Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

Life insurance is a critical investment for anyone who wants to ensure their loved ones are protected financially after they pass away. However, before signing up for a life insurance policy, you will need to undergo a medical examination. This examination will help the insurance company determine the level of risk they will be taking on by insuring you. One aspect of this medical examination is drug testing. In this article, we will explore the types of drugs that life insurance companies test for and what implications this may have for you.

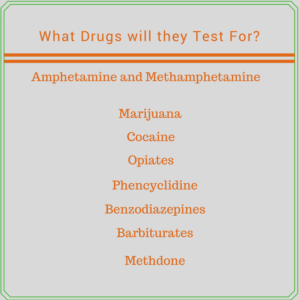

Drug testing is a standard part of a life insurance medical examination, and it aims to detect the presence of illegal drugs or prescription medications that can negatively impact your health. Life insurance companies test for a wide range of substances, including but not limited to marijuana, cocaine, opioids, and amphetamines. Knowing what drugs life insurance companies test for can help you prepare for your medical examination and, if necessary, make any necessary changes to your lifestyle to improve your health and chances of getting approved for life insurance coverage.

Life insurance companies typically test for a range of drugs, including marijuana, cocaine, opioids, amphetamines, and nicotine. These tests are usually conducted as part of the application process, and the results can impact your ability to get coverage or the cost of your premiums. If you are a regular user of any of these drugs, it’s important to disclose this information to the insurance company to avoid any potential issues with your application.

Contents

- What Drugs Do Life Insurance Companies Test for?

- Frequently Asked Questions

- What drugs do life insurance companies typically test for?

- How do life insurance companies test for drugs?

- Can I still get life insurance if I use drugs?

- How long do drugs stay in your system?

- What should I do if I test positive for drugs during a life insurance exam?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

What Drugs Do Life Insurance Companies Test for?

If you are applying for life insurance, it is important to know that insurance companies often require a medical exam, including a drug test. This process is to ensure that the person applying for life insurance is healthy and not engaging in risky behavior, such as drug abuse. However, not all drugs are tested for in a life insurance drug test. Here are the most common drugs that life insurance companies test for:

1. Marijuana

Marijuana is one of the most commonly used drugs in the United States. It is also one of the most commonly tested drugs in life insurance drug tests. Marijuana can stay in your system for up to 30 days after use, depending on how often and how much you use. If you test positive for marijuana, it could affect your life insurance rates or even result in a denial of coverage.

2. Cocaine

Cocaine is a highly addictive drug that can have serious health consequences. It is also one of the drugs that life insurance companies test for. Cocaine can stay in your system for up to 72 hours after use. If you test positive for cocaine, it could result in higher life insurance rates or even a denial of coverage.

3. Opiates

Opiates are a class of drugs that include prescription painkillers, such as OxyContin and Vicodin, as well as illegal drugs, such as heroin. Opiates can stay in your system for up to 72 hours after use. If you test positive for opiates, it could affect your life insurance rates or even result in a denial of coverage.

4. Amphetamines

Amphetamines are a class of drugs that include prescription drugs, such as Adderall and Ritalin, as well as illegal drugs, such as methamphetamine. Amphetamines can stay in your system for up to 48 hours after use. If you test positive for amphetamines, it could affect your life insurance rates or even result in a denial of coverage.

5. Barbiturates

Barbiturates are a class of drugs that include prescription drugs, such as Phenobarbital and Seconal, that are used to treat anxiety and sleep disorders. Barbiturates can stay in your system for up to 72 hours after use. If you test positive for barbiturates, it could affect your life insurance rates or even result in a denial of coverage.

6. Benzodiazepines

Benzodiazepines are a class of drugs that include prescription drugs, such as Xanax and Valium, that are used to treat anxiety and sleep disorders. Benzodiazepines can stay in your system for up to 48 hours after use. If you test positive for benzodiazepines, it could affect your life insurance rates or even result in a denial of coverage.

7. Phencyclidine (PCP)

PCP is a hallucinogenic drug that can have serious health consequences. It can stay in your system for up to 48 hours after use. If you test positive for PCP, it could affect your life insurance rates or even result in a denial of coverage.

8. Methadone

Methadone is a prescription drug that is used to treat opioid addiction. It can stay in your system for up to 48 hours after use. If you test positive for methadone, it could affect your life insurance rates or even result in a denial of coverage.

9. Nicotine

Nicotine is not a drug, but it is often included in life insurance drug tests. Nicotine can stay in your system for up to several days after use. If you test positive for nicotine, it could result in higher life insurance rates.

10. Alcohol

Alcohol is not a drug, but it is often included in life insurance drug tests. Alcohol can stay in your system for up to 24 hours after use. If you test positive for alcohol, it could affect your life insurance rates or even result in a denial of coverage.

In conclusion, life insurance companies test for a variety of drugs to ensure that the person applying for coverage is healthy and not engaging in risky behavior. It is important to be honest about any drug use during the life insurance application process. If you test positive for any of the above drugs, it could affect your life insurance rates or even result in a denial of coverage.

Frequently Asked Questions

When applying for life insurance, it is common for insurance companies to require a medical exam. As part of the exam, they may also test for drug use. Here are some frequently asked questions about what drugs life insurance companies test for:

What drugs do life insurance companies typically test for?

Life insurance companies may test for a variety of drugs, including marijuana, cocaine, opioids, amphetamines, and barbiturates. They may also test for nicotine use, as smoking can significantly increase the risk of certain health problems. The specific drugs tested for can vary depending on the insurance company and the type of policy being applied for.

If drug use is detected, it can impact the premium rates or even lead to a denial of coverage. Therefore, it is important to be honest about any drug use when applying for life insurance.

How do life insurance companies test for drugs?

Life insurance companies may use a variety of methods to test for drugs, including blood tests, urine tests, and hair follicle tests. Blood tests are typically used to detect recent drug use, while urine tests and hair follicle tests can detect drug use over a longer period of time.

Some insurance companies may also ask about drug use on the application and may verify the information provided through medical records or by conducting a prescription drug history check.

Can I still get life insurance if I use drugs?

Yes, it is possible to get life insurance if you use drugs, but it may be more difficult and expensive. If drug use is detected during the medical exam, the insurance company may offer coverage at a higher premium rate or with certain exclusions.

It is important to be honest about any drug use when applying for life insurance, as providing false information can lead to a denial of coverage or even legal action. Working with an experienced insurance agent can help you find the right policy for your needs and budget, even if you have a history of drug use.

How long do drugs stay in your system?

The length of time drugs stay in your system can vary depending on the drug, the amount used, and the individual’s metabolism. Marijuana, for example, can stay in the body for up to a month or more, while cocaine may only be detectable for a few days.

Urinalysis is the most common method used to test for drugs, and it can detect drug use within the past 2-4 days for most drugs. Blood tests can detect drug use within the past 24 hours, while hair follicle tests can detect drug use for up to 90 days or longer.

What should I do if I test positive for drugs during a life insurance exam?

If you test positive for drugs during a life insurance exam, it is important to be honest with the insurance company. They may offer coverage at a higher premium rate or with certain exclusions. If you are denied coverage, you may want to consider seeking treatment for drug use and reapplying for life insurance once you have completed treatment and can provide evidence of your commitment to a healthier lifestyle.

Working with an experienced insurance agent can also help you navigate the process and find the right policy for your needs and budget, even if you have a history of drug use.

Life insurance companies use drug testing as a means to evaluate the risks associated with insuring individuals who may use drugs. The types of drugs tested vary from company to company, but they generally test for common illegal drugs such as marijuana, cocaine, and opioids. Additionally, some companies may test for prescription drugs that are known to be abused or for nicotine since it is a legal but addictive substance.

It is important to remember that drug testing is just one aspect of the underwriting process for life insurance. Other factors such as age, health history, and lifestyle choices also play a significant role in determining a person’s insurability and premiums. While drug use may result in higher premiums or even denial of coverage for some individuals, it is not necessarily a disqualifying factor for everyone. As with any medical condition or risk factor, it is important to be honest and transparent with your life insurance company to ensure that you receive the appropriate coverage for your needs.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts