Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is a crucial financial tool that provides peace of mind for individuals and their loved ones. It is designed to offer financial protection to beneficiaries in the event of the policyholder’s death. However, what happens when the cause of death is an overdose? Is overdose covered by life insurance?

The answer to this question is not straightforward. While most life insurance policies cover accidental death, including death resulting from a drug overdose, there are certain conditions that must be met for the policy to pay out. In this article, we will delve deeper into the topic of life insurance coverage for overdose, exploring the different types of policies available and the requirements for payout.

Yes, overdose is typically covered by life insurance. However, it’s important to note that some policies may have exclusions for deaths resulting from drug or alcohol abuse. It’s important to carefully review your policy to understand what is covered and what is not. If you have any questions, it’s best to contact your life insurance provider directly.

Contents

- Is Overdose Covered by Life Insurance?

- Frequently Asked Questions

- Question 1: Is overdose covered by life insurance?

- Question 2: Will the life insurance policy cover a drug overdose death?

- Question 3: What do I need to do to make a claim for a death due to overdose?

- Question 4: How much money will the life insurance policy pay out for an overdose death?

- Question 5: How can I ensure that my life insurance policy covers deaths due to overdose?

- Will My Life Insurance Policy Cover Drug Abuse?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Is Overdose Covered by Life Insurance?

When it comes to life insurance, many people wonder if it covers an overdose. It’s a valid question, especially considering the opioid epidemic that’s affecting millions of Americans. The answer isn’t straightforward because it depends on different factors. In this article, we’ll explore whether overdose is covered by life insurance and how to ensure that you’re protected.

What is Overdose?

An overdose occurs when someone takes too much of a drug, whether it’s prescription, over-the-counter, or illegal. It can happen accidentally or intentionally. Overdose can lead to serious health problems, including coma, brain damage, and even death. According to the Centers for Disease Control and Prevention (CDC), more than 70,000 Americans died from drug overdoses in 2019.

Does Life Insurance Cover Overdose?

If you have a life insurance policy, you may wonder if it covers overdose. The answer is usually yes, but it depends on the policy’s terms and conditions. Most life insurance policies cover overdose if it’s not a suicide attempt. If the insured person dies due to an accidental overdose, the life insurance company will pay the death benefit to the beneficiaries. However, if the overdose was intentional, the policy may not pay out.

What are the Different Types of Life Insurance?

There are different types of life insurance policies, including term life, whole life, and universal life. Each has its own benefits and drawbacks.

- Term life insurance provides coverage for a specific period, usually 10 to 30 years. It’s the most affordable type of life insurance.

- Whole life insurance provides coverage for the entire life of the insured person. It has a cash value component that grows over time.

- Universal life insurance is a flexible policy that allows the insured person to adjust the premium and death benefit amount.

How to Ensure Your Life Insurance Covers Overdose

If you want to ensure that your life insurance policy covers overdose, you need to read the terms and conditions carefully. Look for any exclusions related to drug use or suicide attempts. If you have a history of drug use or a pre-existing condition, you may need to pay higher premiums or undergo a medical exam.

Benefits of Having Life Insurance

Having life insurance provides several benefits, including:

