is important to weigh the benefits and drawbacks of both options when choosing a health insurance plan.

Contents

- Frequently Asked Questions

- 1. Is Medicare Insurance Tax Deductible?

- 2. What Are the Limitations on the Medicare Premium Tax Deduction?

- 3. Are Medicare Advantage Premiums Tax Deductible?

- 4. Can I Deduct Medicare Supplement (Medigap) Premiums?

- 5. What Documentation Do I Need to Claim the Medicare Premium Tax Deduction?

- Are Medicare Premiums Tax Deductible in 2023? (I Didn’t Even Know THIS!)🤯

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Frequently Asked Questions

Here are some commonly asked questions and answers about whether Medicare insurance is tax deductible.

1. Is Medicare Insurance Tax Deductible?

Yes, Medicare insurance premiums are generally tax deductible. This includes premiums for Medicare Part B, which covers doctor visits and outpatient care, and Medicare Part D, which covers prescription drugs. However, there are certain limitations and requirements that must be met in order to claim the deduction.

To be eligible for the deduction, you must itemize your deductions on your tax return. Your total medical expenses, including Medicare premiums, must exceed a certain percentage of your adjusted gross income (AGI). The percentage can vary depending on your age and other factors.

2. What Are the Limitations on the Medicare Premium Tax Deduction?

There are several limitations on the Medicare premium tax deduction. First, you can only deduct the amount of your premiums that exceeds the standard deduction for your filing status. Second, you cannot deduct premiums that were paid by someone else, such as an employer or a government program. Third, you cannot deduct premiums that were paid with pre-tax dollars, such as through a payroll deduction or a flexible spending account.

It is also important to note that the Medicare premium tax deduction is a miscellaneous itemized deduction, which means that it is subject to the 2% AGI floor. This means that you can only deduct the portion of your medical expenses that exceeds 2% of your AGI.

3. Are Medicare Advantage Premiums Tax Deductible?

Medicare Advantage premiums may be tax deductible, but the rules are slightly different than for traditional Medicare premiums. If you have a Medicare Advantage plan that includes prescription drug coverage, you may be able to deduct the portion of the premium that applies to drug coverage. However, you cannot deduct the portion of the premium that applies to medical coverage, as this is already covered by Medicare Part B.

As with traditional Medicare premiums, you must itemize your deductions and meet the AGI threshold in order to claim the deduction for Medicare Advantage premiums.

4. Can I Deduct Medicare Supplement (Medigap) Premiums?

Medicare Supplement (Medigap) premiums may be tax deductible in certain situations. If you have a Medigap policy that covers medical expenses, you may be able to deduct the premiums that you pay. However, if your Medigap policy includes coverage for prescription drugs, you cannot deduct the portion of the premium that applies to drug coverage.

As with Medicare Advantage premiums, you must itemize your deductions and meet the AGI threshold in order to claim the deduction for Medigap premiums.

5. What Documentation Do I Need to Claim the Medicare Premium Tax Deduction?

To claim the Medicare premium tax deduction, you will need to provide documentation of your premiums and your medical expenses. This may include receipts, statements, or other documentation from Medicare or your insurance provider. You will also need to calculate your AGI and determine whether your medical expenses exceed the AGI threshold for your age and other factors.

It is important to keep accurate records of your medical expenses throughout the year in order to claim the deduction accurately and avoid any potential issues with the IRS.

Are Medicare Premiums Tax Deductible in 2023? (I Didn’t Even Know THIS!)🤯

After exploring the topic of whether Medicare insurance is tax deductible, it’s clear that the answer is not a simple one. While some aspects of Medicare are tax deductible, such as Part B premiums and certain out-of-pocket expenses, others are not. It’s important to consult with a tax professional to ensure that you are taking advantage of all eligible deductions and credits related to Medicare.

In the end, understanding the tax implications of Medicare can be a complicated process. However, with a little bit of research and guidance from a tax professional, you can make informed decisions and optimize your tax savings. As you navigate the world of Medicare and taxes, remember that the most important thing is to prioritize your health and well-being, and to seek out the resources and support you need to maintain your quality of life.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts