Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

As we navigate through life, we are often faced with tough financial decisions. One of the most significant financial investments many of us make is purchasing a whole life insurance policy. While these policies offer the peace of mind that comes with knowing your loved ones will be taken care of in the event of your passing, there may come a time when you need to consider cashing out your policy.

The decision to cash out your whole life insurance policy is not one to be taken lightly. It requires careful consideration of your financial situation, future goals, and the potential consequences of surrendering your policy. In this article, we will explore the reasons why someone may choose to cash out their whole life insurance policy, the potential financial benefits and drawbacks, and the important factors to consider before making this decision.

Should I Cash Out My Whole Life Insurance Policy?

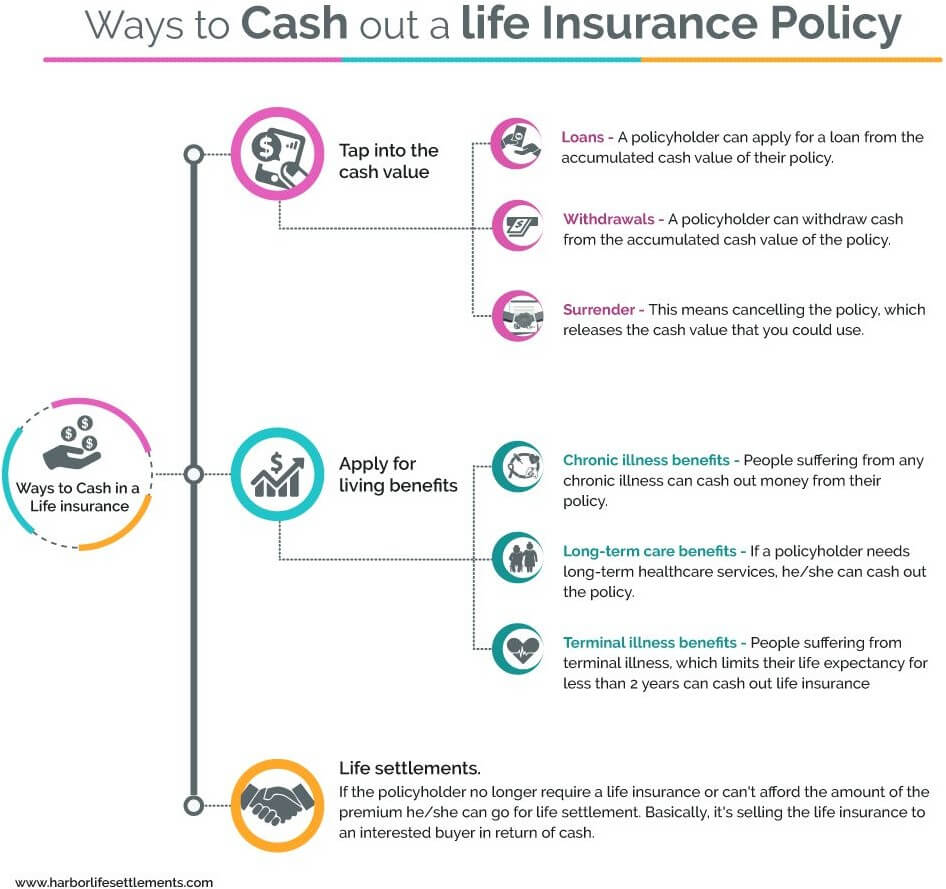

Cashing out a whole life insurance policy should only be considered after reviewing all options. If you need immediate funds, consider borrowing against your policy’s cash value instead of surrendering it completely. Surrendering your policy may result in tax consequences and loss of coverage. Consult with a financial advisor before making a decision.

Contents

- Should I Cash Out My Whole Life Insurance Policy?

- Frequently Asked Questions

- Is it a good idea to cash out my whole life insurance policy?

- How do I know if I have enough cash value in my whole life insurance policy to cash out?

- What are the alternatives to cashing out my whole life insurance policy?

- Will I have to pay taxes if I cash out my whole life insurance policy?

- How can I make an informed decision about cashing out my whole life insurance policy?

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

Should I Cash Out My Whole Life Insurance Policy?

If you own a whole life insurance policy, you may be wondering if it is a good idea to cash it out. This can be a difficult decision to make, as there are many factors to consider. In this article, we will explore the pros and cons of cashing out your whole life insurance policy, so that you can make an informed decision.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life. It also includes a savings component, known as the cash value. The cash value grows over time, and you can borrow against it, use it to pay your premiums, or cash it out entirely.

Benefits of Whole Life Insurance

Whole life insurance has several benefits, including:

- Guaranteed death benefit

- Fixed premiums

- Cash value growth

- Tax-deferred savings

Drawbacks of Whole Life Insurance

Whole life insurance also has some drawbacks, such as:

- Higher premiums compared to term life insurance

- Lower returns on cash value compared to other investments

- Less flexibility in changing coverage or premiums

Reasons to Cash Out Your Whole Life Insurance Policy

There are several reasons why you may consider cashing out your whole life insurance policy, such as:

Financial Hardship

If you are facing financial hardship, you may need to access the cash value of your whole life insurance policy. This can provide you with much-needed funds to pay bills, cover medical expenses, or make a down payment on a home.