- Financial security for your loved ones in case of your unexpected death

- Paying off debts and funeral expenses

- Providing an inheritance to your beneficiaries

- Protecting your business partners in case of your death

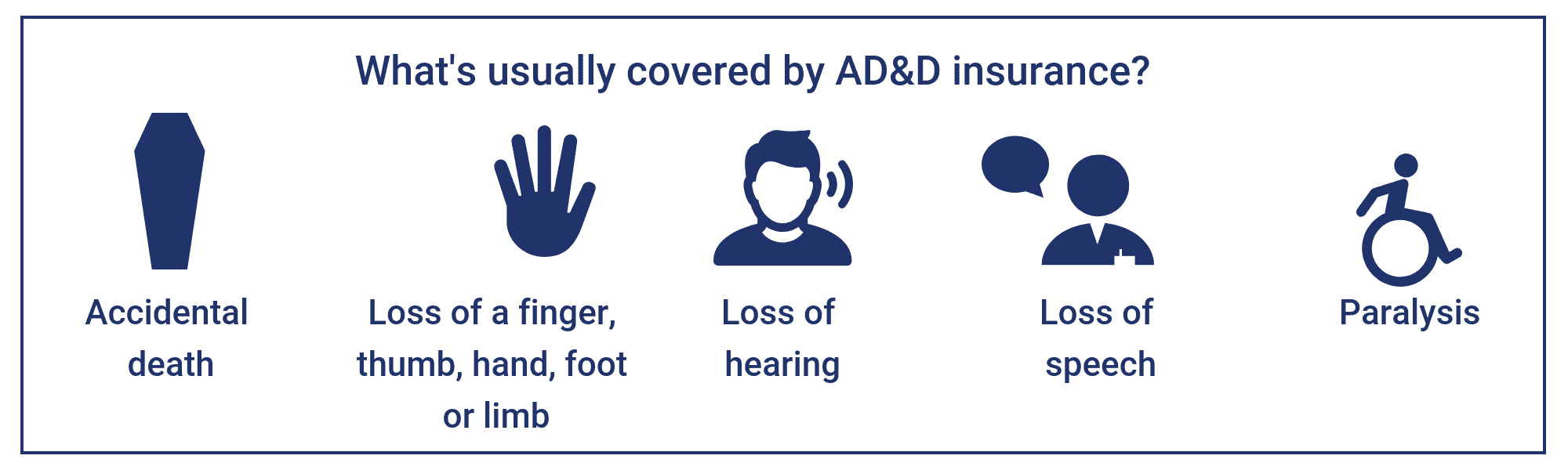

Life Insurance Vs. Accidental Death and Dismemberment Insurance

Accidental Death and Dismemberment (AD&D) insurance is a type of policy that pays out a benefit if the insured person dies or becomes disabled due to an accident. It’s different from life insurance because it only covers accidental death, not natural death or illness. If you’re concerned about accidental death, you can purchase an AD&D policy in addition to your life insurance policy.

Conclusion

In conclusion, overdose is usually covered by life insurance if it’s an accidental death. However, if it’s intentional, the policy may not pay out. It’s essential to read the policy’s terms and conditions carefully and ensure that you’re fully covered. Having life insurance provides financial security for your loved ones and peace of mind for you.

Frequently Asked Questions

Life insurance is important to protect your loved ones financially in case of any unforeseen circumstances. However, when it comes to overdose, there may be some confusion about whether it is covered by life insurance. Here are some frequently asked questions and answers to help you understand this better.

Question 1: Is overdose covered by life insurance?

Yes, in most cases, an overdose is covered by life insurance. However, it depends on the terms and conditions of your policy. If the cause of death is an accidental overdose and not a suicide attempt, then the policy will pay out the death benefit to the beneficiaries.

It is important to note that if the policyholder intentionally overdoses with the intent to harm themselves or commit suicide, the policy may not cover the claim. In such cases, it is best to speak to the insurance company to understand the policy’s terms and conditions.

Question 2: Will the life insurance policy cover a drug overdose death?

Yes, if the cause of death is an accidental overdose of drugs, the life insurance policy will cover the claim. Most policies do not differentiate between accidental drug overdoses and overdose from other causes. However, if the policyholder deliberately overdoses on drugs, the claim may not be covered by the policy.

It is important to read the terms and conditions of the policy to understand what it covers and what it does not. Additionally, if you have any questions, it is best to speak to the insurance company to clarify the doubts.

Question 3: What do I need to do to make a claim for a death due to overdose?

If the policy covers accidental overdose deaths, you will need to submit a claim to the insurance company. The process is similar to making a claim for any other cause of death. You will need to provide a death certificate and any other required documents to support the claim.

If the cause of death is unclear or there is suspicion of foul play, the insurance company may conduct an investigation before approving the claim. It is best to speak to the insurance company to understand the claim process in such cases.

Question 4: How much money will the life insurance policy pay out for an overdose death?

The amount of money the life insurance policy pays out for an overdose death depends on the policy’s terms and conditions. The death benefit amount is typically specified in the policy document. However, if the policyholder had an accidental death rider or other additional coverage, the payout may be more.

If the death is due to drug overdose, the policy may still pay out the full death benefit, provided the policy’s terms and conditions are met. However, if the policyholder was under the influence of drugs or alcohol at the time of death, the payout may be reduced.

Question 5: How can I ensure that my life insurance policy covers deaths due to overdose?

If you want to ensure that your life insurance policy covers deaths due to overdose, you must read the policy document carefully. Look for any exclusions or limitations related to drug overdoses or substance abuse. If you have any questions, it is best to speak to the insurance company to get a clear understanding.

Additionally, if you have a history of substance abuse or other health conditions, it is essential to disclose this information to the insurance company when applying for the policy. Failing to disclose such information may result in the claim being denied later.

Will My Life Insurance Policy Cover Drug Abuse?

In today’s world, where the use of drugs and other addictive substances has become more common than ever, the risk of overdose has increased significantly. This has led many people to wonder: is overdose covered by life insurance? The answer to this question is not a straightforward one, as it depends on the specific policy and the circumstances surrounding the overdose.

Generally speaking, most life insurance policies do cover death by accidental overdose. However, there are some exceptions, such as if the policyholder had a history of drug abuse or if the overdose was intentional. It is important to read the fine print of your policy and to speak with your insurance provider to fully understand what is covered and what is not. Ultimately, the best way to protect yourself and your loved ones is to seek help for any addiction issues and to take steps to prevent an overdose from occurring in the first place.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts