Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering...Read more

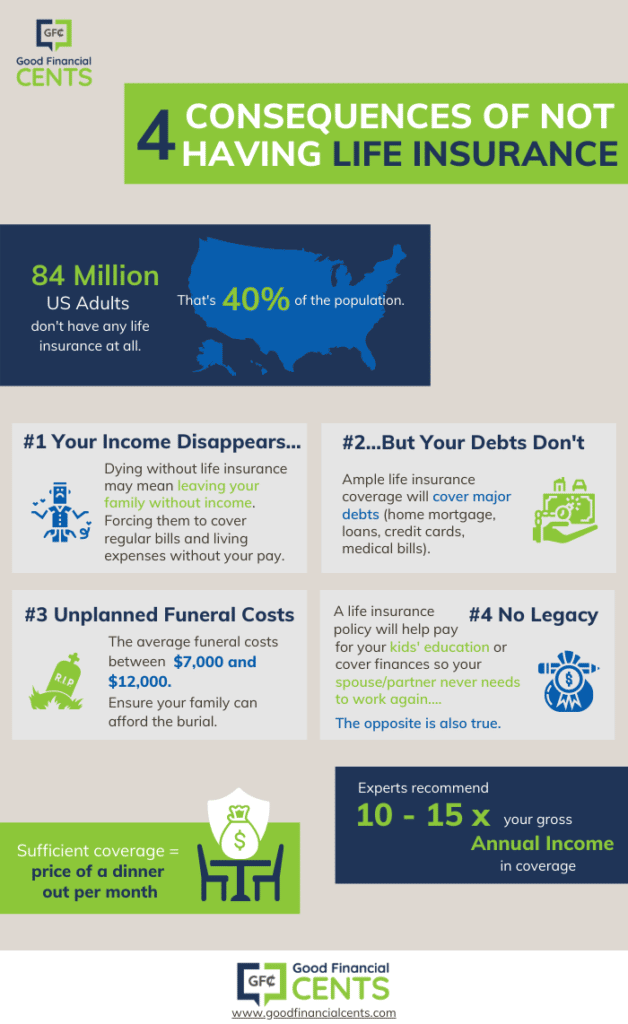

Life insurance is often considered a safety net for individuals and their families in case of an unexpected event. However, many individuals choose to forego this type of insurance, either because they believe they don’t need it, or because they simply can’t afford it. While it’s true that life insurance may not be necessary for everyone, it’s important to understand the potential consequences of not having it.

Without life insurance, your loved ones may face significant financial burdens in the event of your unexpected death. This can include funeral expenses, outstanding debts, and loss of income. In some cases, these expenses can be overwhelming, leaving your family struggling to make ends meet. By understanding the potential consequences of not having life insurance, you can make an informed decision about whether or not it’s right for you and your family.

Without life insurance, your loved ones may struggle financially if you were to pass away unexpectedly. They may have to pay for your funeral expenses, outstanding debts, and ongoing living expenses without your income. This can lead to financial hardship and potentially force them to make difficult decisions. It’s important to consider life insurance as a way to provide financial protection for your family in the event of your untimely death.

Contents

- What Happens if You Don’t Have Life Insurance?

- Frequently Asked Questions

- What happens if you die without life insurance?

- Is life insurance necessary if you don’t have dependents?

- Can you get life insurance if you have a pre-existing medical condition?

- What are the different types of life insurance policies?

- How much life insurance do you need?

- What Happens if Someone Dies & Has No Life Insurance? : Insurance FAQs

- Can I Keep Medicaid If My Job Offers Insurance?

- Does Smile Direct Club Take Medicaid Insurance?

- Does Life Insurance Payout Affect Medicaid?

What Happens if You Don’t Have Life Insurance?

Life insurance is a crucial aspect of financial planning that ensures your loved ones are financially secure in case of your untimely demise. However, many people overlook the importance of life insurance, either because they think they don’t need it or because they underestimate its significance. In this article, we will explore what happens if you don’t have life insurance and why it’s essential to have one.

1. Financial Burden on Your Loved Ones

If you die without life insurance, your loved ones will be left with a significant financial burden. They will have to pay for your funeral expenses, medical bills, outstanding debts, and other expenses. This can put an immense strain on their finances, especially if they don’t have enough savings to cover these costs.

Moreover, if you were the primary breadwinner of the family, your dependents would face financial challenges in your absence. They would have to find ways to replace your income to maintain their standard of living, which can be challenging and stressful.

2. Difficulty in Maintaining Lifestyle

If you don’t have life insurance, your dependents may not be able to maintain their current lifestyle. They may have to cut back on expenses or sell assets to make ends meet. For example, they may have to sell their house, car, or other valuable possessions to cover their expenses.

Even if your dependents manage to maintain their lifestyle, they may have to compromise on their future goals and aspirations. For instance, your children may not be able to pursue higher education or start a business due to financial constraints.

3. No Safety Net for Unexpected Events

Life is unpredictable, and unexpected events can happen at any time. If you don’t have life insurance, your dependents won’t have a safety net to fall back on in case of an emergency. For instance, if one of your family members falls sick, they may not have enough funds to pay for medical bills or other expenses.

4. Limited Access to Credit and Loans

If you don’t have life insurance, your dependents may face challenges in accessing credit and loans. Most lenders require collateral or assurance of repayment before approving a loan or credit application. If your dependents don’t have any assets or security to offer, they may not be able to borrow money.

5. No Inheritance for Your Heirs

If you don’t have life insurance, your heirs won’t receive any inheritance from you. This can be a significant blow, especially if you had valuable assets or properties. Your dependents may feel like they have been left with nothing to remember you by, which can be emotionally challenging.

6. No Tax Benefits

Life insurance policies offer several tax benefits, such as tax-free payouts to beneficiaries and deductions on premiums paid. If you don’t have life insurance, you won’t be able to enjoy these benefits, which can be a missed opportunity to save money.

7. No Peace of Mind

Lastly, if you don’t have life insurance, you won’t have peace of mind. You will constantly worry about the financial security of your loved ones, even after you’re gone. This can take a toll on your mental health and well-being.

Conclusion

Life insurance is a crucial aspect of financial planning that ensures the financial security of your loved ones in case of your untimely demise. If you don’t have life insurance, your dependents will face a significant financial burden, difficulty in maintaining their lifestyle, no safety net for unexpected events, limited access to credit and loans, no inheritance, no tax benefits, and no peace of mind. Therefore, it’s essential to have a life insurance policy that suits your needs and protects your loved ones from financial hardships.

Frequently Asked Questions

Life insurance is an essential aspect of financial planning. However, not everyone has life insurance. Here are some frequently asked questions about what happens if you don’t have life insurance.

What happens if you die without life insurance?

If you die without life insurance, your family may face financial difficulties. Your loved ones will have to pay for your funeral expenses, outstanding debts, and estate taxes out of their pockets. If you are the primary breadwinner of the family, they may struggle to make ends meet without your income. It can lead to a significant financial burden on your family and affect their quality of life.

Moreover, your family may have to sell assets to meet the financial obligations, such as the family home or other valuable possessions. It can be devastating for your loved ones to lose their home, which holds sentimental value.

Is life insurance necessary if you don’t have dependents?

Life insurance is not just for those with dependents. If you don’t have dependents, you may think that life insurance is not necessary. However, it can still benefit you in many ways. For instance, if you have outstanding debts, such as mortgage or student loans, your life insurance can pay off those debts after your death. It can also cover your funeral expenses and any outstanding medical bills you might have at the time of your death.

Furthermore, if you want to leave a legacy or donate to a charity after your death, life insurance can help you achieve that goal. You can name a charity or organization as a beneficiary, and the proceeds will go to them after your death.

Can you get life insurance if you have a pre-existing medical condition?

Yes, you can get life insurance if you have a pre-existing medical condition. However, the premium may be higher than someone without a medical condition. The insurance company will assess the risk involved in insuring you and determine the premium based on that risk. They may also require a medical exam or request medical records to evaluate your health condition.

It’s essential to disclose any pre-existing medical conditions when applying for life insurance. If you don’t disclose it, the insurance company may deny the claim if they find out about the medical condition later.

What are the different types of life insurance policies?

There are two primary types of life insurance policies: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It’s the most affordable type of life insurance and is suitable for those who want coverage for a specific period, such as while paying off a mortgage or while children are young.

Permanent life insurance provides coverage for the entire life of the insured person. It includes a savings or investment component that grows over time and can be used to pay the premiums or as a source of cash value. It’s more expensive than term life insurance but provides lifelong coverage.

How much life insurance do you need?

The amount of life insurance you need depends on various factors, such as your age, income, debts, and lifestyle. A general rule of thumb is to have life insurance coverage that is ten times your annual income. However, you may need more or less depending on your specific circumstances.

You should consider your debts, such as mortgage, student loans, and credit card debt, and how much it would cost to pay off those debts. Additionally, you should factor in your family’s living expenses and how much income they would need to replace in case of your death. It’s essential to consult with a financial advisor to determine the right amount of coverage for your specific situation.

What Happens if Someone Dies & Has No Life Insurance? : Insurance FAQs

In life, we all face uncertainties that can be unsettling, and one of those uncertainties is death. As much as we do not like to think about it, it is crucial to plan for it. While many people avoid the topic of life insurance, the reality is that not having it can be detrimental to those you love the most. Without life insurance, your family will be left to bear the financial burden of your passing, which can be overwhelming and stressful.

Without life insurance, your family will have to come up with the funds to cover your funeral expenses, pay off any debts you may have left behind, and take care of any other financial responsibilities you may have had. This can be especially difficult if you were the primary breadwinner of the household. By having life insurance, you can ensure that your family is taken care of even after you are gone. Life insurance can provide them with the financial stability they need to pay for expenses and maintain their standard of living. In short, life insurance is not just a financial product; it is a way to protect your loved ones’ future and provide them with peace of mind.

Meet Rakibul Hasan, the visionary leader and founder of Freeinsurancetips. With over a decade of experience in the insurance sector, Rakibul is dedicated to empowering individuals to make well-informed decisions. Guided by his passion, he has assembled a team of seasoned insurance professionals committed to simplifying the intricate world of insurance for you.

- Latest Posts by Rakibul Hasan

-

Can I Keep Medicaid If My Job Offers Insurance?

- -

Does Smile Direct Club Take Medicaid Insurance?

- -

Does Life Insurance Payout Affect Medicaid?

- All Posts