Changing Needs

Your needs may have changed since you first purchased your whole life insurance policy. If you no longer need the coverage or can no longer afford the premiums, cashing out the policy may be a good option.

Higher Returns Elsewhere

If your whole life insurance policy is not performing as well as other investments, such as stocks or real estate, cashing out the policy and investing the funds elsewhere may provide you with a higher return on your investment.

Reasons to Keep Your Whole Life Insurance Policy

While there are some good reasons to cash out your whole life insurance policy, there are also several reasons why you may want to keep it, such as:

Guaranteed Death Benefit

With a whole life insurance policy, you have a guaranteed death benefit that will be paid out to your beneficiaries when you pass away. This can provide peace of mind knowing that your loved ones will be taken care of financially.

Tax Benefits

The cash value in your whole life insurance policy grows tax-deferred, meaning you do not have to pay taxes on the growth until you withdraw the funds. Additionally, if you borrow against the cash value, the loan is not considered taxable income.

No Medical Exam Required

If you have developed health issues since you first purchased your whole life insurance policy, you may have difficulty qualifying for a new policy. However, with a whole life insurance policy, you do not need to undergo a medical exam to maintain coverage.

The Bottom Line: To Cash Out or Not to Cash Out?

Deciding whether to cash out your whole life insurance policy is a personal decision that depends on your financial situation and goals. While there are some good reasons to cash out the policy, there are also several reasons to keep it. Consider your options carefully and consult with a financial advisor before making a decision.

In conclusion, cashing out your whole life insurance policy can be a good option in certain circumstances, such as financial hardship or changing needs. However, there are also several good reasons to keep the policy, including the guaranteed death benefit, tax benefits, and no medical exam required. Ultimately, the decision to cash out or keep your whole life insurance policy depends on your unique situation and goals.

Frequently Asked Questions

If you are considering cashing out your whole life insurance policy, you may have some questions. Here are some answers to commonly asked questions to help you make an informed decision.

Is it a good idea to cash out my whole life insurance policy?

Whether or not it is a good idea to cash out your whole life insurance policy depends on your individual circumstances. If you no longer need the coverage or are struggling to pay the premiums, cashing out the policy may be a viable option. However, it is important to weigh the potential benefits and drawbacks before making a decision.

On the one hand, cashing out your policy can provide you with a lump sum of money that you can use to pay off debts or invest in other areas. On the other hand, you will lose the death benefit that the policy provides, and you may have to pay taxes on the cash value of the policy.

How do I know if I have enough cash value in my whole life insurance policy to cash out?

The amount of cash value in your whole life insurance policy will depend on a variety of factors, including the length of time you have had the policy, the premiums you have paid, and the performance of the investments made by the insurance company. You can contact your insurance agent or the insurance company directly to find out how much cash value you have in your policy.

Keep in mind that if you cash out your policy, you will only receive a percentage of the cash value. The insurance company will deduct any outstanding loans or fees from the cash value before paying you the remaining amount.

What are the alternatives to cashing out my whole life insurance policy?

If you are considering cashing out your whole life insurance policy, there may be other alternatives that you can explore. For example, you may be able to take out a loan against the cash value of the policy, which will allow you to access some of the funds without forfeiting the death benefit.

You may also be able to sell your policy to a third-party buyer in a process known as a life settlement. In a life settlement, you sell your policy to a buyer for a lump sum of cash. The buyer then takes over the premiums and receives the death benefit when you pass away.

Will I have to pay taxes if I cash out my whole life insurance policy?

If you cash out your whole life insurance policy, you may be subject to taxes on the cash value of the policy. The amount of taxes you will owe will depend on a variety of factors, including the amount of cash value in the policy, the premiums you have paid, and how long you have had the policy.

It is important to consult with a tax professional before cashing out your policy to understand the potential tax implications.

How can I make an informed decision about cashing out my whole life insurance policy?

Before making a decision about cashing out your whole life insurance policy, it is important to gather as much information as possible about your options. You should consider speaking with your insurance agent or the insurance company directly to understand the details of your policy and the potential benefits and drawbacks of cashing it out.

You may also want to consult with a financial advisor or tax professional to help you make an informed decision based on your individual circumstances.

In conclusion, the decision to cash out a whole life insurance policy is not one to be taken lightly. It is important to weigh the benefits and drawbacks of such a decision carefully. While it may provide immediate financial relief, it can also have long-term consequences on your financial future.

Before making any decisions, it is essential to consult with a financial advisor who can provide personalized advice and guidance based on your unique circumstances. They can help you evaluate your options, explore alternative solutions, and determine the best course of action for your financial goals. Ultimately, the decision to cash out a whole life insurance policy should be made with careful consideration and expert guidance to ensure the best possible outcome.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts